After a decade of working on it, my book is finally out with @OUPLaw.

The book argues that we have entered a new era: a backlash against #investment arbitration has given way to a backlash by arbitrators as new treaties produce old outcomes.🧵(1/9)

Intro oxford.universitypressscholarship.com/view/10.1093/o…

The book argues that we have entered a new era: a backlash against #investment arbitration has given way to a backlash by arbitrators as new treaties produce old outcomes.🧵(1/9)

Intro oxford.universitypressscholarship.com/view/10.1093/o…

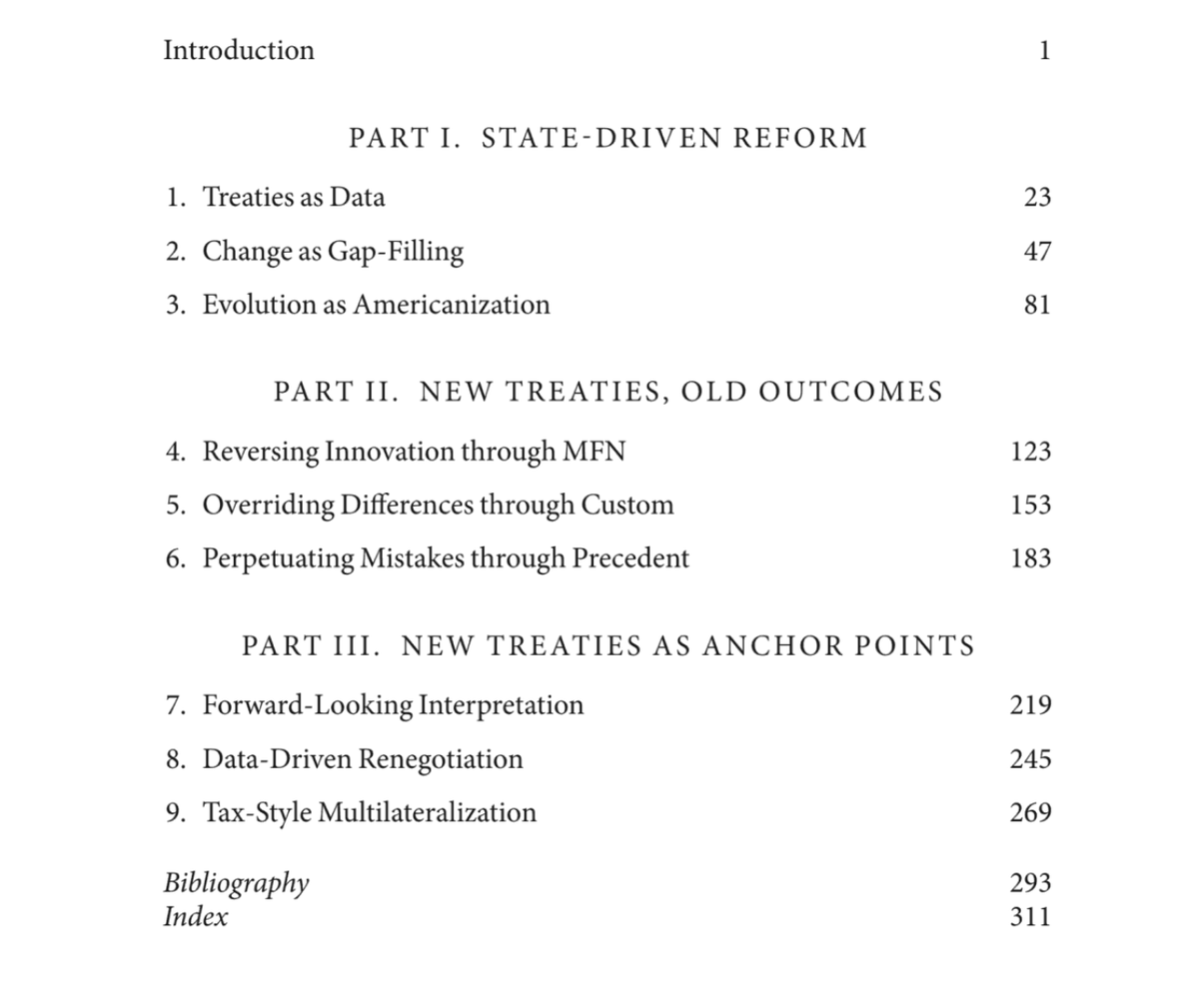

The book (1) charters how states have reformed their investment treaties, (2) tracks how these reforms have been dulled or reversed in investment arbitration, & (3) suggests ways to shift the regime's centre of gravity from old to new treaties. (2/9)

Why spent 10 years on this? Because it was fun to write about but also because it is important.

States seeking to rebalancing investment protection with host state policy space have changed the law in the books, but not the law in action. (3/9)

States seeking to rebalancing investment protection with host state policy space have changed the law in the books, but not the law in action. (3/9)

States have spent 20ys reforming their investment treaties to correct deficiencies of older treaties.

Scholars and policymakers, placing high hopes on these reforms, expected them to rebalance outcomes in arbitration.

See S Spears writing in 2010:

academic.oup.com/jiel/article/1… (4/9)

Scholars and policymakers, placing high hopes on these reforms, expected them to rebalance outcomes in arbitration.

See S Spears writing in 2010:

academic.oup.com/jiel/article/1… (4/9)

However, the first set of arbitration awards under these reformed treaties suggests that little has changed in practice.

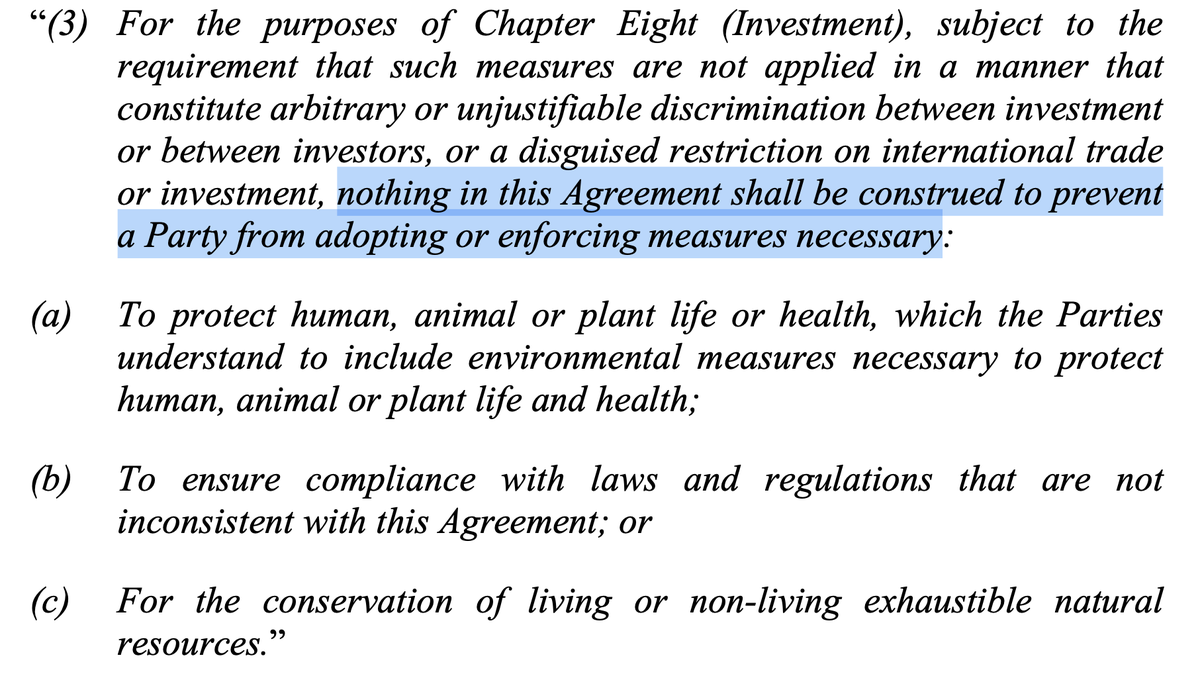

Take general exceptions to protect public health or the environment. They are a novelty in investment treaties, but have become common. (5/9)

Take general exceptions to protect public health or the environment. They are a novelty in investment treaties, but have become common. (5/9)

Last year's Eco Oro decision had to make sense of such an exception and adopted an interpretation that, to quote @jbentonheath, "declar[ed] this provision to be effectively irrelevant in investment arbitration."

iisd.org/itn/en/2021/12… (6/9)

iisd.org/itn/en/2021/12… (6/9)

Eco Oro is not alone. In decision after decision, rebalanced treaties have run into an arbitral firewall.

This should not come as a surprise. José Alvarez, writing in 2011, suspected as much.

scholarship.law.umn.edu/mjil/268/ (7/9)

This should not come as a surprise. José Alvarez, writing in 2011, suspected as much.

scholarship.law.umn.edu/mjil/268/ (7/9)

The book tries to explain and make sense of what is going on and suggests ways to ensure the success of state-driven reform. For now, I will stop here. If you want to read on, here is discount link to the book:

global.oup.com/academic/produ… (8/9)

global.oup.com/academic/produ… (8/9)

This has been quite a journey. It would not have been possible without the support, mentorship and friendship of @JoostPauwelyn @AntheaERoberts @laugepoulsen @ElisabethTuerk @DianaRosert @taylor__stjohn @nicolas_lamp @manfredelsig @LawProfPuig and many others. Thank you! (9/9)

• • •

Missing some Tweet in this thread? You can try to

force a refresh