A recent archeological/twitterological dig uncovered a historical artifact from the Carter years (1977 - 1981) titled "Equitable Treatment by United States of Its Citizens Living Abroad" - a curious thing from a curious time. law.cornell.edu/uscode/text/22…

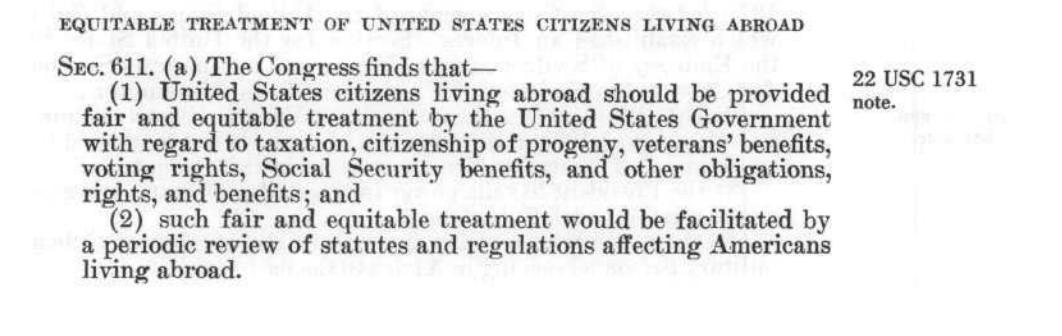

The first law was Public Law 95 - 426 which became law on October 7, 1978. Sec. 611(a) and 611(b) of the "Foreign Relations Authorization Act, Fiscal Year 1979" created a law which acknowledged the existence and value of #Americansabroad. Specifically the mandated ...

The second law was Public Law 96-60 which became law on August 15, 1979. SEC. 407 of that law amended "Subsection (a)(2) of section 611 of the Foreign Relations Authorization Act, Fiscal Year 1979" as follows ... govinfo.gov/content/pkg/ST…

The third law was Public Law 97 - 241 which became law on August 24, 1982. Sec. 505 repealed "obsolete provisions" of other laws. By 1982 the notion of "equitable treatment" of #Americansabroad was now obsolete and was therefore repealed. govinfo.gov/content/pkg/ST…

To be clear the 1978 law was repealed on August 24, 1982. So, this law no longer exists. I found one judicial reference to the law in a 1983 decision which is worth the read. It suggests the law was intended to be aspirational. scholar.google.ca/scholar_case?c…

Here is a 2013 post which includes (1) a detailed summary of the law and (2) references to how the Carter administration considered the treatment of #Americansabroad. You will find references to familiar faces who are still involved in this struggle. renounceuscitizenship.wordpress.com/2013/01/25/pre…

Sec. 611(b) of the 1978 law required that the President do a study and make a report on laws impacting #Americansabroad. The report was apparently done prior to the 1979 amendments. The report (linked here) is a "Treasure Trove" of analysis. babel.hathitrust.org/cgi/pt?id=pur1…

The report includes an extensive discussion of taxation. I would like to point out that in 1978 #Americansabroad had no problems with: #PFIC, #CFC, #ForeignTrusts, #FBAR, #FATCA, etc. The report was not based on the facts (or #FATCAoids) as they are today.

A detailed report - will take time to digest. But, there is a suggestion that @citizenshiptax was retained largely because of the fantasy/myth that America provides protection to #Americansabroad. NO! 1. taxation without vaccination and 2. per @Intlowl

https://twitter.com/Intlowl/status/1546567625014235138.

Once upon a time, well in the last century, America had a President who believed that #Americansabroad had value. That sentiment became "obsolete" in the 1982 law. But, the 1978 law should be resurrected as an interpretive aid for the interpretation of all laws and regulations.

Somehow at least the title to this song comes to mind ...

@threadreaderapp unroll

I see that I didn't provide a direct link to the original 1978 law. Here it is congress.gov/95/statute/STA…

After more research I have discovered that the Sec. 611 of the 1978 "Foreign Relations Authorization Act" originated from Senator McGovern. According to the report the Carter administration was hostile to #Americansabroad See for example page 102 here babel.hathitrust.org/cgi/pt?id=pur1…

I hadn't realized that ACA ("American Citizens Abroad") was actually formed (in Geneva Switzerland) for the purpose of educating the Carter administration (and Congress) on the problems experienced by #Americansabroad (tax, citizenship, voting. social security, medicare, etc.)

In 1976 the USA (evidence of its love for #Americansabroad) had BOTH: 1. Repealed the FEIE and 2. Required that housing provided for #Americansabroad be taxed at the rental market value and not at the cost to the employer. Result: Huge increase in US taxes and crisis for #expats.

The following post describes a law review article which discusses the repeal of the FEIE in 1976 and the resurrection of the FEIE in 1978. At least the USA realized it had made a huge mistake. citizenshipsolutions.ca/2020/05/12/the…

The Carter years were years of crisis for #Americansabroad. The original ACA did a very good job of organizing and (reading through the lines) appear to have been a major factor in causing Senator McGovern to sponsor 1978 law that resulted in the report. babel.hathitrust.org/cgi/pt?id=pur1…

In fact ACA organized an index of 50 categories of issues that negatively impacted the lives of #Americansabroad. You will recognize many of the same issues today.

Sadly the ACA report/approach equates #Americansabroad to #expats (living temporarily abroad). There is not the slightest acknowledgment of #emigrants and #AccidentalAmericans. This is significant because ...

no reference to the #FATCA that via the @citizenshiptax regime the USA is actually imposing worldwide tax on individual who live in and have @taxresidency in other countries and this is a direct attack on the tax base and sovereignty of other countries. Problem described as ...

the US @citizenshiptax regime makes US citizens more expensive to employ (hence the rationale for the FEIE). The issue of "fairness" is not introduced as the primary problem (same as today). Interestingly, ACA seemed more concerned with making #CBT work better and ending #CBT.

Responding to answers from Carter admin, ACA fought back. Pg 78 - Issue 27 - ACA provides a good analysis of the harm inflicted (at that time) by the US @citizenshiptax regime. You should read it! At the end they suggest the possibility of severing citizenship from @taxresidency.

This valuable historical record reinforces that US @citizenshiptax cannot be fixed and that all efforts must be focussed on severing citizenship from @taxresidency. "Carveouts" are as unworkable today as they were in 1978 and will always be.

Remember also that this is from 1978. At that time there were no problems with: #FATCA, #FBAR (wasn't enforced), #PFIC, #CFC, #ForeignTrust, #ExitTax, #GILTI, @USTransitionTax and other forms of #fakeincome. Bottom line is ...

@citizenshiptax has turned the USA into a "fiscal prison" and taxation is the warden. The

@Ewarren proposed wealth tax specifically relies on

@citizenshiptaxto ensure no escape. Again, the report is here ... babel.hathitrust.org/cgi/pt?id=pur1…

@Ewarren proposed wealth tax specifically relies on

@citizenshiptaxto ensure no escape. Again, the report is here ... babel.hathitrust.org/cgi/pt?id=pur1…

Some additional thoughts based on a 1980 NY Times article ...

https://twitter.com/ExpatriationLaw/status/1547158810690740224

• • •

Missing some Tweet in this thread? You can try to

force a refresh