☄️Gateway to Interoperability🔥

A long overdue $QNT focused summary revolved around

✅Utility

✅Connections

✅Team

✅Vision

+ more

🪄This will be a great refresher for those long term OG's & an even better introduction for those new here

🧵Let's get started🎬

A long overdue $QNT focused summary revolved around

✅Utility

✅Connections

✅Team

✅Vision

+ more

🪄This will be a great refresher for those long term OG's & an even better introduction for those new here

🧵Let's get started🎬

To start off

$QNT provides a broad solution, interoperability🎩

🔌Simply put, it means the ability for systems & softwares to communicate together

But theres TONS of projects solving this issue & using this buzzword such as $DOT $ATOM $LINK etc

🤔What makes $QNT unique?

$QNT provides a broad solution, interoperability🎩

🔌Simply put, it means the ability for systems & softwares to communicate together

But theres TONS of projects solving this issue & using this buzzword such as $DOT $ATOM $LINK etc

🤔What makes $QNT unique?

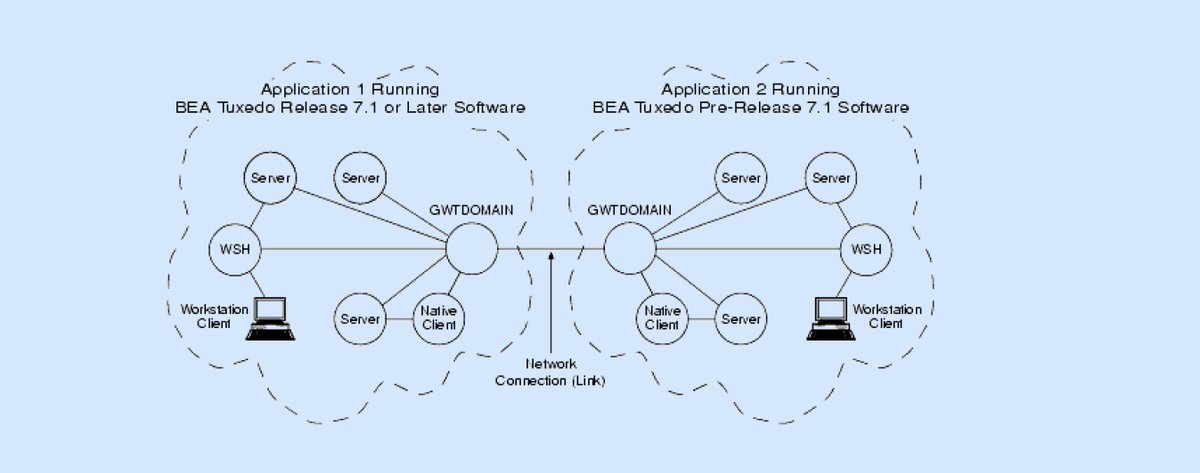

$QNT allows ANY:ANY interoperability

⛓️While 99% of projects solve interoperability, its only blockchain:blockchain

$QNT does so thru their core product Overledger & API Gateways overtop of the blockchain layer for common language🌉

(Diff Networks Diff Languages)🌏

⛓️While 99% of projects solve interoperability, its only blockchain:blockchain

$QNT does so thru their core product Overledger & API Gateways overtop of the blockchain layer for common language🌉

(Diff Networks Diff Languages)🌏

🪐As $QNT solves interoperability at a MUCH wider scale, connecting legacy to DLT & vice versa

👁🗨This is a VERY attractive solution to enterprises n governments for multiple sectors

Heres what the Head of Future Tech @BankOfEngland says about $QNT 👇

👁🗨This is a VERY attractive solution to enterprises n governments for multiple sectors

Heres what the Head of Future Tech @BankOfEngland says about $QNT 👇

https://twitter.com/industry_q/status/1384095700137308167?ref_src=twsrc%5Etfw

⏭Now we have an understanding of how $QNT works, lets look @ WHO uses them

As Overledger works as a white label service, many partners are currently under NDA

Though there are some HUGE public partnerships such as

🏦SIA/Nexi

🪬Oracle

⛓️LACChain

Let's take a look👁️

As Overledger works as a white label service, many partners are currently under NDA

Though there are some HUGE public partnerships such as

🏦SIA/Nexi

🪬Oracle

⛓️LACChain

Let's take a look👁️

SIA partnered w $QNT for interoperability on their platform w their clients being 550+ banks in 50+ countries

🏆SIA is the largest payment provider in Europe & second globally only behind SWIFT

Dec 2021 SIA merged w 🇮🇹 Payments firm Nexi whose building the Digital Euro w ECB🇪🇺

🏆SIA is the largest payment provider in Europe & second globally only behind SWIFT

Dec 2021 SIA merged w 🇮🇹 Payments firm Nexi whose building the Digital Euro w ECB🇪🇺

Its said SIA will be building 12+ dApps leveraging Overledger🏗️

🧪One of these is Spunta Banca which is already live & consists of 100+ 🇮🇹 banks connected on Corda for a more efficient interbanking network

Spunta Banca already does 174% of what $ETH did in TX in 2021🤯

🧪One of these is Spunta Banca which is already live & consists of 100+ 🇮🇹 banks connected on Corda for a more efficient interbanking network

Spunta Banca already does 174% of what $ETH did in TX in 2021🤯

🧿@Oracle is a Top 100 company & a global household name in tech w over 400K customers

They initially brought $QNT into their Startup Ecosystem & since promoted #QNT as their Primary Blockchain Interoperability Solution🛣

👇While also attending multiple Oracle related events🔥

They initially brought $QNT into their Startup Ecosystem & since promoted #QNT as their Primary Blockchain Interoperability Solution🛣

👇While also attending multiple Oracle related events🔥

@gverdian has also collaborated internally within Oracle

✍️In 2021 Gilbert wrote in Oracle Blogs alongside Mark R, Oracle Senior Director, on blockchain interoperability

🎥In Feb 2022 Gilbert was featured in @OracleStartup w Whitney Durmick Oracle Product n Strat Manager

✍️In 2021 Gilbert wrote in Oracle Blogs alongside Mark R, Oracle Senior Director, on blockchain interoperability

🎥In Feb 2022 Gilbert was featured in @OracleStartup w Whitney Durmick Oracle Product n Strat Manager

@LACChain is a global alliance built by IDB to accelerate development in LATAM regions thru blockchain & DLT🏗️

🔡 $QNT joined LACChain in 2021 to connect the entire continent together while also building a new tokenized currency for their region

This ALL goes live in 2023🤯

🔡 $QNT joined LACChain in 2021 to connect the entire continent together while also building a new tokenized currency for their region

This ALL goes live in 2023🤯

🎙️Here is a quick video from the $QNT CEO himself @gverdian summarizing the key aspects of this partnership

✅Creating Latin American Dollar

✅Overledger for Interbank network for 12 countries

✅Create remittance corridors between US & LATAM

✅Creating Latin American Dollar

✅Overledger for Interbank network for 12 countries

✅Create remittance corridors between US & LATAM

https://twitter.com/quant_network/status/1417455115284451330?lang=en

🛑As stated, these are just the general public partners of $QNT, they not only have countless NDA's but also multiple crypto partners

Let's quickly highlight these ⏩

Let's quickly highlight these ⏩

$LCX

$QNT & $LCX are collaborating to bring Overledgers functions to the LCX Exchange along w conducting research for interoperable #CBDC capabilities

Heres a thread on their partnership while connecting some dots 🖇️

⚠️(Advanced & may get confusing) ⚠️

$QNT & $LCX are collaborating to bring Overledgers functions to the LCX Exchange along w conducting research for interoperable #CBDC capabilities

Heres a thread on their partnership while connecting some dots 🖇️

⚠️(Advanced & may get confusing) ⚠️

https://twitter.com/Tokenicer/status/1526825236200443905?s=20&t=adQdVkVTrRON0v4NRPmNhA

$DAG

⚡️ $QNT & $DAG are leveraging both their advanced technologies to bring forth the idea of smart cities where everything is connected thru IoT, AI & ML

Here is a video I'd previously done explaining the scale of this operation🗺

⚡️ $QNT & $DAG are leveraging both their advanced technologies to bring forth the idea of smart cities where everything is connected thru IoT, AI & ML

Here is a video I'd previously done explaining the scale of this operation🗺

$ZCX

🌳 $QNT & $ZCX have an interesting relationship, Gilbert Verdian serves as one of their strategic advisors

Beyond that $ZCX will also be operating an Overledger Gateway in addition to their ZenX Incubator providing support for $QNT mDapps🤯

🌳 $QNT & $ZCX have an interesting relationship, Gilbert Verdian serves as one of their strategic advisors

Beyond that $ZCX will also be operating an Overledger Gateway in addition to their ZenX Incubator providing support for $QNT mDapps🤯

$ALBT

$QNT & $ALBT have some history as $QNT chose to collab w #ALBT when they were just a team of 3 founders

$ALBT will leverage Overledger for COUNTLESS use cases, to allow SMEs to develop applications on their platform + connect #LSEG institutional clients to $ALBT platform

$QNT & $ALBT have some history as $QNT chose to collab w #ALBT when they were just a team of 3 founders

$ALBT will leverage Overledger for COUNTLESS use cases, to allow SMEs to develop applications on their platform + connect #LSEG institutional clients to $ALBT platform

Now a quick summary of their team

Let's start off with Gilbert Verdian, the CEO & Founder of $QNT

☄️As accomplished as it gets. Having worked for 3+ governments & top private sector FinTech security/services while founding an ISO Standard

Couldn't of asked for a better CEO👏

Let's start off with Gilbert Verdian, the CEO & Founder of $QNT

☄️As accomplished as it gets. Having worked for 3+ governments & top private sector FinTech security/services while founding an ISO Standard

Couldn't of asked for a better CEO👏

Lara Verdian COO,

Laras background was largely in healthcare where she was @ large pharma corporations such as Pfizer, Eisai, Intercept, etc💊

🎯She also held a Director of Economics role @Deloitte prior to $QNT

These healthcare connects will play a HUGE role in future 🧵's

Laras background was largely in healthcare where she was @ large pharma corporations such as Pfizer, Eisai, Intercept, etc💊

🎯She also held a Director of Economics role @Deloitte prior to $QNT

These healthcare connects will play a HUGE role in future 🧵's

Andrew Carrier CMO,

@AndrewCarrier spent 8 years @ SWIFT climbing to Head of global PR & 3 years as a Director of marketing for @DeutscheBank 🤯

🌏SWIFT=Top Global Payments Infrastructure

🏦Deutches= Top 20 bank globally by total assets

Andrews connections are a key asset🔑

@AndrewCarrier spent 8 years @ SWIFT climbing to Head of global PR & 3 years as a Director of marketing for @DeutscheBank 🤯

🌏SWIFT=Top Global Payments Infrastructure

🏦Deutches= Top 20 bank globally by total assets

Andrews connections are a key asset🔑

Taking a look @ their advisors, not often we see people of this caliber enter the crypto sphere

Guy Dietrich, 26 years @MorganStanley $6.5T AUM,

3 years @ Rockefeller Capital (Rockefeller family) 🤪

Neil Smit, EX CEO & Chairman of ComCast, advisor of Qualacommn, oversaw AOL🧑💻

Guy Dietrich, 26 years @MorganStanley $6.5T AUM,

3 years @ Rockefeller Capital (Rockefeller family) 🤪

Neil Smit, EX CEO & Chairman of ComCast, advisor of Qualacommn, oversaw AOL🧑💻

The vision for $QNT is FAR beyond connecting banks, or networks

Their ambitious goals reach rewriting TCP/IP for the IoV to allow true economic value to be transferred from one party to another at full scale

Listen to @GregLunt27 dicuss this operation

Their ambitious goals reach rewriting TCP/IP for the IoV to allow true economic value to be transferred from one party to another at full scale

Listen to @GregLunt27 dicuss this operation

Summary of $QNT tokenomics in 🧵 below

✅14.67 million total supply (no inflation)

✅Licenses (tokens) required to use Overledger

✅Tokens get locked as form of licensing

✅Tokens get locked for gateway thruput

✅ALL transactions on Overledger in $QNT

✅14.67 million total supply (no inflation)

✅Licenses (tokens) required to use Overledger

✅Tokens get locked as form of licensing

✅Tokens get locked for gateway thruput

✅ALL transactions on Overledger in $QNT

https://twitter.com/Tokenicer/status/1497445358938439680?s=20&t=6ybQTFZf4fePGf8W5sd9ng

Now some key points & takeaways of $QNT to wrap it up

🟢Solving interoperability at true scale

🔵Strong connections acknowledge its solutions

🟡Perhaps the strongest team in ALL of crypto

🔴Gilbert Verdian is a mastermind

🟣ODAP (SAT) is the future

🟤Already seeing demand

🟢Solving interoperability at true scale

🔵Strong connections acknowledge its solutions

🟡Perhaps the strongest team in ALL of crypto

🔴Gilbert Verdian is a mastermind

🟣ODAP (SAT) is the future

🟤Already seeing demand

🎙Further details/an audio explanation of everything covered in this thread👇

I have an Introduction to $QNT in my YouTube that explains everything a little further📚

🪂I'll also be bringing a $QNT Deep Dive to add towards all this in the coming week

I have an Introduction to $QNT in my YouTube that explains everything a little further📚

🪂I'll also be bringing a $QNT Deep Dive to add towards all this in the coming week

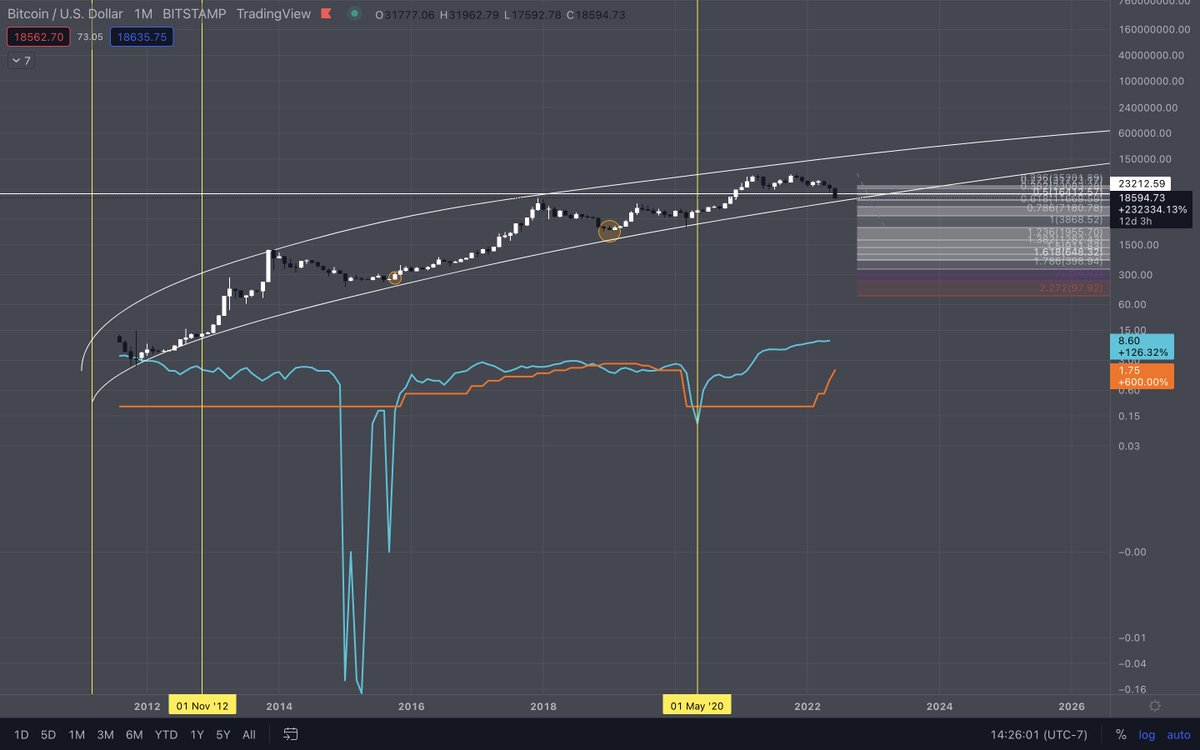

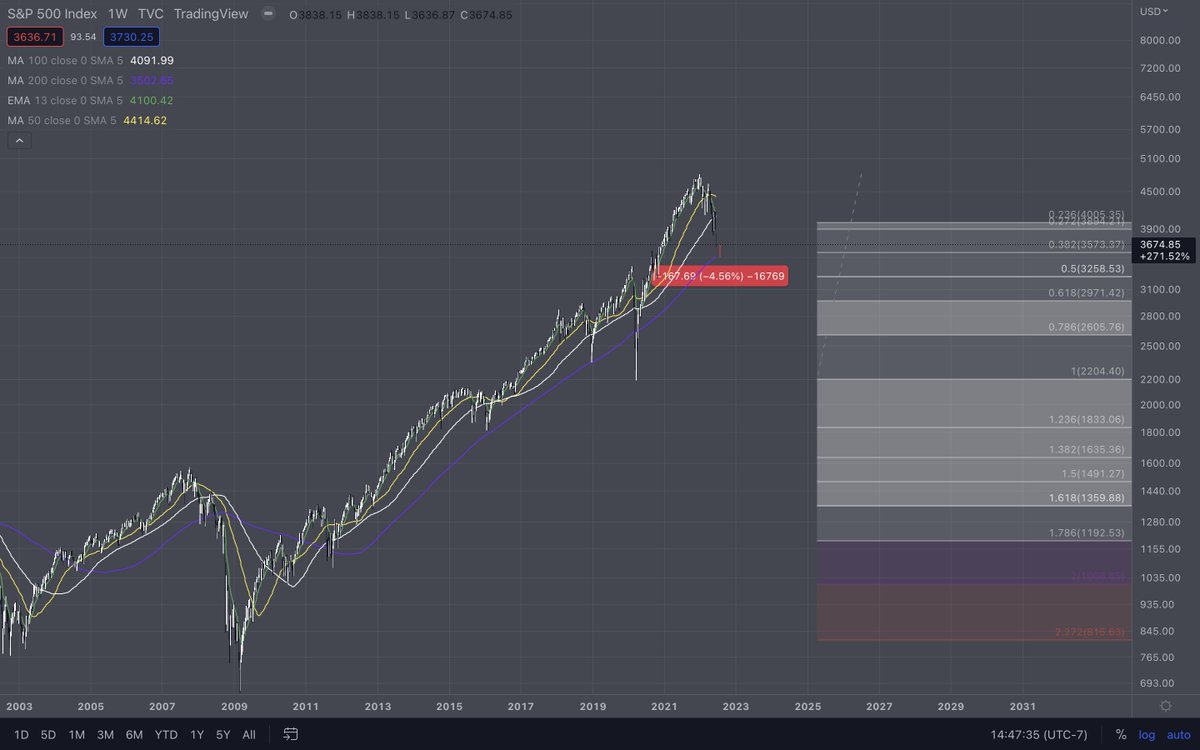

If you'd like to see the prices I buy/sell my $QNT & its allocation to my portfolio👜

🏁Join @terramoonvnture for weekly Deep Dives & TA on utility projects $DAG $HBAR $LCX $ALBT $ZCX

Take 25% off n grab a lil more $QNT w my discount code: "tokenice"🏷

discord.gg/2Cca7x2x5n

🏁Join @terramoonvnture for weekly Deep Dives & TA on utility projects $DAG $HBAR $LCX $ALBT $ZCX

Take 25% off n grab a lil more $QNT w my discount code: "tokenice"🏷

discord.gg/2Cca7x2x5n

If you guys enjoyed this thread, I’d greatly appreciate a follow + sharing w a loved one to spread the knowledge🖤

🔭My goal is to consistently bring quality dee research on utility networks reshaping our global economy🔬

I hope you join us in this journey ahead🛸

🔭My goal is to consistently bring quality dee research on utility networks reshaping our global economy🔬

I hope you join us in this journey ahead🛸

https://twitter.com/Tokenicer/status/1542619551828914178

• • •

Missing some Tweet in this thread? You can try to

force a refresh