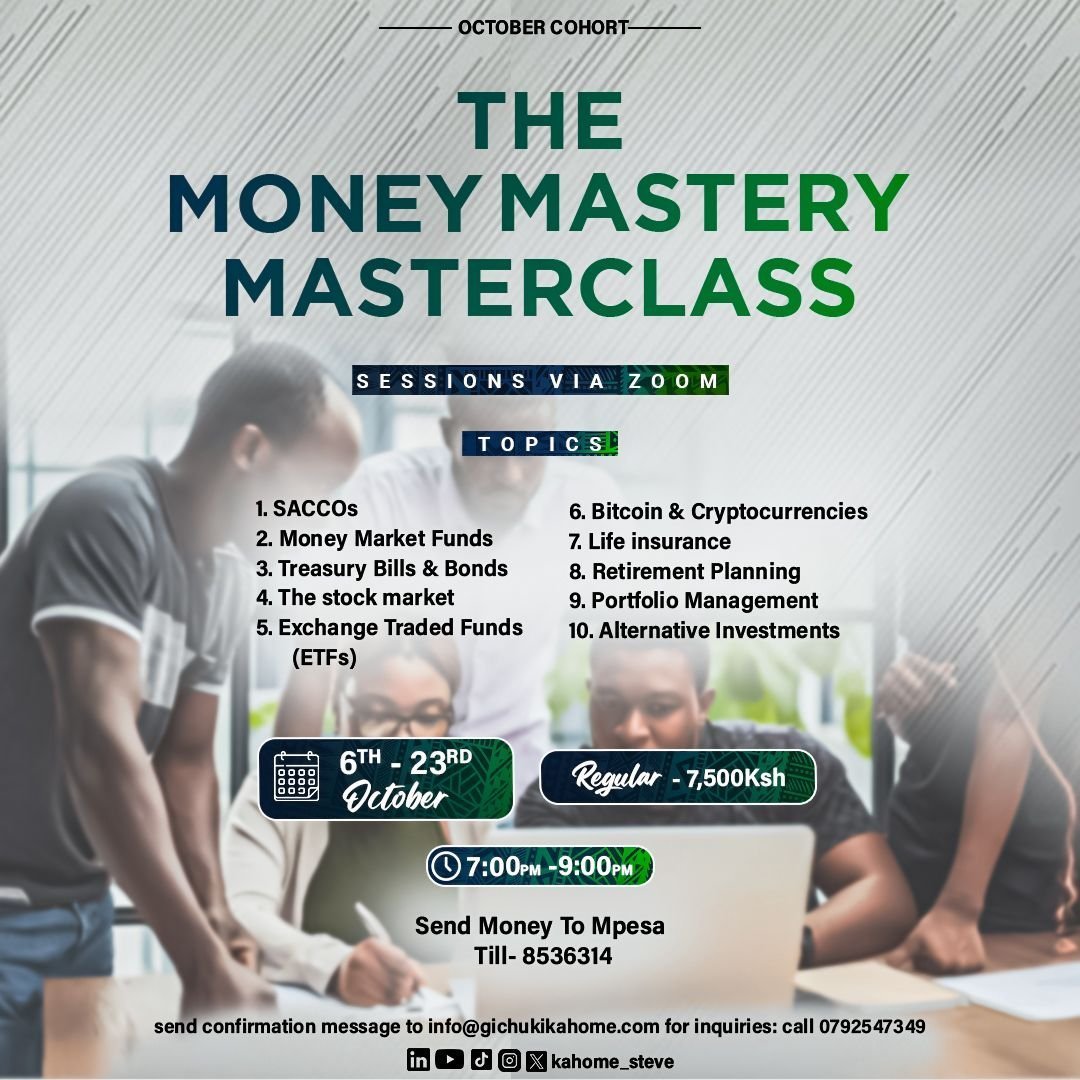

My mission is to spread financial wellness. Email: info@gichukikahome.com WhatsApp: +254793410596

10 subscribers

How to get URL link on X (Twitter) App

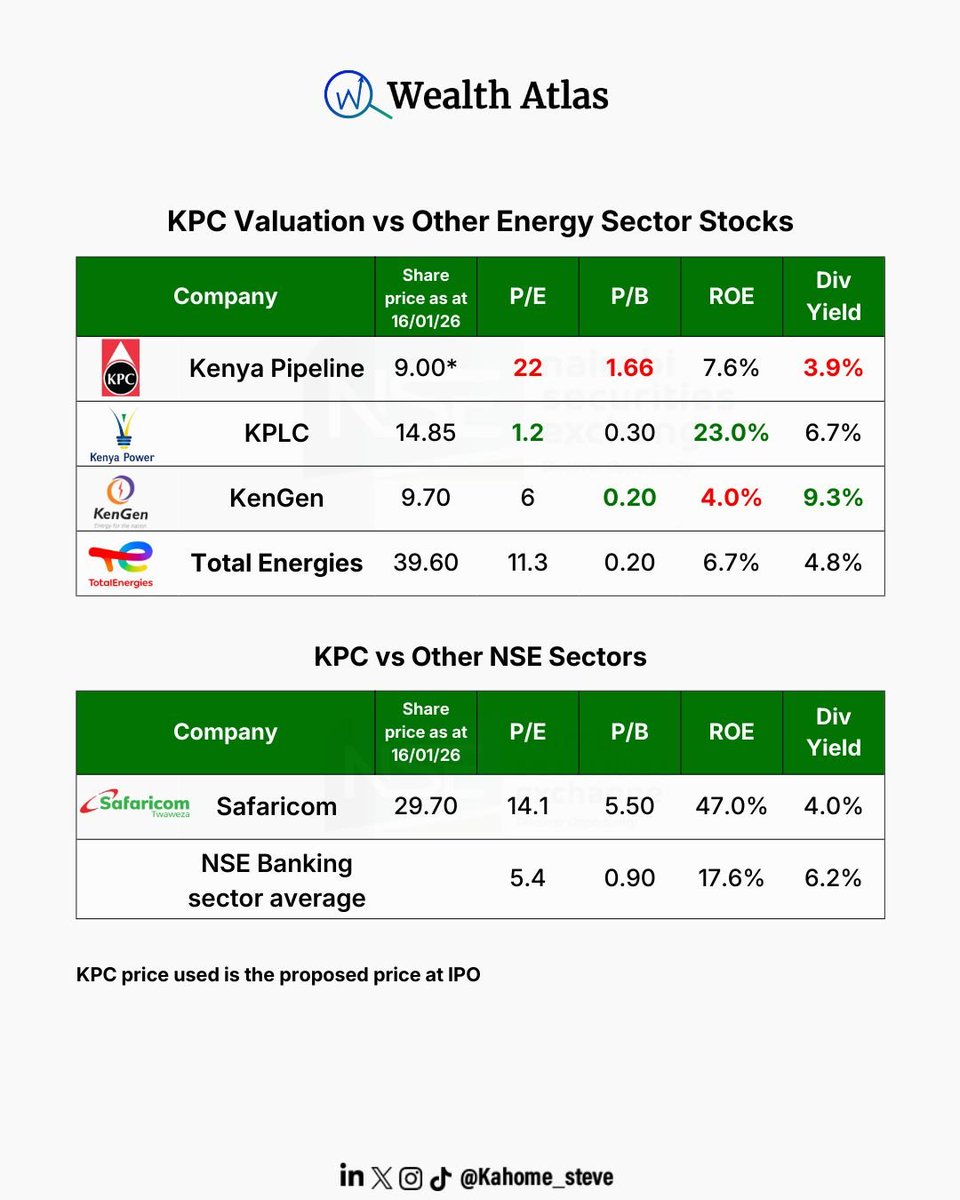

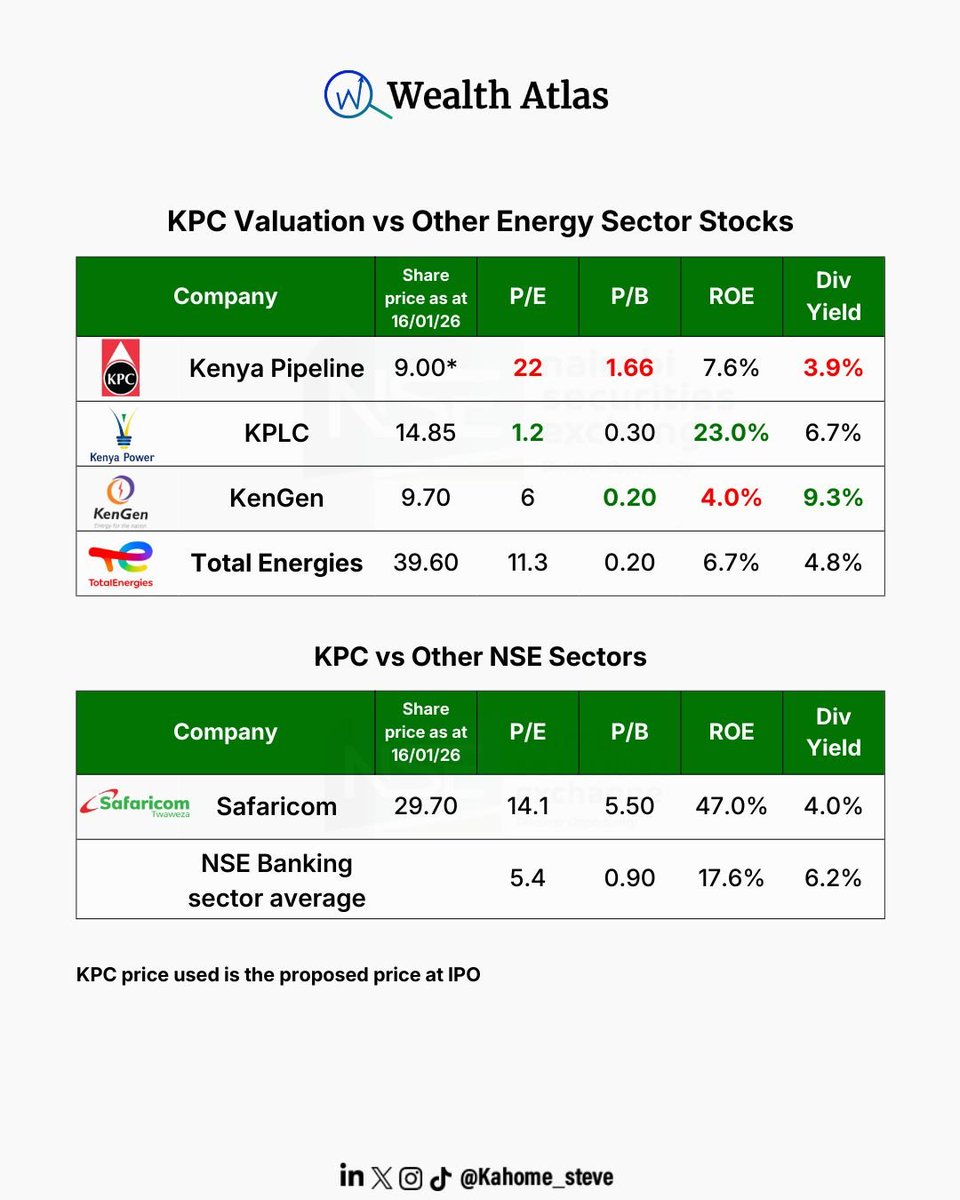

2. KPC is the most expensive energy sector stock on a Price to Book basis.

2. KPC is the most expensive energy sector stock on a Price to Book basis.

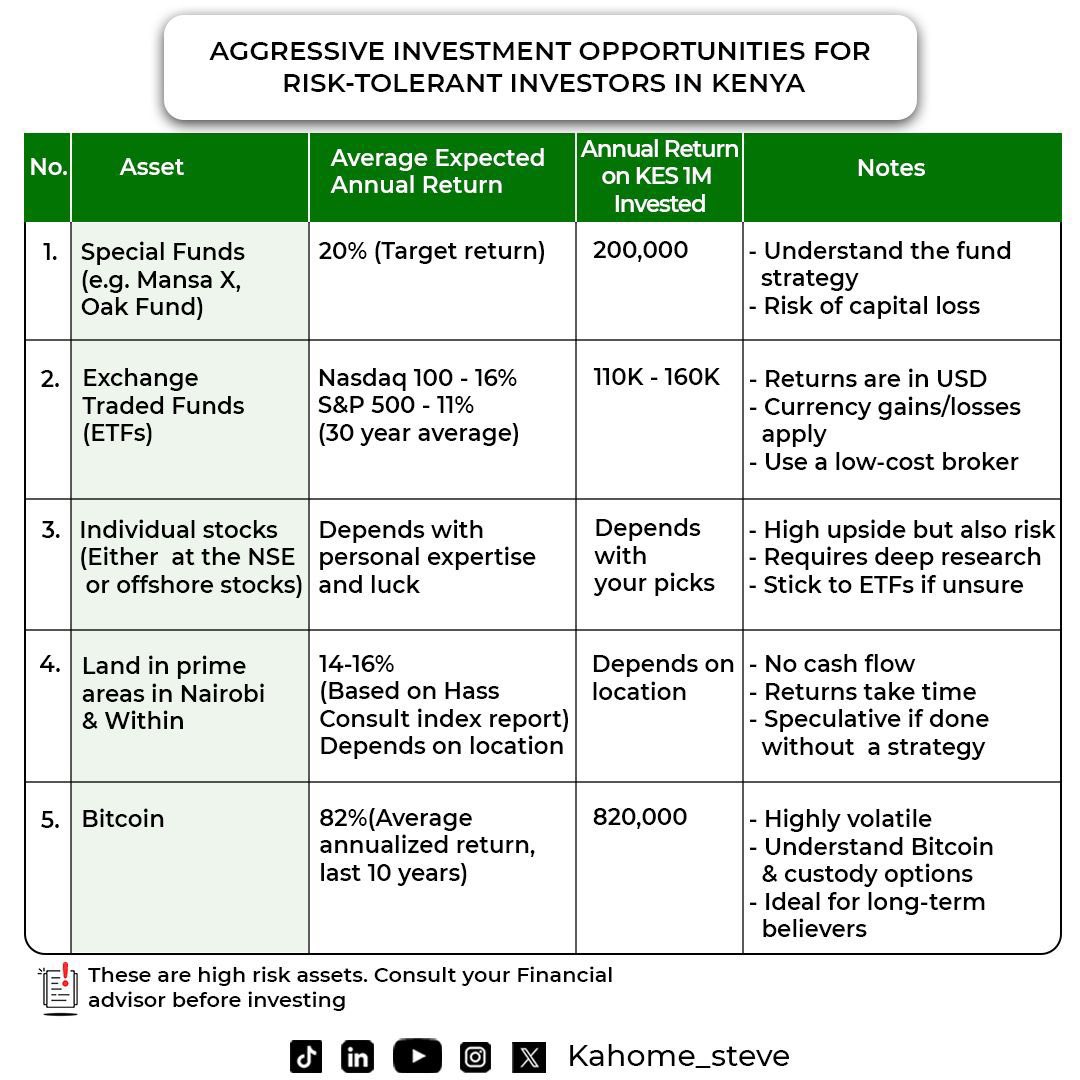

1.Above-average returns: Mansa X has averaged 17–18% p.a. since 2019

1.Above-average returns: Mansa X has averaged 17–18% p.a. since 2019

For global stocks, our area of focus from August was in the HealthCare Sector. This has been one of the worst performing sectors this year. With companies like $UNH $NVO $LLY Seeing huge drawdowns.

For global stocks, our area of focus from August was in the HealthCare Sector. This has been one of the worst performing sectors this year. With companies like $UNH $NVO $LLY Seeing huge drawdowns.