"EACH ENTERPRISE REMAINS UNDERCAPITALIZED"

Citing the 2021 FHFA report to Congress.

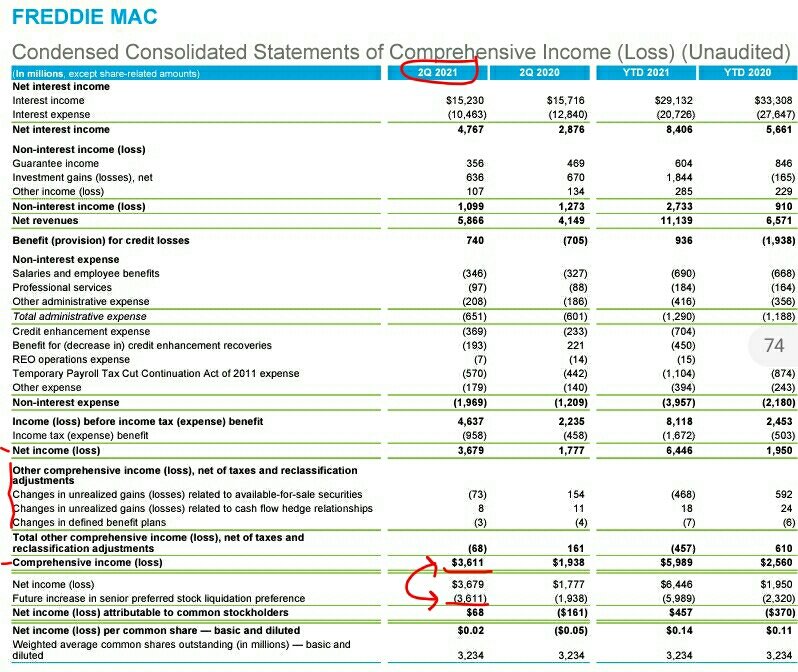

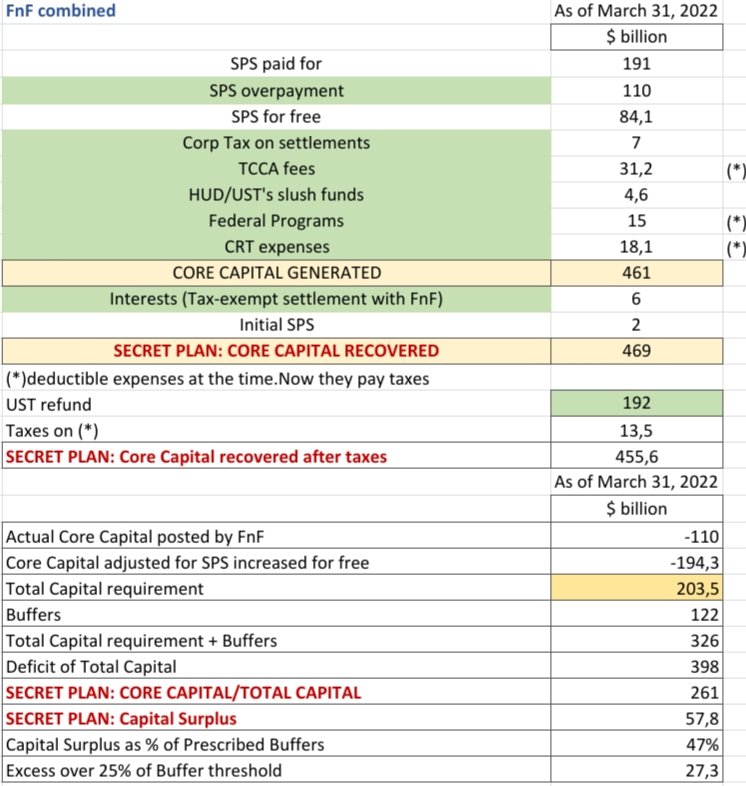

He ignores the Capital Rule is effective Feb16,2021 and that it's been concealed until the 2Q2022 earnings reports, showing a whopping $313B Capital deficit($182+$131👇)

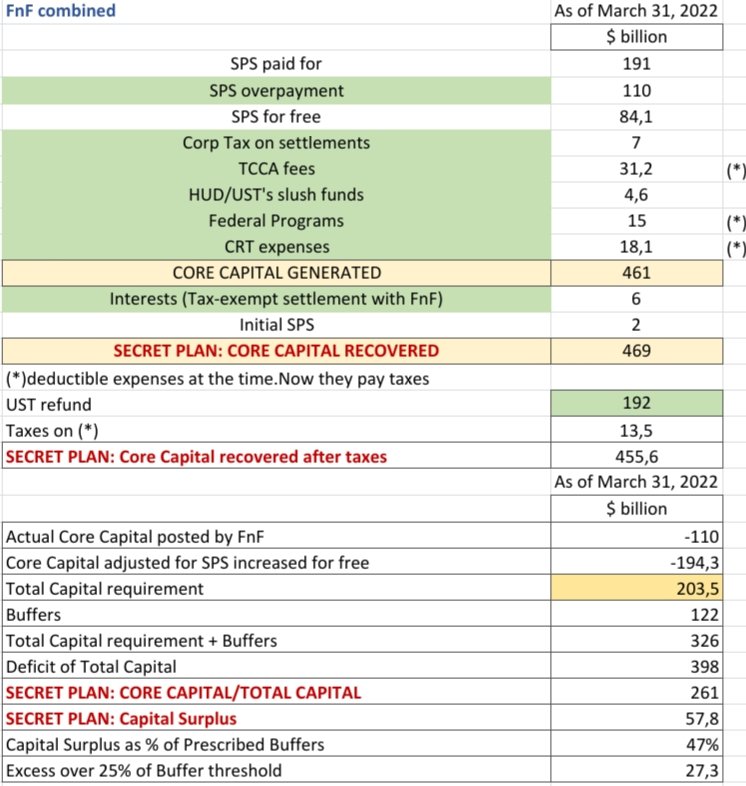

$398B adjusted.#Fanniegate

Citing the 2021 FHFA report to Congress.

He ignores the Capital Rule is effective Feb16,2021 and that it's been concealed until the 2Q2022 earnings reports, showing a whopping $313B Capital deficit($182+$131👇)

$398B adjusted.#Fanniegate

https://twitter.com/RepFrenchHill/status/1545480965241405442

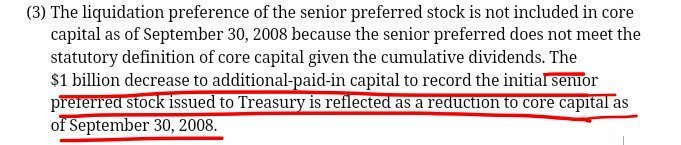

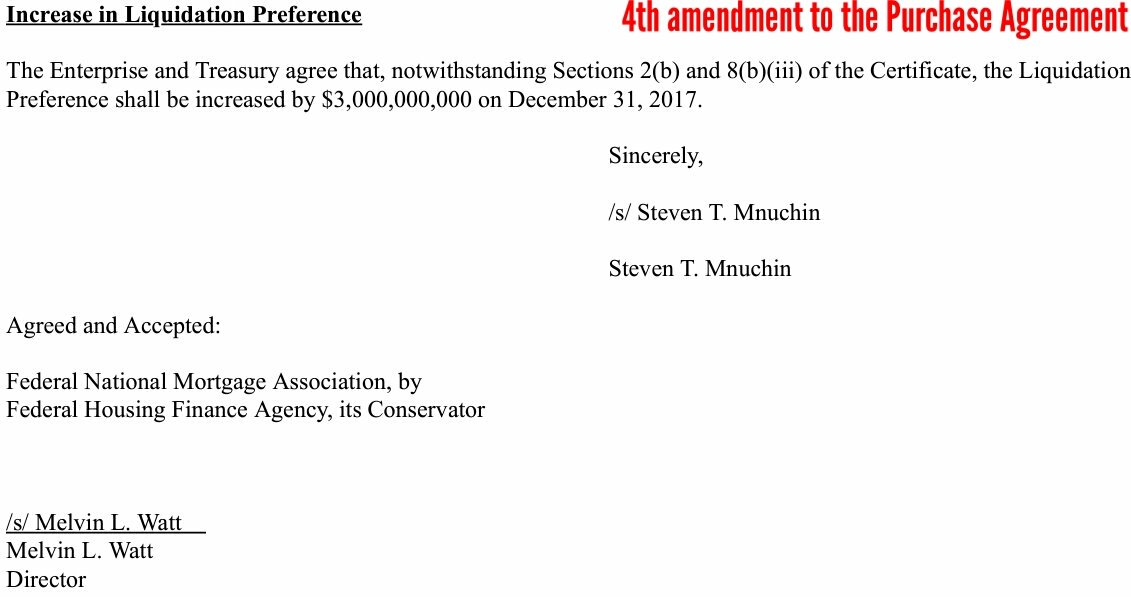

Adjusted for SPS increased for free,reducing Retained Earnings(C.C.).SPS missing on their bce sheets to evade it(@SEC_Enforcement)

Capital is meant to cover unexpected losses and "protect the taxpayer" from SPS purchases when negative NW.

$461B of Capital generated held in escrow

Capital is meant to cover unexpected losses and "protect the taxpayer" from SPS purchases when negative NW.

$461B of Capital generated held in escrow

(*) Concealed until the 1Q2022 earnings reports.

@RepFrenchHill @RepBlaine @RepLoudermilk @RepRalphNorman

@RepFrenchHill @RepBlaine @RepLoudermilk @RepRalphNorman

• • •

Missing some Tweet in this thread? You can try to

force a refresh