FatMan from Terra Research Forum

Cryptocurrency & finance researcher

Whistleblower of the Terra fraud.

Assisted government agencies in taking down Do Kwon.

8 subscribers

How to get URL link on X (Twitter) App

This bombshell data, collated by the anonymous researcher @Cycle_22 (who discovered the Hodlnaut insolvency), reveals that TFL suddenly began furiously dumping hundreds of millions of UST only days before the depeg.

This bombshell data, collated by the anonymous researcher @Cycle_22 (who discovered the Hodlnaut insolvency), reveals that TFL suddenly began furiously dumping hundreds of millions of UST only days before the depeg.

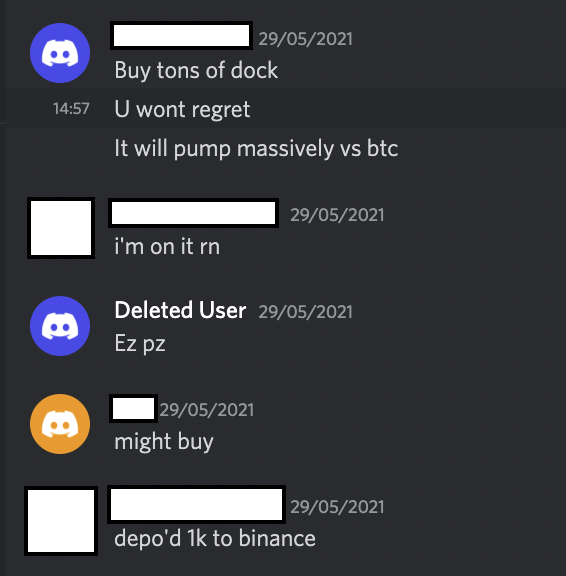

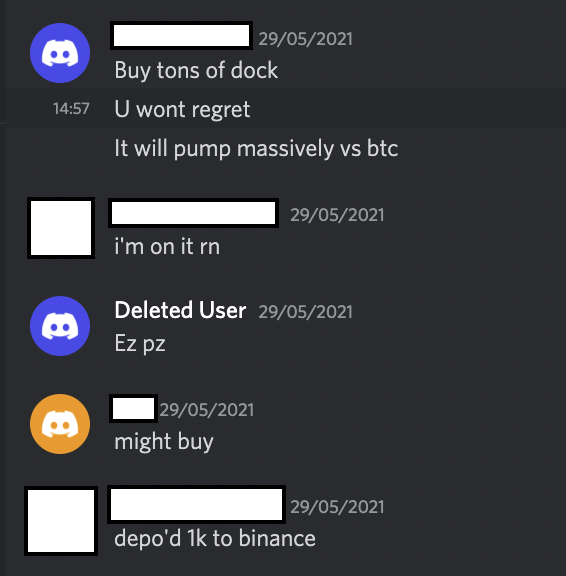

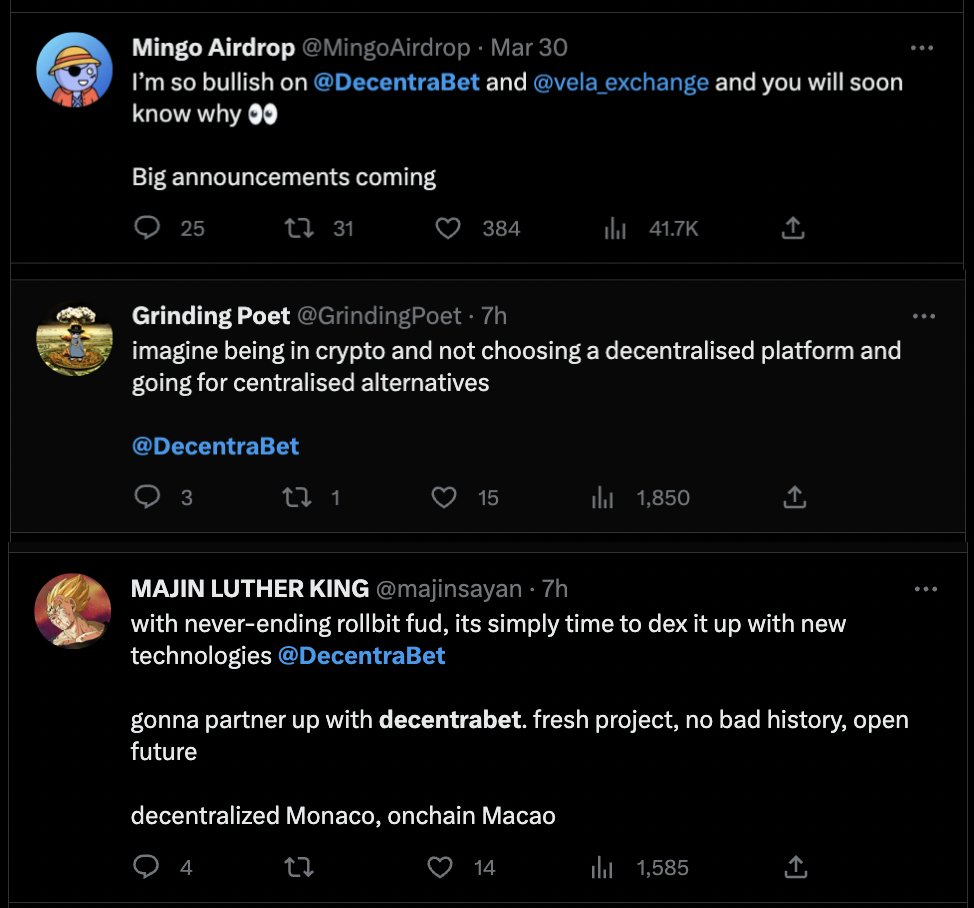

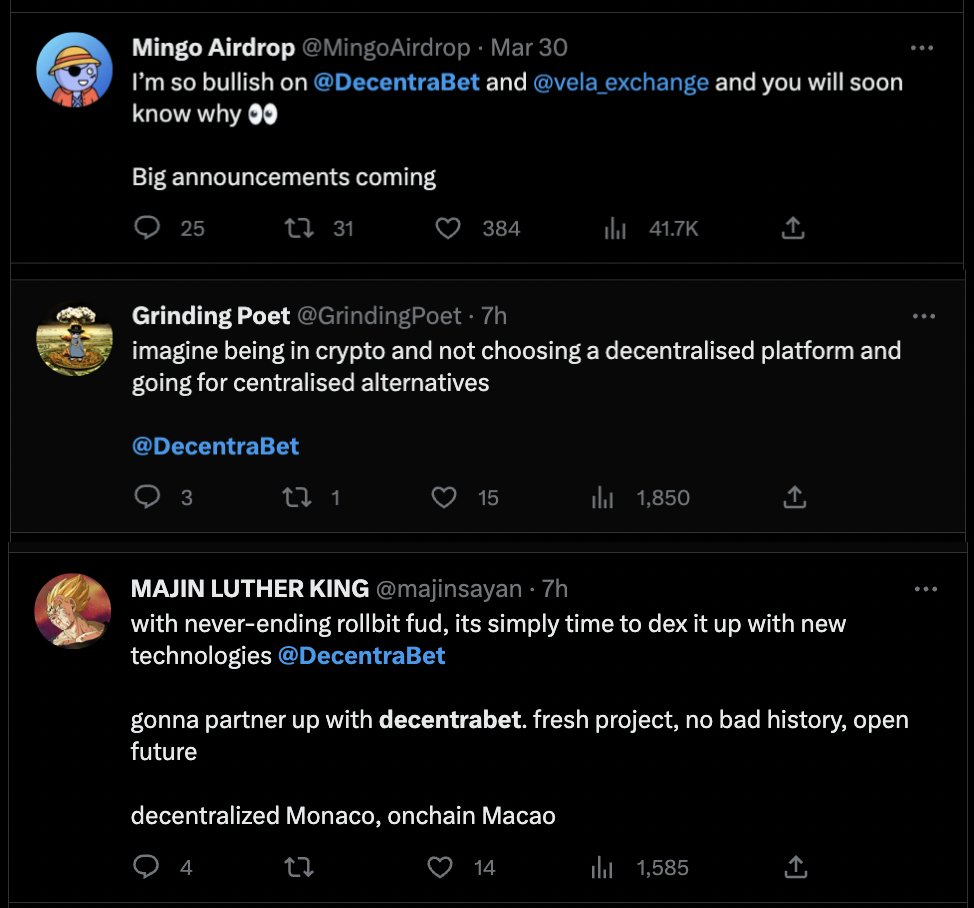

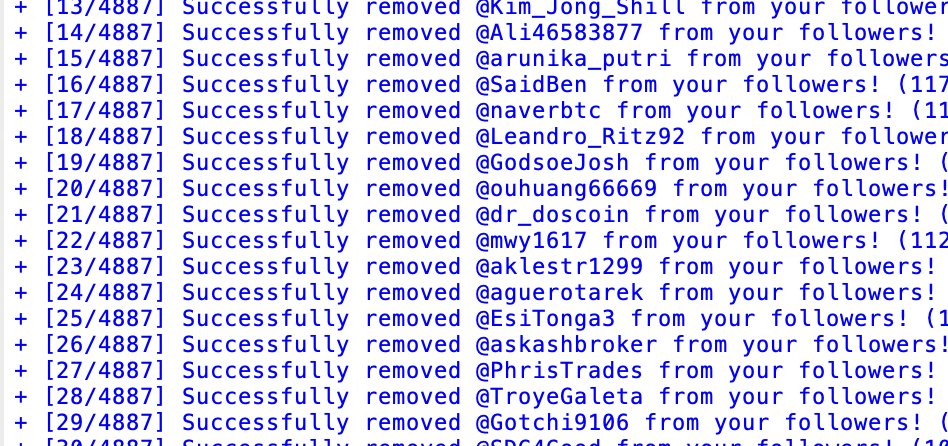

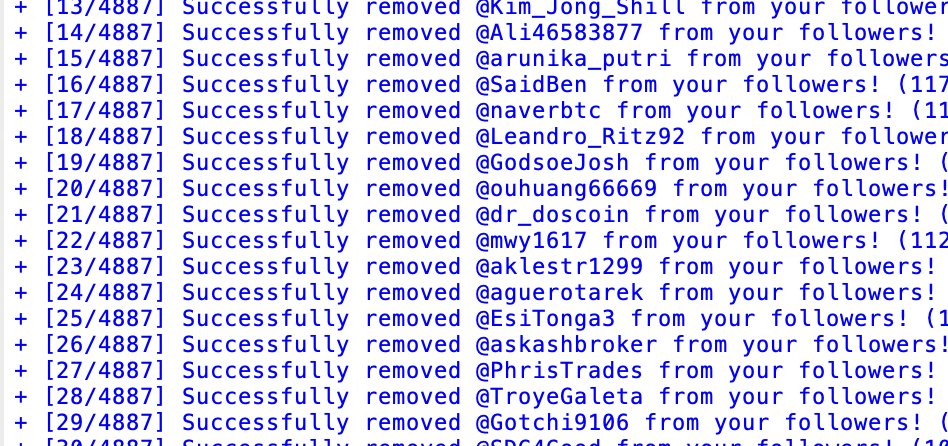

Deleted 5K suspected LUNC shill followers and my Twitter experience has already improved considerably. If the issue persists, I will repeat the exercise with widened parameters. Back to public now, sorry for the inconvenience. Let's keep this a spam-free zone 🤝

Deleted 5K suspected LUNC shill followers and my Twitter experience has already improved considerably. If the issue persists, I will repeat the exercise with widened parameters. Back to public now, sorry for the inconvenience. Let's keep this a spam-free zone 🤝

https://twitter.com/Terra_Alliance/status/1569116430737543168From a Terra analyst: "Only 0.5 trillion $LUNC currently staked, so you just need 0.33 trillion to completely hijack the chain.

https://twitter.com/stablechen/status/1570718133673160704