Nadhim Zahawi founded YouGov, but took no shares in it. A Gibraltar company, Balshore Investments, did instead. Zahawi says this wasn't tax avoidance, but was his father injecting capital into the business.

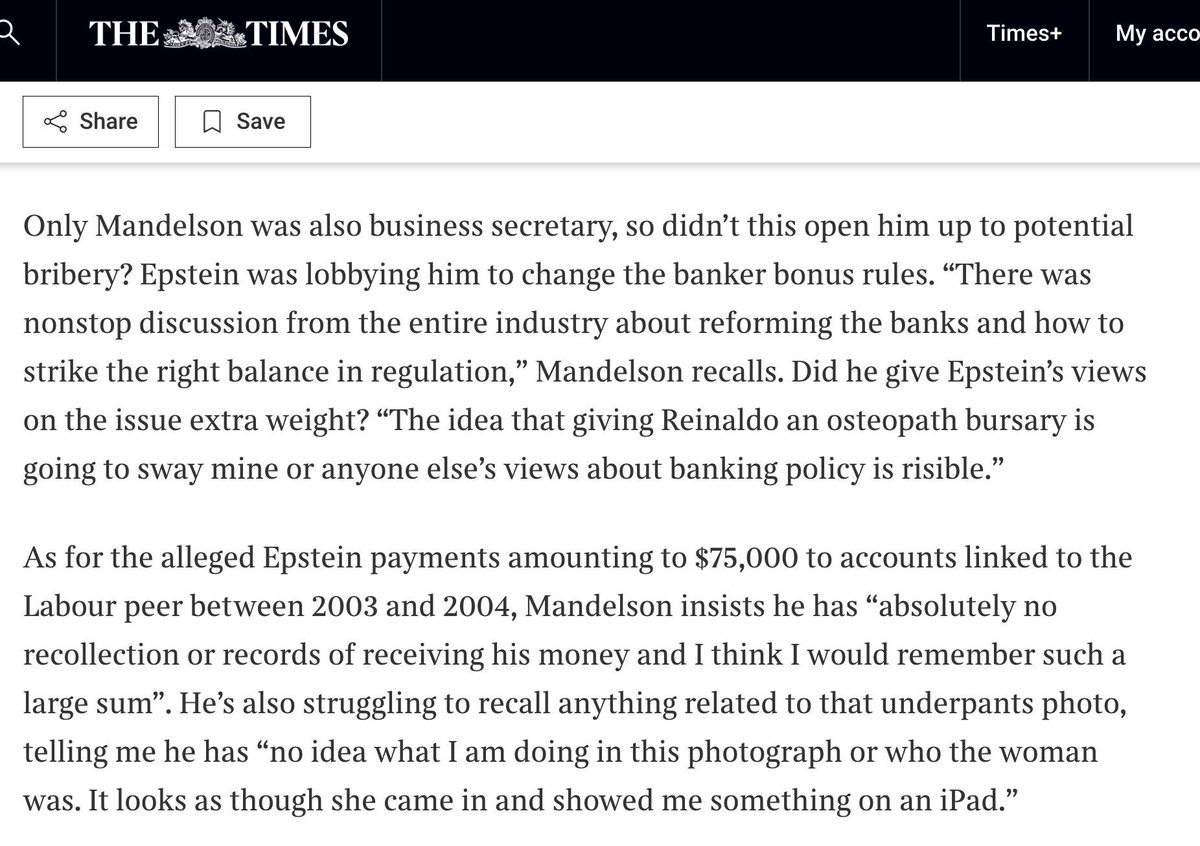

Here's my hunt for evidence. A very lengthy thread:

Here's my hunt for evidence. A very lengthy thread:

I'll start with my conclusion. Only three possibilities:

1. I am missing something.

2. Balshore did provide capital, but this was omitted from all of YouGov's accounts and filings, and not even picked up during the IPO.

3. Zahawi is lying, and this was tax avoidance.

1. I am missing something.

2. Balshore did provide capital, but this was omitted from all of YouGov's accounts and filings, and not even picked up during the IPO.

3. Zahawi is lying, and this was tax avoidance.

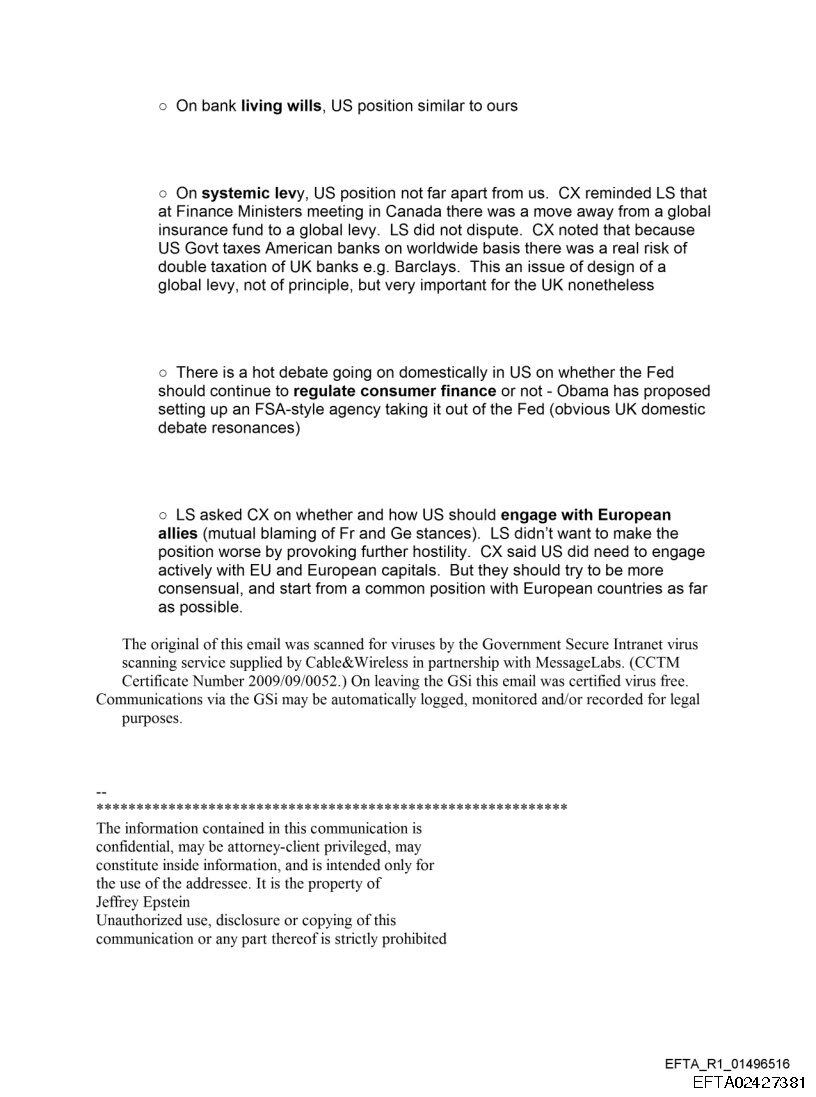

Here's the first YouGov share issuance from 2000

Neil Copp provided £287,500 of capital & got 15% of the shares

Balshore provided no capital and got 42.5%

The same deal as Stephan Shakespeare - one of the founders

Zahawi, the other founder, got nothing.

Why?

Neil Copp provided £287,500 of capital & got 15% of the shares

Balshore provided no capital and got 42.5%

The same deal as Stephan Shakespeare - one of the founders

Zahawi, the other founder, got nothing.

Why?

But perhaps the form is wrong and Balshore did provide capital. Let's look at the accounts.

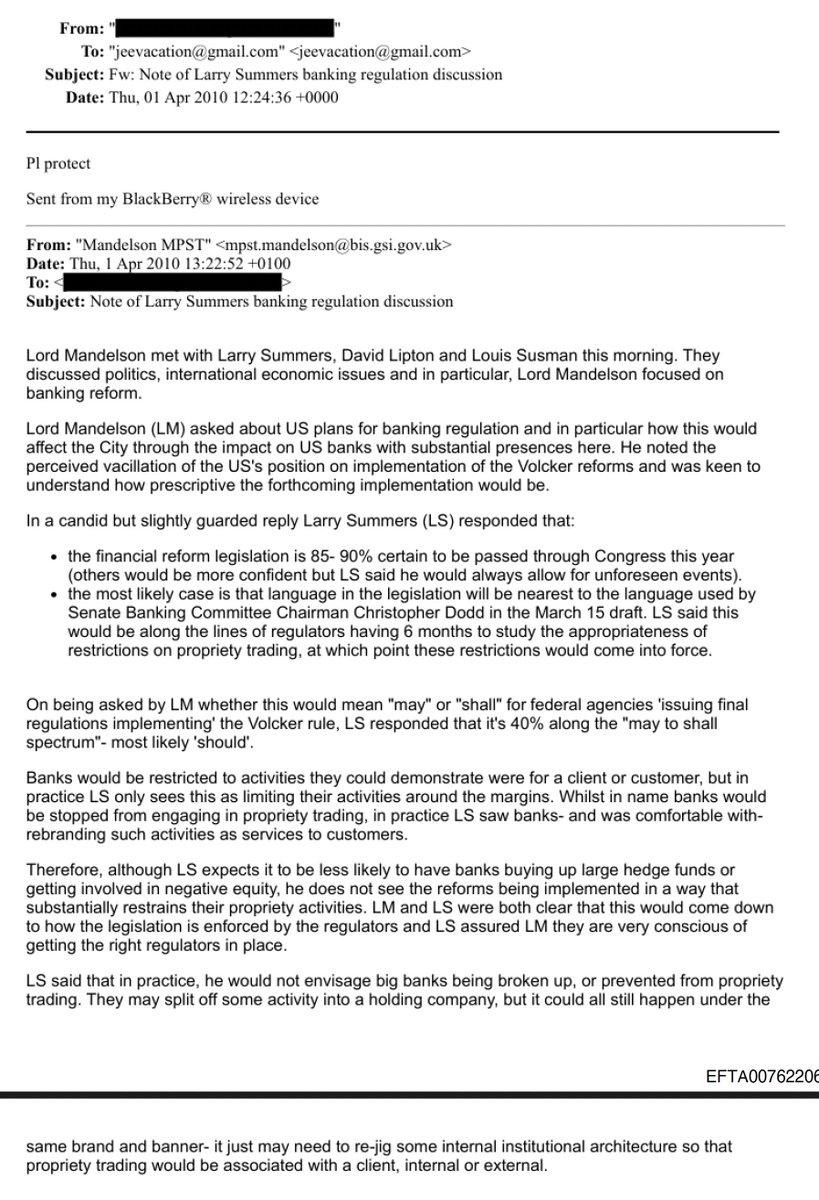

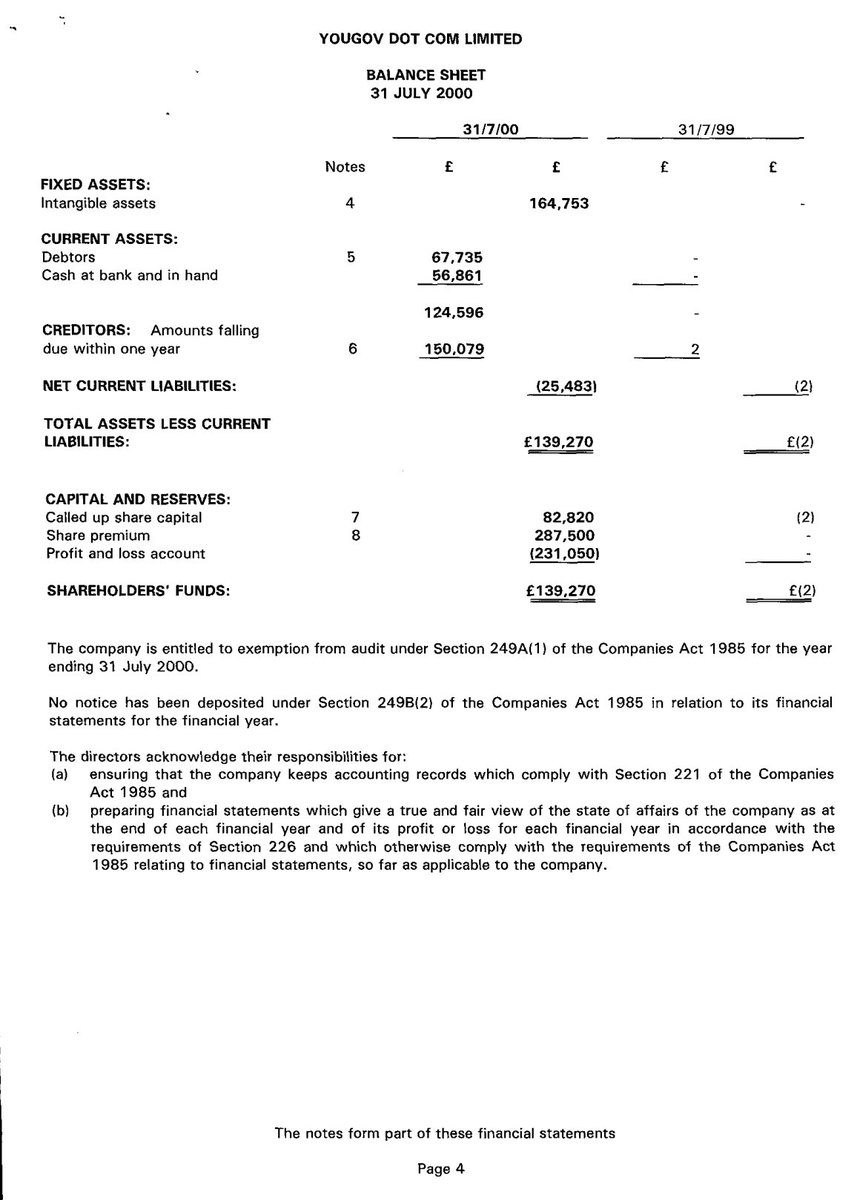

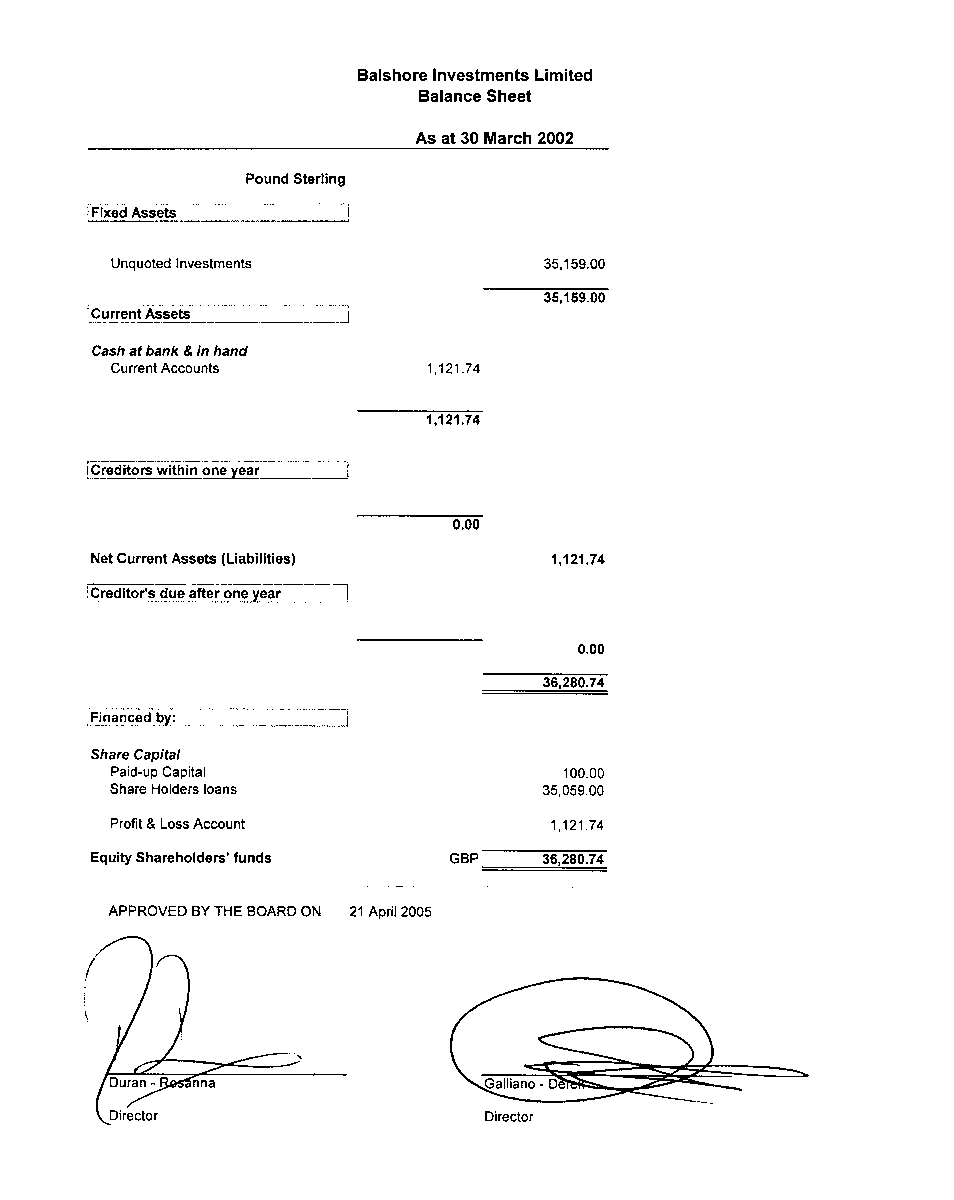

Here's the balance sheet from two months after that share issuance.

No sign of any equity capital other than Copp's.

Here's the balance sheet from two months after that share issuance.

No sign of any equity capital other than Copp's.

Startups often make mistakes, and Companies House filings and accounts can be wrong. This is generally picked up as a company matures... particularly if it's planning an IPO (which is the path YouGov was on).

YouGov did just that...

YouGov did just that...

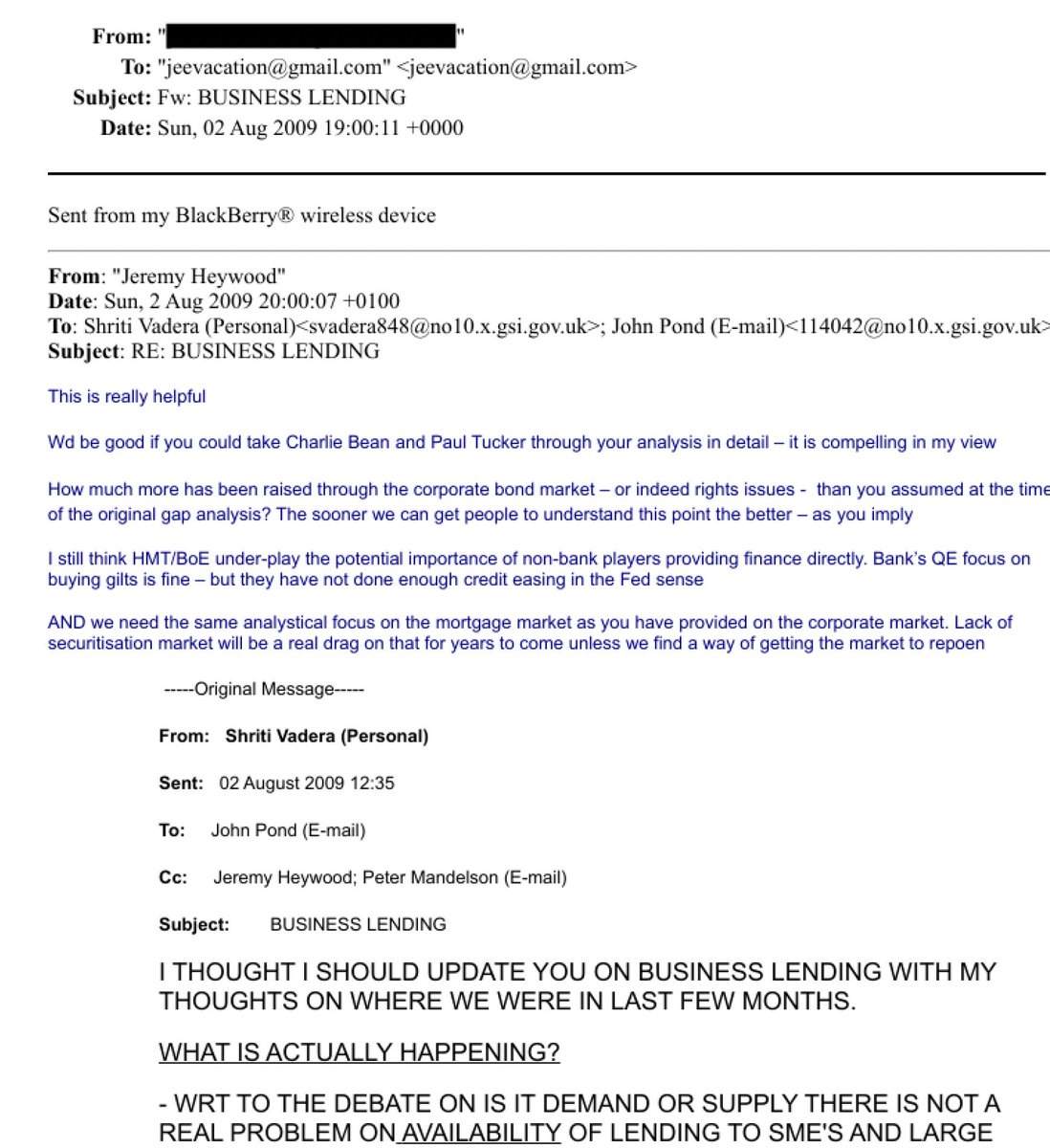

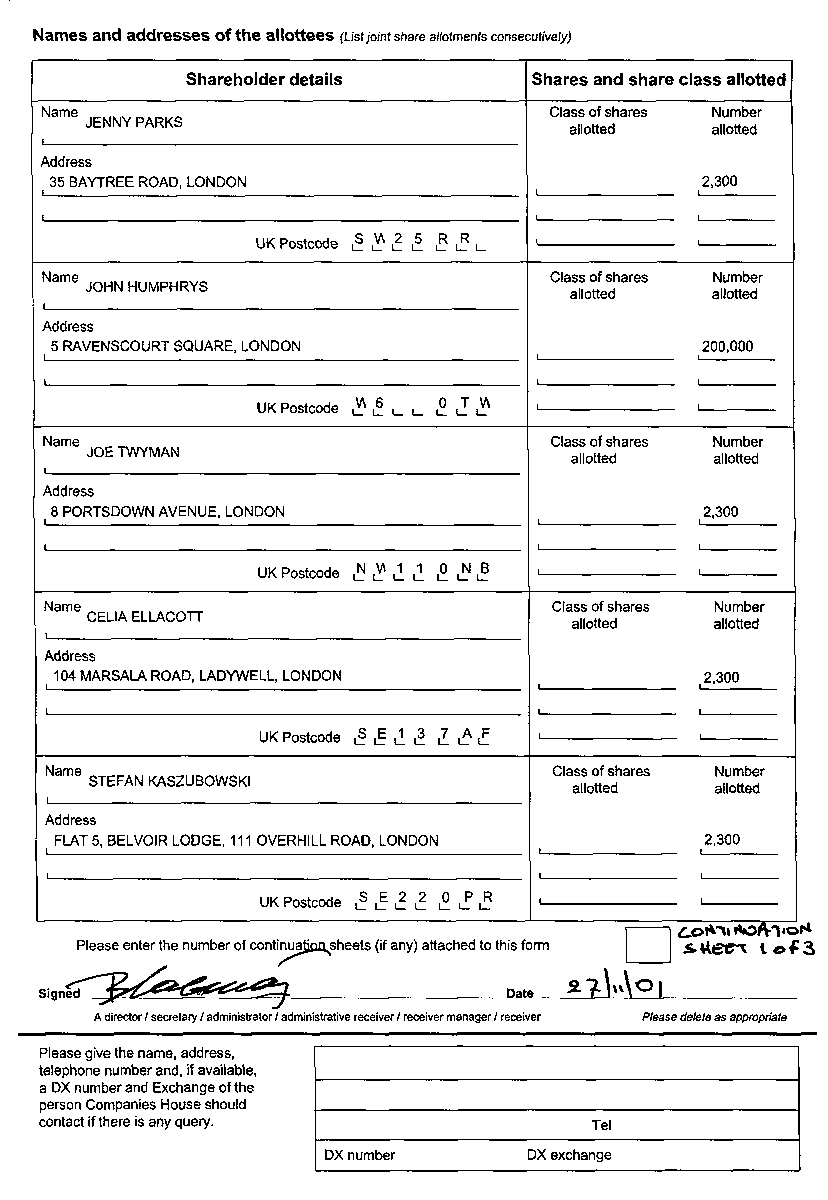

... Two years later, YouGov filed a late form showing Shakespeare & Balshore acquied more shares back in 2000. But for "nominal" value - only £7k each

This wasn't a capital injection - just (typical) cheap shares for founders.

Balshore wasn't a founder. Why did it get this?

This wasn't a capital injection - just (typical) cheap shares for founders.

Balshore wasn't a founder. Why did it get this?

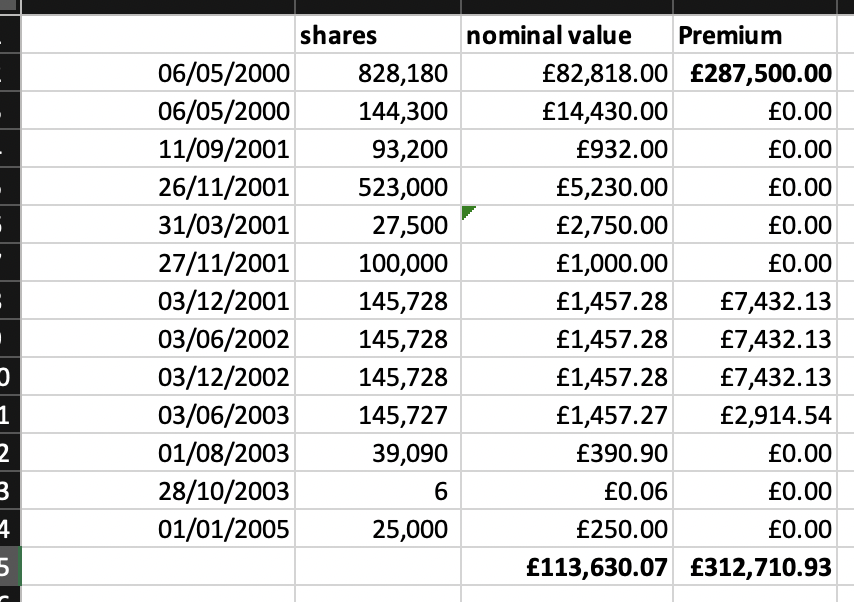

More share issuances in the next few years.

The wonderful Peter Kellner got involved, so got shares for free. As did Roland Berger & Partners (consulting firm):

The wonderful Peter Kellner got involved, so got shares for free. As did Roland Berger & Partners (consulting firm):

Small freebie shares dished out to employees and consultants (including @JamesDuddridge). Again, perfectly normal for a startup:

(the last page is missed out, due to Twitter's four image limitation, but it's not interesting)

(the last page is missed out, due to Twitter's four image limitation, but it's not interesting)

Chime Communications then acquired 27,500 shares for the (bargain) nominal price of 10p each. There's a good reason for that - we'll come to it later.

Then Peter Kellner gets to buy more shares at the cheap but eccentric price of 6.1p each. Then the same a few months later.

... and more Kellner - catching up somewhat with the original founders. He's paying a bit, but it's not what you'd call capital.

There are now a lot of shareholders. At this point, founders often want to preserve their power to direct the organisation and take "special" shares.

That happens here: Shakespeare, Zahawi, Kellner each get two special shares (with Shakespeare's giving one of his to his wife):

That happens here: Shakespeare, Zahawi, Kellner each get two special shares (with Shakespeare's giving one of his to his wife):

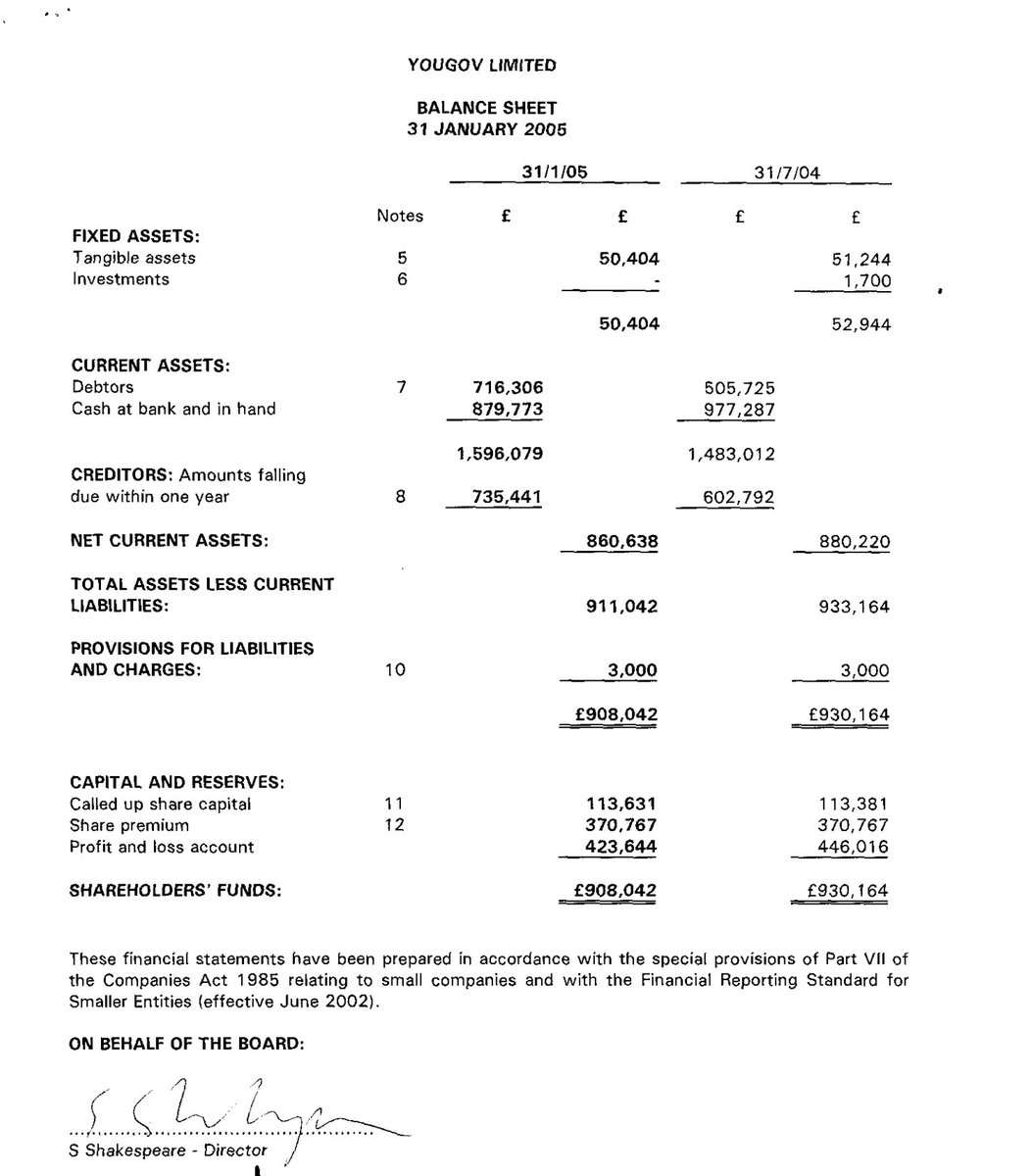

And that takes us up to the April 2005 IPO.

At this point I count £113,630 of share capital, £312,711 of share premium.

None of that was from Balshore.

At this point I count £113,630 of share capital, £312,711 of share premium.

None of that was from Balshore.

That is broadly consistent with the Jan 2005 balance sheet - except it shows £370,767 of share premium.

I can't see where the additional £58k comes from, but it's hardly a significant amount of capital, and it wasn't Balshore (as they haven't received any shares since 2000).

I can't see where the additional £58k comes from, but it's hardly a significant amount of capital, and it wasn't Balshore (as they haven't received any shares since 2000).

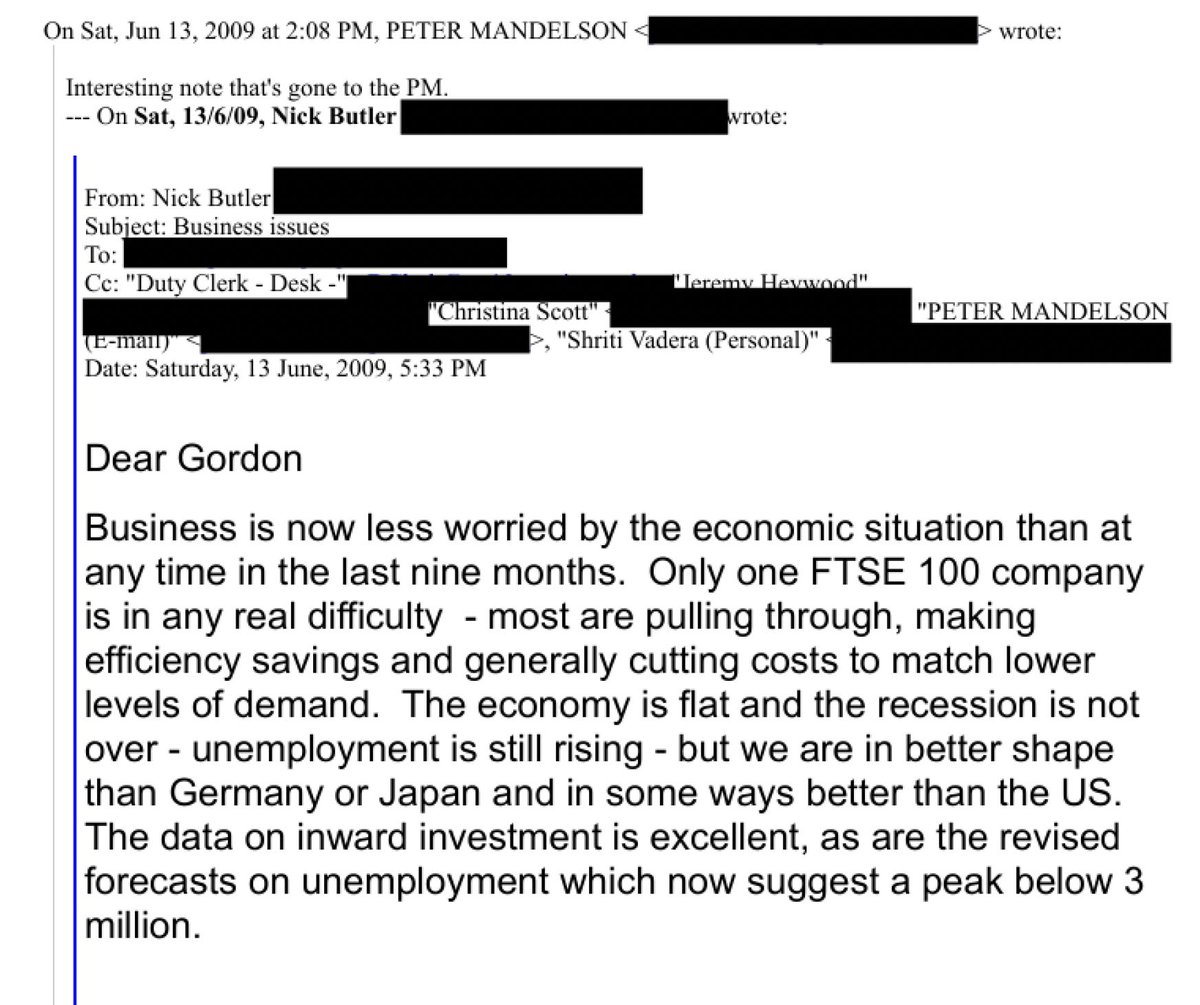

What about the creditors? Could Balshore have provided loan finance and that's how it got the shares for free?

Back in the year Balshore got its shares, there were £91,459 of "other creditors". Could that be it?

Back in the year Balshore got its shares, there were £91,459 of "other creditors". Could that be it?

The £91k is still there in the next few years, but there's no corresponding entry in Balshore's accounts.

It's possible Balshore's accounts are wrong, and the £91k was a loan from Balshore.

But it's credible (and wouldn't have been legal) for Neil Copp to pay £287,500 cash for a 15% stake, but Balshore to *lend* £91k and get a 45% stake.

But it's credible (and wouldn't have been legal) for Neil Copp to pay £287,500 cash for a 15% stake, but Balshore to *lend* £91k and get a 45% stake.

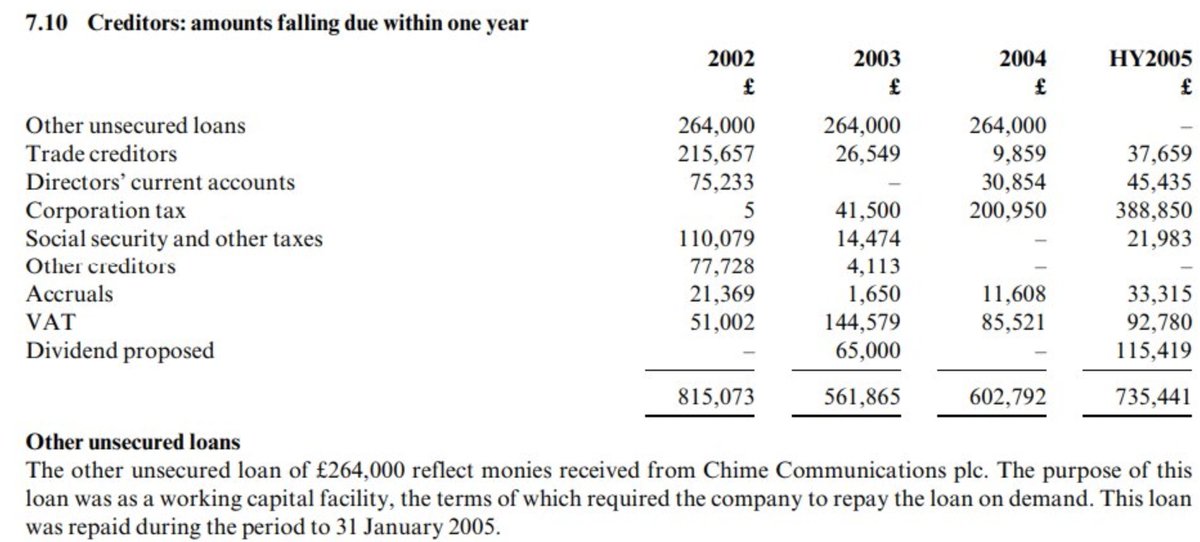

There was some debt funding, from Chime Communications. Which explains why (way upthread) they got cheap shares.

So to conclude this very lengthy thread: Zahawi is saying that Balshore got a 45% stake in YouGov because it provided capital to YouGov.

There is zero evidence of any capital from Balshore

(except, just about possibly, a £91k loan - but that wouldn't justify a 45% stake).

There is zero evidence of any capital from Balshore

(except, just about possibly, a £91k loan - but that wouldn't justify a 45% stake).

I see only three possibilities:

1. I am missing something. What?

2. Balshore did provide capital, but this was omitted from all of YouGov's accounts and filings, and not even picked up during the IPO.

3. Zahawi is lying, and this was tax avoidance.

1. I am missing something. What?

2. Balshore did provide capital, but this was omitted from all of YouGov's accounts and filings, and not even picked up during the IPO.

3. Zahawi is lying, and this was tax avoidance.

If the answer is 1 or 2 then Zahawi should prove it by pointing us towards some actual evidence, and not just making assertions in background briefings to journalists.

For anyone wanting to go hunting:

Here are all the pre-IPO 88(2) forms in one place: taxpolicy.org.uk/assets/pre-IPO…

Here are the 2000 accounts: taxpolicy.org.uk/assets/yougov_…

Here are all the pre-IPO 88(2) forms in one place: taxpolicy.org.uk/assets/pre-IPO…

Here are the 2000 accounts: taxpolicy.org.uk/assets/yougov_…

Here's the Jan 2005 balance sheet: taxpolicy.org.uk/assets/yougov_…

And all the Companies House filings are here: …te.company-information.service.gov.uk/company/036073…

And all the Companies House filings are here: …te.company-information.service.gov.uk/company/036073…

My full analysis is here: taxpolicy.org.uk/zahawi

I've compiled this thread into a blog post for those who find that more convenient: taxpolicy.org.uk/2022/07/13/zah…

Obviously I would be delighted if @nadhimzahawi or his team would get in touch and explain their position. My DMs are open and my email address is at taxpolicy.org.uk.

What happened next:

https://twitter.com/DanNeidle/status/1548213116709658626

• • •

Missing some Tweet in this thread? You can try to

force a refresh