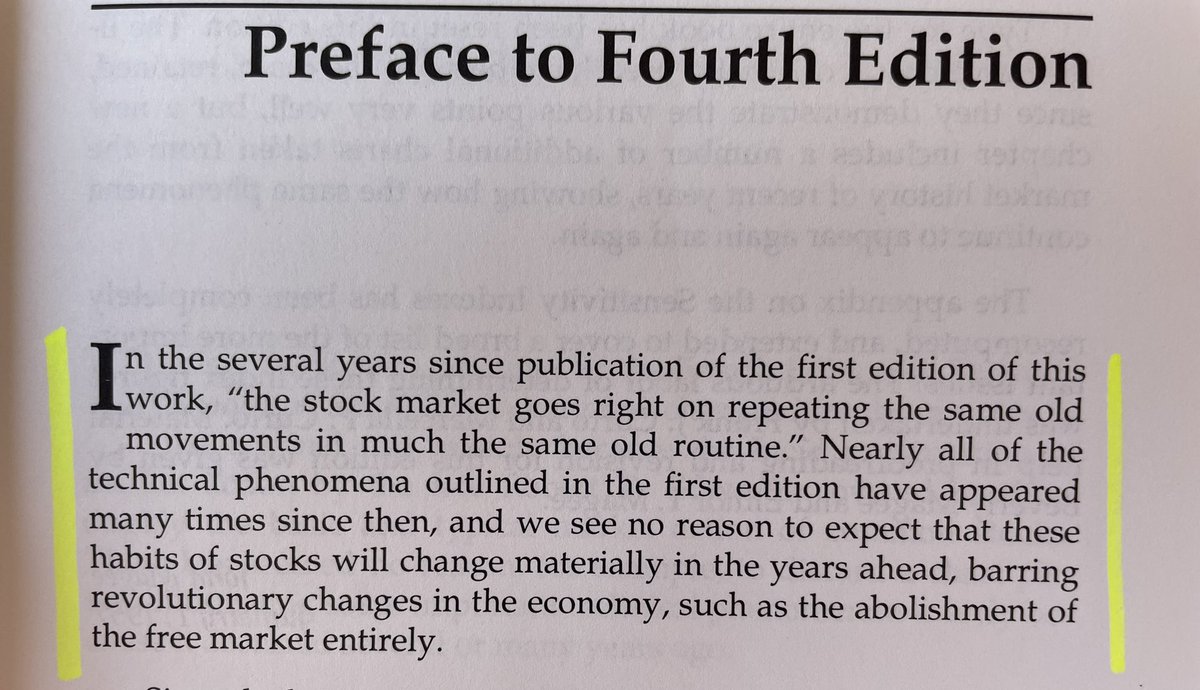

I’m reading through Technical Analysis of Stock Trends (Edwards & Magee) 7th Ed, 1998. The first edition came out in 1948. This thread contains book notes, excerpts, interesting bits.

The first edition came out <20 years after the Crash of 1929. Editions after included the prior charts from the boom & bust leading up to & after and are excellent for learning history of crazed euphoria and despair. It does remind me of ‘98-02 in particular. #Study the action.

Dow Theory pervades the book. Knowing & following the Primary Trend is critical. A study of Dow Theory’s 50 yr track record from 1897-1956 turned $100 into 11,237. Obviously compounding matters greatly.

Definition of TA - “the study of the action of the market itself…usually in graphic form.” I consider tabulation of market data to also fall under that criteria. Price is the truth to know & study when it come to markets.

There are so many charts with pattern examples throughout. But note that these are all OHLC sticks. Candlestick charting was basically unknown to the western world until Steve Nison wrote Japanese Candlestick Charting Techniques in 1991.

The chapter on “Futures/Derivatives Charts” includes many indicators, uses of MAs, oscillators that we now routinely apply across all assets. They have their place if used correctly.

Be thankful we have computers and don’t have to plan our day around when we get the newspaper, how our lighting is, what size the desk is, what kind of graph paper we use, or if our dozen pencils are sharp enough.

It was only since 1975 that competitive commissions have existed. Prior to that, a round trip of $1,000 worth of stock would cost 4.4%. Be thankful for competition. It forces everyone to be better.

• • •

Missing some Tweet in this thread? You can try to

force a refresh