I talk to investors on a daily basis and most have no clue how to analyze a property.

Here is a simple playbook(with the financial model) you can use👇🧵

Here is a simple playbook(with the financial model) you can use👇🧵

Quick preface:

I am not saying I do it the best way. But if consulting has taught me anything, it's how to create financial models.

But here is a kicker:

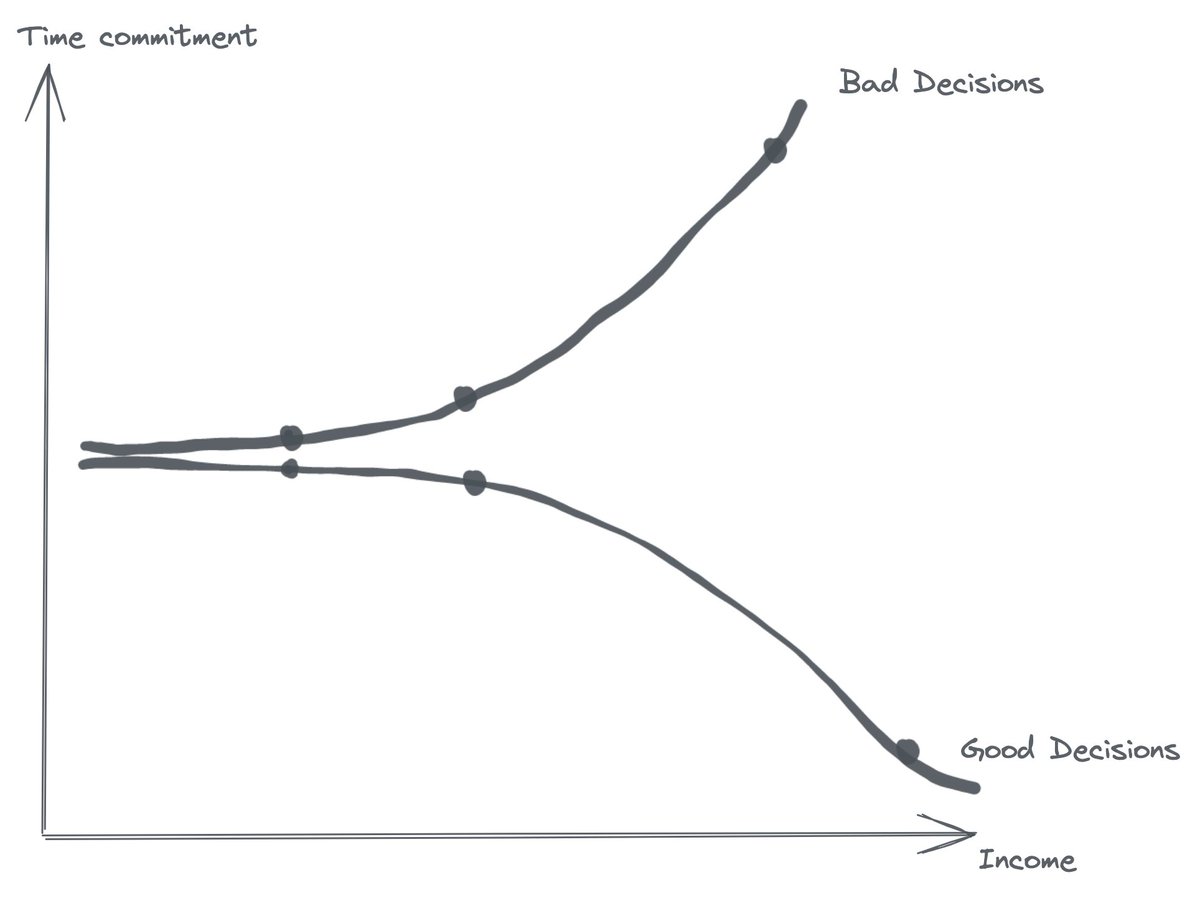

The analysis is not even about how to create a great financial model but rather more about the strategy behind it.

I am not saying I do it the best way. But if consulting has taught me anything, it's how to create financial models.

But here is a kicker:

The analysis is not even about how to create a great financial model but rather more about the strategy behind it.

It's a way of thinking and that's what I want to share today.

It has worked for me because I always undershoot and I don't rely on market cycles.

It has worked for me because I always undershoot and I don't rely on market cycles.

Let's dive in:

My strategy is 1-20 units so this overview is only for 1-20 units.

If you are looking for larger MFs, the fundamentals still remain the same.

I'll share the analyzer at the end.

My strategy is 1-20 units so this overview is only for 1-20 units.

If you are looking for larger MFs, the fundamentals still remain the same.

I'll share the analyzer at the end.

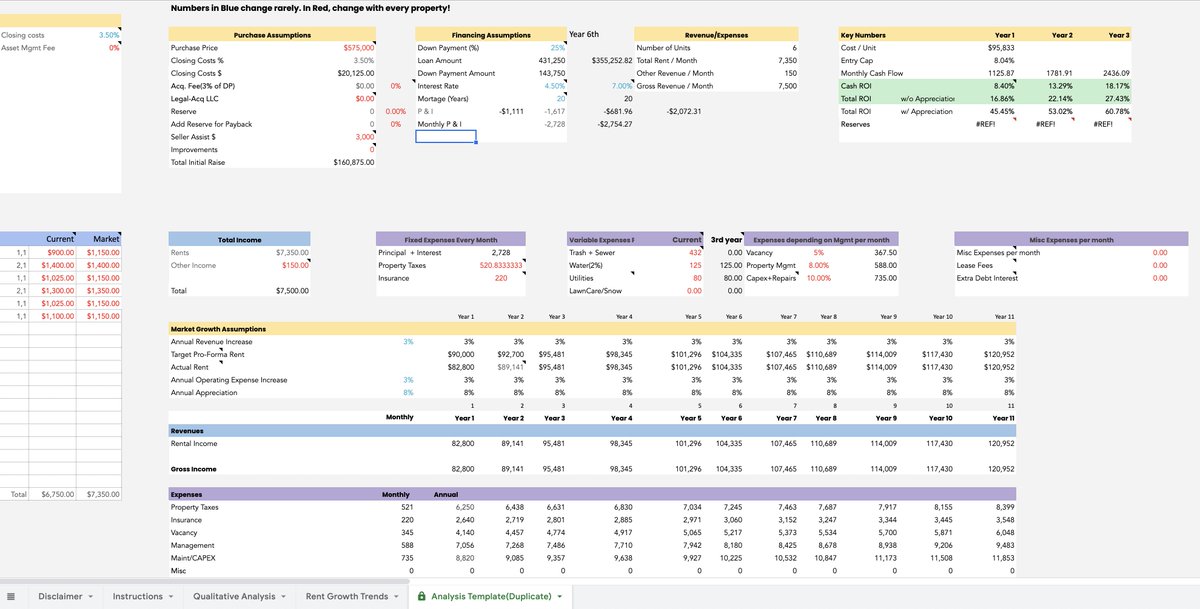

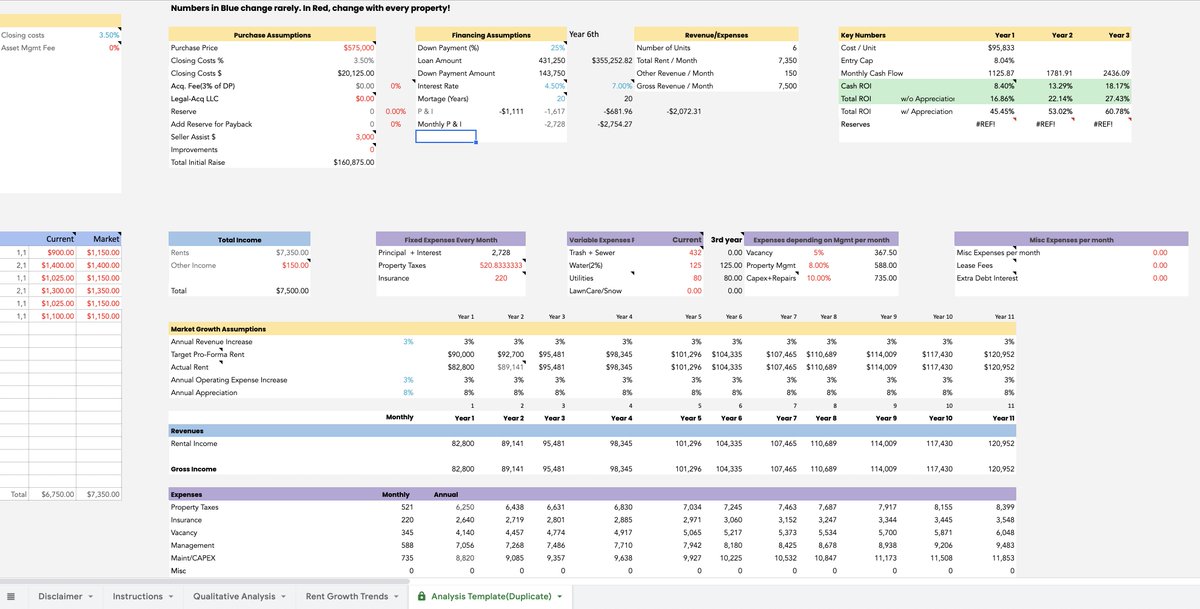

Let's work with an actual 6 units I have had under contract.

I will cover in the future how I calculate the model differently with capital partners using the standard waterfall method:

Sign up for the newsletter to be notified(Link above)

I will cover in the future how I calculate the model differently with capital partners using the standard waterfall method:

Sign up for the newsletter to be notified(Link above)

- I got this one off-market from a broker in a hot market with >20 offers/listing.

- Reason I won is by building relationships with major brokers & establishing street cred.

My leads are all inbound now.

- Reason I won is by building relationships with major brokers & establishing street cred.

My leads are all inbound now.

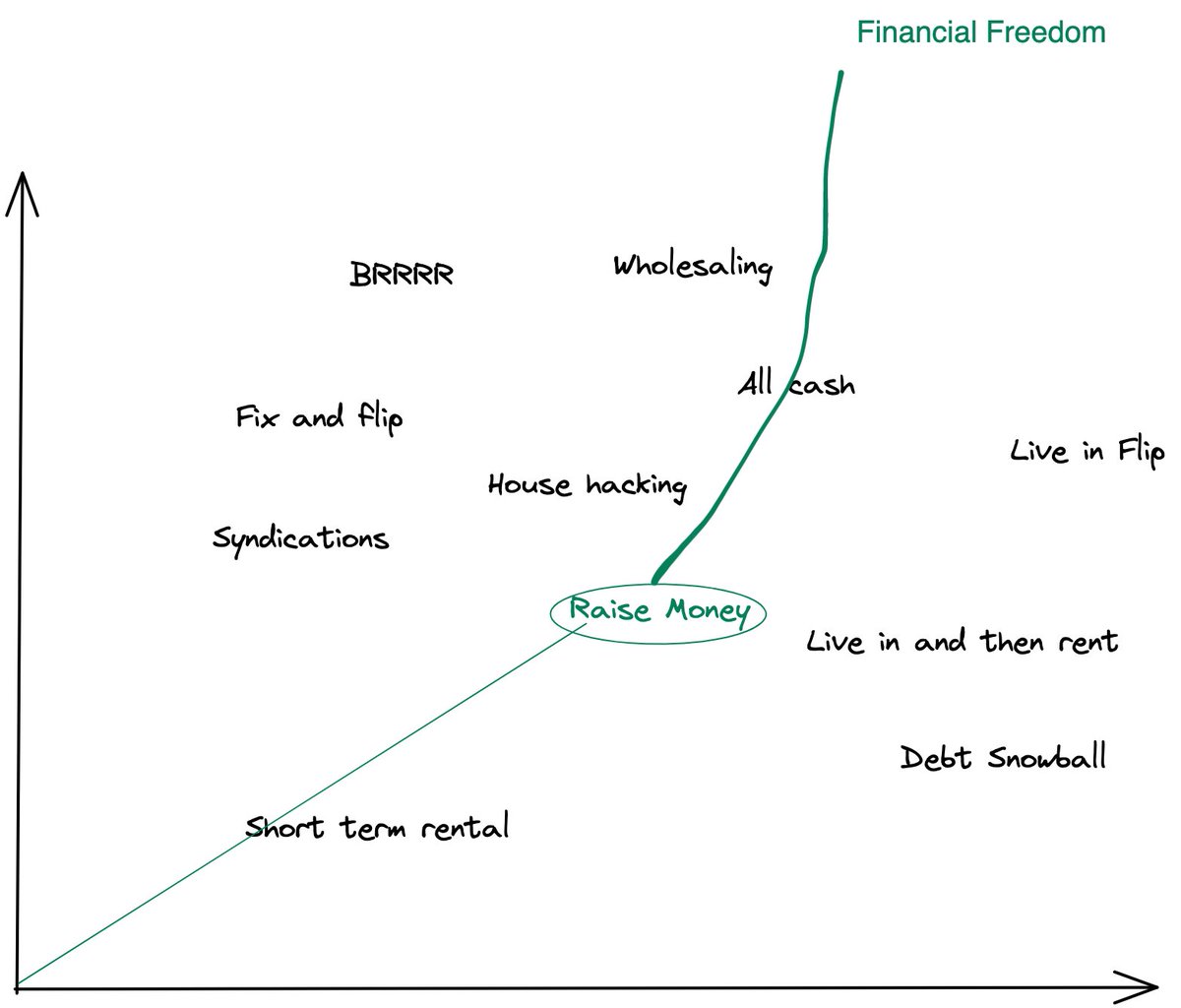

I think outbound stuff like mail marketing, cold calling, driving for dollars, etc is very low leverage and a waste of time if you are in it to grow really fast like me.

✅Step 1:

I asked the broker for gross rents and asking price to do an initial napkin analysis.

My goal is always to try to respond within 30 mins, even if breaking my daily routine, which I am religious about.

Speed is critical with good brokers.

I asked the broker for gross rents and asking price to do an initial napkin analysis.

My goal is always to try to respond within 30 mins, even if breaking my daily routine, which I am religious about.

Speed is critical with good brokers.

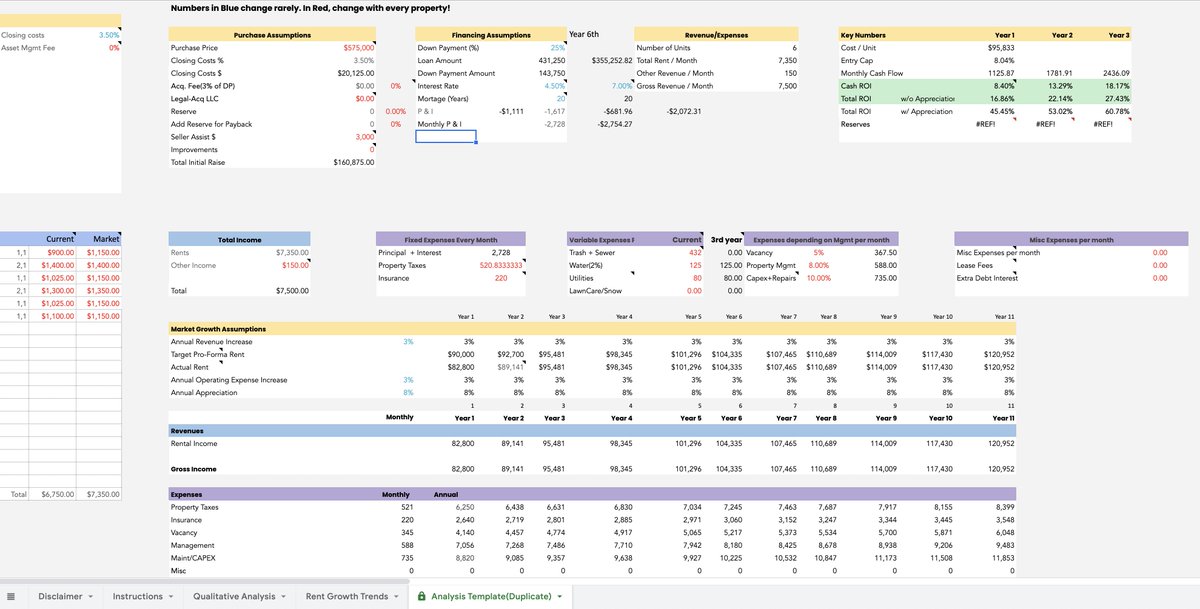

• Gross rents were = $6,750 and asking = $575K

• Gross rents per month > 1% of asking, so this is an indicator that it might meet my cash return goals.

I'll move it to the next stage.

• Gross rents per month > 1% of asking, so this is an indicator that it might meet my cash return goals.

I'll move it to the next stage.

✅Step 2:

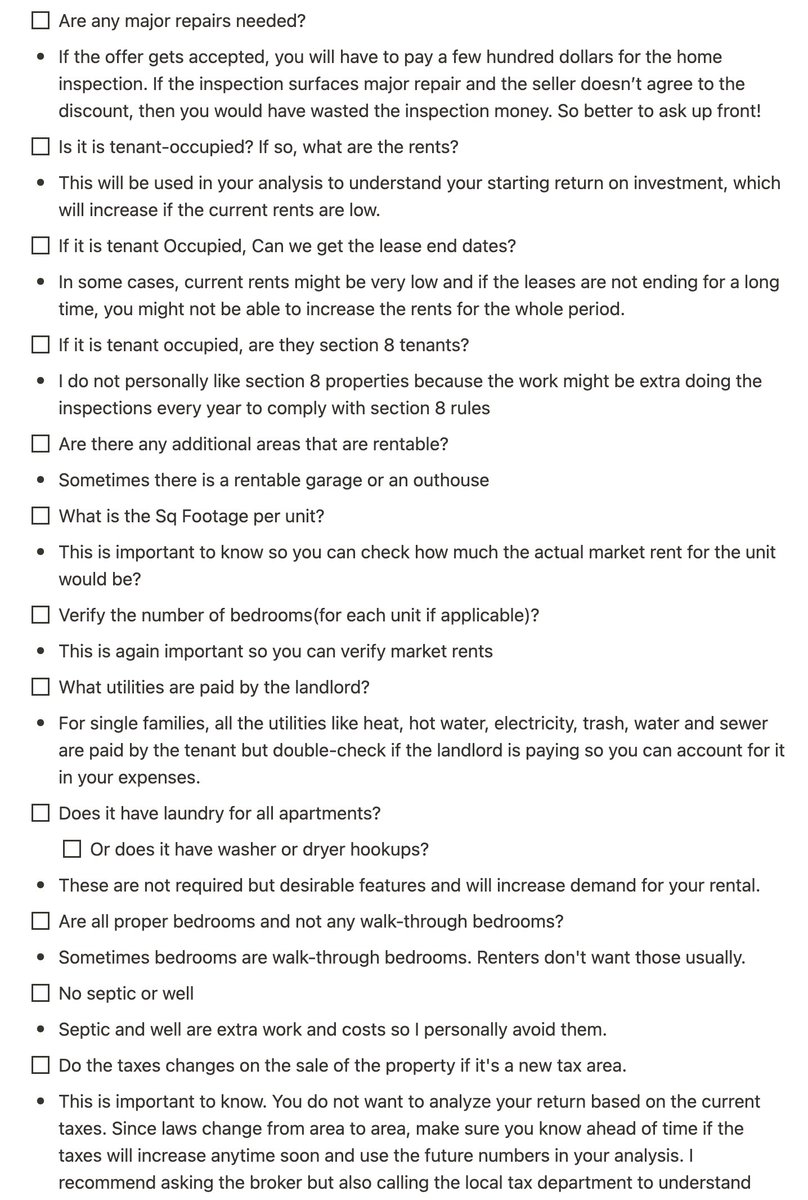

Since the listing is off-market & not all info is online.

I'll reach out to the broker to get inputs for my financial model and to do some qualitative analysis(See a portion of my list in the pic)

I'll ask:

• More pictures

• Property taxes, current insurance info

Since the listing is off-market & not all info is online.

I'll reach out to the broker to get inputs for my financial model and to do some qualitative analysis(See a portion of my list in the pic)

I'll ask:

• More pictures

• Property taxes, current insurance info

• Confirm the going interest rate with the lender again.

• The current rents per apt.

• The Sq footage and # of bedrooms per apartment so I can get rent comparables

• The current rents per apt.

• The Sq footage and # of bedrooms per apartment so I can get rent comparables

• If the utilities are paid by the landlord or are the meters separate so I can bill to tenants? In multi-families, some utilities are paid by the landlords.

• Are there any significant repairs needed? I don't do fixer-uppers

• Are there any significant repairs needed? I don't do fixer-uppers

• Can the seller give a certificate of occupancy before closing?

This is the inspection the city does and if not passed by the city, I might have to account for extra repair costs.

• Does it have laundry for all apartments? This is attractive to the tenants.

This is the inspection the city does and if not passed by the city, I might have to account for extra repair costs.

• Does it have laundry for all apartments? This is attractive to the tenants.

• Are all bedrooms really proper bedrooms? Sometimes there is a bedroom that is a walkthrough and that can really reduce the rent projections. Sellers love to wrongly advertise 😎

• Lease end dates so I can understand how long it will take me to up the rent to market rent.

• Lease end dates so I can understand how long it will take me to up the rent to market rent.

• Why is the seller selling it? They can make it up but I still ask because the seller might be selling other properties as well and this could give me more leads.

• Check that property is not in a flood zone.

• Check that property is not in a flood zone.

✅Step 3:

If all looks good, now a deeper financial analysis is worthy of my time.

I'll enter the data in the model(link at the end).

I have added in-cell notes for anyone to follow along.

If all looks good, now a deeper financial analysis is worthy of my time.

I'll enter the data in the model(link at the end).

I have added in-cell notes for anyone to follow along.

Some important notes

- I tweak the appreciation growth based on my exit cap rate

- I do not compress my exit caps. I assume I'll not be able to maximize the value add (even though I know will)

- I'll cap my rent growth at 3 even if the market has grown by 10% YOY last 8 years

- I tweak the appreciation growth based on my exit cap rate

- I do not compress my exit caps. I assume I'll not be able to maximize the value add (even though I know will)

- I'll cap my rent growth at 3 even if the market has grown by 10% YOY last 8 years

Now, I look for a 12% cash return conservatively by year 2 and this has 13.29%(see top right) at the asking price(top left)

✅Step 4:

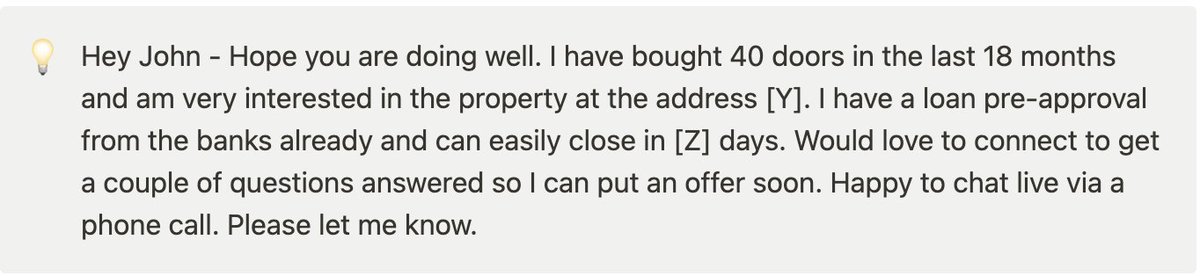

At this point, I'll put in a verbal offer.

There is no point in drafting the written proposal until the seller accepts the verbal offer = saves time.

At this point, I'll put in a verbal offer.

There is no point in drafting the written proposal until the seller accepts the verbal offer = saves time.

I also arm the broker with a short bio to convince the seller of my ability to close. (See pic)

Most buyers don’t do this and that little extra is what counts.

Also got a loan pre-approval in minutes from better dot com = Extra ammo!

Most buyers don’t do this and that little extra is what counts.

Also got a loan pre-approval in minutes from better dot com = Extra ammo!

In this case, the verbal offer was accepted🎉

Because it’s extra work for me to review offers prepared by the agents, I write my own offers from my pre-built Docusign template #hack

Again saving time.

Because it’s extra work for me to review offers prepared by the agents, I write my own offers from my pre-built Docusign template #hack

Again saving time.

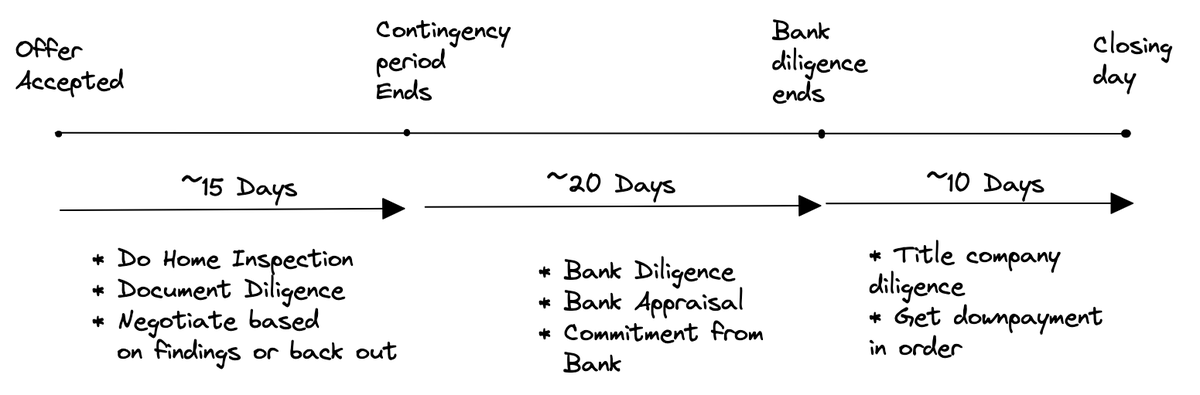

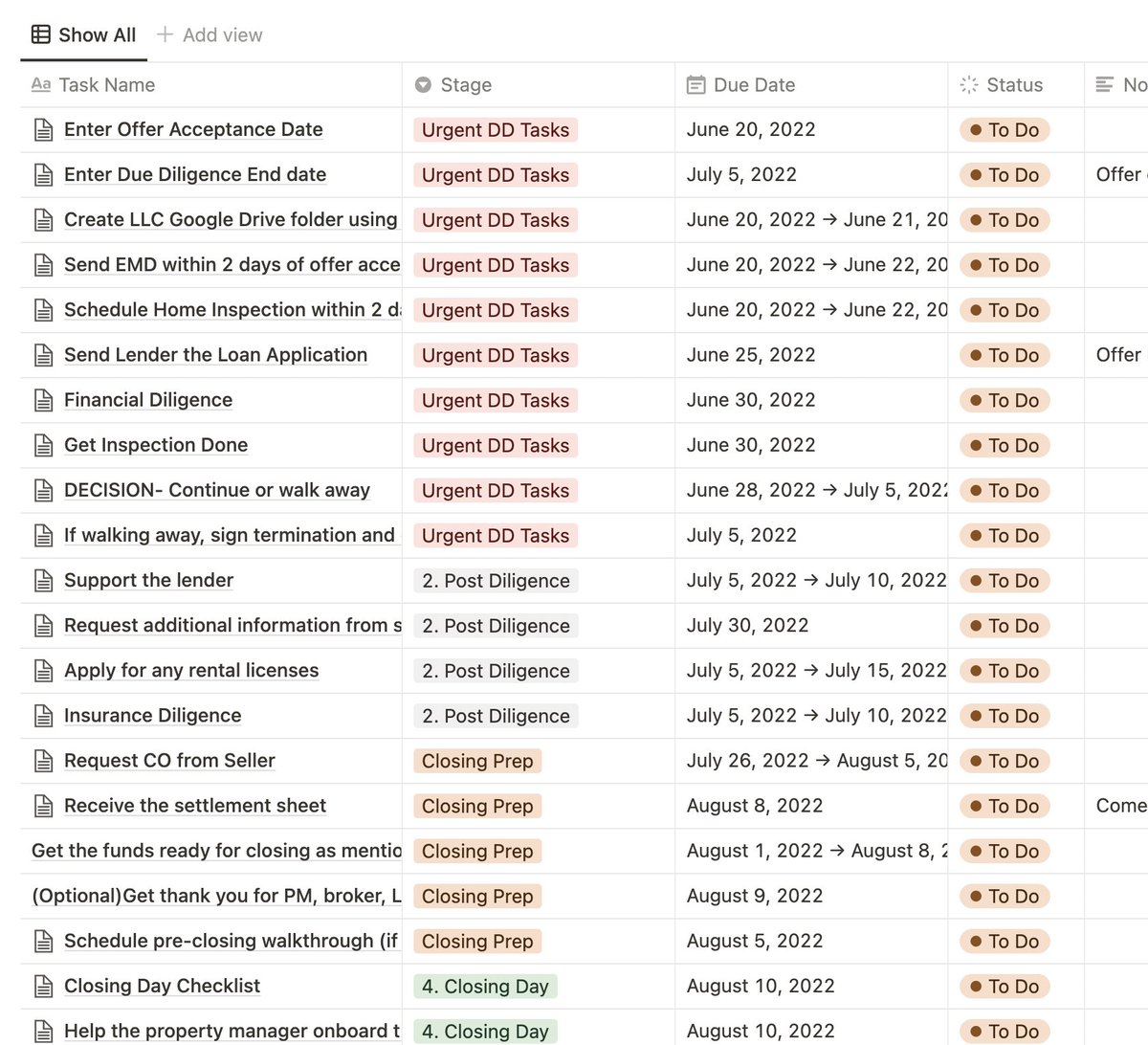

As soon as I receive the signed offer from the seller, the deal is live and all parties have 45 days(per my offer) to do the work to close.

Check this pic for a high-level plan.

Check this pic for a high-level plan.

For the next 45 days, I did an autopsy to try to find any flaws in the property before finally closing.

See this pic for my live deal plan!

See this pic for my live deal plan!

That's it friends.🙂

Hope this helps!

If you want

✔️Deep playbooks

✔️Deal reviews

✔️Financial models

✔️Private equity learnings

✔️Strategy frameworks

✔️Case Studies

✔️Automation hacks and more:

Join >3,000 subscribers on:

rehacks.io/newsletter

Hope this helps!

If you want

✔️Deep playbooks

✔️Deal reviews

✔️Financial models

✔️Private equity learnings

✔️Strategy frameworks

✔️Case Studies

✔️Automation hacks and more:

Join >3,000 subscribers on:

rehacks.io/newsletter

Also, if you found this thread helpful.

- Follow me @rehacks_ for more

- It would mean a lot if you could retweet or quote tweet the first tweet of this thread so I can spread the insights.

Let's help others make sound decisions. 🙌🏼

- Follow me @rehacks_ for more

- It would mean a lot if you could retweet or quote tweet the first tweet of this thread so I can spread the insights.

Let's help others make sound decisions. 🙌🏼

https://twitter.com/rehacks_/status/1540713955219320834

• • •

Missing some Tweet in this thread? You can try to

force a refresh