#Syngene FY 2022 Annual Report Takeaways 💊💊

Like & Retweet for better reach !

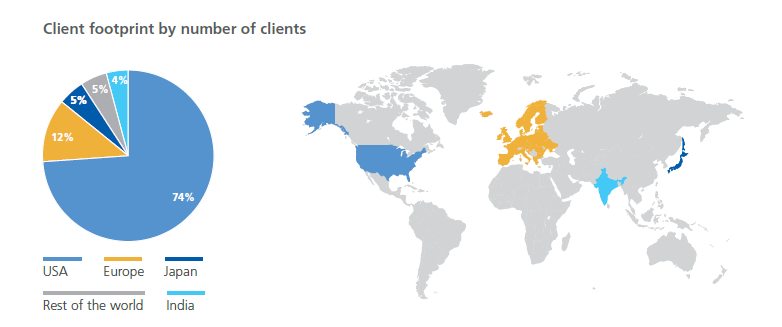

1. They were able to add 100+ new clients during the year while increasing repeat business from existing clients

Like & Retweet for better reach !

1. They were able to add 100+ new clients during the year while increasing repeat business from existing clients

2. SynVent - their integrated drug discovery platform made good progress during the year. It is proving to be a particularly attractive model for emerging biotech companies which choose not to establish their own infrastructure.

3. Capex for the year was ₹621 Cr. 70% of it was spent on Discovery Services and Dedicated Centers, 10% was spent on Development Services and another 10% was spent on Manufacturing Services. The remaining investments were in

common assets used across the company including added power grid capacity.

Segment-wise updates

1. Dedicated R&D Centers:

The BMS contract was extended upto 2030 in February 2021. During the year, they increased the

Segment-wise updates

1. Dedicated R&D Centers:

The BMS contract was extended upto 2030 in February 2021. During the year, they increased the

scope of services provided to BMS and the number of scientists on the project.

The Amgen contract was extended during the year upto 2026. The scope of engagement covers integrated drug discovery and development solutions in discovery chemistry and biology,

The Amgen contract was extended during the year upto 2026. The scope of engagement covers integrated drug discovery and development solutions in discovery chemistry and biology,

peptide chemistry, antibody and protein reagents, pharmacokinetics and drug metabolism and pharmaceutical development. In addition to operating the existing dedicated facility, a new exclusive laboratory will be built to accelerate Amgen projects.

2. Discovery Services:

They completed the Phase 3 expansion of the Hyderabad facility during the year. Along with the additional space of 48,200 sq. ft. the facility now accommodates nearly 600 scientists working on synthetic and organic chemistry and

They completed the Phase 3 expansion of the Hyderabad facility during the year. Along with the additional space of 48,200 sq. ft. the facility now accommodates nearly 600 scientists working on synthetic and organic chemistry and

integrated drug discovery projects.

During the year, Discovery Chemistry scientists were listed as authors in four publications and as inventors on eight patent applications and Discovery Biology scientists were listed as

During the year, Discovery Chemistry scientists were listed as authors in four publications and as inventors on eight patent applications and Discovery Biology scientists were listed as

authors in five publications and four posters were presented in events

3. Development Services

They worked on the development of a generic drug for one of the world’s largest drug companies. They were able to execute in a period of 5 months whereas the industry standard is

3. Development Services

They worked on the development of a generic drug for one of the world’s largest drug companies. They were able to execute in a period of 5 months whereas the industry standard is

8-10 months. The project scope included technology transfer, pilot batches, scaleup batches and registration batches.

They also made progress in building a project pipeline covering a combination of novel molecules, niche generic APIs and intermediates.

They also made progress in building a project pipeline covering a combination of novel molecules, niche generic APIs and intermediates.

6 of Syngene’s scientists were cited among the inventors in a US patent filed by Panbela Therapeutics.

They expect the injectable fill finish facility to be completed in Q1 FY23 which will help them offer sterile manufacturing for clinical trials.

They expect the injectable fill finish facility to be completed in Q1 FY23 which will help them offer sterile manufacturing for clinical trials.

They also strengthened their development service offering through more complex chemistry capabilities like oligonucleotides, polymers and highly potent APIs.

4. Manufacturing Services:

They commissioned a new cGMP microbial facility and expanded their existing mammalian

4. Manufacturing Services:

They commissioned a new cGMP microbial facility and expanded their existing mammalian

facility by 30% during the year. The new microbial facility includes 2 stainless steel fermenters of 200L and 500L capacity.

Qualification and validation batches are underway at the Mangalore API facility which is expected to attract a USFDA and EMA inspection in calendar

Qualification and validation batches are underway at the Mangalore API facility which is expected to attract a USFDA and EMA inspection in calendar

year 2023. The ramp up of the facility is expected to happen H2 FY24.

• • •

Missing some Tweet in this thread? You can try to

force a refresh