100 questions you should ask yourself when analyzing tokenomics

You’ve found a project you like and are considering aping in. Before you do, consult this list. Asking these really helps to avoid fool’s gold and to choose better long-term investments in the crypto market.

🧵

You’ve found a project you like and are considering aping in. Before you do, consult this list. Asking these really helps to avoid fool’s gold and to choose better long-term investments in the crypto market.

🧵

Question outline:

- General

- Token launch

- Supply

- Demand

- Token utility

- Past performance

- Currently relevant questions

👇

- General

- Token launch

- Supply

- Demand

- Token utility

- Past performance

- Currently relevant questions

👇

General

1. Which tokens does the project use?

2. If there are several tokens, why?

3. What is the market cap of the token?

4. What is the circulating supply?

5. What is the maximum possible supply? (more on this in the Supply section)

1. Which tokens does the project use?

2. If there are several tokens, why?

3. What is the market cap of the token?

4. What is the circulating supply?

5. What is the maximum possible supply? (more on this in the Supply section)

6. What is the Fully-Diluted Valuation?

7. Is the token’s supply inflationary, stable, or deflationary?

8. Where can you buy the token?

9. Why is the token on these specific DEXes / CEXes?

10. How deep is the liquidity on these exchanges for the token?

7. Is the token’s supply inflationary, stable, or deflationary?

8. Where can you buy the token?

9. Why is the token on these specific DEXes / CEXes?

10. How deep is the liquidity on these exchanges for the token?

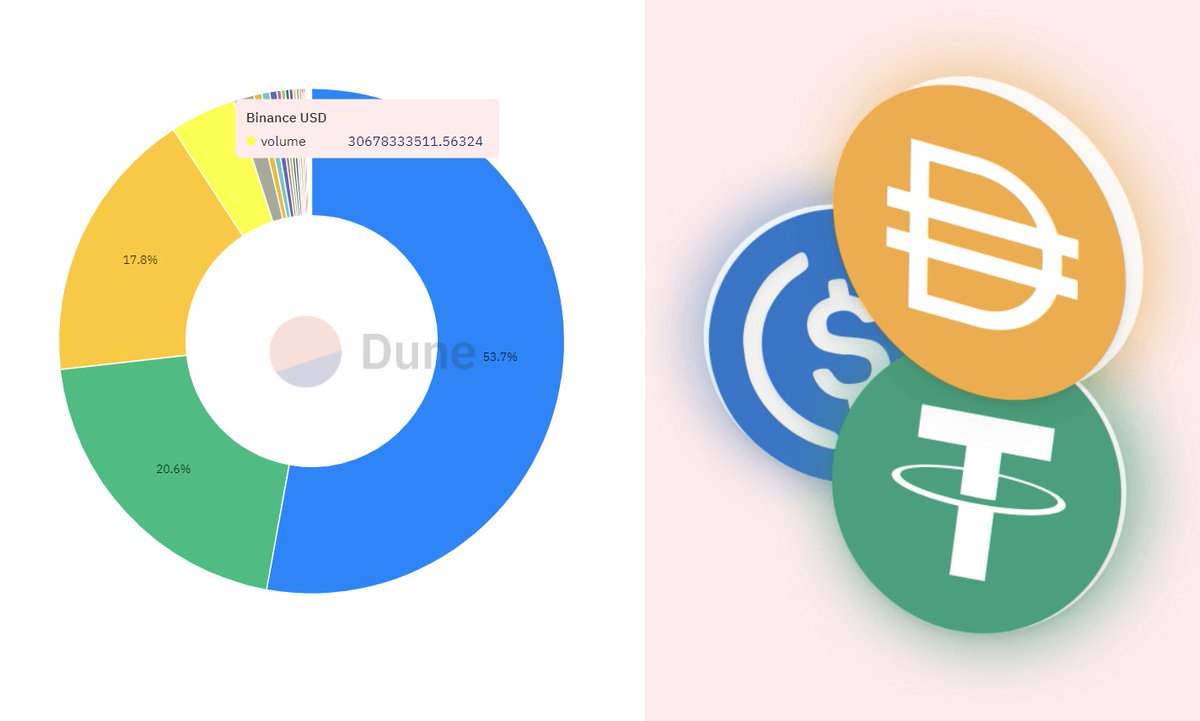

11. How high is the token’s volume on these exchanges?

12. Who are the main liquidity providers / market makers?

13. Are they in for the long term or incentivized via unsustainable token emissions?

12. Who are the main liquidity providers / market makers?

13. Are they in for the long term or incentivized via unsustainable token emissions?

14. Which parties do you put faith in when holding the token (ie chain, bridge, team, etc)?

15. Does the team benefit from the token appreciating?

16. Do users (not tokenholders) benefit from the token appreciating?

17. Can the project function without a token?

15. Does the team benefit from the token appreciating?

16. Do users (not tokenholders) benefit from the token appreciating?

17. Can the project function without a token?

Token launch

- How the project launched its token

18. Why was this blockchain chosen to launch the token?

19. Is the chosen chain best for security, speed, or interoperability?

20. How old was the project when it launched the token?

- How the project launched its token

18. Why was this blockchain chosen to launch the token?

19. Is the chosen chain best for security, speed, or interoperability?

20. How old was the project when it launched the token?

21. Which token launch method was used?

22. How much did the project raise through its token launch?

23. What Fully-Diluted Valuation (FDV) was the launch done at?

22. How much did the project raise through its token launch?

23. What Fully-Diluted Valuation (FDV) was the launch done at?

24. How has the Market Cap / FDV changed since launch?

25. How does the chosen percentage of initial supply affect the emissions and tokenholder dilution in the future?

25. How does the chosen percentage of initial supply affect the emissions and tokenholder dilution in the future?

Supply

- A token’s price is fundamentally determined by supply and demand. Let’s first analyze supply.

26. What factors affect the token’s selling pressure?

27. How much will token supply grow in the future?

28. Who holds the token?

- A token’s price is fundamentally determined by supply and demand. Let’s first analyze supply.

26. What factors affect the token’s selling pressure?

27. How much will token supply grow in the future?

28. Who holds the token?

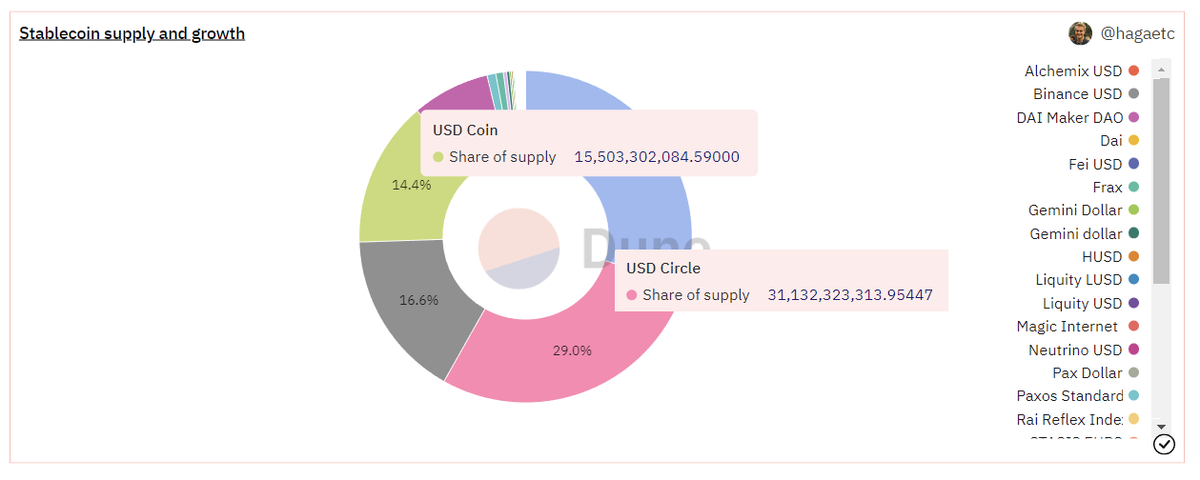

29. What % of supply do top 10 addresses control?

30. How about top 100 addresses?

31. When are VC and Team unlocks?

32. Have a large number of coins been lost or burned?

33. How much does the community hold?

30. How about top 100 addresses?

31. When are VC and Team unlocks?

32. Have a large number of coins been lost or burned?

33. How much does the community hold?

34. How fair is the distribution?

35. What is the overall emissions schedule?

36. Who do emissions go to?

37. What is their behavior (do they sell off instantly or hold)?

38. Can you benefit from emissions by staking or LPing?

35. What is the overall emissions schedule?

36. Who do emissions go to?

37. What is their behavior (do they sell off instantly or hold)?

38. Can you benefit from emissions by staking or LPing?

39. Do emissions generate you profit, or just protect you against dilution?

40. Why are some released tokens not in circulating supply?

41. What will happen when locked (or staked) tokens are released?

42. Are there bulk unlocks in community lockup mechanisms?

40. Why are some released tokens not in circulating supply?

41. What will happen when locked (or staked) tokens are released?

42. Are there bulk unlocks in community lockup mechanisms?

Demand

- Now let’s look at demand, why the token is purchased from the market.

43. What are the key drivers of demand for the token?

44. Are there other projects users can easily substitute to?

45. How did you find out about this project?

- Now let’s look at demand, why the token is purchased from the market.

43. What are the key drivers of demand for the token?

44. Are there other projects users can easily substitute to?

45. How did you find out about this project?

46. Will other people want this token in the future?

47. What is your expected return from holding the token?

48. Are there protocol revenues that get distributed to the token holders? (more on this in the Utility section)

47. What is your expected return from holding the token?

48. Are there protocol revenues that get distributed to the token holders? (more on this in the Utility section)

49. Does the project buy back and / or burn its own tokens?

50. Do tokens get destroyed or transferred when used to purchase a good / service from the protocol?

51. Does the project have a cult-like following?

52. How is the energy in their Discord?

50. Do tokens get destroyed or transferred when used to purchase a good / service from the protocol?

51. Does the project have a cult-like following?

52. How is the energy in their Discord?

53. How active is the project on Twitter?

54. How active is the community on Twitter?

55. How long have they been this active?

56. Will they be as active a month or a year from now?

54. How active is the community on Twitter?

55. How long have they been this active?

56. Will they be as active a month or a year from now?

57. Is there game theory driven incentive to hold the token?

58. Is there a token lockup mechanism?

59. Does it smell like a Ponzi scheme?

60. Is there a burn mechanism?

58. Is there a token lockup mechanism?

59. Does it smell like a Ponzi scheme?

60. Is there a burn mechanism?

Token utility

- What the token is used for in the project

61. What is the purpose of the token?

62. Are you supposed to hold it or use it for transactions / services?

63. What percentage of a project’s cash flows are distributed to tokenholders?

- What the token is used for in the project

61. What is the purpose of the token?

62. Are you supposed to hold it or use it for transactions / services?

63. What percentage of a project’s cash flows are distributed to tokenholders?

64. Are cash flows dilutive or redistributive?

65. Do you plan to instantly sell or hold onto the earnings?

66. Is the token used for governance?

67. If yes, how concentrated are governance votes?

68. Will your vote make a difference?

65. Do you plan to instantly sell or hold onto the earnings?

66. Is the token used for governance?

67. If yes, how concentrated are governance votes?

68. Will your vote make a difference?

69. What are the minimum token requirements to submit and escalate a governance proposal?

70. Can governance enable or affect profit distribution?

71. Are there bribes for governance voting that you can earn from?

70. Can governance enable or affect profit distribution?

71. Are there bribes for governance voting that you can earn from?

72. Do the tokens secure the project?

73. Can the token be used as collateral to borrow liquidity?

73. Can the token be used as collateral to borrow liquidity?

Past performance

- Token performance since launch

74. Is the token correlated with the broader crypto market (ETH, BTC) or not?

75. Why would you want to hold the token instead of ETH or BTC?

76. How volatile is the token’s price?

- Token performance since launch

74. Is the token correlated with the broader crypto market (ETH, BTC) or not?

75. Why would you want to hold the token instead of ETH or BTC?

76. How volatile is the token’s price?

77. How has the token held up against USD or ETH since its inception?

78. Have emissions / staking earnings offset any of the losses?

79, What is the token’s velocity (velocity = transaction volume / market cap)?

78. Have emissions / staking earnings offset any of the losses?

79, What is the token’s velocity (velocity = transaction volume / market cap)?

80. What’s the difference between current price and the ATH?

81. Has the token price been responsive to positive / negative news?

81. Has the token price been responsive to positive / negative news?

Currently relevant questions

- Bear market things and otherwise relevant stuff you should consider

82. Do the tokenomics still make sense in the bear market?

83. How has the token been affected by the crash?

- Bear market things and otherwise relevant stuff you should consider

82. Do the tokenomics still make sense in the bear market?

83. How has the token been affected by the crash?

84. Do the tokenomics hold up during high volatility and other edge cases?

85. Does the token resemble a security (what are the chances of SEC knocking)?

86. Is there enough liquidity for you to exit quickly?

87. How about if everyone were exiting at the same time?

85. Does the token resemble a security (what are the chances of SEC knocking)?

86. Is there enough liquidity for you to exit quickly?

87. How about if everyone were exiting at the same time?

88. Are tokenomics affected by inflow / outflow of users?

89. Are there tranches to cover protocol losses incurred in black swan events?

90. Has the team adjusted tokenomics in the past?

91. Are there other projects with similar tokenomics and how are they doing?

89. Are there tranches to cover protocol losses incurred in black swan events?

90. Has the team adjusted tokenomics in the past?

91. Are there other projects with similar tokenomics and how are they doing?

92. Are there well-known holders?

93. Are they selling or accumulating?

94. Will the project remain relevant to see the next bull run?

95. Are the tokenomics of this project better than that of its direct competitors?

93. Are they selling or accumulating?

94. Will the project remain relevant to see the next bull run?

95. Are the tokenomics of this project better than that of its direct competitors?

96. Has there been research into the tokenomics of this project?

97. Is the project behind the token doing well?

98. Are the tokenomics of the project overly complex and does that introduce more points of failure?

97. Is the project behind the token doing well?

98. Are the tokenomics of the project overly complex and does that introduce more points of failure?

99. How available was the data to answer all of these questions?

100. Are you still sure you want to ape in?

100. Are you still sure you want to ape in?

• • •

Missing some Tweet in this thread? You can try to

force a refresh