How does India 🇮🇳 Pay ₹?

who emerges as the Digital Payments Leader among UPI, credit Cards, debit cards, prepaid wallets and prepaid cards?

A thread 🧵

who emerges as the Digital Payments Leader among UPI, credit Cards, debit cards, prepaid wallets and prepaid cards?

A thread 🧵

A report from Q1 2022, by @WorldlineGlobal confirms that UPI P2M transactions emerged as the most preferred payment mode among consumers with a market share of 64% in volume and 50% in terms of value.

(1/n)

(1/n)

📌Fast Facts for Q1 2022 Digital Payments🇮🇳

💸9.36 billion transactions amounting to

💰INR 10.25 trillion

💳Number of POS terminals: 6.07 Mn

♒️Number of Bharat QRs: 4.97 Mn

♒️ Number of UPI QRs stood at 172.73 Mn

💳 Number of Credit Cards 73.6 Mn , Debit Cards 917.66 Mn

(2/n)

💸9.36 billion transactions amounting to

💰INR 10.25 trillion

💳Number of POS terminals: 6.07 Mn

♒️Number of Bharat QRs: 4.97 Mn

♒️ Number of UPI QRs stood at 172.73 Mn

💳 Number of Credit Cards 73.6 Mn , Debit Cards 917.66 Mn

(2/n)

📌 Report Highlights

▸ Credit cards accounted 7% of transactions but 26% of value indicating that customers still prefer to use their credit cards for high value transactions.

(3/n)

▸ Credit cards accounted 7% of transactions but 26% of value indicating that customers still prefer to use their credit cards for high value transactions.

(3/n)

📌 Report Highlights

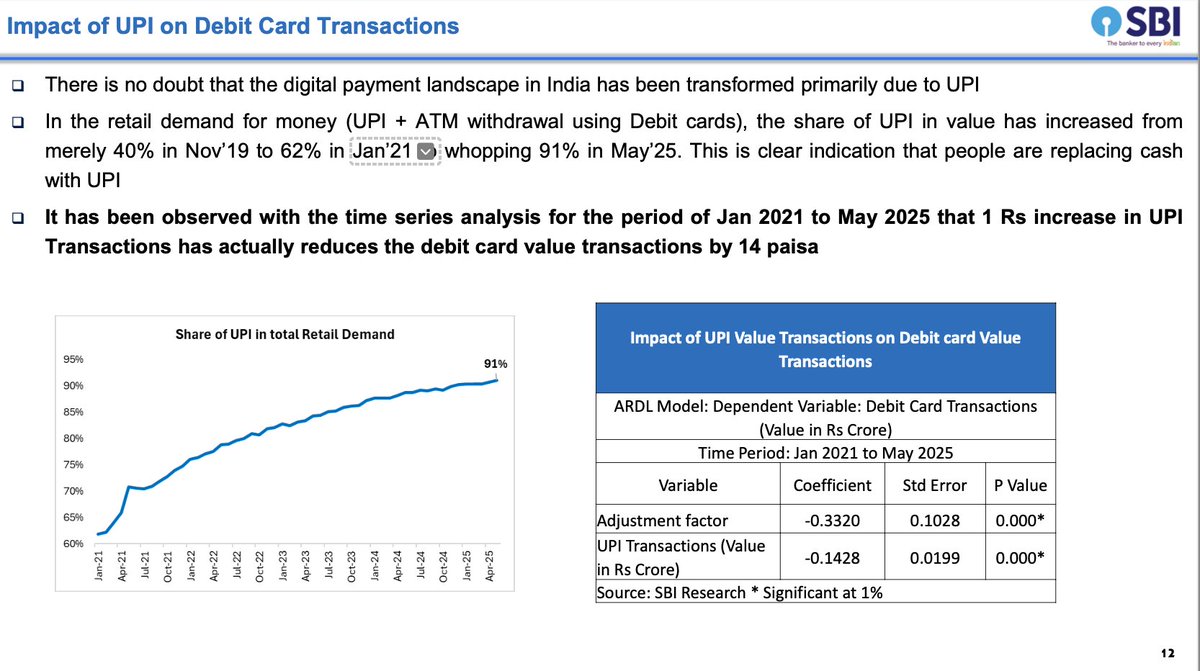

▸ Debit cards account for 10% of transactions but 18% in value – the volume and volume has shrunk from previous years and is likely because of the rise of UPI.

(4/n)

▸ Debit cards account for 10% of transactions but 18% in value – the volume and volume has shrunk from previous years and is likely because of the rise of UPI.

(4/n)

📌 Report Highlights

▸Shift from P2P to P2M in UPI: In Q1 2022, out of total UPI volumes, 56% transactions were P2P while 44% were P2M; in terms of value, P2M transactions generally contributed to about 19% of UPI transactions.

(5/n)

▸Shift from P2P to P2M in UPI: In Q1 2022, out of total UPI volumes, 56% transactions were P2P while 44% were P2M; in terms of value, P2M transactions generally contributed to about 19% of UPI transactions.

(5/n)

📌 Report Highlights

▸ Move from Physical to Digital: Even though credit cards volume at POS & ecomm are nearly equal, value of ecomm transactions is significantly higher as compared with value of transactions at POS.

(6/n)

▸ Move from Physical to Digital: Even though credit cards volume at POS & ecomm are nearly equal, value of ecomm transactions is significantly higher as compared with value of transactions at POS.

(6/n)

📌 Report Highlights

▸Consumers are getting more comfortable to make online purchases via credit cards for big ticket size transactions while debit cards are more frequently used for small ticket size purchases at physical touchpoints

(7/n)

▸Consumers are getting more comfortable to make online purchases via credit cards for big ticket size transactions while debit cards are more frequently used for small ticket size purchases at physical touchpoints

(7/n)

📌 Report Highlights

▸ The Average Ticket size of Credit Card Transactions is 5x that of a UPI P2M transaction, Indicating usage of UPI for low value merchant payments

(8/n)

▸ The Average Ticket size of Credit Card Transactions is 5x that of a UPI P2M transaction, Indicating usage of UPI for low value merchant payments

(8/n)

📌 Report Highlights

▸ Mobile payments have become widespread and being used for small ticket transactions while internet browsers are the preferred mode for traditional shopping from e-commerce platforms

(9/n)

▸ Mobile payments have become widespread and being used for small ticket transactions while internet browsers are the preferred mode for traditional shopping from e-commerce platforms

(9/n)

📌 Report Highlights

▸ States and cities with the highest number of transactions at physical touch points in Q1 2022 for Worldline India

(10/n)

▸ States and cities with the highest number of transactions at physical touch points in Q1 2022 for Worldline India

(10/n)

📌 Report Highlights

▸ AePS (bank led model that enables interoperable financial inclusion) registered ~54% growth over Q1 2021, processing transactions worth INR 840.23 billion,∆ of 33% over Q1 2021

A huge commendable effort to make #DigitalIndia truly inclusive

(11/n)

▸ AePS (bank led model that enables interoperable financial inclusion) registered ~54% growth over Q1 2021, processing transactions worth INR 840.23 billion,∆ of 33% over Q1 2021

A huge commendable effort to make #DigitalIndia truly inclusive

(11/n)

📌 Report Highlights

▸ Bharat Bill Payment Central Unit (BBPCU) registered a growth rate of 117% and 134% in

volume and value respectively as compared with

Q1 2021.

(12/n)

▸ Bharat Bill Payment Central Unit (BBPCU) registered a growth rate of 117% and 134% in

volume and value respectively as compared with

Q1 2021.

(12/n)

📌 Report Highlights

▸ Transactions Volume for National Electronic Toll Collection increased by 49% while value increased by 41%

total number of banks live with NETC FASTag were 36 while about 49.6 Mn NETC FASTags have been issued since inception

(13/n)

▸ Transactions Volume for National Electronic Toll Collection increased by 49% while value increased by 41%

total number of banks live with NETC FASTag were 36 while about 49.6 Mn NETC FASTags have been issued since inception

(13/n)

If you like this thread, please RT/share the first tweet 👇. Also do follow me (@jasuja) . I tweet about fintech and payment, digital economy, leadership and careers in tech. Thank you for reading

https://twitter.com/jasuja/status/1545406659769483264?s=20&t=6DCKzw5fmEHLCd1V6oF3_Q

Tagging @psb_dc @SpirosMargaris @BrettKing @JimMarous @leimer @cgledhill @efipm @enricomolinari @Xbond49 @UrsBolt @richardturrin @JameDiBiasio @mikulaja @AlexH_Johnson @os7borne @twifintech @MITFinTech

as this might be of interest

as this might be of interest

• • •

Missing some Tweet in this thread? You can try to

force a refresh