Mission to Digitise Fast Growing Asian Economies | Product Strategist | Onalytica Top 15 Global Fintech Leader | Views personal, not employers

How to get URL link on X (Twitter) App

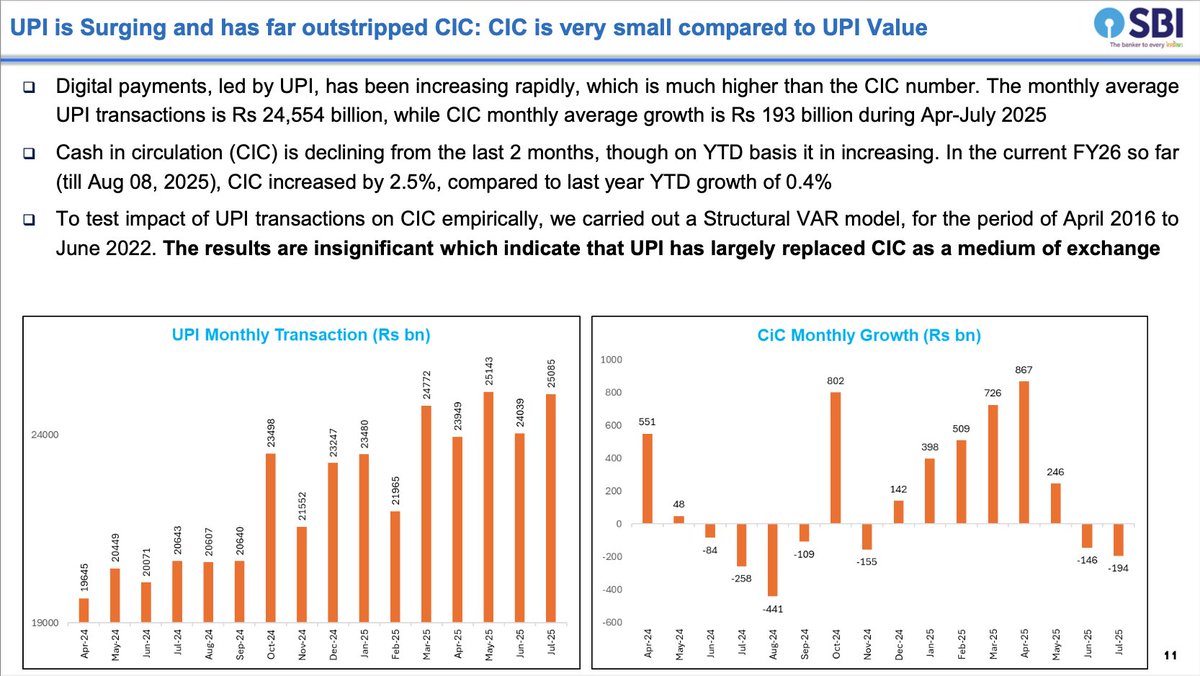

1/ UPI transactions:

1/ UPI transactions:

1/ Why Governments Are Bullish on CBDCs

1/ Why Governments Are Bullish on CBDCs

𝗞𝗲𝘆 𝗦𝘁𝗮𝘁𝘀 𝗮𝗻𝗱 𝗙𝗮𝘀𝘁 𝗙𝗮𝗰𝘁𝘀:

𝗞𝗲𝘆 𝗦𝘁𝗮𝘁𝘀 𝗮𝗻𝗱 𝗙𝗮𝘀𝘁 𝗙𝗮𝗰𝘁𝘀: