Principal trading @GalaxyHQ, studied @Wharton. Opinions my own and not financial advice.

5 subscribers

How to get URL link on X (Twitter) App

One way to think about EigenLayer is that it’s similar to Polkadot and Cosmos Interchain Security - extending the same validator set to secure standalone applications, or Actively Validated Services (AVS)

One way to think about EigenLayer is that it’s similar to Polkadot and Cosmos Interchain Security - extending the same validator set to secure standalone applications, or Actively Validated Services (AVS)

Cosmos TL;DR:

Cosmos TL;DR:

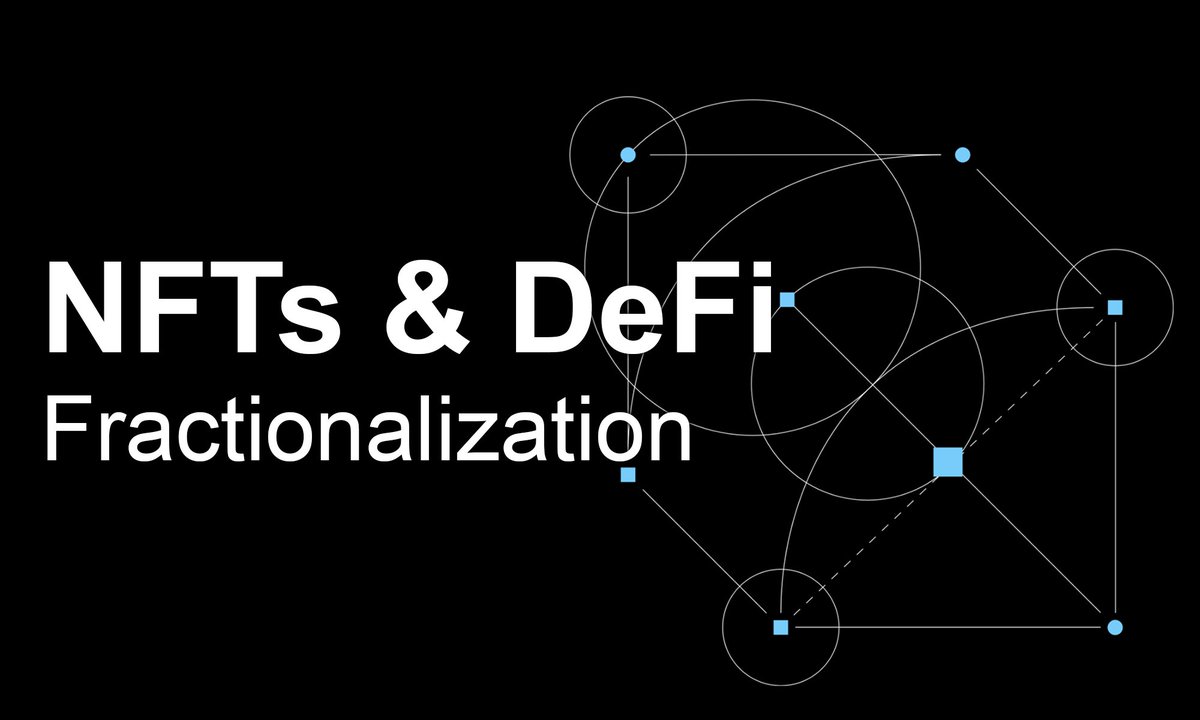

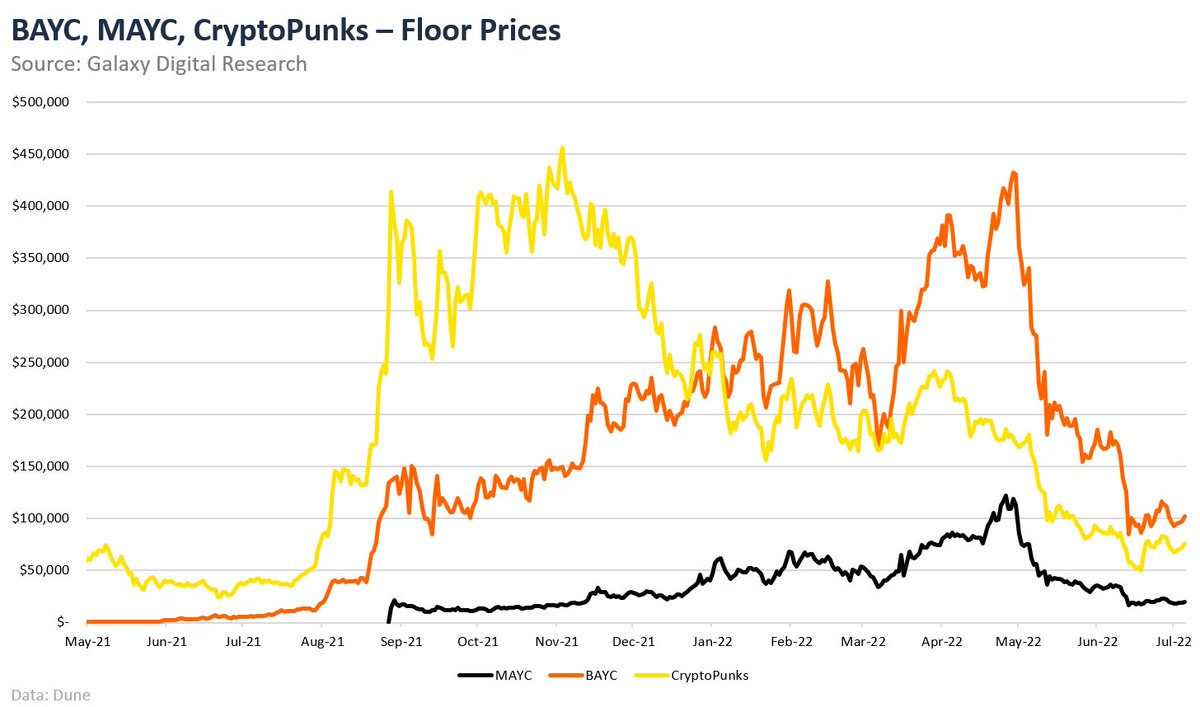

One of the challenges of long-term investment in NFTs is treasury management. Holding NFTs means locking up significant amounts of capital into an illiquid investment which can drop in price in a matter of days.

One of the challenges of long-term investment in NFTs is treasury management. Holding NFTs means locking up significant amounts of capital into an illiquid investment which can drop in price in a matter of days.

Marquee collections like BAYC, MAYC, and CryptoPunks have floor prices beyond what most retail investors can afford. Driven by FOMO, some seek to buy a part of the hot NFT to become part of the ecosystem. This often carries implicit tradeoffs, unique to each project.

Marquee collections like BAYC, MAYC, and CryptoPunks have floor prices beyond what most retail investors can afford. Driven by FOMO, some seek to buy a part of the hot NFT to become part of the ecosystem. This often carries implicit tradeoffs, unique to each project.

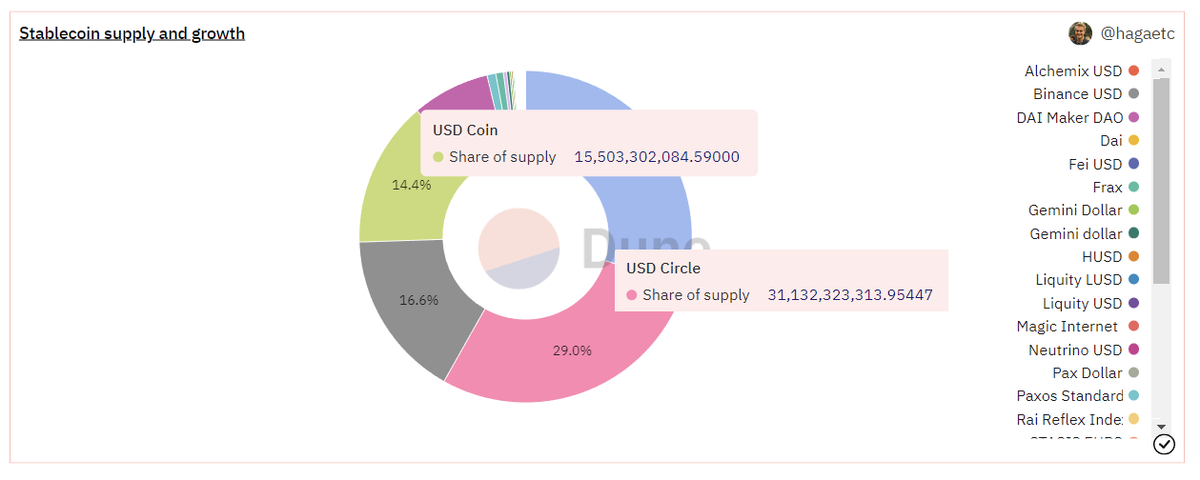

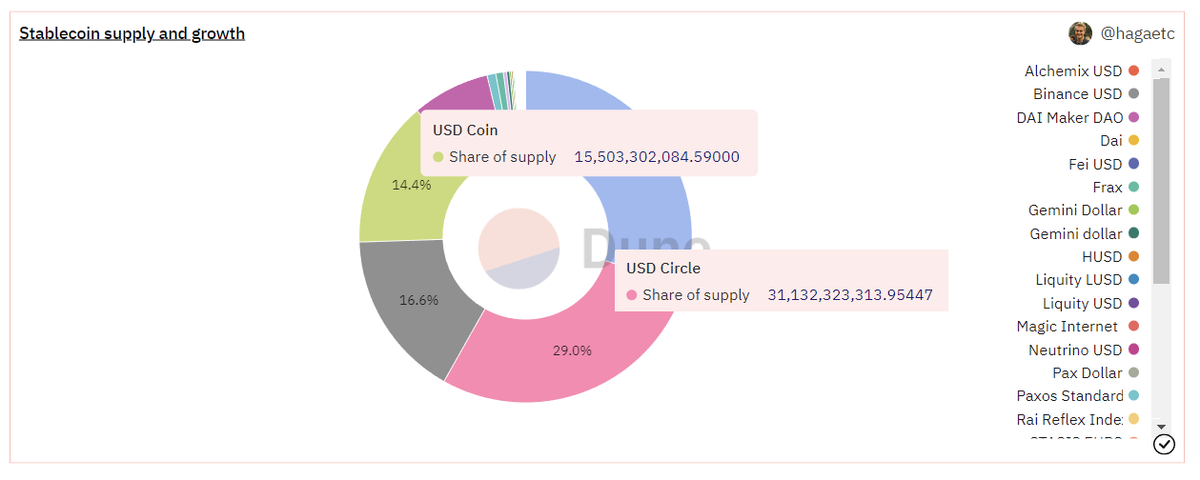

MakerDAO was launched in 2017 with a Single-Collateral DAI system (SAI), which allowed users to mint $DAI using $ETH as collateral. Users could take out overcollateralized stablecoin loans against their $ETH holdings. If the value of $ETH fell, they’d get liquidated

MakerDAO was launched in 2017 with a Single-Collateral DAI system (SAI), which allowed users to mint $DAI using $ETH as collateral. Users could take out overcollateralized stablecoin loans against their $ETH holdings. If the value of $ETH fell, they’d get liquidated

Question outline:

Question outline:

While some people may be familiar with the general concepts of how these lending platforms work, few can explain the gigabrain formulas. It may get complex fairly quickly, so feel free to pause or skip parts of the thread.

While some people may be familiar with the general concepts of how these lending platforms work, few can explain the gigabrain formulas. It may get complex fairly quickly, so feel free to pause or skip parts of the thread.

I noticed that most of the new talent in the crypto space aren’t familiar with the mechanics of these protocols, which are really central to DeFi infrastructure and its history

I noticed that most of the new talent in the crypto space aren’t familiar with the mechanics of these protocols, which are really central to DeFi infrastructure and its history

I’m sure you heard of The OpenDAO back when it was airdropped to users on the 23rd of December. Influencers left and right were pledging to advocate for the project for years to come. Like with every trend, however, the hype soon subsided.

I’m sure you heard of The OpenDAO back when it was airdropped to users on the 23rd of December. Influencers left and right were pledging to advocate for the project for years to come. Like with every trend, however, the hype soon subsided.

The smart contract interfaces described in EIP-3525 outline an extension to ERC-721 and add “units” and “slot” properties. “Units” indicates the quantitative nature of the token. “Slot” groups tokens into categories and allows to split and merge tokens with the same slot.

The smart contract interfaces described in EIP-3525 outline an extension to ERC-721 and add “units” and “slot” properties. “Units” indicates the quantitative nature of the token. “Slot” groups tokens into categories and allows to split and merge tokens with the same slot.

Unlike other L1s, NEAR does not have an established money market yet. Most protocols aren’t even past alpha testing. And while they don’t have tokens (yet), one can participate by contributing to development, building out their community, or just yield farming early.

Unlike other L1s, NEAR does not have an established money market yet. Most protocols aren’t even past alpha testing. And while they don’t have tokens (yet), one can participate by contributing to development, building out their community, or just yield farming early.

Harmony is a high-throughput, low-latency and low-fee consensus platform founded in 2018 by @stse, @RongjianLan, and @SahilDewan. It’s mainnet went live in June 2019, being the first sharding-based blockchain.

Harmony is a high-throughput, low-latency and low-fee consensus platform founded in 2018 by @stse, @RongjianLan, and @SahilDewan. It’s mainnet went live in June 2019, being the first sharding-based blockchain.

Disclaimer: nothing you will read in this thread is financial advice. This research was collected for educational and advisory purposes at @HASHCIB. Definitely reach out to us if you are raising funds for your next venture.

Disclaimer: nothing you will read in this thread is financial advice. This research was collected for educational and advisory purposes at @HASHCIB. Definitely reach out to us if you are raising funds for your next venture.