Cineline- MovieMax with Max Potential? A unique special situation

A long thread 🧵

#stocks #StockMarketindia #StocksToBuy

A long thread 🧵

#stocks #StockMarketindia #StocksToBuy

I don’t think any of us can now imagine our lives without our own version of Netflix and Chill. But, there’s also the looming nostalgia of visiting theatres, isn’t it? Yes, we are social beings, after all, and the numbers confirm it.

In the listed space, we have only two cinema exhibition players, PVR and Inox. The COVID-19 pandemic, being a severe shocker for the industry, is now witnessing a lot of consolidation including closure of single-screen cinemas,few players in NCLT,& the merger of these two leaders

With the economy re-opening, people are now visiting the theatres to experience the cinema on big screens (slow subscriber growth for Netflix is a leading indicator), and the popcorn tub and coke business model shall witness better days ahead.

During my research on the merger, I came to know about another cinema exhibitor called Cineline Interestingly, Cineline had an 11% market share operating under the brand Cinemax which it sold off to PVR in 2012. Cineline then shifted its focus on its core competency – Real Estate

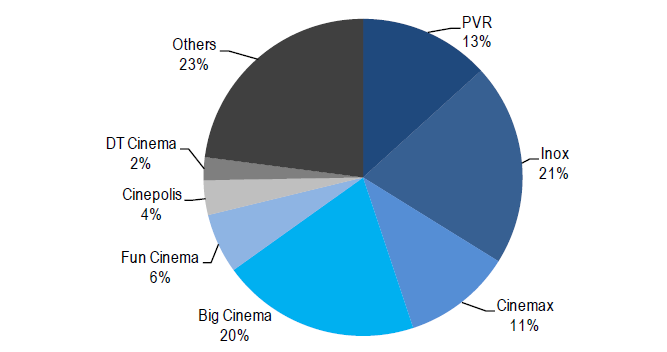

In the pre-pandemic era, the multiplex industry was quite fragmented (graph above) and it made sense for players to acquire companies/theaters for increasing their market share rather than slowly grinding for organic growth

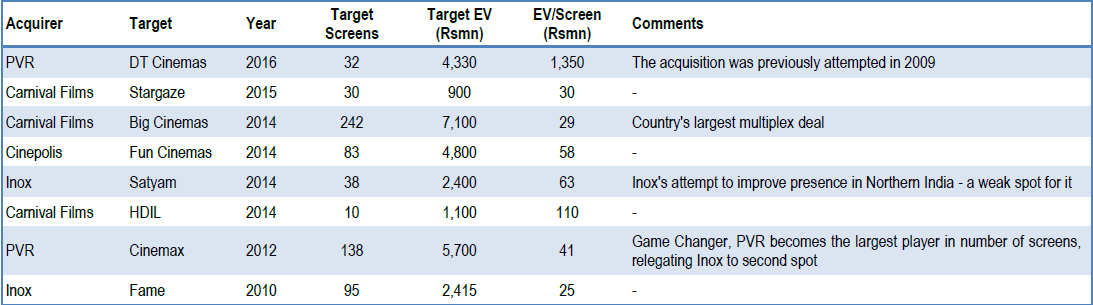

Here’s a snapshot of some of the significant M&A history

Here’s a snapshot of some of the significant M&A history

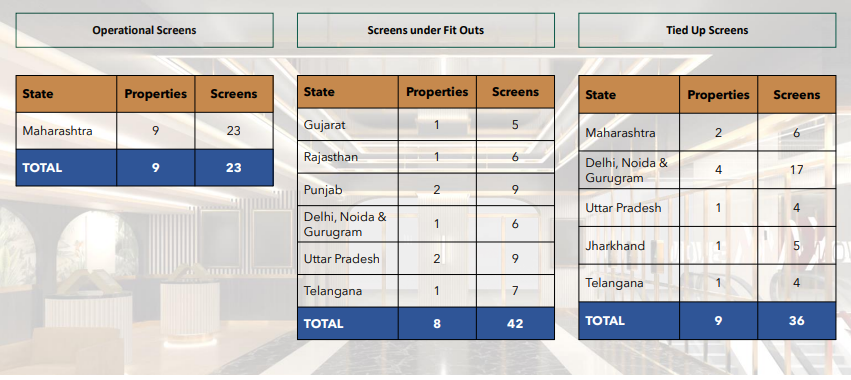

What caught my attention was that Cineline has re-entered the film exhibition business, post expiry of their non-compete agreement with PVR. They started operating the multiplex under the brand name MovieMax in 9 properties with 23 screens

which were earlier leased out to PVR under the leave and license agreement (now expired in March 2022).

But, what’s the current industry scenario?

Total number of screens in India ~ 9500+

Single screens~6500

Multiplex Screens~3000

Inox+PVR~1500

Carnival and Cinepolis ~ 400 each

But, what’s the current industry scenario?

Total number of screens in India ~ 9500+

Single screens~6500

Multiplex Screens~3000

Inox+PVR~1500

Carnival and Cinepolis ~ 400 each

The industry continues to be dominated by single screens with a 70% market share. Multiplexes are now sincerely trying to penetrate the Tier2/3 cities by offering a better screen experience (in terms of screen quality, sound, Hygiene, etc.) (PSU vs Pvt bank story will repeat)

Carnival Cinemas is currently facing debt issues and is trying to onboard PE to solve the crisis. While time only will tell how this partnership/onboarding will pan out, but, this provides a good runway for players like Cineline to grab on to the opportunity.

Inox and PVR have applied for a merger which will make them India’s number 1 player having almost 50% market share in multiplexes and plan to double the screen count in the next 5-7 years.

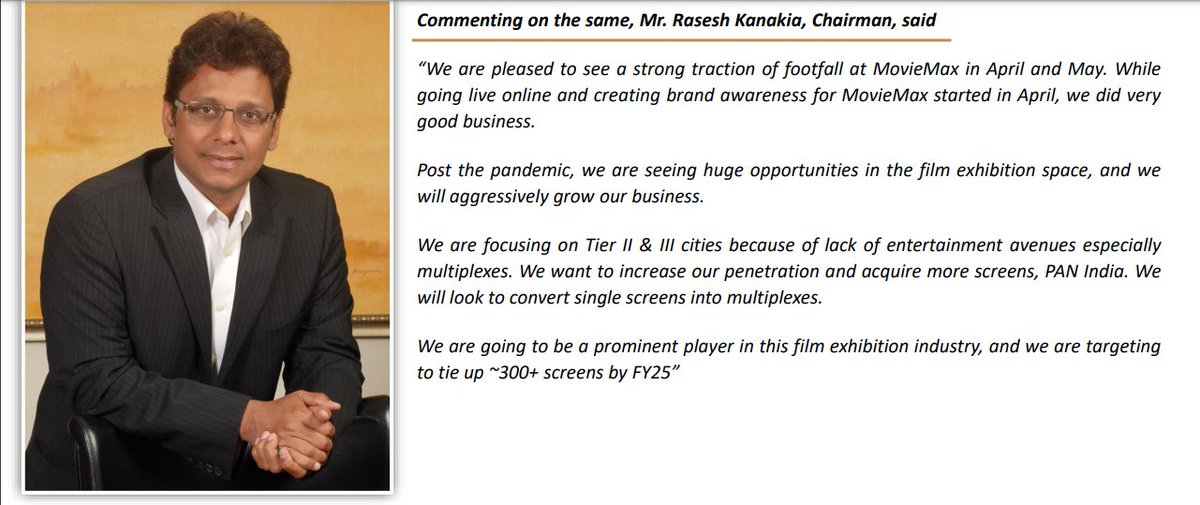

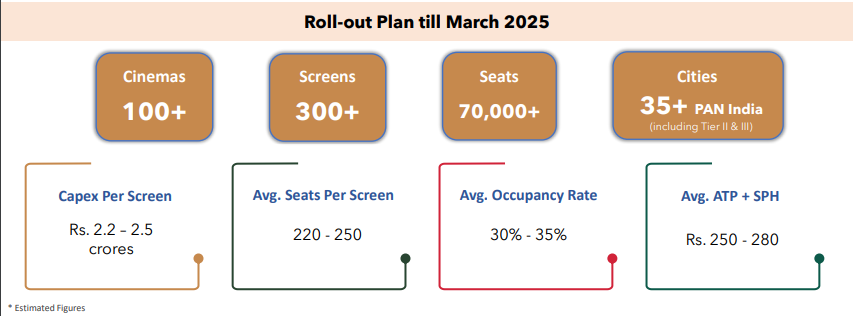

With other players focusing on the post-pandemic rebound, Cineline is present at the right time and right place. It plans to take its screen count from 23 to 300+(yes, you read it correctly) by FY25 (on lease) implying significant growth in the underlying business.

The total no of screens has gone up from 23 to 101 as of 27 May 2022 reflecting strong momentum. However, currently, only 23 are operational, 42 are under fit-outs which will be operational in FY23 and the remaining 36 are tied-up screens that will open up in the coming years

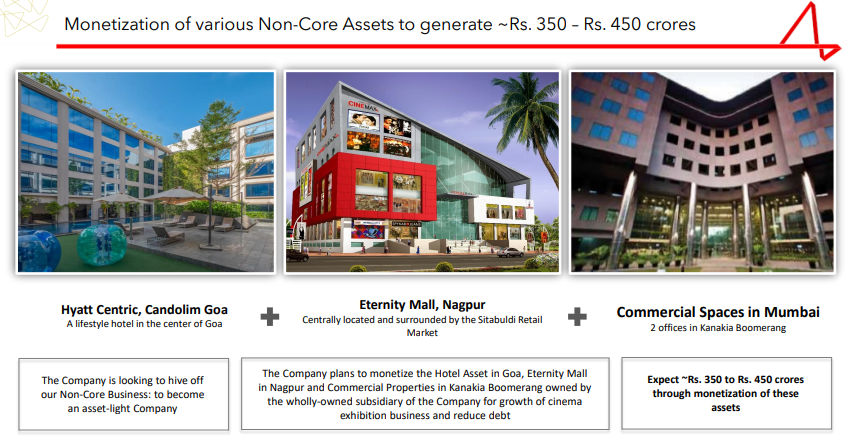

CAPEX requirement would be roughly INR 650 crores which will be primarily funded by hiving off the non-core assets worth INR 400 crores, gradually.The CAPEX requirement is low as compared to the other two players due to its differentiated strategy of targeting only smaller cities

With respect to leadership, the company directors have recently approved monetizing the Nagpur mall for a consideration of INR 60 crores. They have appointed a new COO, Kunal Sawhney, (Ex- Carnival, PVR), and the Chairman’s Son, Ashish Kanakia..

budding CEO is bringing agility and enthusiasm at the organizational level

Furthermore, the promoters have recently infused funds via convertible warrants worth INR 35 crores at a price of INR 130/sh and INR 10 crores earlier at a price of INR 71.5/sh taking their holding to 70%

Furthermore, the promoters have recently infused funds via convertible warrants worth INR 35 crores at a price of INR 130/sh and INR 10 crores earlier at a price of INR 71.5/sh taking their holding to 70%

While it is difficult to predict the financial outcome, the company`s guidance, historical performance, and peer performance can help us improve our probability.

Cineline used to earn ~ 2.25-2.5 cr Rev/screen and EBITDA margin in the range of 15-20%, at par with Inox 2.5cr/screen

Cineline used to earn ~ 2.25-2.5 cr Rev/screen and EBITDA margin in the range of 15-20%, at par with Inox 2.5cr/screen

Cineline’s ATP( Average Ticket Price) and SPH( Spend per head) are low in comparison to Inox and PVR simply because the target audience is Tier2/3/4 cities. Point to note – Cineline’s CAPEX and lease requirement will also be low thereby, balancing it out.

I recently watched a movie at a local multiplex that offered 10-15% lower ticket prices and 15-20% lower F&B prices. With increasing income levels and consumers demanding a better experience, they will have a clear edge over the single screens in smaller cities

Assuming Movie Max does business at par with Inox, as it has done in the past, we are looking at a potential INR 1000 crore topline company in the next 5-6 years, with 16-17% EBITDA margins (pre-Ind AS).

The ROIC would be in the range of 15-17% due to high CAPEX and maintenance CAPEX requirement which is partly set off by low working capital requirement. The current market cap of the company, post-dilution, stands at INR 440 crores with roughly INR 300 crores of debt.

Now, if I were to compare it with Inox’s valuation, the stock has the potential to re-rate significantly and can be a 4-5x opportunity from its current levels.

There are multiple ways to value this company

There are multiple ways to value this company

First, on the basis of EV/EBITDA or EV/EBIT metric, and second, on the EV/Screen ratio. As of today, the market has valued PVR+Inox at 13-14x EBITDA FY24E and its screen valuation is approximately INR 10 crores per screen.

PVR had paid more than INR 4cr/screen to Cineline 10 years ago and had also acquired Sathyam Cinemas in 2018 for more than INR 10cr/ screen.

I will control my urge toward financial modeling but this would give you a broad sense of what could be the potential valuation of Cineline

I will control my urge toward financial modeling but this would give you a broad sense of what could be the potential valuation of Cineline

Risk Factors

Execution: This would be the key indicator every quarter.

OTT: For all the theatre players which could result in stock de-rating and potentially much lower upside

Delay in monetizing non-core assets: Delay in monetization could result in potential equity dilution

Execution: This would be the key indicator every quarter.

OTT: For all the theatre players which could result in stock de-rating and potentially much lower upside

Delay in monetizing non-core assets: Delay in monetization could result in potential equity dilution

At CMP(130/sh), I believe, we have high MOS and minimal downside risk, the upside would depend on management`s execution strategy

Consider this special situation as a private equity bet where we are backing up an experienced promoter to create the third-largest multiplex chain

Consider this special situation as a private equity bet where we are backing up an experienced promoter to create the third-largest multiplex chain

Disclosure

I have invested in the stock at 120/share and will update the position here

Not a SEBI registered advisor. This is not a buy/sell recommendation. Consult your financial advisor before acting on the above-mentioned information.

I have invested in the stock at 120/share and will update the position here

Not a SEBI registered advisor. This is not a buy/sell recommendation. Consult your financial advisor before acting on the above-mentioned information.

If you want to read it in a better format(unfortunately Twitter has it`s own limitations), here is the link

maniacmarkets.wordpress.com/2022/06/23/cin…

maniacmarkets.wordpress.com/2022/06/23/cin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh