The rise and fall of the consumer.

Household demand for goods and services is poised to fall off a cliff.

The US economy simply cannot handle the Fed’s continued monetary tightening.

This is the onset of a vicious stagflationary environment.

Here is a thread 👇👇👇

Household demand for goods and services is poised to fall off a cliff.

The US economy simply cannot handle the Fed’s continued monetary tightening.

This is the onset of a vicious stagflationary environment.

Here is a thread 👇👇👇

The unprecedented combination of excessive debt, speculative asset bubbles, and persistent inflation makes the current economic environment truly precarious.

A major contraction in consumer demand is imminent.

These factors will soon pressure the Fed into a policy dilemma.

A major contraction in consumer demand is imminent.

These factors will soon pressure the Fed into a policy dilemma.

The Fed is facing one of the worst predicaments of its existence as it continues to raise interest rates into an economic downturn.

The problem is that sooner rather than later it will be forced to relent and inject liquidity into an already inflationary environment.

The problem is that sooner rather than later it will be forced to relent and inject liquidity into an already inflationary environment.

Historically elevated cost of living, surging mortgage rates, and tightening financial conditions are about to trigger a significant contraction in household spending.

Note:

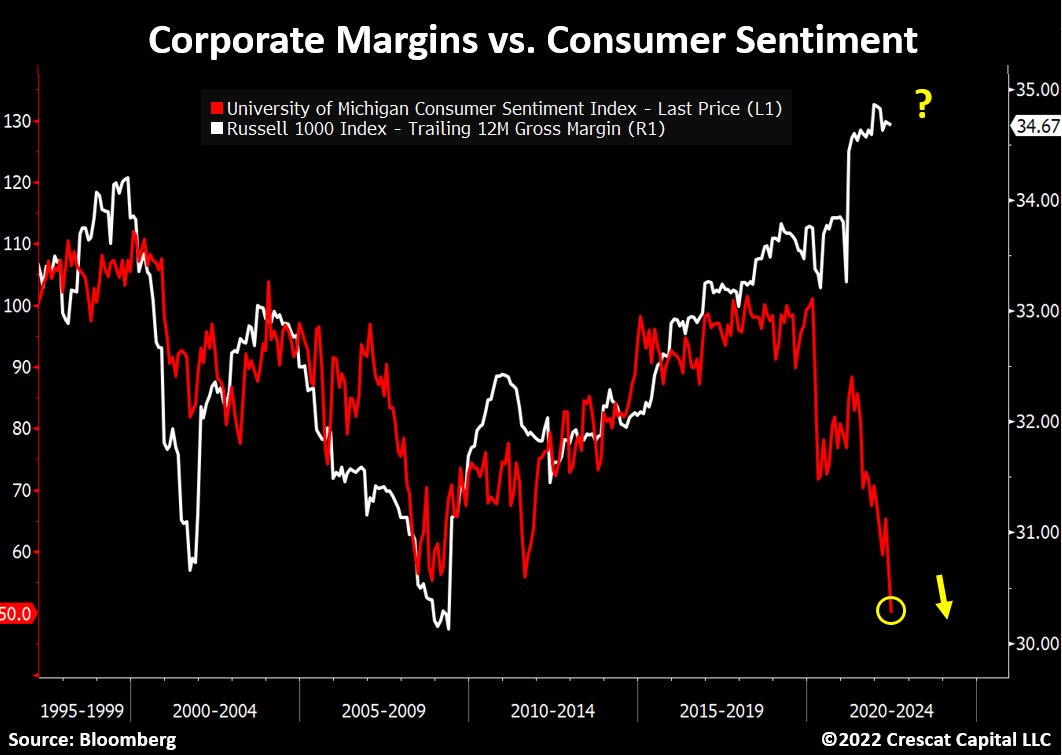

The collapse in consumer sentiment suggests that corporate margins are likely to decline drastically.

Note:

The collapse in consumer sentiment suggests that corporate margins are likely to decline drastically.

While workers are starting to make more money, the growth in salaries is not outpacing inflation.

In real terms, wages are declining by almost 4%, worse than the GFC.

Saving rates are also plummeting.

Now at the lowest level in 14 years.

Consumers are at a breaking point.

In real terms, wages are declining by almost 4%, worse than the GFC.

Saving rates are also plummeting.

Now at the lowest level in 14 years.

Consumers are at a breaking point.

As problematic as it may appear:

The recent decline in equity markets should also drastically impact consumer demand.

US stocks have already lost $13T in market cap since the downturn started.

That is already a greater capital loss than during the GFC and Covid Recession.

The recent decline in equity markets should also drastically impact consumer demand.

US stocks have already lost $13T in market cap since the downturn started.

That is already a greater capital loss than during the GFC and Covid Recession.

In addition to the consumer demand side risks:

Today’s inflation problem is likely to compress margins significantly from record levels.

It's a combination of systemic issues:

• Steep rise in cost of capital

• Structurally rising raw materials prices

• Wage pressure

Today’s inflation problem is likely to compress margins significantly from record levels.

It's a combination of systemic issues:

• Steep rise in cost of capital

• Structurally rising raw materials prices

• Wage pressure

The recent strength of the dollar is also an important factor to consider.

History shows that as the US currency appreciates relative to its peers, significant declines in corporate profits tend to follow.

History shows that as the US currency appreciates relative to its peers, significant declines in corporate profits tend to follow.

Analysts are slow to incorporate macro factors like currency changes into their earnings estimates.

As a result, we expect US multinational companies to be subject to material negative earnings surprises for the June quarter now ending.

As a result, we expect US multinational companies to be subject to material negative earnings surprises for the June quarter now ending.

Also:

For those who believe consumer demand will remain strong after 30-yr mortgage interest rates doubled in last 6 months, it is time to re-consider that view.

The median mortgage payment monthly is up 56% YoY.

This factor alone is likely to handicap household spending.

For those who believe consumer demand will remain strong after 30-yr mortgage interest rates doubled in last 6 months, it is time to re-consider that view.

The median mortgage payment monthly is up 56% YoY.

This factor alone is likely to handicap household spending.

As corporate earnings deteriorate, we believe the labor market will suffer accordingly.

The rise in part-time employees for economic reasons likely portends significant weakness in labor markets ahead.

A similar divergence with unemployment rates also preceded the GFC.

The rise in part-time employees for economic reasons likely portends significant weakness in labor markets ahead.

A similar divergence with unemployment rates also preceded the GFC.

Wall Street analysts are always looking in the rear-view mirror.

After a stimulus-led surge in corporate earnings, they are now projecting another 35% spurt in the next 3 yrs.

We expect corporate profits to nominally contract, while in real terms, to substantially decline.

After a stimulus-led surge in corporate earnings, they are now projecting another 35% spurt in the next 3 yrs.

We expect corporate profits to nominally contract, while in real terms, to substantially decline.

Looking back in history, at the very first wave of the inflation problem in the late 1960s and early 1970s, real corporate earnings contracted by almost a third.

Such level of decline is unimaginable for most investors today.

Such level of decline is unimaginable for most investors today.

The planned degree of monetary tightening today is a major concern.

While we saw the same decline in corporate bonds in 3/2020 as we have over the last year, the difference is that back then, the Fed doubled the size of its balance sheet and slashed rates to 0% to address it.

While we saw the same decline in corporate bonds in 3/2020 as we have over the last year, the difference is that back then, the Fed doubled the size of its balance sheet and slashed rates to 0% to address it.

Among all tech stocks in the Russell 3000, only 10% of them remain above their 200-DMA.

This sector represents the largest part of the US economy today.

If the stock underperformance persists, it should have a significant impact on future employment plans of these companies.

This sector represents the largest part of the US economy today.

If the stock underperformance persists, it should have a significant impact on future employment plans of these companies.

Let us not forget that the bursting of the Tech Bubble 2.0 is only getting started.

In 2000, the technology sector’s overall market cap peaked out at 21% of the US economy.

Today, despite the recent selloff, this valuation measure is still at Tech Bubble 1.0 highs.

In 2000, the technology sector’s overall market cap peaked out at 21% of the US economy.

Today, despite the recent selloff, this valuation measure is still at Tech Bubble 1.0 highs.

Tightening monetary conditions and the steep rise in cost of capital will not only negatively impact consumers, corporate earnings, and overvalued financial assets, it will also cause pain for highly indebted sovereigns.

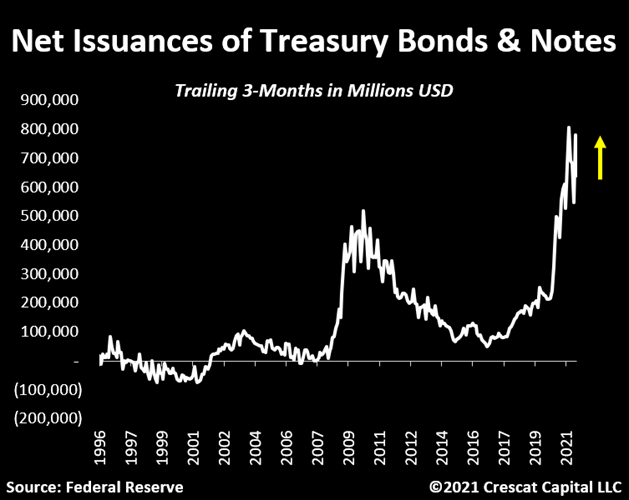

As we have laid out repeatedly, one of the most concerning issues with US interest rates, particularly at the long end of the curve, continues to be the overwhelming amount of Treasury issuances driven by the excessive twin deficits, fiscal and trade.

We believe the US economy is spiraling headlong into recession.

On a real GDP basis, we think one has already begun due to today’s high inflation rate.

Unemployment, a lagging indicator, is naturally the next shoe to drop.

On a real GDP basis, we think one has already begun due to today’s high inflation rate.

Unemployment, a lagging indicator, is naturally the next shoe to drop.

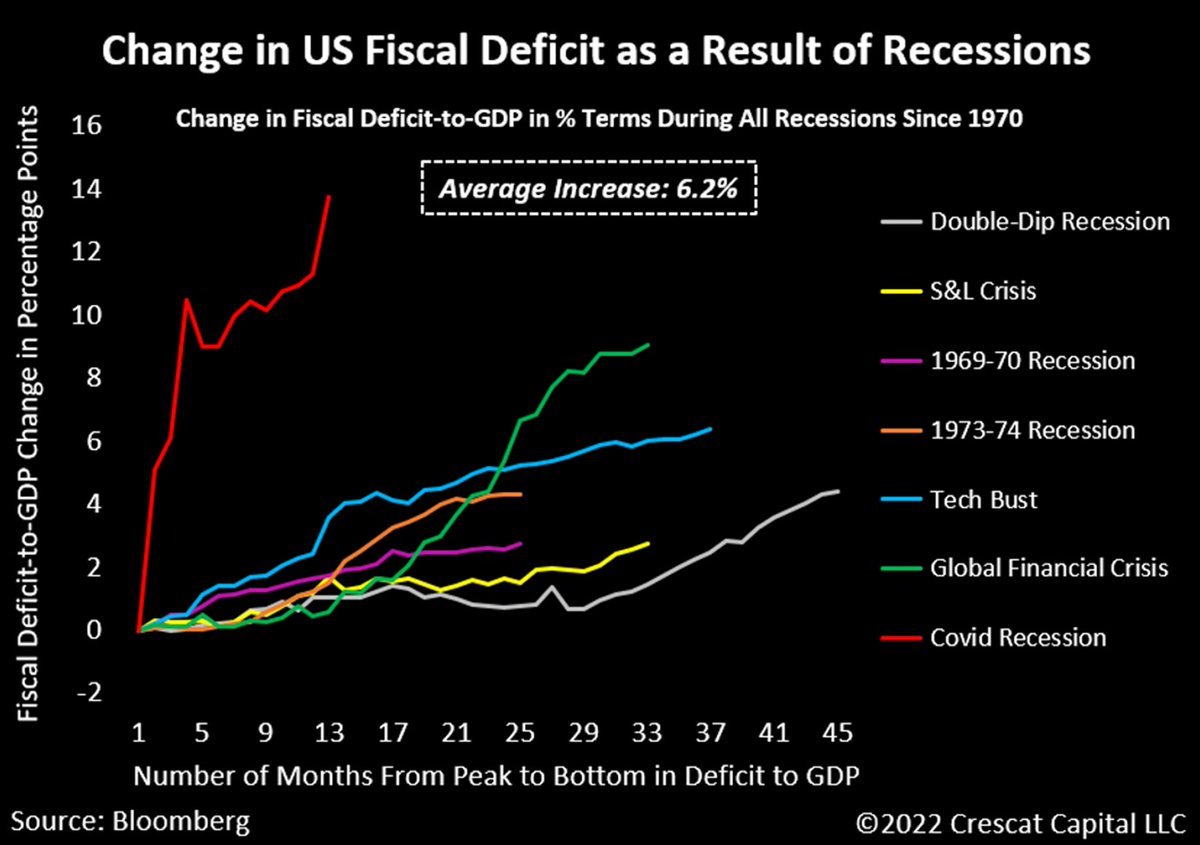

If indeed we are entering a recession, just like every other economic downturn since 1970, the fiscal deficit to GDP will only increase further.

In most cases, it is the result of larger government spending to address the downturn and sometimes also declining nominal GDP levels.

In most cases, it is the result of larger government spending to address the downturn and sometimes also declining nominal GDP levels.

Looking at all recessions since 1970, fiscal deficit-to-GDP worsened by an average of 6.2%.

We think the next downturn will be no different.

We think the next downturn will be no different.

The problem is:

Government spending will likely be increasing with inflation rates already historically elevated so nominal GDP may also be rising.

Ultimately, this combination should prove very positive for tangible assets, particularly gold.

Government spending will likely be increasing with inflation rates already historically elevated so nominal GDP may also be rising.

Ultimately, this combination should prove very positive for tangible assets, particularly gold.

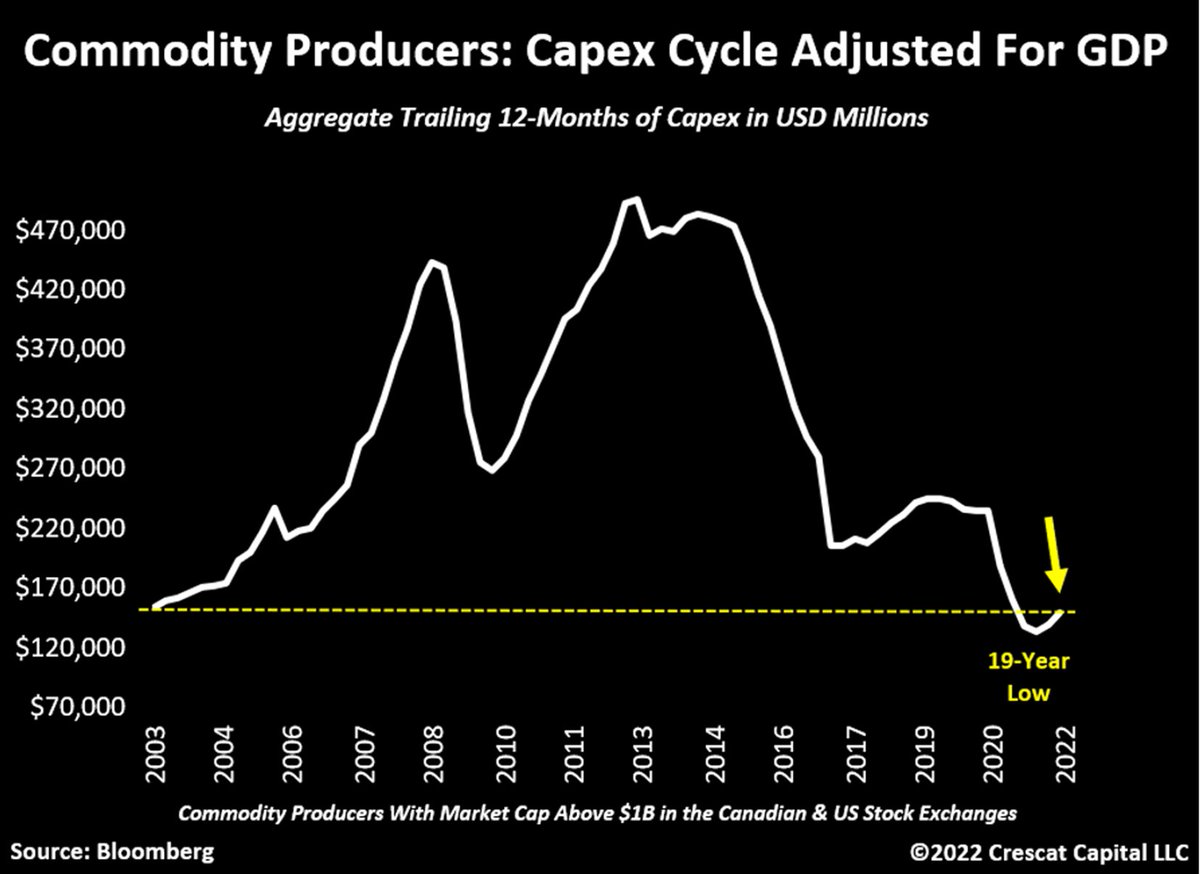

It amazes us how much commodities have fallen in just the last month despite years of depressed capital investment in producing new supplies.

It is a signal of a weakening economy and fear over Fed tightening that will almost certainly hit consumer demand and corporate earnings.

It is a signal of a weakening economy and fear over Fed tightening that will almost certainly hit consumer demand and corporate earnings.

While the current hawkish stance by the Fed should create downward pressure on inflationary forces by reducing the availability of capital and credit in the economy it will only exacerbate the structural issues we face.

As we have presented multiple times, the long-term capital spending among natural resource industries is near historical lows.

We strongly believe that until this imbalance gets resolved, the supply of raw materials will remain severely constrained.

CAPEX trends take a long time to reverse, and this issue should continue to fuel commodity prices to increase over time.

CAPEX trends take a long time to reverse, and this issue should continue to fuel commodity prices to increase over time.

Also:

I don’t care if you think this insanity is being caused by shareholder or political pressure:

Resource companies are almost returning more capital to their shareholders than investing in their own businesses.

This is not a sign of a commodities cycle at its peak. Period.

I don’t care if you think this insanity is being caused by shareholder or political pressure:

Resource companies are almost returning more capital to their shareholders than investing in their own businesses.

This is not a sign of a commodities cycle at its peak. Period.

Additionally:

Rising deglobalization trends are likely to prompt a long-overdue manufacturing re-build in developed economies including a boost to non-residential construction.

That’s the next waive of demand for commodities.

Rising deglobalization trends are likely to prompt a long-overdue manufacturing re-build in developed economies including a boost to non-residential construction.

That’s the next waive of demand for commodities.

On a separate, but related, topic:

It is also very impressive how gold has been holding up despite the bloodbath in global sovereign bonds.

Wait until something really breaks in the economy and the Fed is forced to reverse its policy in an already inflationary environment.

It is also very impressive how gold has been holding up despite the bloodbath in global sovereign bonds.

Wait until something really breaks in the economy and the Fed is forced to reverse its policy in an already inflationary environment.

Despite the recent pessimism towards precious metals, since the CPI went above the Fed’s 2% annualized growth target, gold and commodities were one of the few assets to perform positively in this new macro environment.

The global economy is interconnected.

It can't sustain this level of monetary tightening from developed economies to fight inflation without causing issues.

Argentina is a great example.

Its CDS just surged to ATHs.

More issues to come if financial conditions don't ease up.

It can't sustain this level of monetary tightening from developed economies to fight inflation without causing issues.

Argentina is a great example.

Its CDS just surged to ATHs.

More issues to come if financial conditions don't ease up.

Lastly:

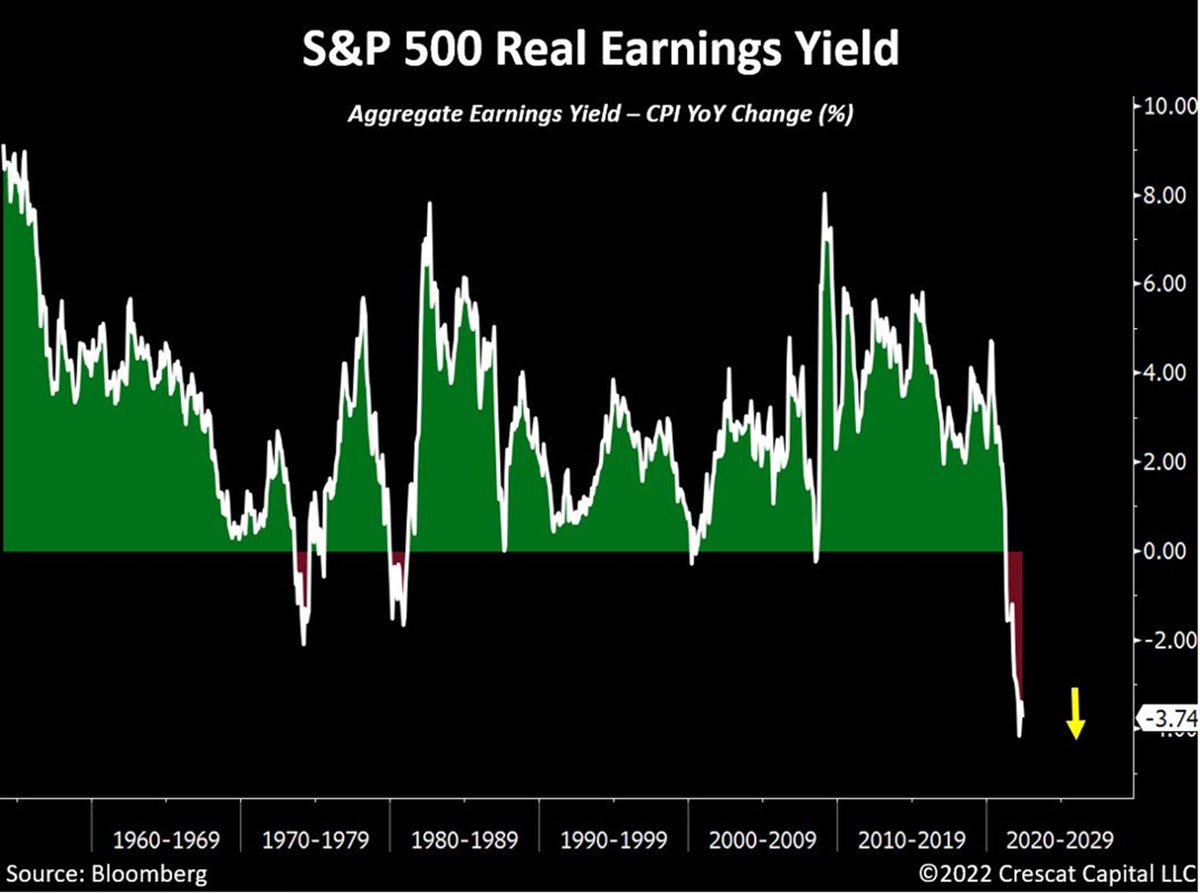

Macro imbalances are far worse than any other inflationary regime.

On a real earnings yield basis, the S&P 500 is almost 2x as expensive as it was in the 70s.

Never mind the overall debt problem which also weighs on the ability of policy makers to fight inflation.

Macro imbalances are far worse than any other inflationary regime.

On a real earnings yield basis, the S&P 500 is almost 2x as expensive as it was in the 70s.

Never mind the overall debt problem which also weighs on the ability of policy makers to fight inflation.

Let’s not forget.

For the first time in history, the US is experiencing a confluence of three macro extremes all at once:

▪️ The debt problem of the 1940s

▪️ The rising inflationary environment of the 1970s

▪️ The excessive financial asset valuations of the late 1990s

For the first time in history, the US is experiencing a confluence of three macro extremes all at once:

▪️ The debt problem of the 1940s

▪️ The rising inflationary environment of the 1970s

▪️ The excessive financial asset valuations of the late 1990s

If there was ever a time to buy commodities and short near record overvalued equities, we think it is today.

This is the beginning of a trend, not the end of one.

Our latest letter:

crescat.net/the-rise-and-f…

This is the beginning of a trend, not the end of one.

Our latest letter:

crescat.net/the-rise-and-f…

• • •

Missing some Tweet in this thread? You can try to

force a refresh