Former asset manager for Celsius files lawsuit alleging the company was a Ponzi scheme

July 7, 2022

web3isgoinggreat.com/?id=former-ass…

July 7, 2022

web3isgoinggreat.com/?id=former-ass…

The court document is quite a read.

iapps.courts.state.ny.us/nyscef/ViewDoc…

iapps.courts.state.ny.us/nyscef/ViewDoc…

Let's tweet through it, shall we!

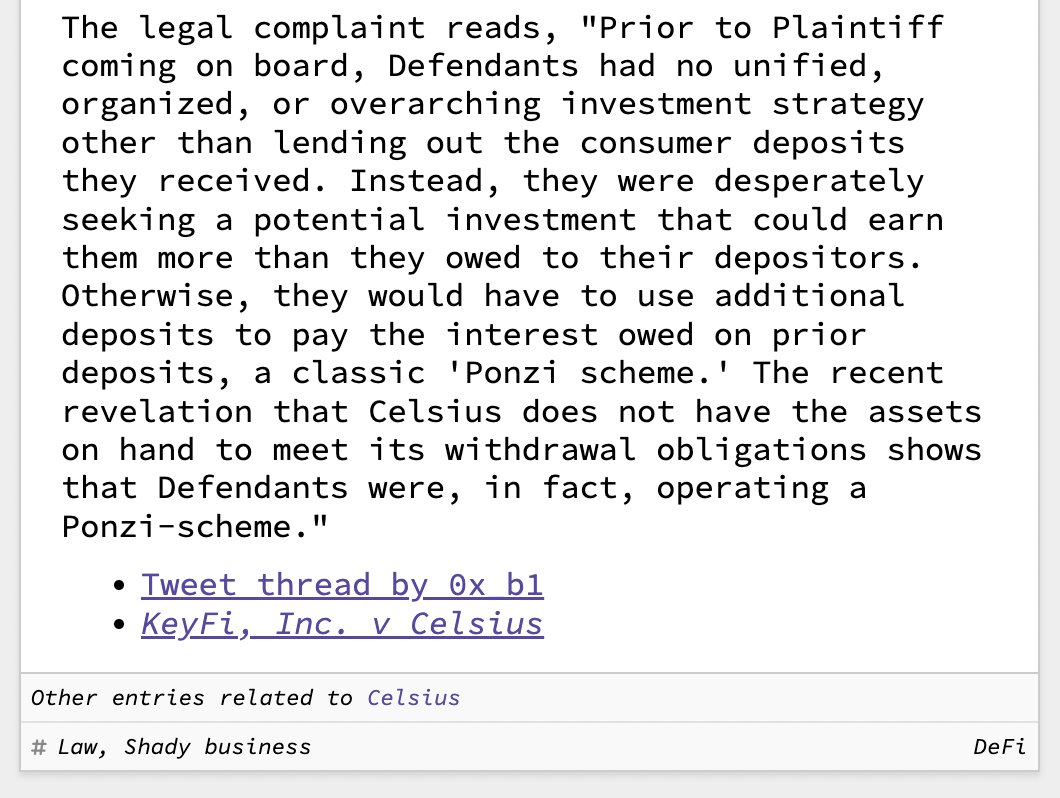

"Prior to Plaintiff coming on board, Defendants had no unified, organized, or overarching investment strategy other than lending out the consumer deposits they received." 1/

"Instead, they were desperately seeking a potential investment that could earn them more than they owed to their depositors. Otherwise, they would have to use additional deposits to pay the interest owed on prior deposits, a classic 'Ponzi scheme.'" 2/

"The recent revelation that Celsius does not have the assets on hand to meet its withdrawal obligations shows that Defendants were, in fact, operating a Ponzi-scheme." 3/

"For most of that time, the parties operated without any formal written agreement, recognizing instead that they were engaged in an enterprise for 'mutual benefit...based on mutual respect and trust.'"

😳

4/

😳

4/

"As in any investment relationship, Plaintiff and Stone were responsible for generating a profit on the funds provided to them, while Celsius was responsible for ensuring that its investment strategies would not prevent it from repaying its depositors in kind." 5/

"Stone discovered that not only did Defendants lack basic security controls to protect the billions of dollars in customers’ funds they held, but that they were actively using customer funds to manipulate crypto-asset markets to their benefit." 6/

"The most egregious example of this was Plaintiff's discovery that Celsius used customer bitcoin deposits to inflate its own crypto-asset called the 'Celsius token' ('CEL')." 7/

"Stone also learned of multiple incidents where Defendants ... endangered customer funds. ... Celsius improperly account[ed] for certain payments owed to customers, resulting in a $200M liability the company did not even understand how or why it owed." 8/

"That summer, Plaintiff and Celsius cut a handshake deal where Plaintiff would manage billions of dollars in customer crypto-deposits in return for a share of the profits generated from those crypto-deposits." 9/

Call me old fashioned but "managing billions of dollars in customer crypto-deposits" does not sound like the time for a "handshake deal"... 10/

Celsius and KeyFi later formalized an Asset Purchase

Agreement and Service Agreement, which detailed a never-defined "Earnout Payment" that the lawsuit argues refers to a profit-sharing agreement mentioned in the Service Agreement: 50% of Celsius' earnings from staking, and

11/

Agreement and Service Agreement, which detailed a never-defined "Earnout Payment" that the lawsuit argues refers to a profit-sharing agreement mentioned in the Service Agreement: 50% of Celsius' earnings from staking, and

11/

20% of profits from defi activities.

"Celsius has refused to provide KeyFi with an accounting of such costs and expenses. However, KeyFi estimates that Gross Profits allocable to the parties exceeds $838 million less such costs and expenses."

12/

"Celsius has refused to provide KeyFi with an accounting of such costs and expenses. However, KeyFi estimates that Gross Profits allocable to the parties exceeds $838 million less such costs and expenses."

12/

"In breach of the APA, Celsius and the SPV have refused to pay KeyFi its agreed share of these profits." 13/

"To date, Celsius has refused to provide Stone as CEO of KeyFi, or in his capacity as CEO of Celsius KeyFi, with a full accounting of the transactions it was attributing the Celsius KeyFi account." 14/

"Critically, Celsius has failed to provide KeyFi or Stone with an accounting reflecting any of the hedging transactions it was supposed to make.... This is because, on information and belief, Celsius lied to Stone and never engaged in these transactions." 15/

"In January 2021... Stone grew alarmed by Celsius’ improper business practices, ultimately concluding that its business practices were so corrupt that he and KeyFi could no longer do business with Celsius." 16/

"Stone became aware that since at least February 2020, Celsius had engaged in a series of transactions designed to artificially inflate the price of CEL tokens." 17/

"Connor Nolan, head of coin deployment at Celsius, informed Stone that Celsius had used approximately 4,500 bitcoin, with a current value of $90 million, in customer deposits to purchase CEL on the open market between Feb 2020 and Nov 2020 to artificially inflate the price." 18/

"Second, Stone became aware that Celsius had deceived him about the existence of hedging transactions designed to hedge against the authorized DeFi transactions Stone was performing." 19/

"Stone learned that Celsius had exposed other customer deposits (i.e., not managed by the SPV) to potentially billions of dollars in losses by failing to properly hedge against all its profit seeking activities." 20/

"Third, Stone learned of further financial mismanagement that threatened to plunge Celsius into insolvency." Stone alleges that Celsius recorded in USD the payments to customers it had made in crypto tokens, failing to mark-to-market the assets as they appreciated.

21/

21/

"Celsius failed to update its ledger in order reflect the increased dollar value of its liabilities at least at any time before 2021. The accounting error masked hundreds of millions of dollars in liabilities that Celsius was not prepared to pay out." 22/

"When Jason Stone left Celsius, Celsius had a $100-$200 million hole on its balance sheet that it could not fully explain or resolve." 23/

"In January 2021, the crypto-markets began a bull cycle which caused Celsius (who had recklessly and fraudulently failed to hedge its investments) to suffer severe exchange rate losses." 24/

"As customers sought to withdraw their ether deposits, Celsius was forced to buy ether in the open market at historically high prices, suffering heavy losses. Faced with a liquidity crisis, Celsius began to offer double-digit interest rates in order to lure new depositors..." 25/

"...whose funds were used to repay earlier depositors and creditors. Thus, while Celsius continued to market itself as a transparent and well capitalized business, in reality, it had become a Ponzi scheme." 26/

"After Stone left Celsius KeyFi, Celsius maintained access and control of the 0xb1 wallet. Celsius’ CEO, Alex Mashinsky, used that control for his own personal benefit. In one example, Celsius’ CEO transferred valuable NFTs from the 0xb1 accounts to his wife’s wallet." 27/

"KeyFi has repeatedly requested that Defendants engage in an accounting to determine how much they are owed and Defendants have repeatedly rejected KeyFi’s requests." 28/

KeyFi is seeking an accounting for all money earned by KeyFi for Celsius, and damages, punitive damages, and pre- and post-judgement interest, as well as other and further relief determined by the court. 29/29

• • •

Missing some Tweet in this thread? You can try to

force a refresh