Deepak Nitrite has become a market darling over the last years, but how much do you know about its sister company?

Despite the name, only 10% of Deepak Fertilizer's profits come from fertilizers.

A short thread on why the company is actually a proxy play on infra.

1/14

Despite the name, only 10% of Deepak Fertilizer's profits come from fertilizers.

A short thread on why the company is actually a proxy play on infra.

1/14

In this thread:

• Why Deepak Fert is an explosives company.

• Competitive landscape.

• Why they've taken on two enormous capex projects.

• Antithesis pointers.

Disclosure: invested from lower levels, no transactions in 6 months.

2/14

• Why Deepak Fert is an explosives company.

• Competitive landscape.

• Why they've taken on two enormous capex projects.

• Antithesis pointers.

Disclosure: invested from lower levels, no transactions in 6 months.

2/14

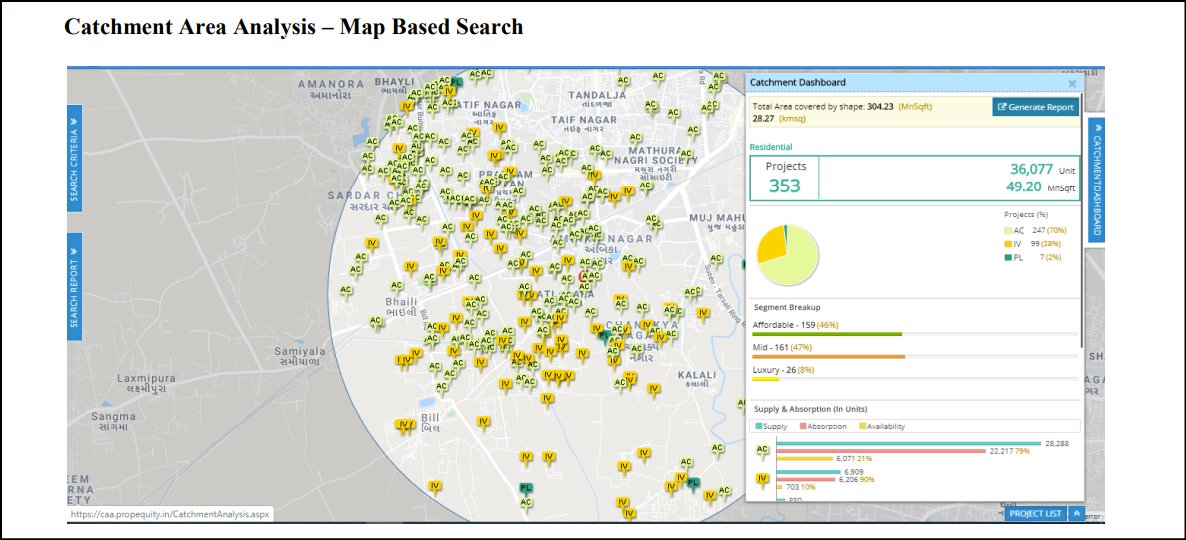

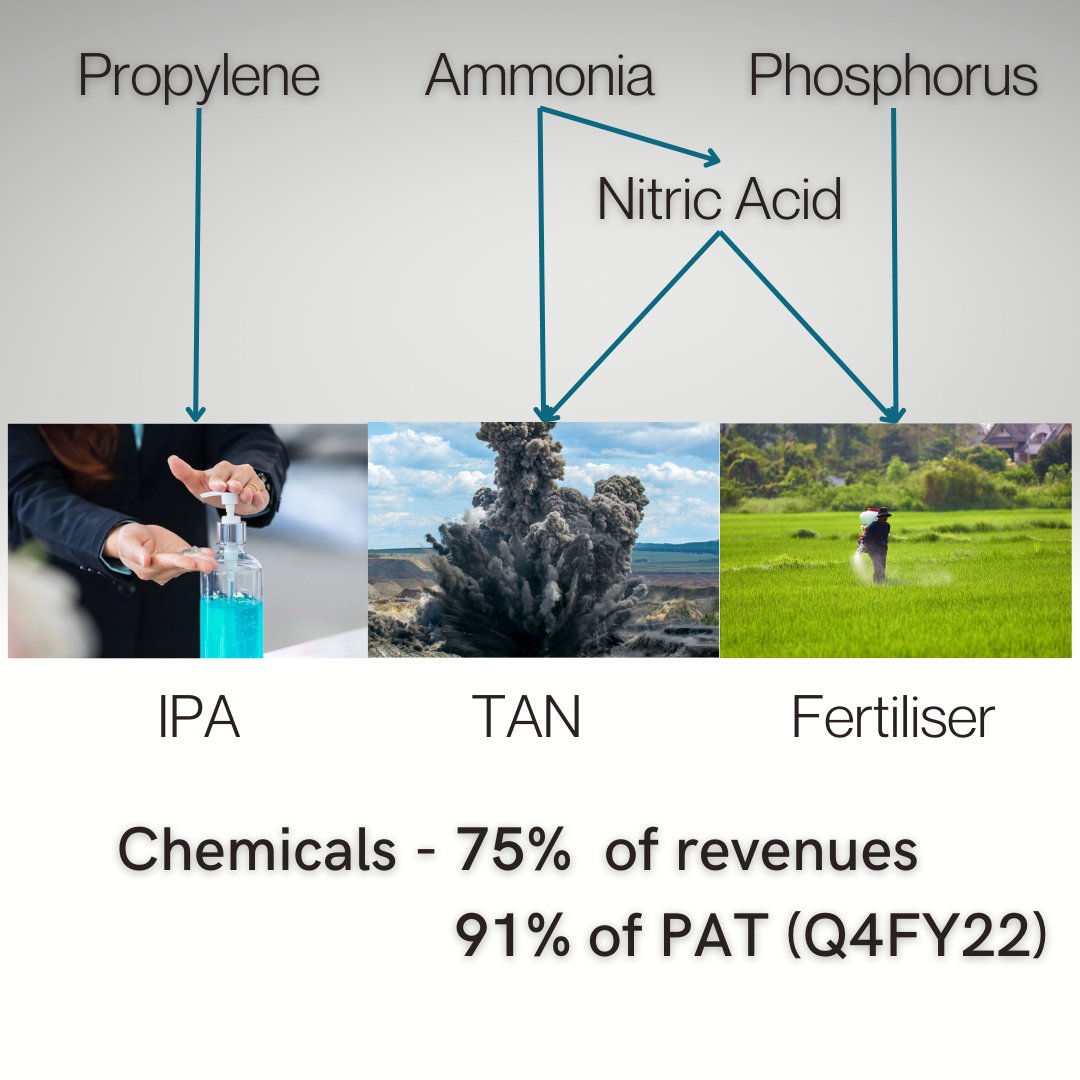

With any company, it's important to understand the value chain and business segments first.

To those reading that find chemical names hard to remember, an easy way is to associate an end use with the chemical, and you'll never forget.

In this case, our focus is on TAN.

3/14

To those reading that find chemical names hard to remember, an easy way is to associate an end use with the chemical, and you'll never forget.

In this case, our focus is on TAN.

3/14

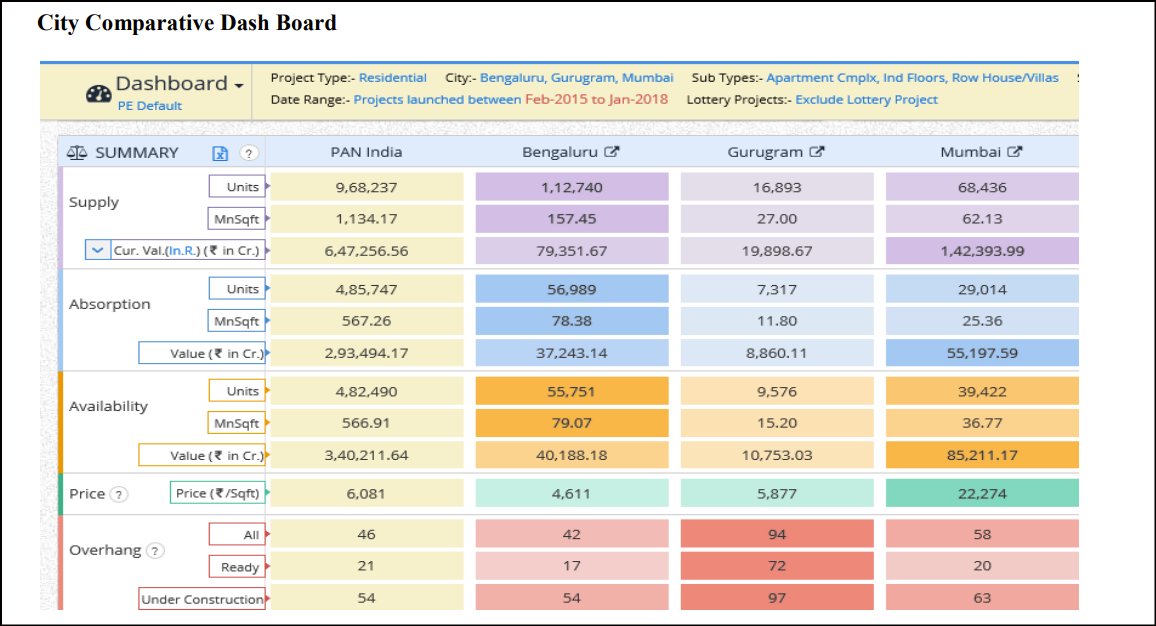

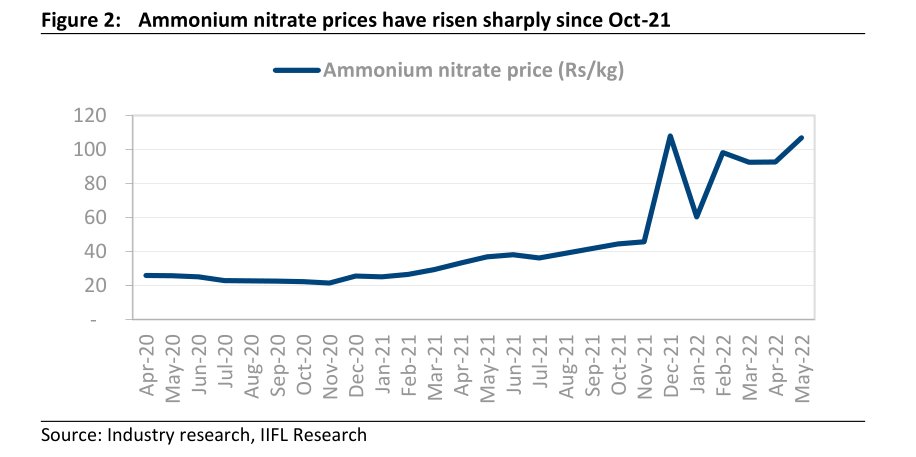

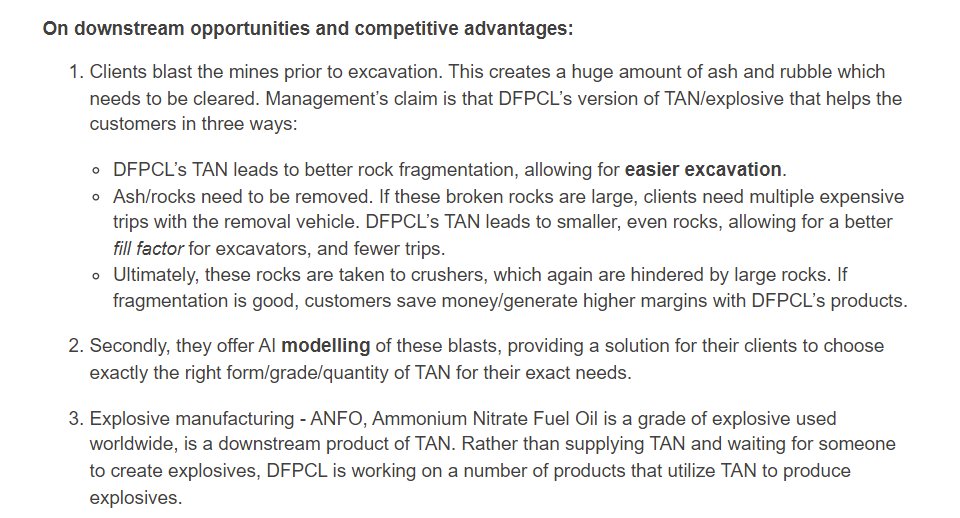

In FY22, TAN formed nearly 60% of the chemical revenues, and had the highest realisations.

Following this, nitric acid contributed 22% of the chemical revenues, and IPA is the least interesting part of the pie.

Sharing last year's revenue mix (image)

4/14

Following this, nitric acid contributed 22% of the chemical revenues, and IPA is the least interesting part of the pie.

Sharing last year's revenue mix (image)

4/14

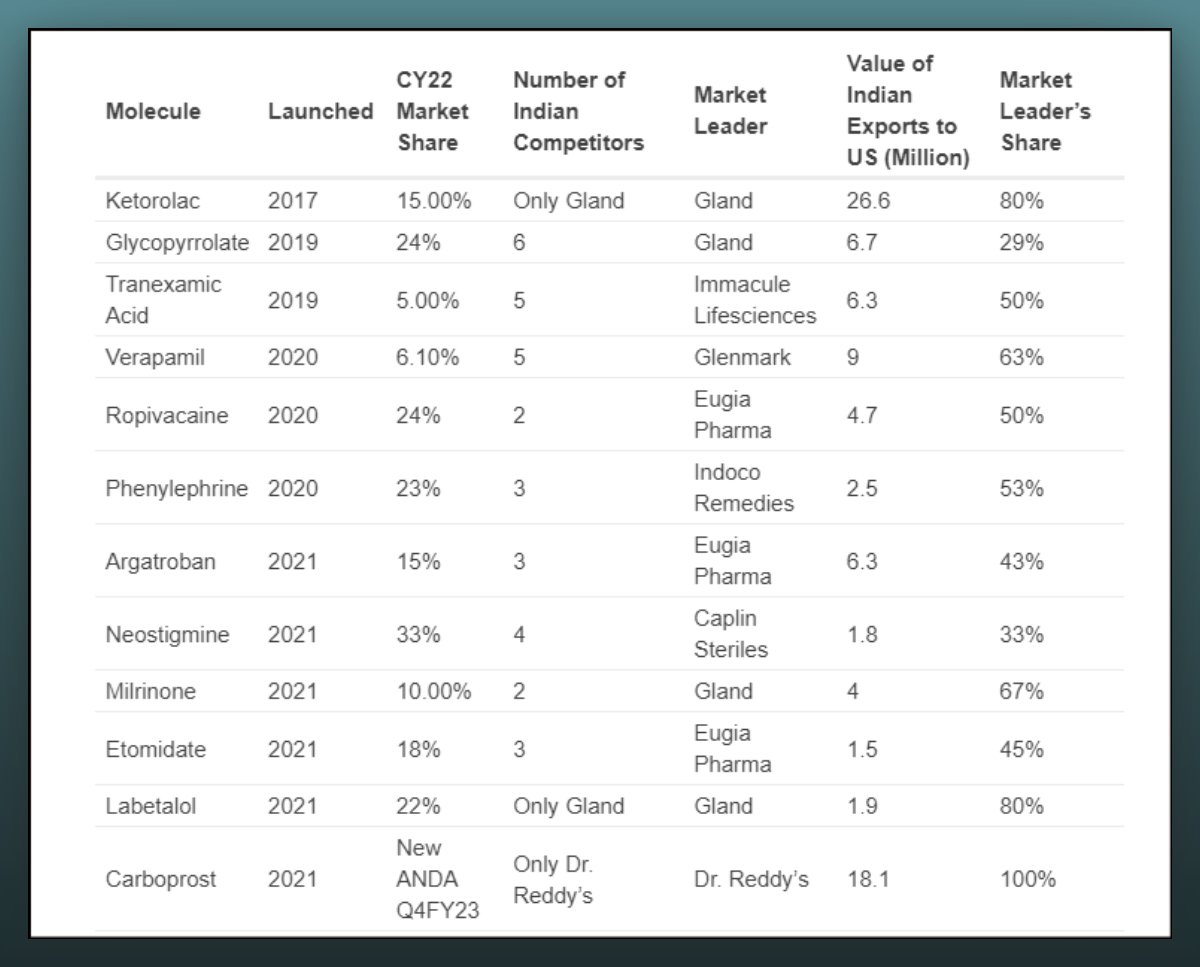

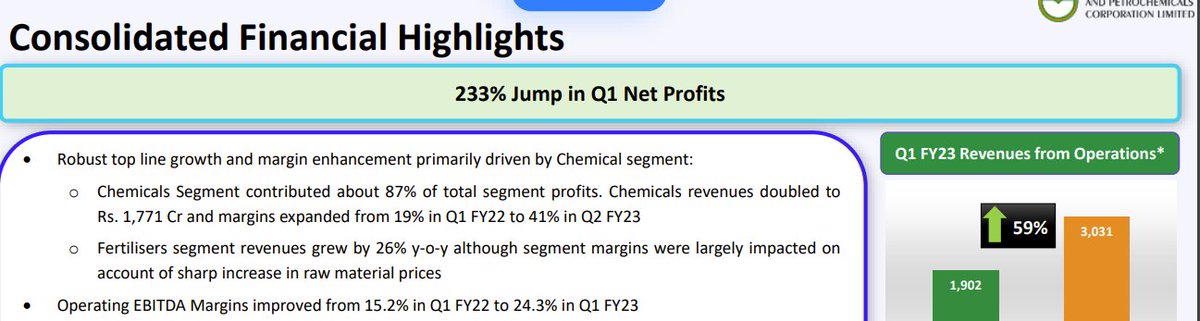

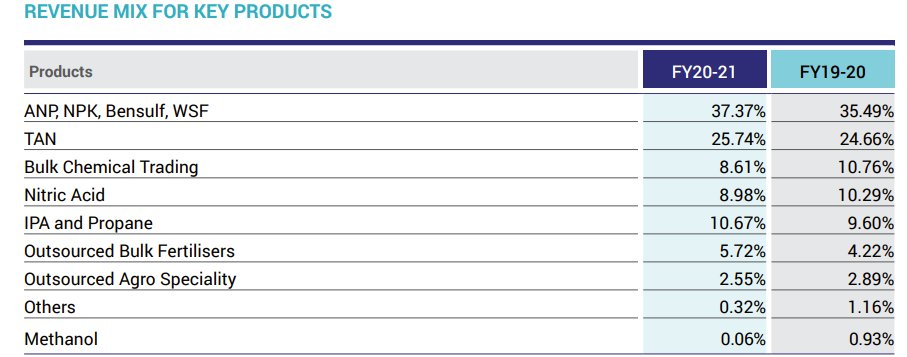

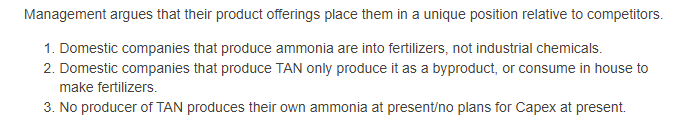

TAN is the biggest piece of this story, and makes or breaks Deepak Fertiliser's bottom line.

Coal and limestone mining companies use TAN to make explosives. They blast these mines prior to excavation.

DFPCL's management explains their value proposition (image).

5/14

Coal and limestone mining companies use TAN to make explosives. They blast these mines prior to excavation.

DFPCL's management explains their value proposition (image).

5/14

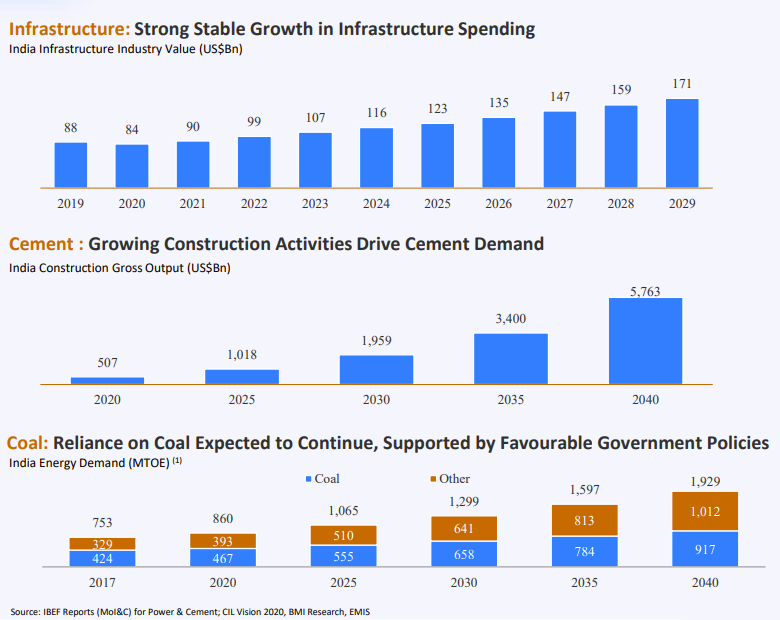

So why is this interesting?

• While ultimately mining is a sunset sector, demand for coal and cement will remain for another 20 years.

• All of Deepak Fertilizer's competitors are PSUs!

6/14

• While ultimately mining is a sunset sector, demand for coal and cement will remain for another 20 years.

• All of Deepak Fertilizer's competitors are PSUs!

6/14

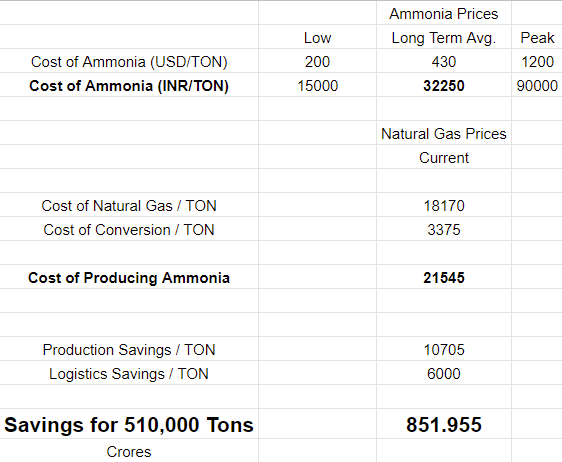

Deepak Fert has planned to spend 𝟔𝟓𝟎𝟎 𝐂𝐫. on capacity expansion.

The first of DFPCL's large projects is ammonia. This is what they use to make TAN.

100% of the 500,000 tonnes will be consumed in house, and poses no sales risk.

7/14

The first of DFPCL's large projects is ammonia. This is what they use to make TAN.

100% of the 500,000 tonnes will be consumed in house, and poses no sales risk.

7/14

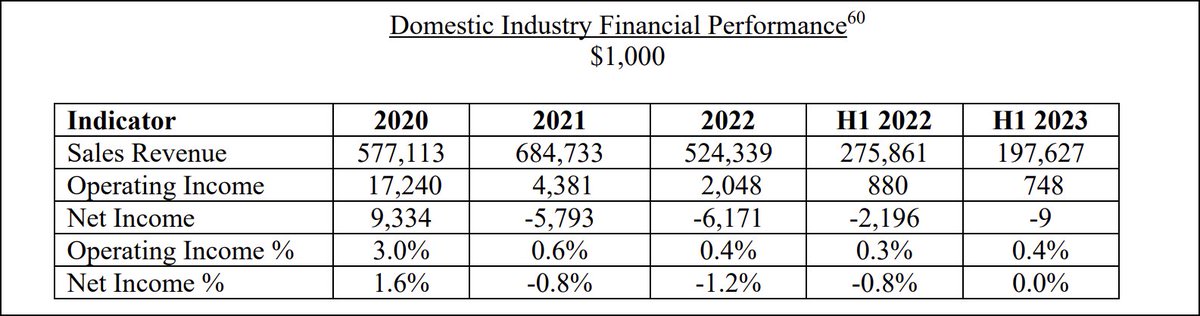

What would the capacity coming online do to the PnL?

Sheet below contains calculations based on long term average prices of commodities. One can listen to Q3's concall for these figures and compute.

There are additional benefits the company gets that can add on 150 Cr.

8/14

Sheet below contains calculations based on long term average prices of commodities. One can listen to Q3's concall for these figures and compute.

There are additional benefits the company gets that can add on 150 Cr.

8/14

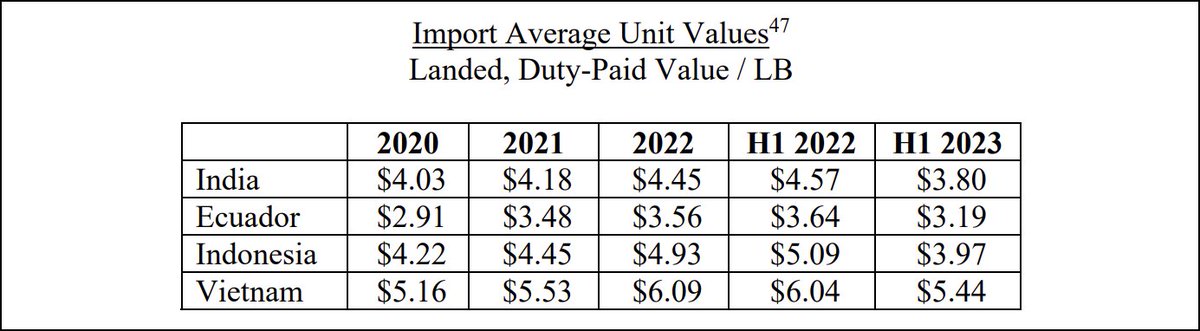

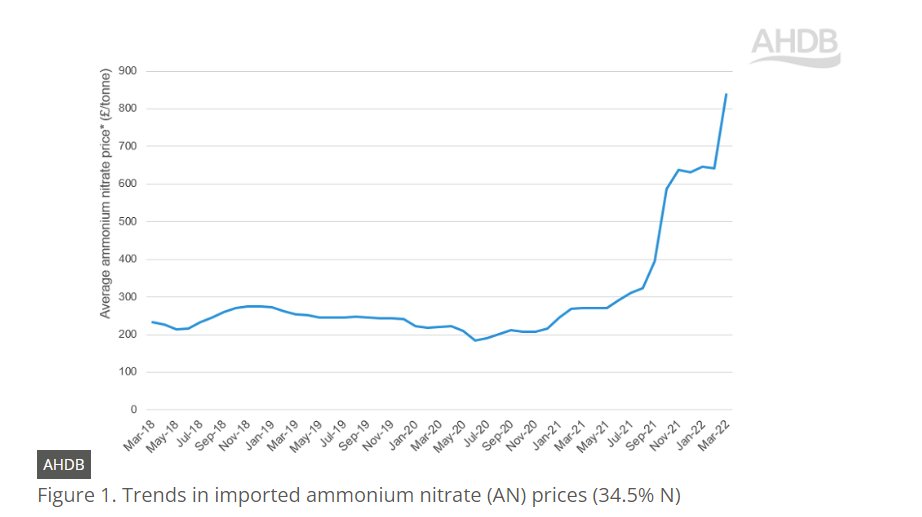

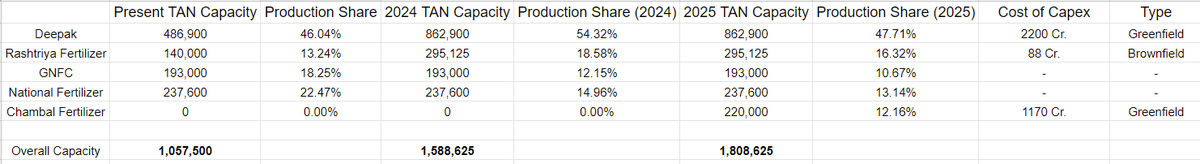

The second capex plan is topline accretive. They're expanding TAN capacities, and building a new plant close to the mining hubs of India on the east.

India is a net importer of TAN, and this is an import substitute.

Image below has the TAN landscape over the next 5 years.

9/14

India is a net importer of TAN, and this is an import substitute.

Image below has the TAN landscape over the next 5 years.

9/14

• TAN comes in three different grades. DFPCL is the only producer of all three grades, while competitors produce a single form.

• It remains to be seen whether competitors can stick to timelines.

In addition, management points out three things about the landscape:

10/14

• It remains to be seen whether competitors can stick to timelines.

In addition, management points out three things about the landscape:

10/14

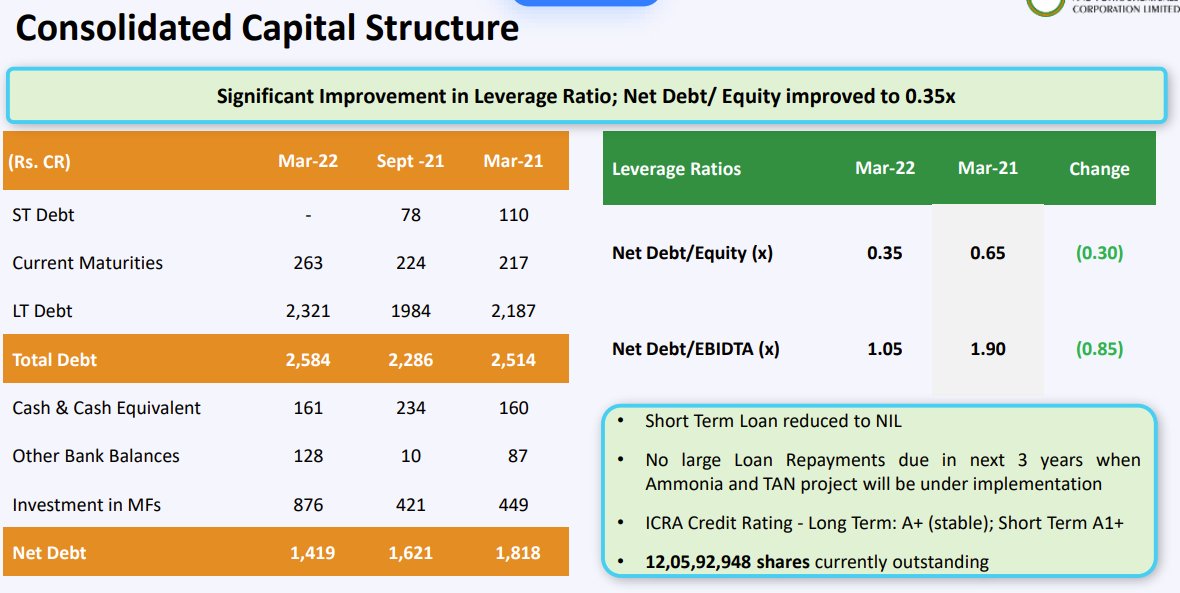

When they first announced these plans, the amount of debt needed for these projects was a concern.

However, not all debt is the same, and should be broken up into short term and long term.

Due to a strong FY22, there is no more short term debt owed.

11/14

However, not all debt is the same, and should be broken up into short term and long term.

Due to a strong FY22, there is no more short term debt owed.

11/14

Antithesis pointers:

• End industries are cyclical. Realisations will depend on coal and cement outlook.

• TAN has elements to it that are commodity, and downstream elements that are not. May continue to trade at commodity valuations.

12/14

• End industries are cyclical. Realisations will depend on coal and cement outlook.

• TAN has elements to it that are commodity, and downstream elements that are not. May continue to trade at commodity valuations.

12/14

• Competitors are moving into TAN in 2025 if they can stick to timescales, and it will be a test of whether the different grades, in-house ammonia manufacturing, and strategic geography makes DFPCL a preferred customer.

• TAN realisations will likely soften in FY23.

13/14

• TAN realisations will likely soften in FY23.

13/14

The fertilizer division is also very interesting, and is a great case study of why turnarounds are slow.

Will write a Part II to cover the fertilizer business.

14/14

Will write a Part II to cover the fertilizer business.

14/14

I hope you found this introduction useful.

Please consider re-tweeting the first tweet below.

For those interested, long read with more details at: forum.valuepickr.com/t/deepak-ferti…

Please consider re-tweeting the first tweet below.

For those interested, long read with more details at: forum.valuepickr.com/t/deepak-ferti…

https://twitter.com/Chins1729/status/1545760765096865792

Edit: I didn't expect it to be a controversial statement.

The extent of the relation between Deepak Nitrite and Fertilizer is in shared origins, with Mr. CK Mehta founding both companies. There is no other relation between the two.

Old article from 2003: timesofindia.indiatimes.com/business/india…

The extent of the relation between Deepak Nitrite and Fertilizer is in shared origins, with Mr. CK Mehta founding both companies. There is no other relation between the two.

Old article from 2003: timesofindia.indiatimes.com/business/india…

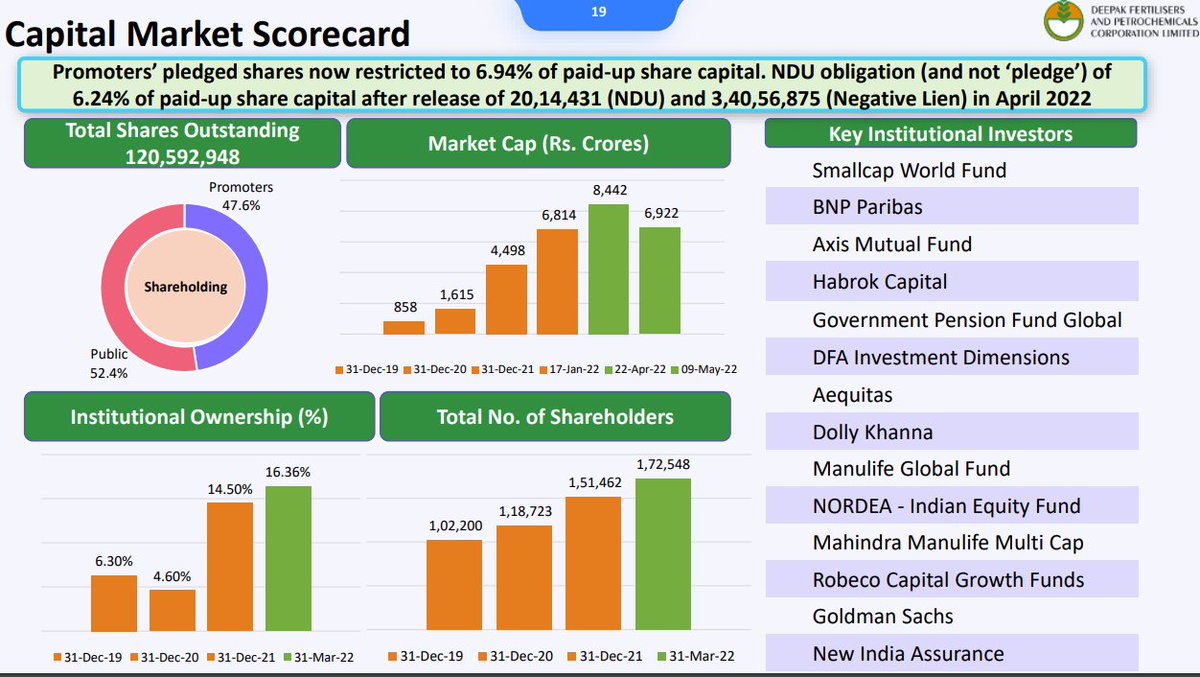

On the pledge: a large portion of it is an NDU, and not really a pledge. Actual percentage of holding pledged is 6.94%, and has been steadily falling in the last year.

This is not a buy recommendation, merely a discussion on one vertical of the business.

This is not a buy recommendation, merely a discussion on one vertical of the business.

• • •

Missing some Tweet in this thread? You can try to

force a refresh