Okay guys, it’s time to put the tinfoil hat on. I suspect that Credit Suisse is largely behind the massive efforts in precious metals rigging that have defied all logic for quite some time. I still don’t think I’m at the bottom of the rabbit hole, but here’s what I have uncovered

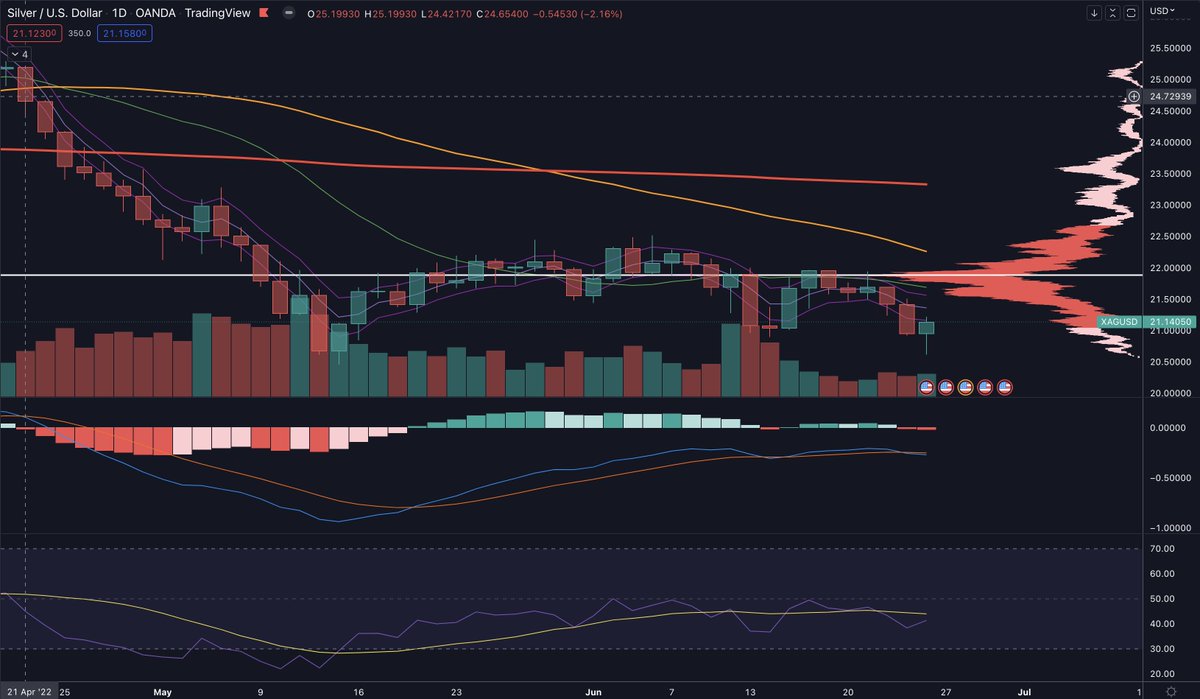

First, I want you to take a look at $SLVO — today it closed under the March 2020 lows FFS!!! This ETF uses a covered call strategy and is sold as being a product that offers a higher yield than just owning an asset/commodity outright (silver e.g. — without selling any options)

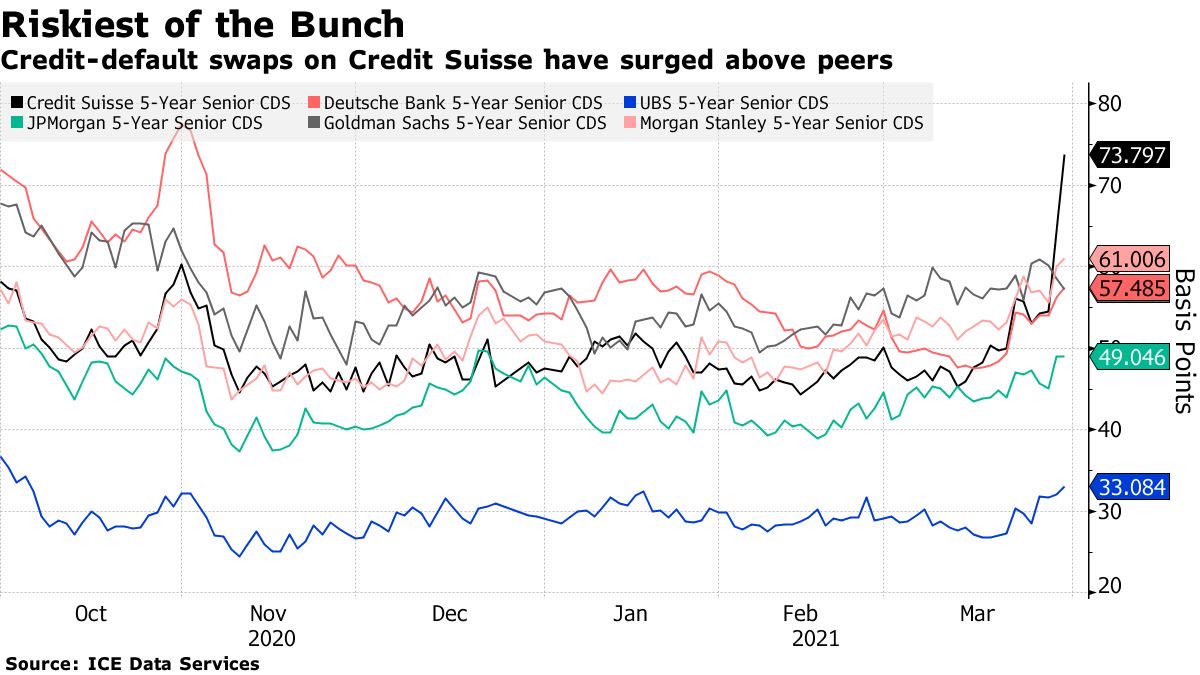

Think about that: this product, sold to customers as being conservative, volatility reducing, and income generating, is now UNDER march 2020 lows. Is this insane? Yes, it is. Please continue reading: Recently, we saw a massive spike in Credit Suisse CDS. CDS stands for Credit

Default Swap—you know, those things Michael Burry bought on the housing market that made his fortune. This is mind boggling. CDS are 99% of the time money losing hedges. To see CDS on Credit Suisse specifically rising against all other banks says something is wrong, very wrong.

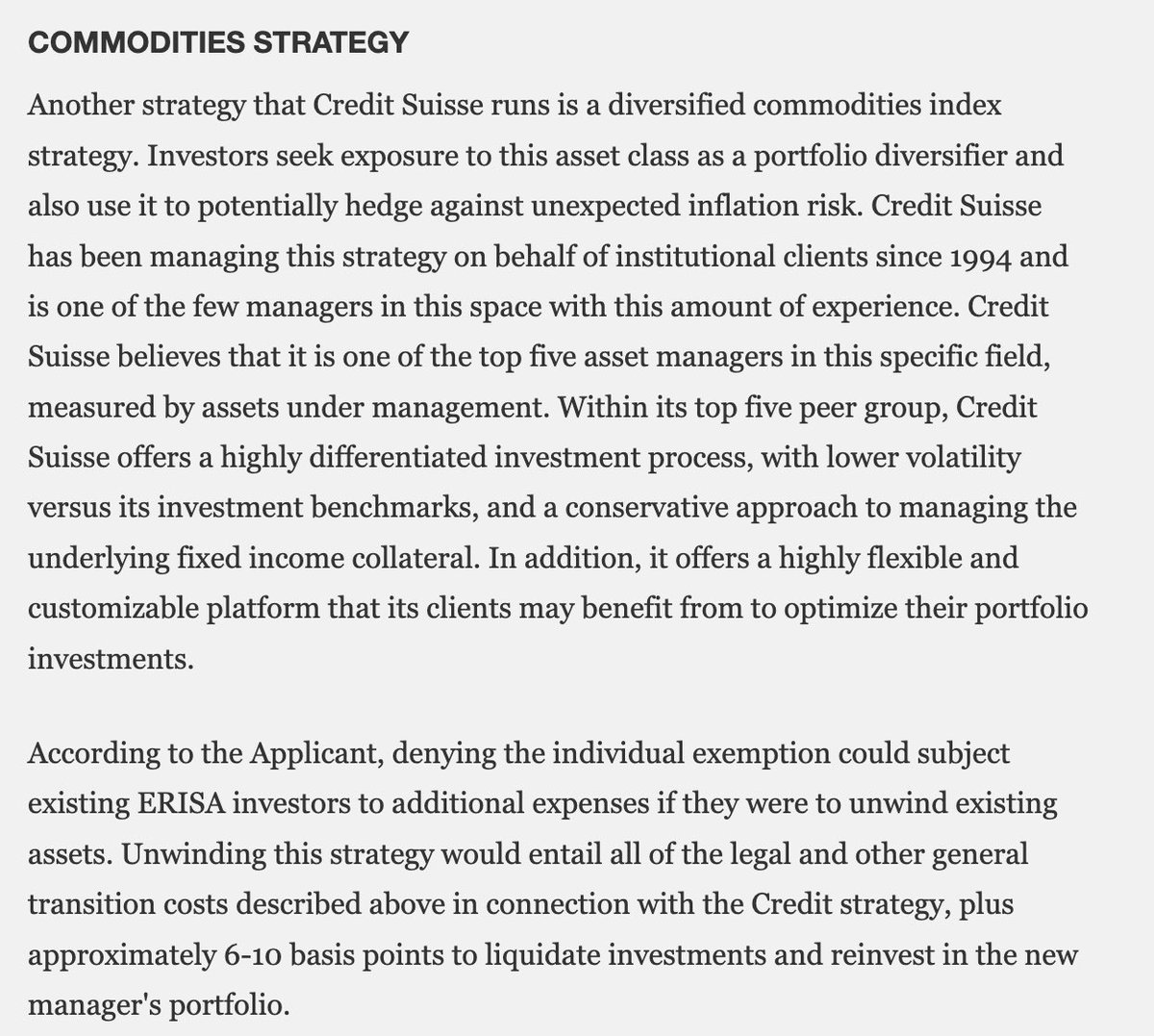

But wait, there’s more! A document was published on April 19, 2022 by the Department of Labor (DOL), titled “Exemption for Certain Prohibited Transaction Restrictions Involving Credit Suisse Group AG (CSG or the Applicant), Located in Zurich, Switzerland”

This document basically said (summed up and interpreted): Yes, we know Credit Suisse was recently caught in a massive international fraud scandal and fined hundreds of millions if not billions of dollars by the US, but they are still involved in some systemically important things

The fine brought against Credit Suisse by the US and referenced in this 4/19/2022 document is 57 pages long, was issued on 10/19/2021 and can be found here: justice.gov/opa/press-rele…

The 4/19/22 exemption issued by the DOL contained a rather strange note about Credit Suisse’s “commodities strategy.” Remember? $SLVO — which has lost 80% of its value since inception investing in #silver while the spot price has remained relatively flat during the same period?

This document actually brags about Credit Suisse being in the TOP 5 asset managers measured by AUM. What’s the current AUM of $SLVO ? — $180 million. Enough $ to take well over 10% of the registered silver category in the comex (if we can even trust the registered number).

Now why was Credit Suisse issued this exemption by the DOL? Because if they hadn’t, $SLVO AUM would have been forced to liquidate, causing the #silver price to break out above $28 (the level right where $SLVO was urgently created 10 years ago), it would have also

Literally bankrupted Credit Suisse and possibly had major collateral damage effects in the banking sector. Here’s where it gets crazy though: this exemption issued by the US DOL, was issued on 4/19/22. What happened on 4/19/22? The start of a 20% decline in the silver price.

As I always say you either believe in coincidences or you dont. The fact that $SLVO was created a day after a 20%+ decline in #silver to soak up demand says something. And the days proceeding $SLVO bail out saw silver decline by 20% can’t be ignored or written off as coincidence.

So let’s sum everything up so far:

1. Credit Suisse issued a product ($SLVO) to its clients on 4/16/2013. The day AFTER silver saw a 20% decline in TWO DAYS.

2. This product has hilariously lost 80% of its value despite spot silver being at the same fucking price it was then.

1. Credit Suisse issued a product ($SLVO) to its clients on 4/16/2013. The day AFTER silver saw a 20% decline in TWO DAYS.

2. This product has hilariously lost 80% of its value despite spot silver being at the same fucking price it was then.

3. We recently saw a surge in CDS on Credit Suisse which coincided with a dramatic rise in the silver price during Q1 2022.

4. A judgement was issued by the US DOL which effectively bailed out Credit Suisse and avoided mass liquidations in $SLVO.

4. A judgement was issued by the US DOL which effectively bailed out Credit Suisse and avoided mass liquidations in $SLVO.

5. The day this judgement was issued coincided with a 20% decline in the #silver price to new 52 week recent lows.

6. I’m sure there’s more to uncover and I plan on continuing my research, re-reading documents that have been issued, and posting new information as I find it.

6. I’m sure there’s more to uncover and I plan on continuing my research, re-reading documents that have been issued, and posting new information as I find it.

7. In the mean time, I encourage everyone to do a google search on recent Credit Suisse news articles — the amount of litigation, allegations of fraud, client losses, bizarre deals that blew up in 2018/2019, is all overwhelming and I’m sure fits nicely into the puzzle unfolding.

• • •

Missing some Tweet in this thread? You can try to

force a refresh