Expatriation - #FATCA Letter - CRS - CFC - PFIC - @CitizenshipTax

- US Citizenship Renunciation - @JustRenounce

- Green Card Abandonment - @GreenCardTax

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/acavoice/status/1950692916151582941Hurd bill - H.R. 4501 - does not include an exemption from Subtitle F of the IRC which is where all the penalty laden foreign asset reporting requirements live. But exempting the Pope from Subtitle F would not be a complete solution bc … 2/

https://x.com/jgoshksk/status/1859265146519949547

https://x.com/ExpatriationLaw/status/1831988096281329727

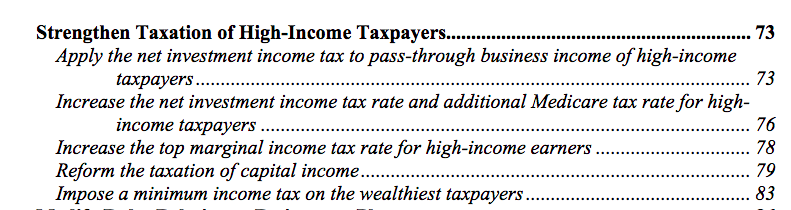

The 2025 Green Book repeats proposals in 2024, 2023 and 2022. For "some" of the impacts on #Americansabroad see this 2022 post from @VLJeker us-tax.org/2022/04/21/par…

The 2025 Green Book repeats proposals in 2024, 2023 and 2022. For "some" of the impacts on #Americansabroad see this 2022 post from @VLJeker us-tax.org/2022/04/21/par…

https://twitter.com/ACAVoice/status/1784794739847405738USA is arguing that US/France tax treaty should be interpreted to REQUIRE @doubletaxation if France dares to tax investment income sourced in France and received by US citizens (property) resident in France. Treaty #savingclause used to create #doubletax and not avoid it.

@TaxResidency Both US citizens and Green Card holders are subject to all provisions (worldwide tax, reporting and penalties) of US tax code. Green card holders (but not citizens) may use treaty (dual @taxresidency tie break) to become "treaty nonresidents" and taxable only on US source income.

@TaxResidency Both US citizens and Green Card holders are subject to all provisions (worldwide tax, reporting and penalties) of US tax code. Green card holders (but not citizens) may use treaty (dual @taxresidency tie break) to become "treaty nonresidents" and taxable only on US source income.

2016 US Model Tax Treaty has three "saving clause" provisions: 1. "Saves" US right to tax its "residents" (as determined under treaty tie break rules). 2. Tax US citizens who are residents of treaty partner country (treaty tie break rules don't apply) 3. Tax former citizens!

2016 US Model Tax Treaty has three "saving clause" provisions: 1. "Saves" US right to tax its "residents" (as determined under treaty tie break rules). 2. Tax US citizens who are residents of treaty partner country (treaty tie break rules don't apply) 3. Tax former citizens!