What are some of the things you consider when choosing your banking partner?

Here's what makes [@DTBKenya] standout:

1/ Professionalism

DTB is managed by qualified professionals from the Board of Management to all staff cadres.

#BankWithUsBankOnUs

Here's what makes [@DTBKenya] standout:

1/ Professionalism

DTB is managed by qualified professionals from the Board of Management to all staff cadres.

#BankWithUsBankOnUs

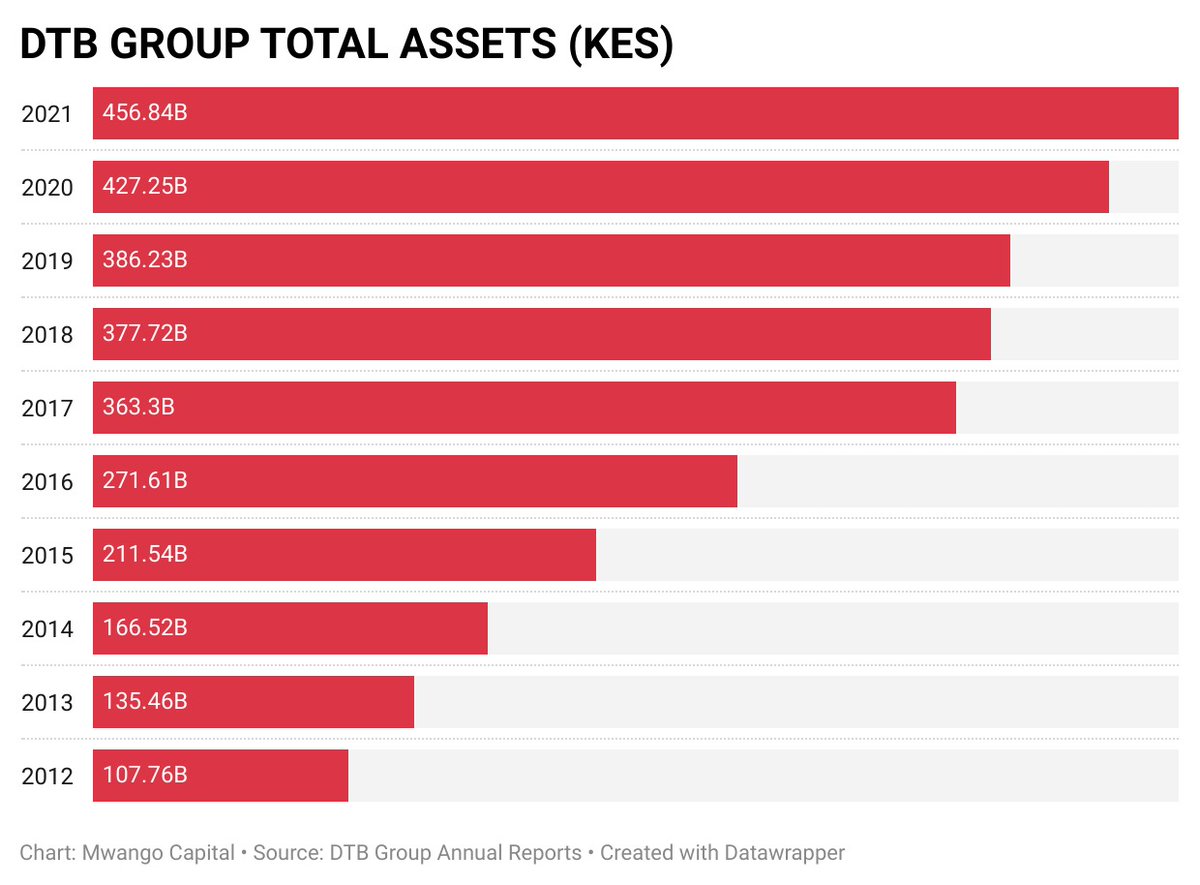

2/ Financial Strength

DTB[@DTBKenya] has a strong balance sheet of over Ksh 200B across corporate and retail banking.

3/ People centered

DTB has a strong culture of supporting employees and providing opportunities for growth and development

#BankWithUsBankOnUs

DTB[@DTBKenya] has a strong balance sheet of over Ksh 200B across corporate and retail banking.

3/ People centered

DTB has a strong culture of supporting employees and providing opportunities for growth and development

#BankWithUsBankOnUs

4/ Robust 24/7 digital presence.

With the DTB Mobile banking app, you can access your account anytime.

#BankWithUsBankOnUs

With the DTB Mobile banking app, you can access your account anytime.

#BankWithUsBankOnUs

5/ Physical presence

DTB has 65 branches in Kenya and is present in the region making it convenient for customers with presence in East Africa.

#BankWithUsBankOnUs

DTB has 65 branches in Kenya and is present in the region making it convenient for customers with presence in East Africa.

#BankWithUsBankOnUs

Whether you are saving for school, buying a house, a car or paying everyday bills,

You can rest assured that DTB will ensure you save or make money while fueling your growth.

#BankWithUsBankOnUs

You can rest assured that DTB will ensure you save or make money while fueling your growth.

#BankWithUsBankOnUs

• • •

Missing some Tweet in this thread? You can try to

force a refresh