MAPPING CONTAGION IN CRYPTO

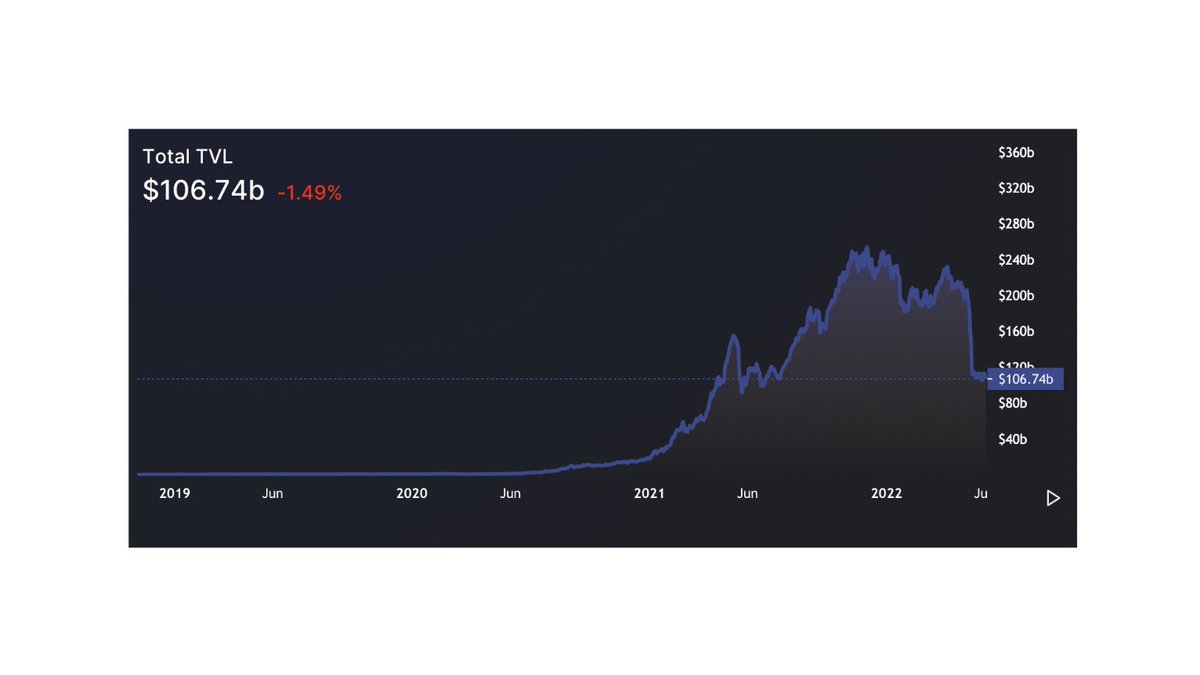

Crypto has slowly bled trillions since November, wiping out one big player at a time.

But how exactly did the giant crypto institutions fall, in what order, and why?

Today, we'll map out contagion in crypto and try to take lessons from the collapse:

Crypto has slowly bled trillions since November, wiping out one big player at a time.

But how exactly did the giant crypto institutions fall, in what order, and why?

Today, we'll map out contagion in crypto and try to take lessons from the collapse:

THE GRAYSCALE PREMIUM:

Much can all be traced back to Grayscale BTC, crypto's first publicly-traded BTC fund.

The way GBTC works:

• Deposit bitcoin in the fund

• Get $GBTC shares after a 6 months

At first there was huge demand for the fund, so it traded at a premium to BTC

Much can all be traced back to Grayscale BTC, crypto's first publicly-traded BTC fund.

The way GBTC works:

• Deposit bitcoin in the fund

• Get $GBTC shares after a 6 months

At first there was huge demand for the fund, so it traded at a premium to BTC

If the fund had 99 BTC under management, you could deposit 1 BTC (worth, say $10,000), wait 6 months, and get 1% of the fund's shares.

Since the fund was trading at a premium to assets under management, it was a good trade.

Every $1 of $BTC deposited yielded $1.30 in shares.

Since the fund was trading at a premium to assets under management, it was a good trade.

Every $1 of $BTC deposited yielded $1.30 in shares.

Who took part?

• Bitcoin miners

• Three Arrows Capital (held ~6% of the trust)

• BlockFi

The problem?

After a while, $GBTC no longer traded at a premium, but a discount. Players ended up underwater on their BTC.

A trade that at one time earned 30% suddenly LOST money.

• Bitcoin miners

• Three Arrows Capital (held ~6% of the trust)

• BlockFi

The problem?

After a while, $GBTC no longer traded at a premium, but a discount. Players ended up underwater on their BTC.

A trade that at one time earned 30% suddenly LOST money.

The fund basically created a $6b black hole based on this $GBTC discount, with big institutions having to hold shares underwater in the hopes that they could eventually redeem at face value.

It was the first time we saw liquidity getting sucked out of the crypto space at scale.

It was the first time we saw liquidity getting sucked out of the crypto space at scale.

THE LUNA DEATH SPIRAL:

While a tightening macro environment didn't help, the next chink in the armor was the Luna collapse.

If you're not familiar, my friend Jon Wu explains below:

While a tightening macro environment didn't help, the next chink in the armor was the Luna collapse.

If you're not familiar, my friend Jon Wu explains below:

https://twitter.com/jonwu_/status/1523793482850050048?s=20&t=ZI039a893EQva5bSMPhJiQ

Institutions as well got hit, with lenders like Celsius being the biggest one, you can read about their insolvency crisis here:

https://twitter.com/JackNiewold/status/1536401979466981377?s=20&t=ZI039a893EQva5bSMPhJiQ

The most recent liquidity crisis was around Lido Staked Eth, called stETH:

• stETH represents $ETH tokens earning interest and locked on the beacon chain

• These tokens typically trade at a slight discount to $ETH

Most people count on them to more-or-less hold parity with ETH

• stETH represents $ETH tokens earning interest and locked on the beacon chain

• These tokens typically trade at a slight discount to $ETH

Most people count on them to more-or-less hold parity with ETH

Many people use stETH to earn interest, and quite a few of them also borrowed against these stETH positions.

When Celsius and 3AC effectively got liquidated, they sold their stETH, further reducing the discount, pushing more people into liquidation: another death spiral.

When Celsius and 3AC effectively got liquidated, they sold their stETH, further reducing the discount, pushing more people into liquidation: another death spiral.

Enjoying the thread?

You'd love our newsletter disussing the assets and narratives shaping crypto:

CryptoPragmatist.com/sign-up/

You'd love our newsletter disussing the assets and narratives shaping crypto:

CryptoPragmatist.com/sign-up/

With 3AC outright MIA post stETH dump, the next wave of contagion began.

Anyone directionally aligned with 3AC or the assets they held is negatively affected by the market dumping of their assets.

The following industry players appear to be profoundly affected:

Anyone directionally aligned with 3AC or the assets they held is negatively affected by the market dumping of their assets.

The following industry players appear to be profoundly affected:

• Voyager Digital, a publicly traded digital asset exchange/broker that lent 3AC over $670m on an unsecured line of credit (probably toast)

• DeFiance Capital, which operates as a sub-fund of 3AC (might be ok)

• FinBlox, a crypto savings platform (paused all redemptions)

• DeFiance Capital, which operates as a sub-fund of 3AC (might be ok)

• FinBlox, a crypto savings platform (paused all redemptions)

And now, one of the only assets that 3AC hasn't yet liquidated is an NFT called 'CryptoDickbutt #1462'

It's the absolute icing on the cake.

It's the absolute icing on the cake.

https://twitter.com/JackNiewold/status/1542170744901230592?s=20&t=vDM0p-Hvu9YDcEaVljP3vg

Who else is affected?

@ApeDigest put together a nice spreadsheet documenting the extent of contagion.

@ApeDigest put together a nice spreadsheet documenting the extent of contagion.

https://twitter.com/ApeDigest/status/1540691313204482049?s=20&t=ZI039a893EQva5bSMPhJiQ

Some names you've heard of that are now likely reeling post GBTC/Luna/Celsius/3AC are:

• Maple Finance

• Genesis Global Trading

• Babel Finance

• 8 Blocks capital

• Maple Finance

• Genesis Global Trading

• Babel Finance

• 8 Blocks capital

Centralized lenders/custodians have been the worst-hit, likely because of poor lending decisions and the lack of transparency from these services.

Ironically, this is something that DeFi largely protects users against.

Ironically, this is something that DeFi largely protects users against.

For Voyager Digital, it doesn't look good.

Today, FTX just announced the purchase of BlockFi for $25m, a distressed asset that once was valued at $4.4 billion now hyper-discounted based on its obligations.

theblock.co/post/155069/ft…

Today, FTX just announced the purchase of BlockFi for $25m, a distressed asset that once was valued at $4.4 billion now hyper-discounted based on its obligations.

theblock.co/post/155069/ft…

Meanwhile, Goldman Sachs is rumored to be an interested party in Celsius.

https://twitter.com/Blockworks_/status/1540430676905918464?s=20&t=xkf4WCW2uErCiZt_Z7IfVw

While it's possible that the worst is behind us, there are plenty of players that can still blow up:

• Exchanges begin to fail

• Michael Saylor's Micro-Strategy is liquidated

• Heavy gov't regulation of the space

• Centralized stablecoin issuers fail (HIGHLY unlikely)

• Exchanges begin to fail

• Michael Saylor's Micro-Strategy is liquidated

• Heavy gov't regulation of the space

• Centralized stablecoin issuers fail (HIGHLY unlikely)

Enjoyed the thread?

Do me a favor and drop a RT/Fav on the first tweet, linked below:

Do me a favor and drop a RT/Fav on the first tweet, linked below:

https://twitter.com/JackNiewold/status/1542589830189776898?s=20&t=i3PpNYulDntk_ZReoPopNA

• • •

Missing some Tweet in this thread? You can try to

force a refresh