How to Spot New Leaders in BEAR Market

A Short Thread🧵

If you want a Youtube Video drop a " YES"

A Short Thread🧵

If you want a Youtube Video drop a " YES"

Inspiration and credits: Mark Minervini sir

Youtube Link :

1/n

Youtube Link :

1/n

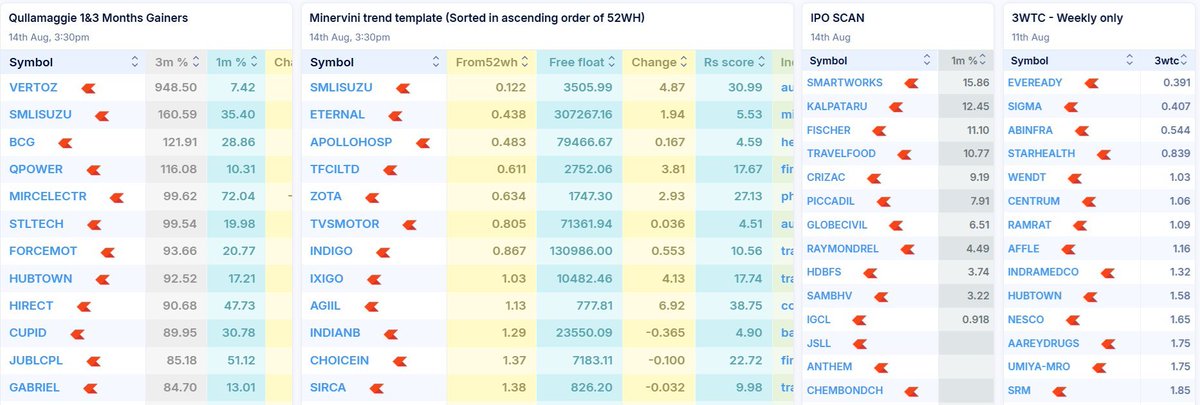

Screener for stocks that are within 25% of their Highs

The screener filters out Stocks that have

1. Relative Strength Positive

2. Above 50 dema on

3. Above 30 wema ( in Stage 2)

4. Volume greater than 50k

5. Above 20 rs

chartink.com/screener/stock…

3/n

The screener filters out Stocks that have

1. Relative Strength Positive

2. Above 50 dema on

3. Above 30 wema ( in Stage 2)

4. Volume greater than 50k

5. Above 20 rs

chartink.com/screener/stock…

3/n

Example of Stocks that have Corrected less than 25% in this Bear Market

Always Look for Stocks that in longer term uptrend and still near 52 week high .

These Stocks tend to outperform when market recovers

Stock vs Nifty50

#Bls #MFL #Timken

4/n

Always Look for Stocks that in longer term uptrend and still near 52 week high .

These Stocks tend to outperform when market recovers

Stock vs Nifty50

#Bls #MFL #Timken

4/n

Ipo base stocks

#Tarsons gave a cheat entry within its ipo base . Stock is up more than 20% in few days

#Rolexrings : Stock had broken out of its ipo base and gave a decent rally as markets recovered

5/n

#Tarsons gave a cheat entry within its ipo base . Stock is up more than 20% in few days

#Rolexrings : Stock had broken out of its ipo base and gave a decent rally as markets recovered

5/n

#Homefirst: Stock hasnt broken out but has good Volatility contration and near the retest of old breakout

#Metrobrands consolidating from past 6 months

breakout can give good Rally

#Kpigreen

6/n

#Metrobrands consolidating from past 6 months

breakout can give good Rally

#Kpigreen

6/n

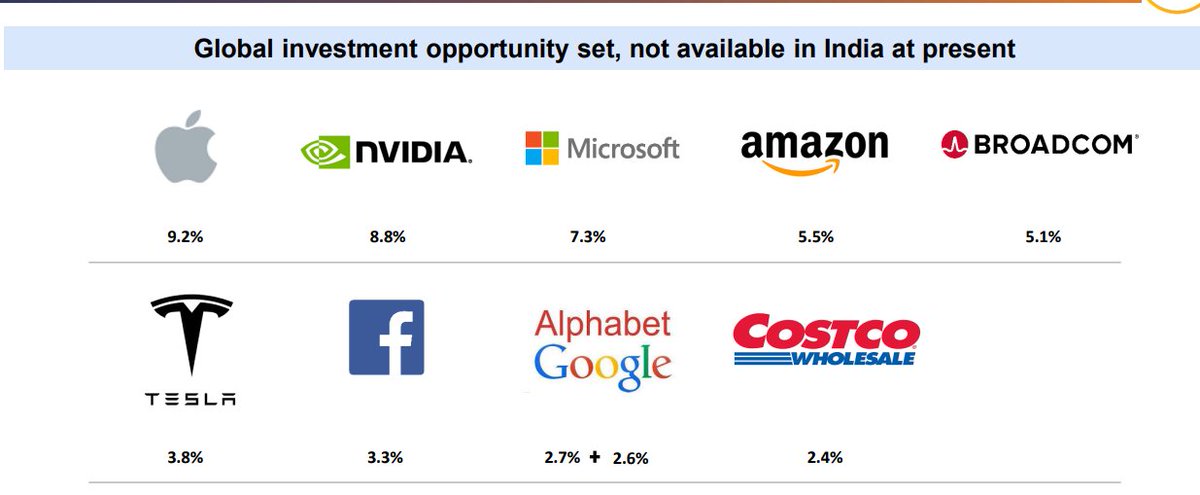

THINK DIFFERENT !

1. look at the old leaders the old leaders are not most likely going to lead in the new cycle it's very difficult to do

2. they're not going to go out of business see a stock doesn't have to go out of business to make you go out of business

10/n

1. look at the old leaders the old leaders are not most likely going to lead in the new cycle it's very difficult to do

2. they're not going to go out of business see a stock doesn't have to go out of business to make you go out of business

10/n

Some went down and moved sideways and some of them didn't come back to break even for 20 years

Guess Which Indian Stock ? vs $MFST

11/n

Guess Which Indian Stock ? vs $MFST

11/n

Fast rebound Stocks

1. stock come ripping back off the lows and this is where you should be looking to buy

2. These stocks move 20-50% in Small duration during small market recovery from the lows and reach their highs

12/n

1. stock come ripping back off the lows and this is where you should be looking to buy

2. These stocks move 20-50% in Small duration during small market recovery from the lows and reach their highs

12/n

MentorShip Program:

SWING TRADING MENTORSHIP GROUP!

✅Mentorship starting on 9th July on weekends only with recording

LINK FOR ENQUIRY:

wa.link/si4jn4

Payment Link :tagmango.app/4efa5b90c1

13/n

SWING TRADING MENTORSHIP GROUP!

✅Mentorship starting on 9th July on weekends only with recording

LINK FOR ENQUIRY:

wa.link/si4jn4

Payment Link :tagmango.app/4efa5b90c1

13/n

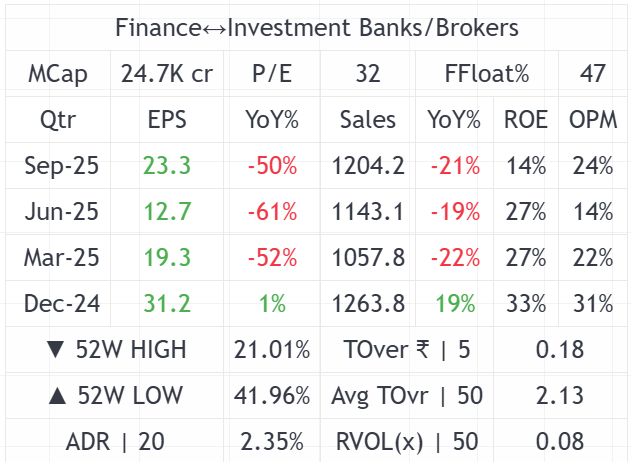

There are 100s of stocks in screener

To filter more use this criteria

Eps Growth Qtr on Qtr

Eps Growth Yr on Yr

Fiis Increasing Stake

Roe and Roce >15

Use combination of the above criteria

To filter more use this criteria

Eps Growth Qtr on Qtr

Eps Growth Yr on Yr

Fiis Increasing Stake

Roe and Roce >15

Use combination of the above criteria

• • •

Missing some Tweet in this thread? You can try to

force a refresh