Warren Buffett is buying #oil stocks: He recently revealed purchases of $26B of $cvx and $oxy. Below an analysis of Warren Buffett's history with oil and gas investments, and why recent purchases may indicate the best is yet to come for oil and gas equities. 🧵

(1/24) Buffett’s recent purchases of major stakes in oil and gas companies are an indicator of his optimism for the sector. General sentiment and positioning in oil and gas has lagged, as indicated by energy’s small portion of the overall equity market versus historical levels:

(2/24) And while Buffett is known to prefer investments with stable, predictable, and growing cash flows, and not cyclicals, he has intermittently owned and done well with oil & gas equities—particularly in inflationary periods much like the present:

(3/24) Aside from being a brilliant value investor, Buffett is also an excellent market timer. Given this impressive track record, it is worth examining some of Buffett’s past oil and gas investments in detail to infer his view on oil and gas equities today.

(4/24) In 1956, Buffett wrote a newspaper article titled: “The Security I Like Best; Oil & Gas Property Management, Inc.”, in which he laid out the value investment thesis for an oilfield management company.

(5/24) Mr. Buffett had approached Property Management Inc. from with a value investment framework, which allowed him to uncover that the firm’s reserves were substantially undervalued and had become worth enough to cover the firm’s outstanding debt.

(6/24) And while Buffett saw value in Property Management Inc. in particular, he also recognized that oil and gas businesses would be an excellent hedge against inflation—estimating that this investment could return 400% if oil prices increased 50 cents (which they did).

(7/24) In his 1983 Berkshire Hathaway shareholder letter, Buffett cautioned against oil and gas businesses with high rates of required re-investment, and dismissed the broad consensus that these would be the best hedges against inflation. @OlivaZachary

zacksnotes.com/blog/buffett-o…

zacksnotes.com/blog/buffett-o…

(8/24) This displayed his market timing prowess, as it avoided substantial losses that may have been incurred in oil & gas equities, with oil prices falling nearly 60% from 1983 to their bottom in 1998.

(9/24) In 2002, Buffett bought 1.3% of PetroChina $ptr, China’s largest oil producer, for $488MM . He faced pushback at the time, with many citing depleted reserves, mature fields, and an overly encumbered cost structure as potential issues with this investment.

(10/24) Buffett’s investment in $ptr was partially a bet on valuation: at a 15% cash yield, he could realize a meaningful return even if oil prices didn’t move much. And it didn’t hurt that oil prices increased nearly 300% shortly thereafter!

(11/24) $ptr soon became one of Buffett’s best investments to date. Berkshire sold it in 2007, when the market cap was 275B, realizing a $3.6B gain. This amounted to a 720% return over his 5-year holding period, or 52% annualized.

fortune.com/2014/10/31/war…

fortune.com/2014/10/31/war…

(12/24) The lessons from Buffett’s past purchases of oil and gas companies, such as Property Management, Inc. and PetroChina, and his aversion to natural resources companies in 1983, tie together with his recent purchases of $cvx and $oxy shares.

(13/24) The investment theses for Buffett’s previous oil and gas investments shared similar themes: compelling free cash flow, and upside to higher commodity prices (which hedges inflation).

(14/24) This time appears no different. Today, $cvx and $oxy are generating enormous free cash flow, have upside to higher commodity prices, offer inflation protection, and are returning part of their free cash flow to shareholders via buybacks and dividends.

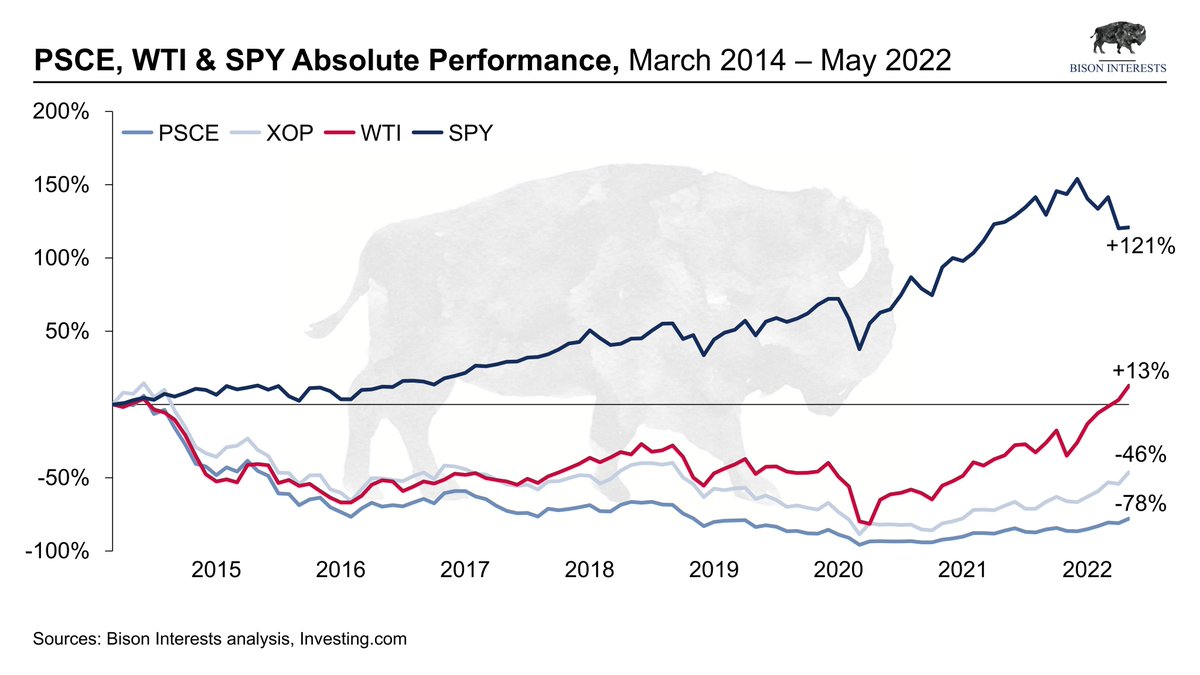

(15/24) And while we share Buffett’s oil and gas optimism, we see more upside in small cap equities—which are trading at lower valuations. These have materially lagged large caps and the market, with multiples having compressed as fundamentals improve faster than share prices:

(16/24) And improved cost structures among since the end of the prior oil bull market have already translated into higher operating cash flows than large caps, as can be seen below:

(17/24) And while small caps are particularly compelling here, there are some timing concerns holding investment back that merit addressing. Inflation is running hot, many cyclical equities have already materially outperformed and we’re in an equity bear market.

(18/24) Higher equity valuations increase share price sensitivities to interest rates. And while many of the most overvalued equities have are down more than 50% in response to the shifting monetary regime, there may still be a long way down from here:

(19/24) Continuing strong oil fundamentals are supporting high oil prices. This bolsters our view that 1970’s style stagflation is a likely scenario, in which oil and gas equities performed exceptionally well:

(20/24) Despite this history and strong fundamentals, a broad, negative outlook for the economy appears to be baked into oil and gas equities, more in line with the oil market’s backwardated futures curve.

(21/24) If a negative economic outlook is fully priced into equities, there should be meaningful price upside to positive data in the future. From a timing perspective, oil and gas equities may be compelling today as more economic malaise is priced in.

(22/24) And as interest rates rise and tech stocks continue to crater, we may see an acceleration of the rotation out of growth stocks and into value stocks with high cash flow yields. This rotation is already well underway:

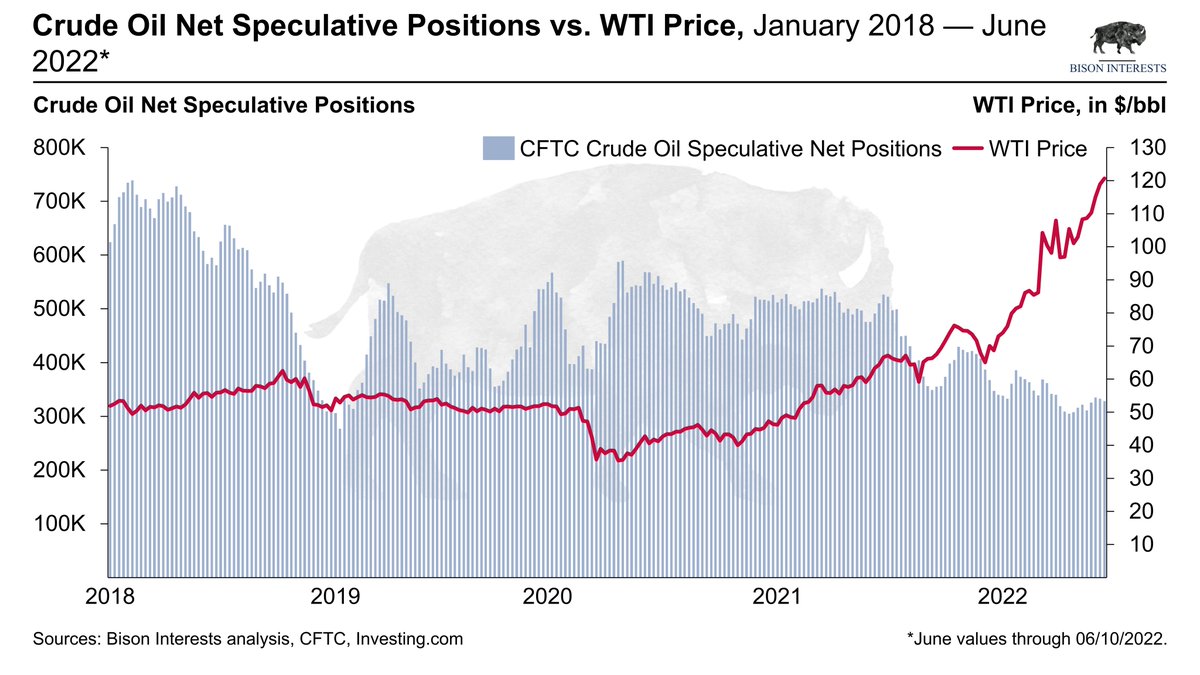

(23/24) And despite strong fundamentals and buy signals from Warren Buffett and other prolific investors, oil and gas investment interest remains comparatively low:

(24/24) We hope we have added some color to Buffett’s recent oil and gas investments and provided some valuable insights on market timing. Based on Mr. Buffett’s track record, perhaps the best is yet to come for the oil and gas industry!

bisoninterests.com/content/f/buff…

bisoninterests.com/content/f/buff…

• • •

Missing some Tweet in this thread? You can try to

force a refresh