I post charts, backtests, trade strategies, and journal thoughts on abnormal market events. Nothing is advice, just information.

How to get URL link on X (Twitter) App

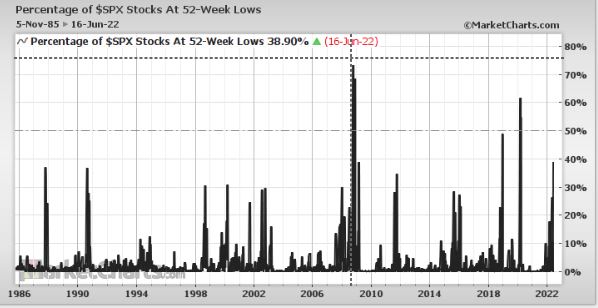

Full study details can be seen via the backtest I ran using @MarketCharts

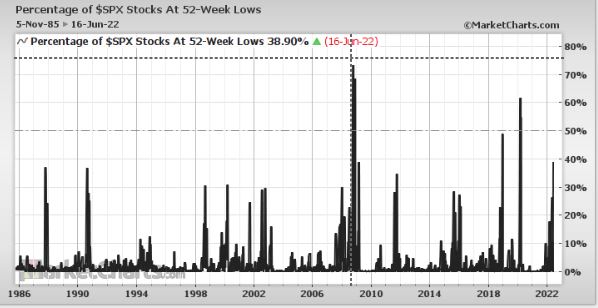

Full study details can be seen via the backtest I ran using @MarketCharts

Items of note:

Items of note: