How to get URL link on X (Twitter) App

Background:

Background:

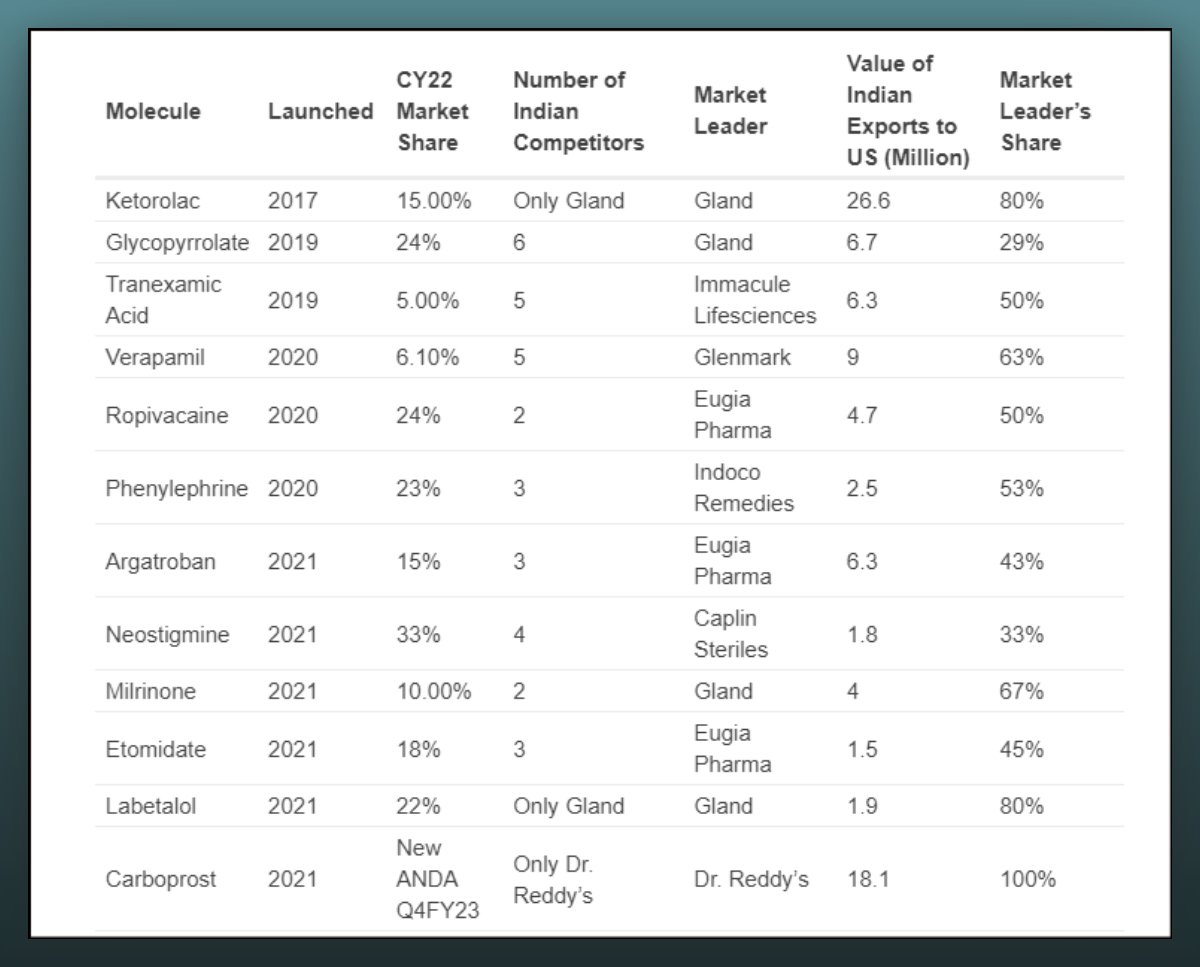

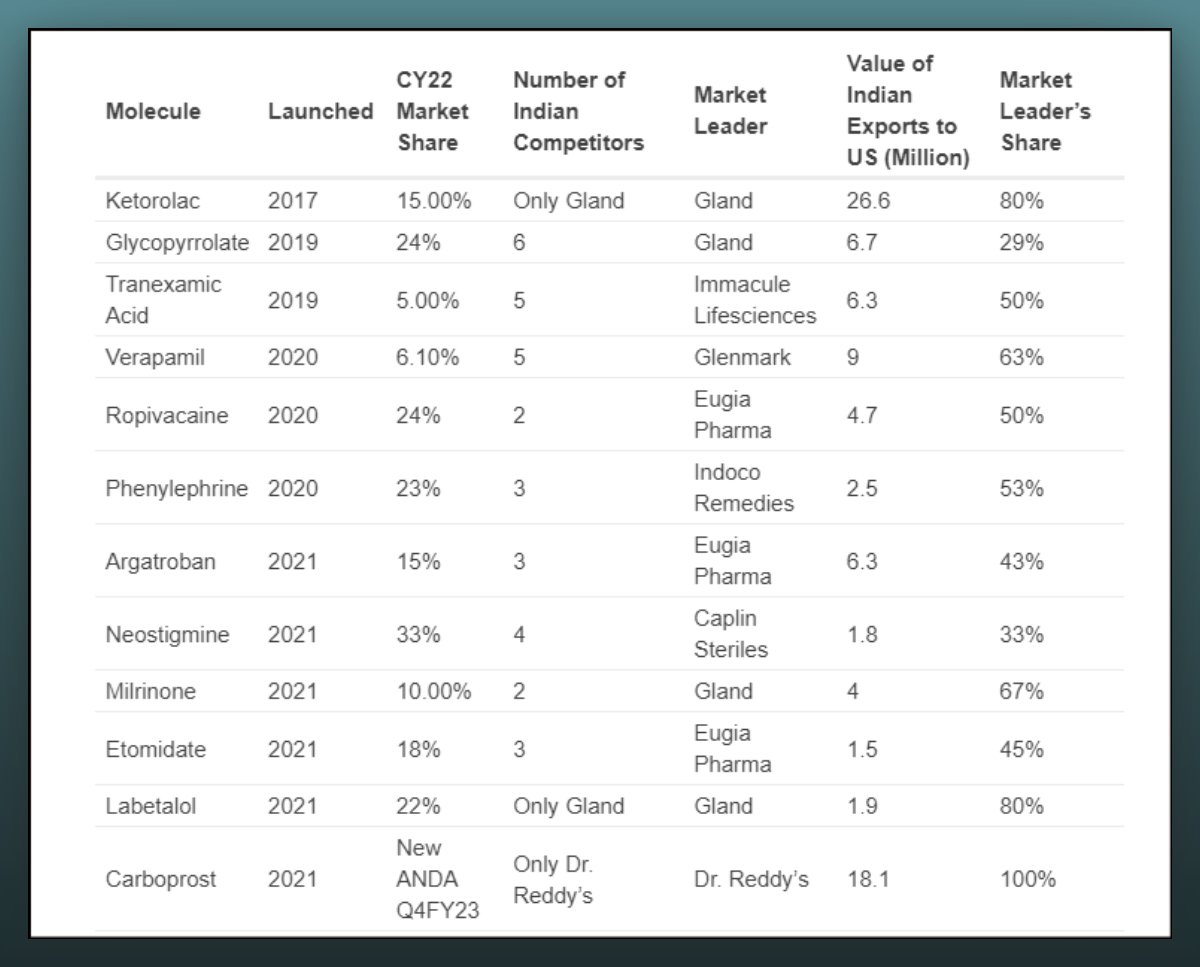

Caplin Point invested in their injectable plant in 2014, and launched their first molecule Ketorolac, around 2018.

Caplin Point invested in their injectable plant in 2014, and launched their first molecule Ketorolac, around 2018.

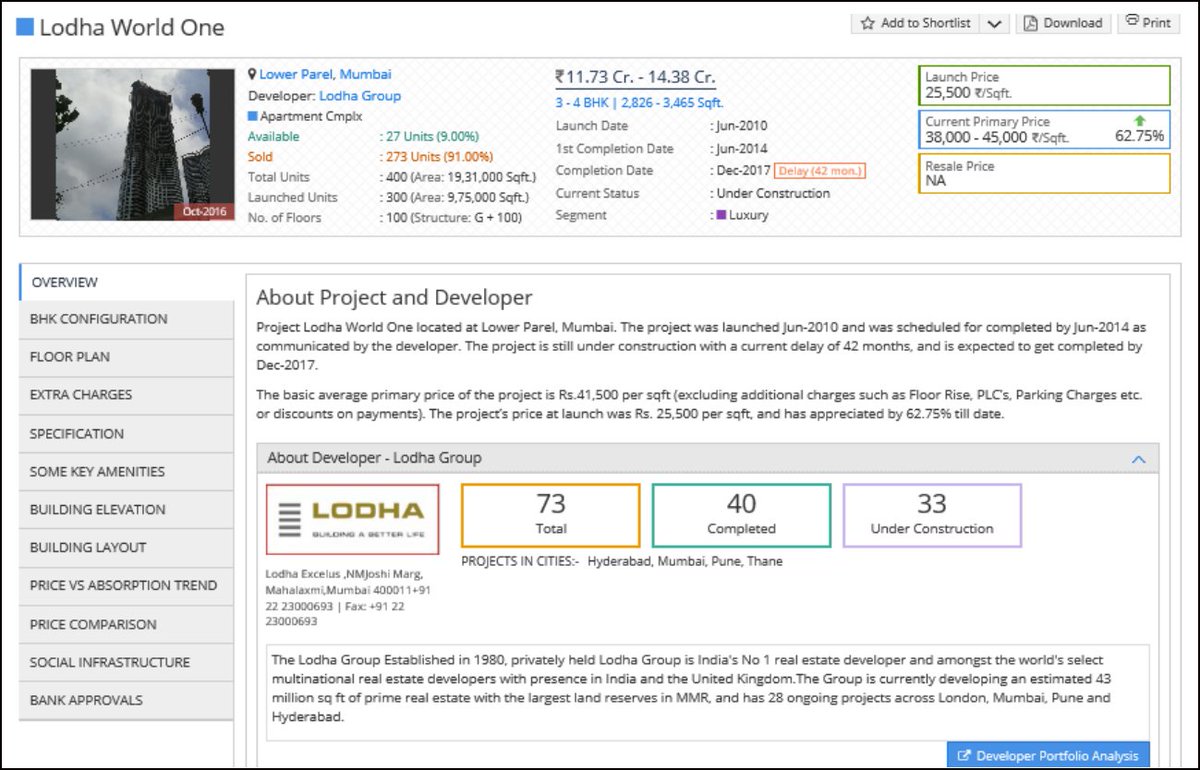

PropEquity's main offering is a data analytics database that captures nuanced granular information on the real estate market.

PropEquity's main offering is a data analytics database that captures nuanced granular information on the real estate market.

Disclaimer:

Disclaimer:

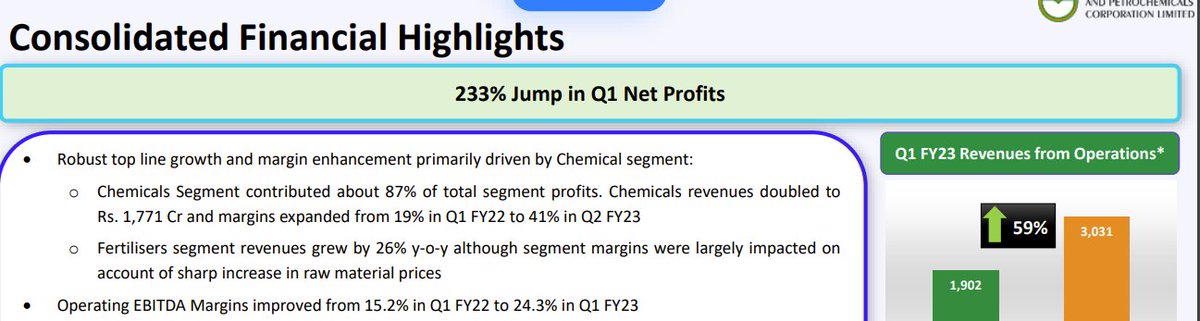

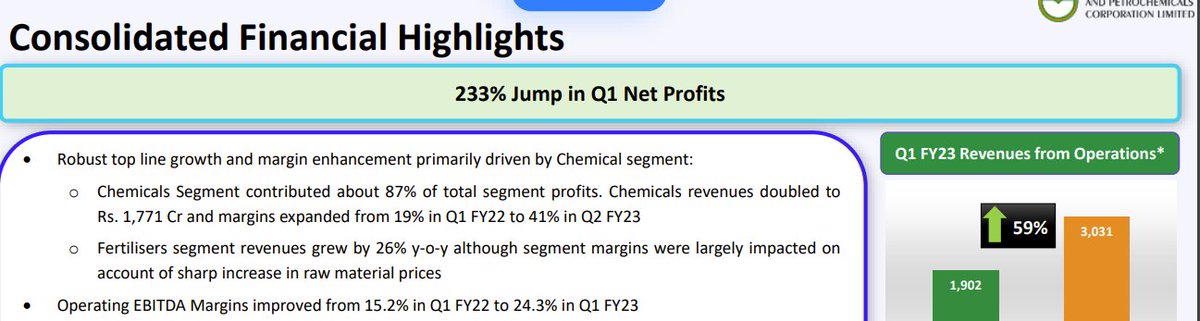

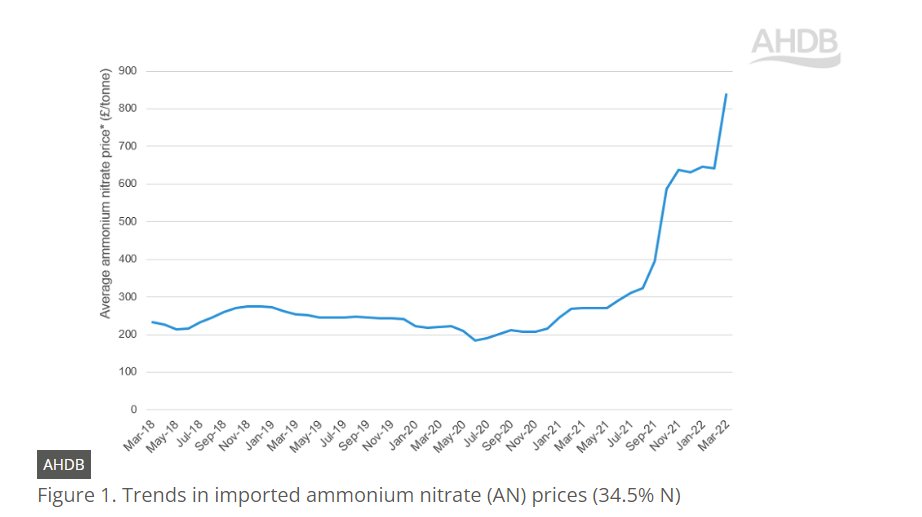

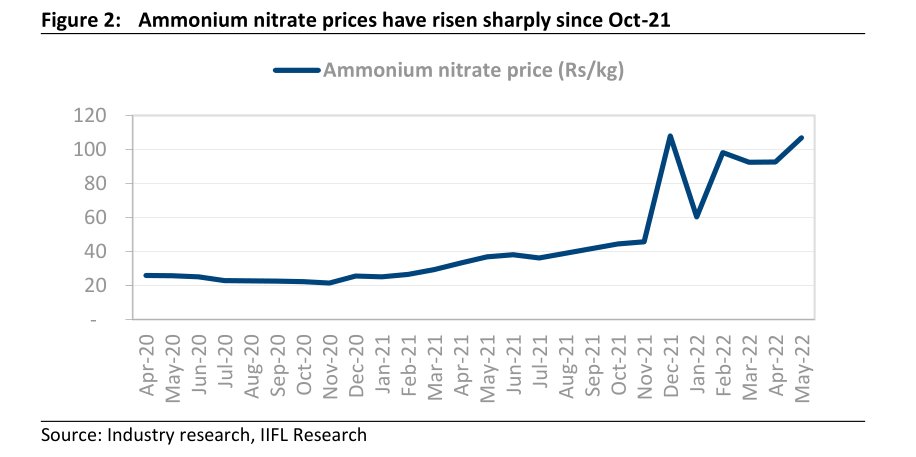

The star of this show is Technical Ammonium Nitrate, which probably contributed more than 60% of the profits this quarter.

The star of this show is Technical Ammonium Nitrate, which probably contributed more than 60% of the profits this quarter.

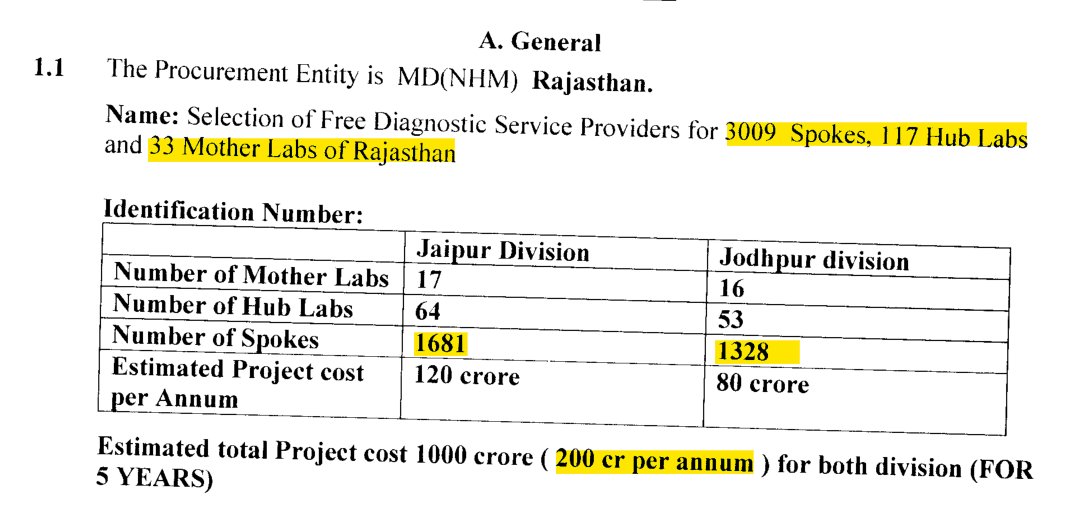

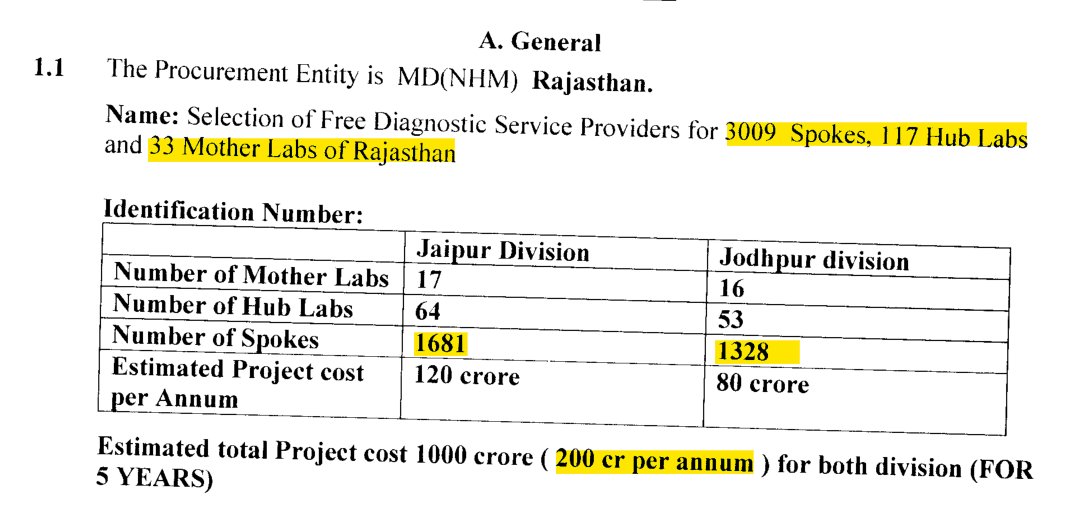

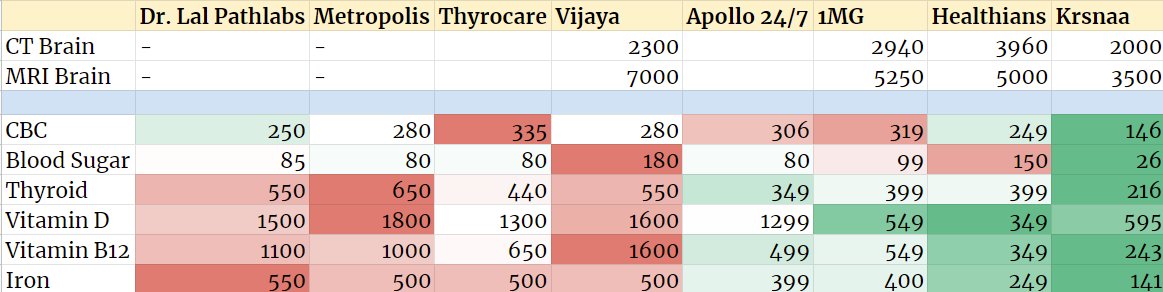

Context: Krsnaa Diagnostics bids for PPP tenders, and I was looking to see if I can map out the landscape of tenders currently floated by different governments.

Context: Krsnaa Diagnostics bids for PPP tenders, and I was looking to see if I can map out the landscape of tenders currently floated by different governments.https://twitter.com/thepodiumIn/status/1548949195209732097Nice story of Mr. Nath's journey of raising 950 Cr. in 2016. Took 3 years from the fund raise, identifying the right SPAC, and SEBI/RBI approval.

Some important terminology. Fertilizers are classified by the three key nutrients present within them:

Some important terminology. Fertilizers are classified by the three key nutrients present within them:

In this thread:

In this thread:

In this thread I will cover -

In this thread I will cover -

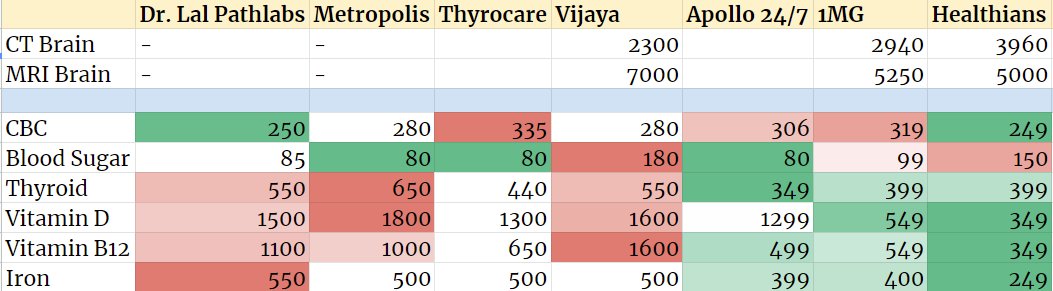

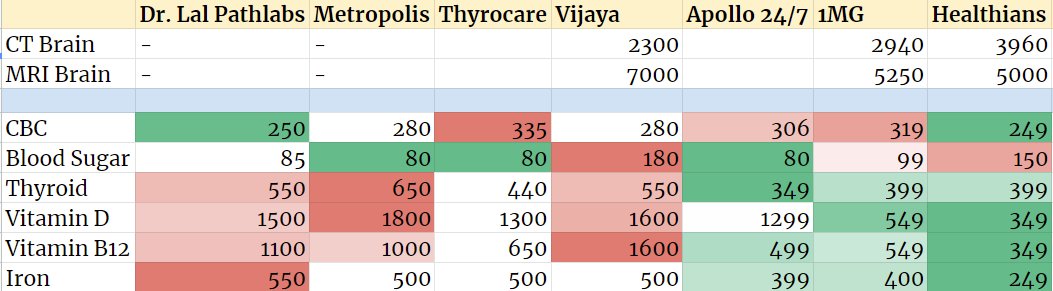

However, 1mg's prices don't look as appealing if one adds Krsnaa's price offerings into the mix:

However, 1mg's prices don't look as appealing if one adds Krsnaa's price offerings into the mix:

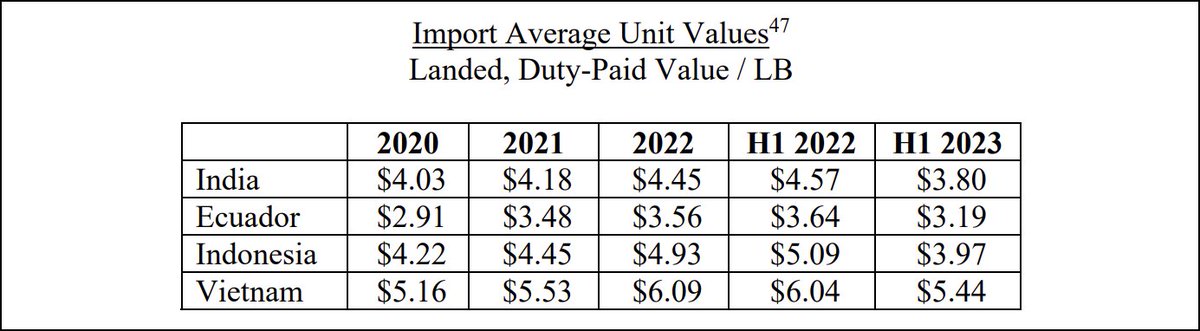

Fast fashion retailers like Zara or Mango are famous for their wide range of apparel. Behind the scenes, there is a complex supply chain responsible for each piece of clothing reaching a store or warehouse.

Fast fashion retailers like Zara or Mango are famous for their wide range of apparel. Behind the scenes, there is a complex supply chain responsible for each piece of clothing reaching a store or warehouse.