FinTwit is mentally exhausting these days, even after my holiday… the issue is one of probabilistic outcomes 1/

Right now there are more realistic possible outcomes than at any time I’ve ever worked in and as a macro investor my job is to endlessly reassess the odds of the outcomes. Hence why it’s exhausting!

So, what are the main probabilistic outcomes?

So, what are the main probabilistic outcomes?

1. Recession where inflation is not fully brought to heel and thus rates remain higher for longer and inflation comes back after recession. This is the core FinTwit view and is very reasonable. This is the 1970’s redux view. I think we lack demand for this.

2. Recession lowers demand and price rises fall back to the 2% range as 5 yr break evens suggest. The recovery when it comes does see commodity prices firm but % increases aren’t enough to drive inflation (like 2003 to 2008). This is my main view. A short sharp recession.

3. Recession leads to negative inflation prints in 12 to 18 months as YOY effects of the Covid bullwhip come into play. I have significant sympathy with this view too. This is a repeat of 1947 to 1949.

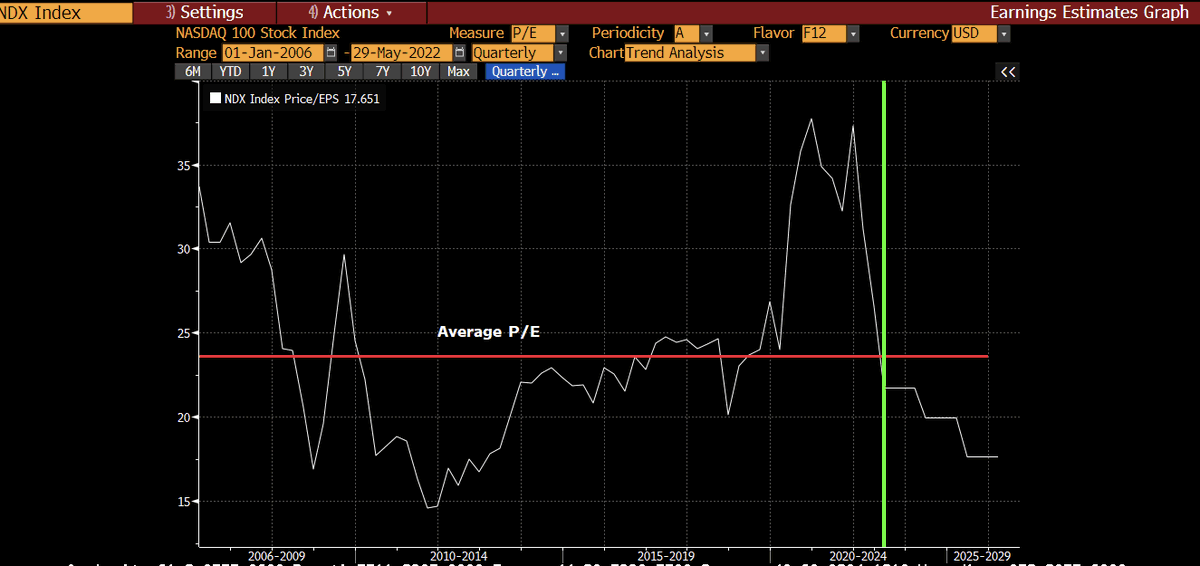

4. Recession is going to be longer and deeper and equities will get re-rated much lower. This is the 2002 redux and 2008. Again, quite probable although I don’t see all conditions in place. This is the VC held view and the value investor view. Growth tech is already -80% tho…

5. It’s just a growth scare like 1985, 1987, 1994 and 2016 and recession is narrowly avoided. This is the outcome that would make most people wrong. It’s definitely possible. 2016 caught me off guard for sure.

6. Recession where real rates need to get to 100bps or more higher to stop the inflation and that destroys everything but pleases those who think rates have been too abnormally low. I don’t put as high a probability on this but it’s possible.

That is a wide range of outcomes that makes this very tricky to invest in.

Peak cycle is always the hardest time to get clarity and patience is required.

Peak cycle is always the hardest time to get clarity and patience is required.

As ever I’m waiting for signals from bonds. When the equity/bond correlation reverses then that will call the cycle turn. I.e a leg lower in stocks = lower yields.

The leg lower in stocks/crypto if it occurs will give us a lot more informational value as will ISM over next 2 months. The Fed have paused or reversed 100% of the time ISM crosses 50 since 1970.

Let’s see how it pans out but all the loud differences of opinions on FinTwit are a very understandable outcome of the difficulties of assessing the broad probability distribution.

Our job as investors is to hold all these outcomes in our heads, re-assess the odds endlessly and as Druck says, we need to decide what the world will look like in 18 months, not today.

To me, that is lower rates (I think after fastest rise in history, this is an easier bet), rise in tech (tech trend doesn’t stop even if it gets re-rated more) and some squeezy commodities such as copper.

But as ever, one step at a time. We first need to see the rate cycle turn.

• • •

Missing some Tweet in this thread? You can try to

force a refresh