Thought it would be fun to share a story from last year where I watched a friend of mine pump a sh*tcoin on Binance by buying billboards and a BitBoy Crypto video. Nothing we don't already know, but I found it fascinating to watch in real time. (1/9)

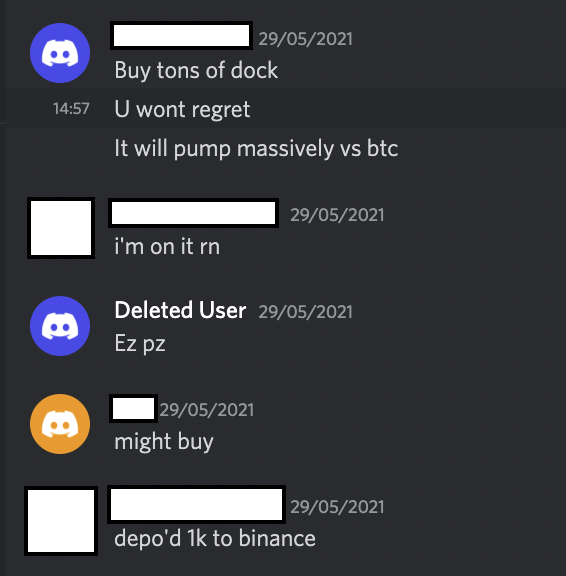

In our group chat in 2021, my whale friend told us to buy DOCK. He's a fairly small-time whale (I think he only had a few hundred coins at the time), so his coin of choice was a lower volume Binance coin (easier to pump & doesn't need to accommodate crazy sell volume). (2/9)

Over the next few days, he began explaining his strategy. He was in talks with BitBoy Crypto to buy a shill video (he showed me a rate sheet outlining several paid services BitBoy provided) and also planned to buy billboards & ads across the world to advertise DOCK. (3/9)

He posted pictures of things like the panel where he could purchase billboards, screenshots of his conversations with BitBoy's advertising manager, and various other avenues he was using to shill. He wasn't even a part of the DOCK team - he was just using it for a pump. (4/9)

Sure enough, over the next few days, ads started popping up in London, NYC and Amsterdam. There were loads of lovely pictures he sent me but I can't find all of them. Also, lo and behold, the BitBoy video goes up a week later (7 June), which my friend said he paid $30k for. (5/9)

There was no indication that it was sponsored in the title, description, or thumbnail, nor was there *any* visible disclosure in the visuals. There was no upfront disclosure in the beginning of the video that he was being paid to shill DOCK. (6/9)

However, he does very briefly thank DOCK for sponsoring the video (at 10:05 out of 10:30, when most people have already clicked away from the video) - very sneakily protecting liability. IMO, this info should at least be in the description if not the start of the video. (7/9)

In the days that followed my friend's message in the group chat, the DOCK charts started looking like this... Pretty insane. I witnessed before my very eyes yet another example of how manipulated - and easy to manipulate - crypto can be. Today, DOCK is down 80% since. (8/9)

Other than the obvious message - don't trust these grifter influencers; they make money by selling you hopium - something else comes to mind. If some random guy did all of this with < $200k... To what extent could you manipulate a larger coin if you had billions? (9/9)

• • •

Missing some Tweet in this thread? You can try to

force a refresh