Ever wonder how many billionaires Forbes misses?

Garfield burst into the zeitgeist in 1978. @Forbes doesn’t count its creator, Jim Davis, but he’s almost certainly in the billionaire club.

What can we learn from a boy who was raised on a cow farm in Indiana?

Read on.🧵👇

1/x

Garfield burst into the zeitgeist in 1978. @Forbes doesn’t count its creator, Jim Davis, but he’s almost certainly in the billionaire club.

What can we learn from a boy who was raised on a cow farm in Indiana?

Read on.🧵👇

1/x

Dream Big:

Davis had huge aspirations - his stated goal was to create a comic that was a mass-market sensation!

From da Vinci to Buffett: greats use Apprenticeship to gain Mastery. For years, Davis trained under the tutelage of an existing success: Tom Ryan for “Tumbleweeds.”

Davis had huge aspirations - his stated goal was to create a comic that was a mass-market sensation!

From da Vinci to Buffett: greats use Apprenticeship to gain Mastery. For years, Davis trained under the tutelage of an existing success: Tom Ryan for “Tumbleweeds.”

7 Years in the Desert:

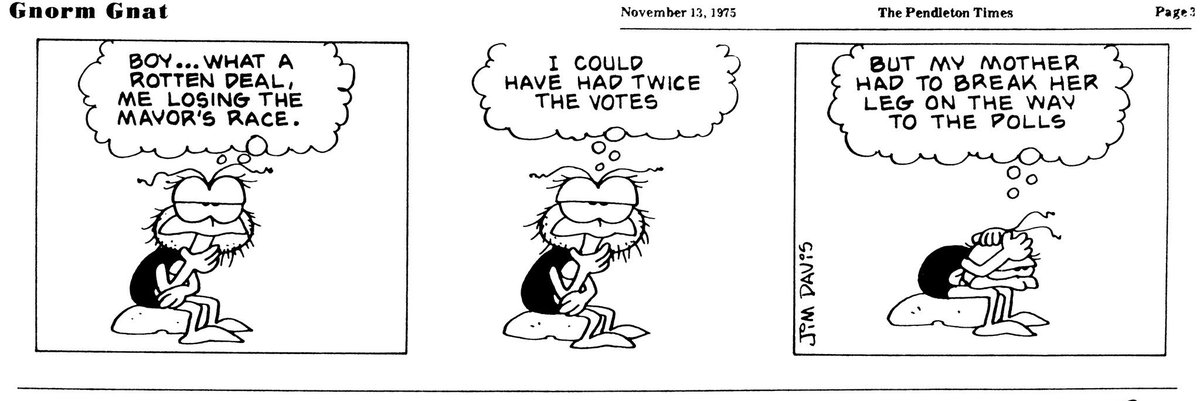

In 1973, Davis left Ryan to create “Gnorm Gnat.” But the 27 year-old’s comic strip floundered: his cynical gnat failed to gain traction.

By 1975, an editor told him: "Your art is good, your gags are great, but bugs — nobody can relate to bugs!"

🤔 🐞

In 1973, Davis left Ryan to create “Gnorm Gnat.” But the 27 year-old’s comic strip floundered: his cynical gnat failed to gain traction.

By 1975, an editor told him: "Your art is good, your gags are great, but bugs — nobody can relate to bugs!"

🤔 🐞

Reflect:

Admonished, Davis studied other comic commercial successes.

“[Seeing the success of the] Peanuts property over the years, I knew that sort of thing could happen with a comic strip, primarily an animal, again.

“Snoopy is very popular in licensing. Charlie Brown is not.”

Admonished, Davis studied other comic commercial successes.

“[Seeing the success of the] Peanuts property over the years, I knew that sort of thing could happen with a comic strip, primarily an animal, again.

“Snoopy is very popular in licensing. Charlie Brown is not.”

Unlocking an Insight:

In studying what worked and what didn’t, Davis noticed lots of successful dogs - Snoopy, Belvedere, Marmaduke - but no cats.

His “gags” were great, but nobody likes bugs?

Perhaps there was room for an Everyman Cat. One whose personality rhymed with Gnorm’s.

In studying what worked and what didn’t, Davis noticed lots of successful dogs - Snoopy, Belvedere, Marmaduke - but no cats.

His “gags” were great, but nobody likes bugs?

Perhaps there was room for an Everyman Cat. One whose personality rhymed with Gnorm’s.

Paved with Gold

“It's…a formula. I noticed dog strips doing well, and I knew an animal strip would be strong. People aren't threatened by an animal. They have a lot of latitude to do things that humans can't.”

Cat > Bug? Garfield = Product-Market Fit?

😽

Lovable Animals = Big $

“It's…a formula. I noticed dog strips doing well, and I knew an animal strip would be strong. People aren't threatened by an animal. They have a lot of latitude to do things that humans can't.”

Cat > Bug? Garfield = Product-Market Fit?

😽

Lovable Animals = Big $

Davis reverse engineered the building blocks of mass-market success.

“[I made a] conscious effort to come up with a good, marketable character.

“[I’d] been trying to get syndicated for years - that's a lot of time to try to figure out what makes some strips go and others fail.”

“[I made a] conscious effort to come up with a good, marketable character.

“[I’d] been trying to get syndicated for years - that's a lot of time to try to figure out what makes some strips go and others fail.”

The Wisdom of Elders:

“Mort Walker [Beetle Bailey + Hi & Lois] was a ’big hands, big feet‘ cartoonist - he knew how to create personalities. Peanuts taught me the power of gentle sentiments in everyday situational humor. Milton Caniff took me places I didn’t even know existed.”

“Mort Walker [Beetle Bailey + Hi & Lois] was a ’big hands, big feet‘ cartoonist - he knew how to create personalities. Peanuts taught me the power of gentle sentiments in everyday situational humor. Milton Caniff took me places I didn’t even know existed.”

Davis pursued a broad appeal that would drive commercial success - from the beginning, he planned for success beyond the newsprint.

Davis chose, in his words, “a fat, lazy, lasagna-loving, cynical” cat - an animal and personality everyone could relate to.

Garfield was born.

Davis chose, in his words, “a fat, lazy, lasagna-loving, cynical” cat - an animal and personality everyone could relate to.

Garfield was born.

“I saw licensing down the road. I really did.”

The Muppets & Peanuts showed Davis there was a business of teeshirts and calendars to be had, if only he could get the formula right.

And why stop with a cat? He added Odie, an adorable dog as Garfield’s happy, unknowing nemesis.

The Muppets & Peanuts showed Davis there was a business of teeshirts and calendars to be had, if only he could get the formula right.

And why stop with a cat? He added Odie, an adorable dog as Garfield’s happy, unknowing nemesis.

Formula:

“Great cartoonists were doing a study in contrasts. Put smart + stupid, tall + short, fat + skinny. Garfield had a strong personality - patterned after my grandfather. Jon is patterned after me – easygoing, wishy-washy, positive about life. Garfield is the pessimist.”

“Great cartoonists were doing a study in contrasts. Put smart + stupid, tall + short, fat + skinny. Garfield had a strong personality - patterned after my grandfather. Jon is patterned after me – easygoing, wishy-washy, positive about life. Garfield is the pessimist.”

Don’t Just Copy. Innovate

“It would have been easy to go the cute-cat route, but that wouldn't have been true to my humor. I felt a selfish, cynical, lazy type of character with a little soft underbelly would endure.”

“It would have been easy to go the cute-cat route, but that wouldn't have been true to my humor. I felt a selfish, cynical, lazy type of character with a little soft underbelly would endure.”

1,000 True Fans:

Starting in 1976, Davis honed his cat. In 1978, Garfield debuted in 41 papers.

“Several months after launch, the Chicago Sun-Times cancelled Garfield. Over 1,300 angry readers demanded that Garfield be reinstated. It was. And the rest, as they say, is history.”

Starting in 1976, Davis honed his cat. In 1978, Garfield debuted in 41 papers.

“Several months after launch, the Chicago Sun-Times cancelled Garfield. Over 1,300 angry readers demanded that Garfield be reinstated. It was. And the rest, as they say, is history.”

Not a Businessman; I’m a Business, Man

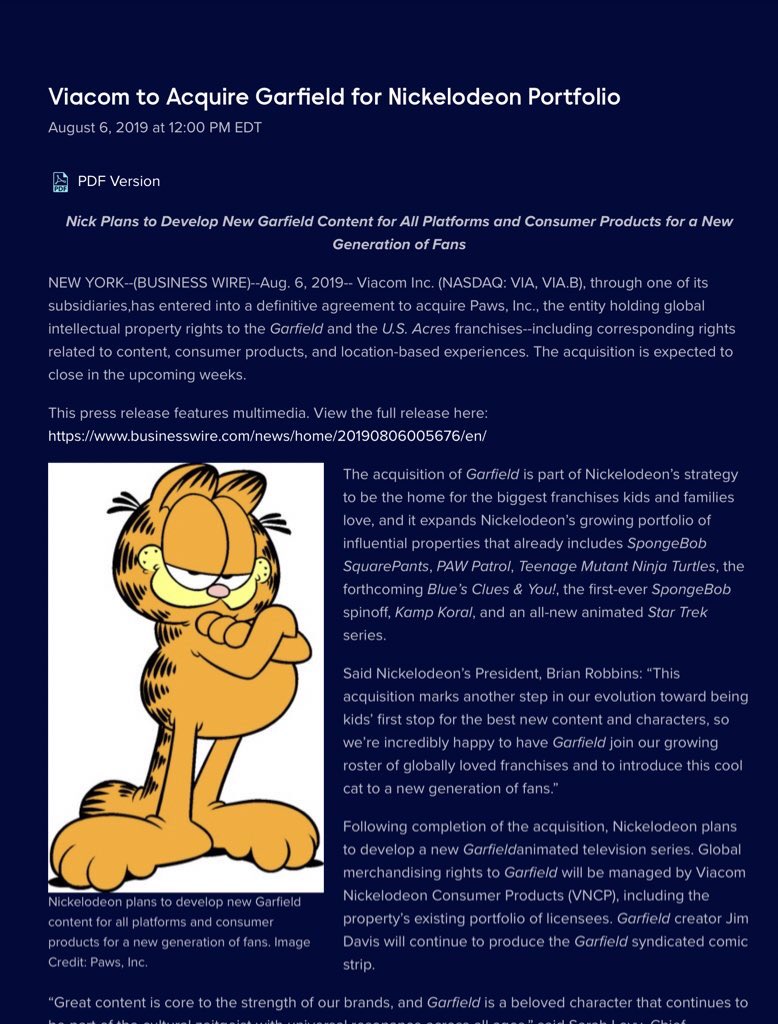

By 1981, Davis formed Paws, Inc., to market and license Garfield.

One year later, Paws grossed $50 to $60 million ($150 to $180 million in 2022 dollars!).

By 1981, Davis formed Paws, Inc., to market and license Garfield.

One year later, Paws grossed $50 to $60 million ($150 to $180 million in 2022 dollars!).

Davis had a mega-hit, but would it endure?

Davis understood his audience - his goal was NOT daily innovation, but daily CONSISTENCY. Davis would include everyone and create evergreen content. Garfield rarely references pop culture or narrow topics like a specific sport.

🍝

Davis understood his audience - his goal was NOT daily innovation, but daily CONSISTENCY. Davis would include everyone and create evergreen content. Garfield rarely references pop culture or narrow topics like a specific sport.

🍝

Mass Appeal: “I don't use seasons”

Garfield works in any society. No rhyming gags, wordplay, colloquialisms. The only holiday is Christmas.

“Keep the gags broad, the humor general & applicable to everyone: I deal mainly w/ eating & sleeping. That applies to everyone, anywhere.”

Garfield works in any society. No rhyming gags, wordplay, colloquialisms. The only holiday is Christmas.

“Keep the gags broad, the humor general & applicable to everyone: I deal mainly w/ eating & sleeping. That applies to everyone, anywhere.”

Consumable - Know Your Fan:

“I distill everything. Garfield art is very, very simple. Usually there's a tabletop. Nothing distracts the eye. Hopefully they see the characters, the expression. There's as few words as possible. Garfield's expressions are very carefully drawn.”

“I distill everything. Garfield art is very, very simple. Usually there's a tabletop. Nothing distracts the eye. Hopefully they see the characters, the expression. There's as few words as possible. Garfield's expressions are very carefully drawn.”

CAC:

Davis worked to recreate on-ramps for new readers.

It might leave Garfield a little static, but “I [feel responsible] for the brand-new readers. The fact that he loves lasagna, he's lazy, that he's cynical, that he's selfish, that he hates to exercise, loves to sleep.”

Davis worked to recreate on-ramps for new readers.

It might leave Garfield a little static, but “I [feel responsible] for the brand-new readers. The fact that he loves lasagna, he's lazy, that he's cynical, that he's selfish, that he hates to exercise, loves to sleep.”

EV/Sales:

The business of Garfield took off.

At one point, 7 of the top 15 books on @nytimes book list were Garfield, forcing NYT to change its ranking methodology!

In the early 2000s, two Garfield movies were made, grossing a combined $350 million.

Garfield was minting it.

The business of Garfield took off.

At one point, 7 of the top 15 books on @nytimes book list were Garfield, forcing NYT to change its ranking methodology!

In the early 2000s, two Garfield movies were made, grossing a combined $350 million.

Garfield was minting it.

Garfield ANNUALLY sold $0.75 to $1 BILLION in licensed goods retail sales.

The comic strip peaked in 2004, circulating in nearly 2,600 daily newspapers.

The Guinness Book of World Records would name Garfield “the most widely syndicated comic strip in the world.”

🏆

The comic strip peaked in 2004, circulating in nearly 2,600 daily newspapers.

The Guinness Book of World Records would name Garfield “the most widely syndicated comic strip in the world.”

🏆

Beyond Print - The Small Screen:

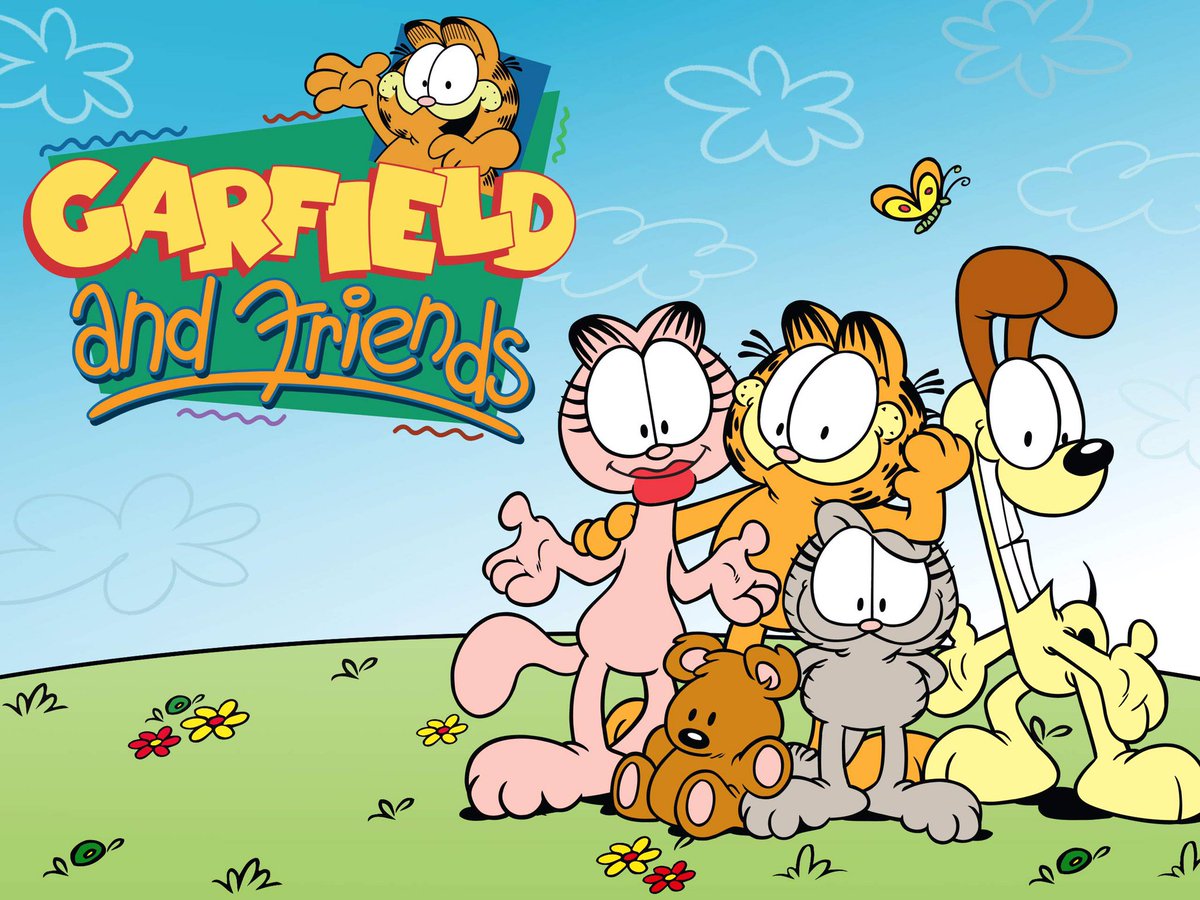

From 1988 to 1994, a TV cartoon called “Garfield and Friends” aired.

A CGI animated “The Garfield Show” aired from 2009-2016 (available on Netflix).

A 3rd Garfield series is set to premier on Paramount+ this fall.

From 1988 to 1994, a TV cartoon called “Garfield and Friends” aired.

A CGI animated “The Garfield Show” aired from 2009-2016 (available on Netflix).

A 3rd Garfield series is set to premier on Paramount+ this fall.

A Franchise:

From newsprint, to books, to calendars, to teeshirts, to TV, to the big-screen - Garfield is everywhere and loved across generations.

And the cynical cat may just be getting started - in 2023, we’ll hear Samuel L. Jackson & Chris Pratt in the 3rd Garfield movie.

From newsprint, to books, to calendars, to teeshirts, to TV, to the big-screen - Garfield is everywhere and loved across generations.

And the cynical cat may just be getting started - in 2023, we’ll hear Samuel L. Jackson & Chris Pratt in the 3rd Garfield movie.

Davis’ inspiration, Peanuts, was sold in 2010 for $175mm.

In 2019, ViacomCBS ( $PARA) bought Paws, Inc. from Davis. The price was undisclosed, but Davis likely had already made over $1 Billion in lifetime earnings.

Selling was just icing for Davis, allowing him to slow down.

In 2019, ViacomCBS ( $PARA) bought Paws, Inc. from Davis. The price was undisclosed, but Davis likely had already made over $1 Billion in lifetime earnings.

Selling was just icing for Davis, allowing him to slow down.

Nailed It:

50 yrs ago, Jim Davis set out to create a comic strip hit with mass-market appeal and licensing opportunities - he looked up to the greats and wanted to join them.

He did - by 2015, his net worth was estimated to be >$800 million. Today it likely exceeds $1 Billion.

50 yrs ago, Jim Davis set out to create a comic strip hit with mass-market appeal and licensing opportunities - he looked up to the greats and wanted to join them.

He did - by 2015, his net worth was estimated to be >$800 million. Today it likely exceeds $1 Billion.

Hopefully you enjoyed this reprieve from market and political chaos - I had fun doing it!😀

And, maybe, we learned a lesson about pursuing greatness.

Like & RT the first tweet if you had fun!🙏

Inspired by @TrungTPhan.

To my American friends, Happy 4th! We are blessed.

🇺🇸🎇❤️

And, maybe, we learned a lesson about pursuing greatness.

Like & RT the first tweet if you had fun!🙏

Inspired by @TrungTPhan.

To my American friends, Happy 4th! We are blessed.

🇺🇸🎇❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh