Founder, Tax Policy Associates Ltd. Tax realist.

More boring on LinkedIn https://t.co/Cm5n2PhqrD

28 subscribers

How to get URL link on X (Twitter) App

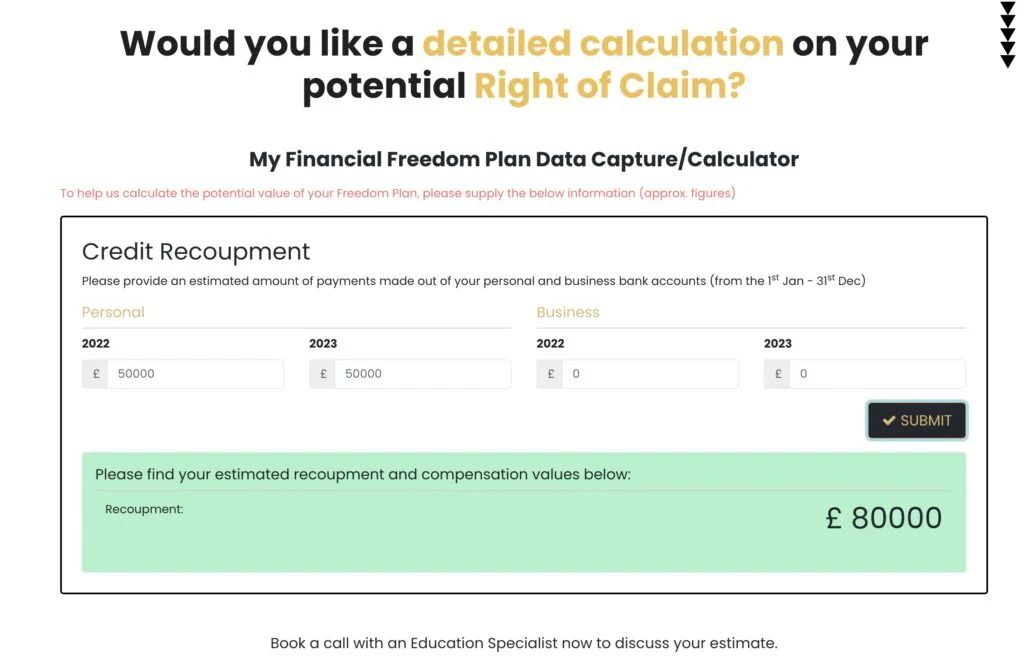

The scammer is Iain Clifford Stamp, who has monetised the "sovereign citizen" conspiracy theory. He makes millions of £ every year promising people he can create free money for them:

The scammer is Iain Clifford Stamp, who has monetised the "sovereign citizen" conspiracy theory. He makes millions of £ every year promising people he can create free money for them:

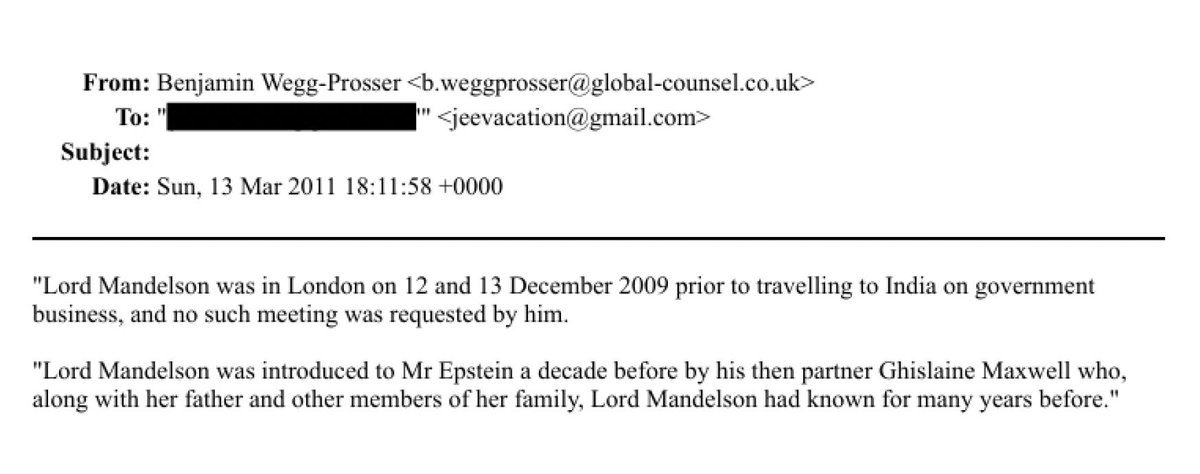

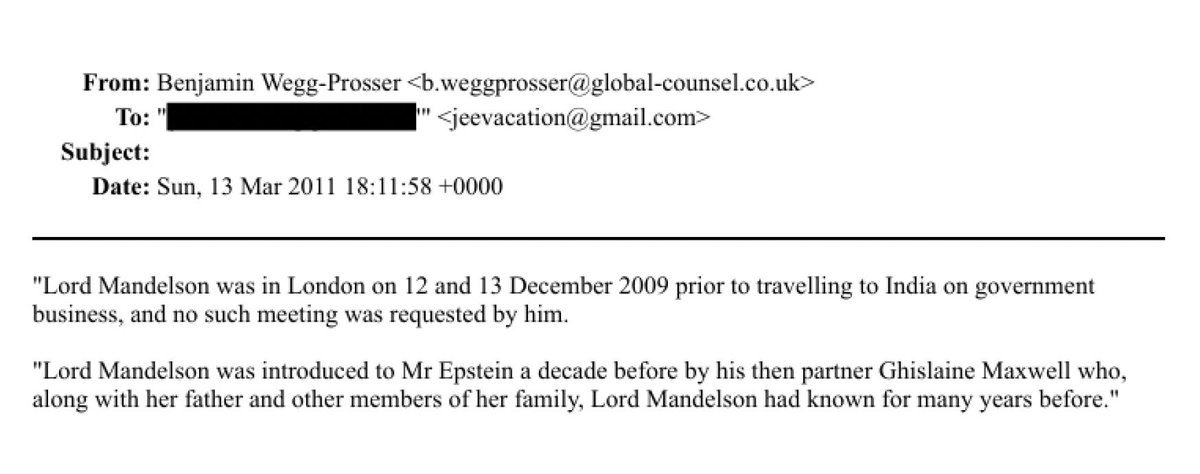

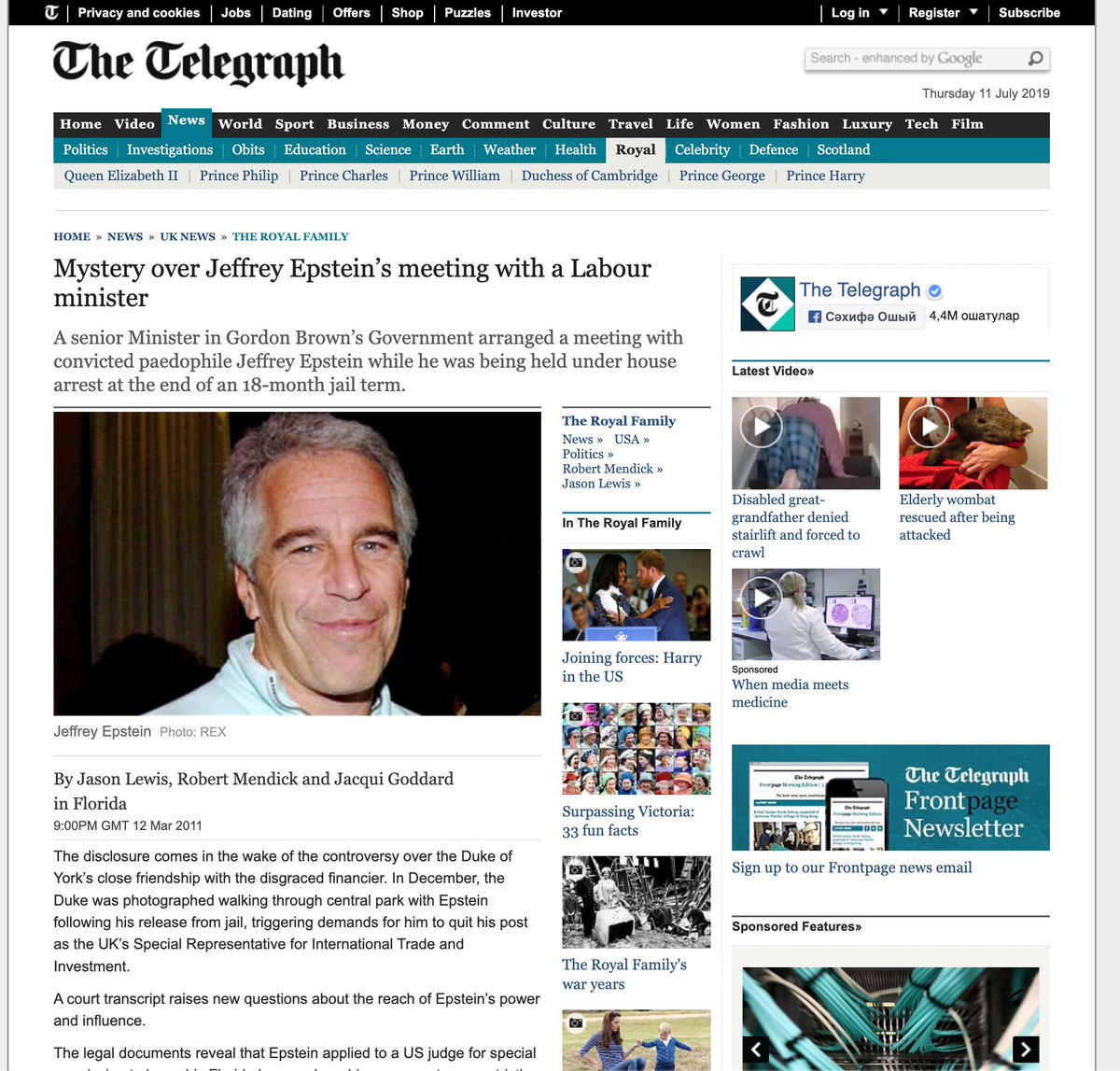

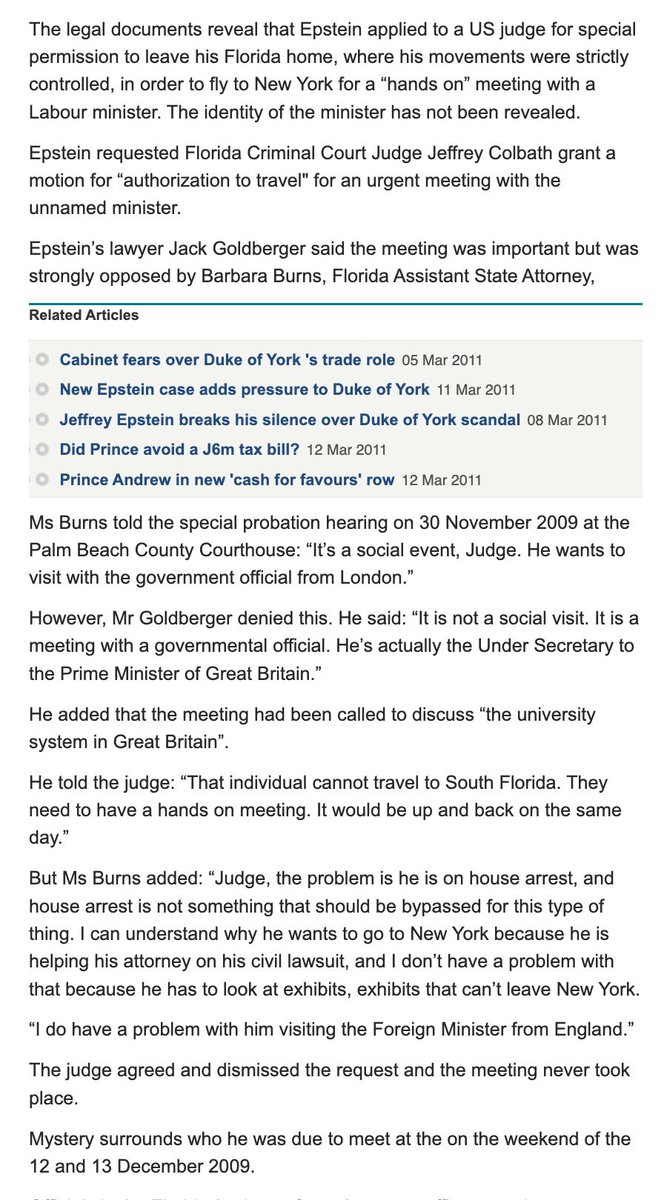

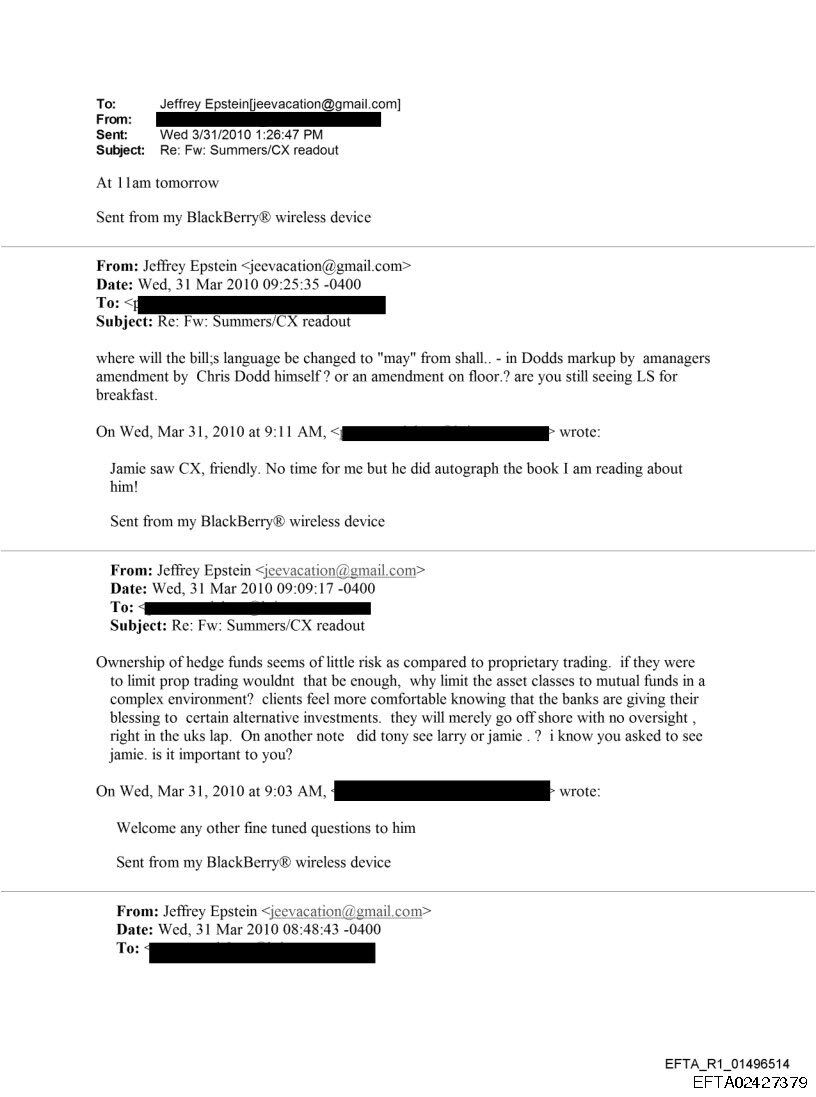

They're responding to this Telegraph story, the previous day, revealing that Epstein planned to meet a British Government Minister in New York on the weekend of 12/13 December 2009.

They're responding to this Telegraph story, the previous day, revealing that Epstein planned to meet a British Government Minister in New York on the weekend of 12/13 December 2009.

The timeline is damning.

The timeline is damning.

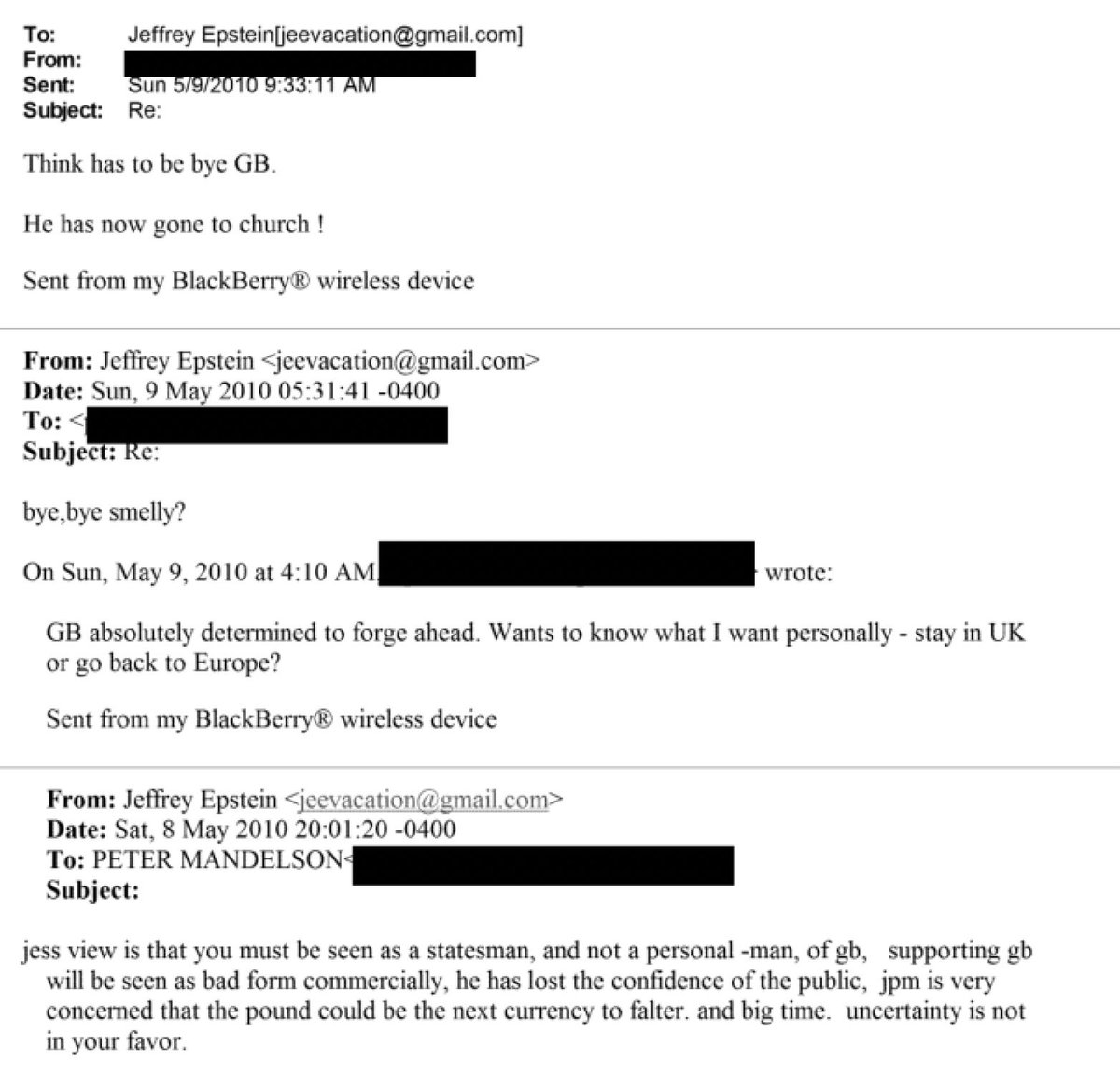

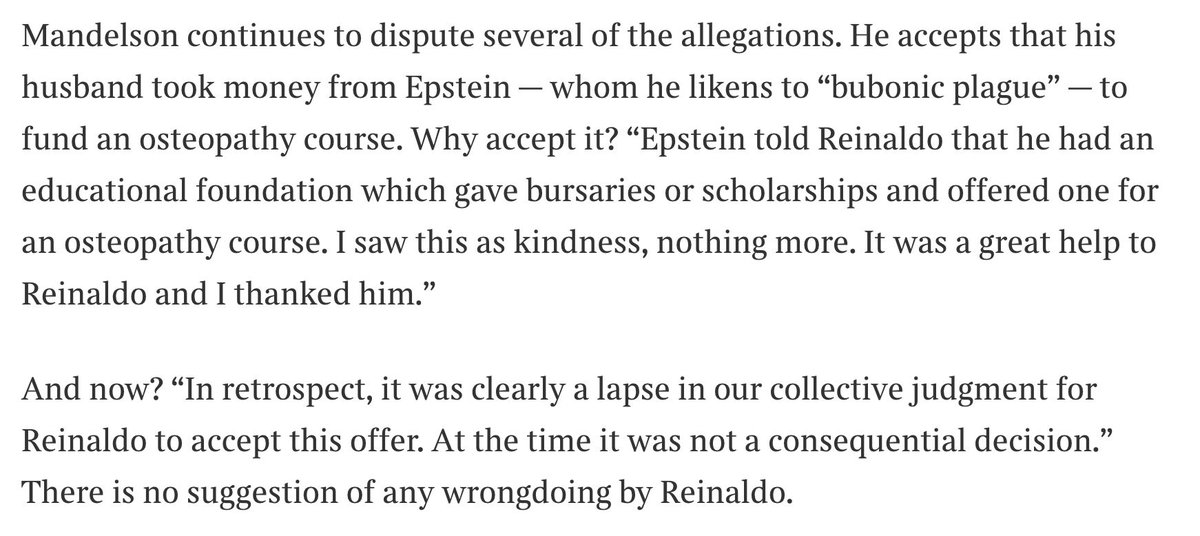

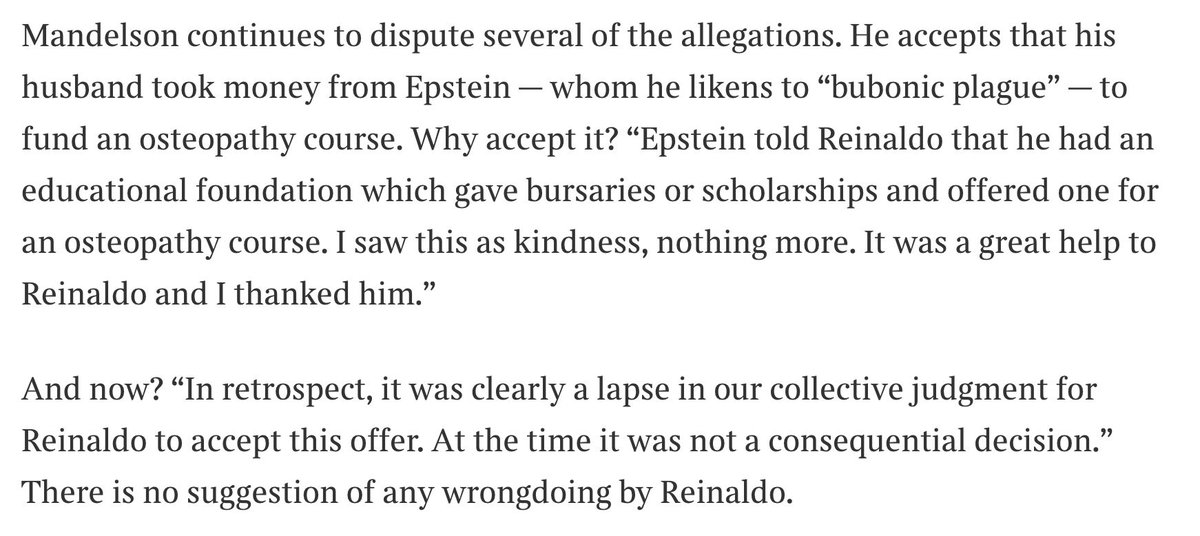

The offer to help came from Epstein alone. No mention of a foundation/bursary.

The offer to help came from Epstein alone. No mention of a foundation/bursary.

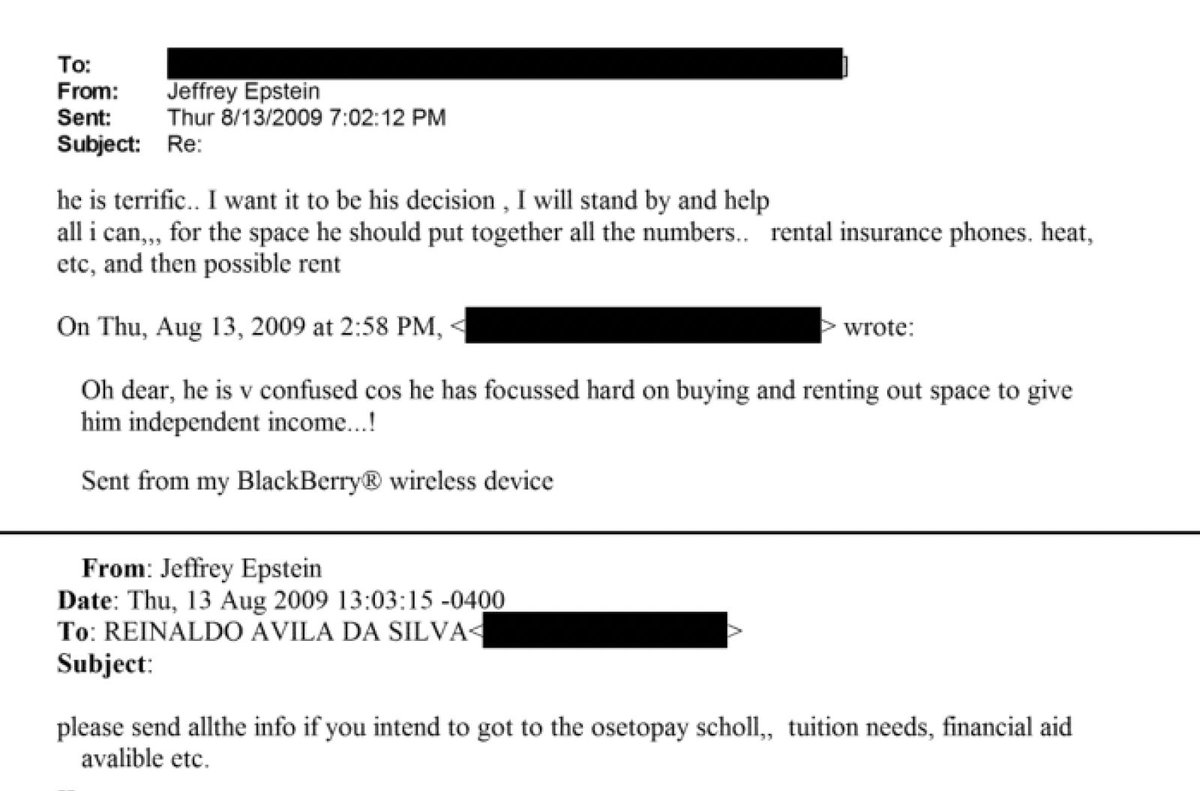

This was a pretty detailed discussion. Epstein responded with suggestions as to how hedge funds should be taxed, and then detailed questions about the drafting of the new US rules ("may" vs "shall).

This was a pretty detailed discussion. Epstein responded with suggestions as to how hedge funds should be taxed, and then detailed questions about the drafting of the new US rules ("may" vs "shall).

The name of the leaker is redacted. Could be any of Vadera, Pond, Heywood, Mandelson, or anyone they forwarded the email to.

The name of the leaker is redacted. Could be any of Vadera, Pond, Heywood, Mandelson, or anyone they forwarded the email to.

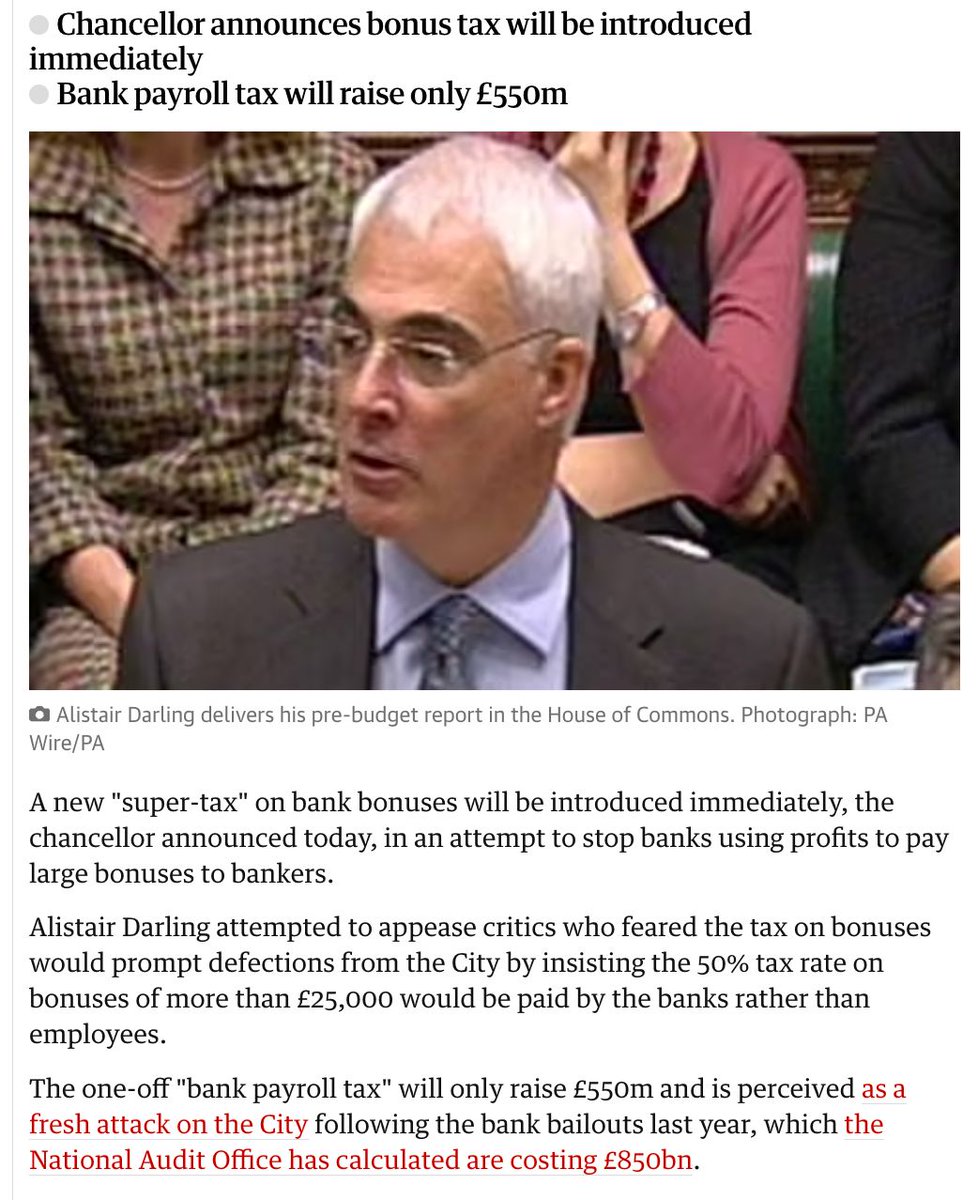

On 9 December 2009, Alistair Darling - then the Chancellor of the Exchequer - announced a one-off 50% tax on bankers’ bonuses.

On 9 December 2009, Alistair Darling - then the Chancellor of the Exchequer - announced a one-off 50% tax on bankers’ bonuses.

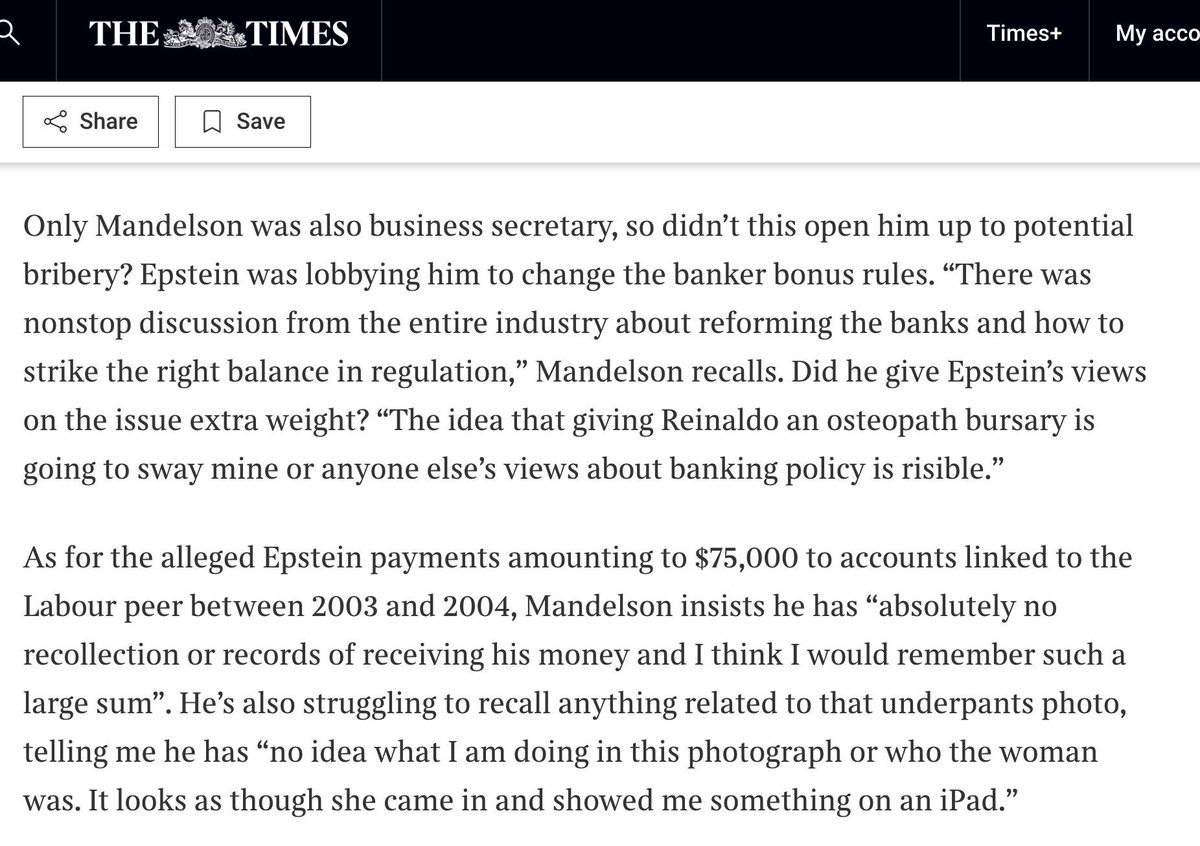

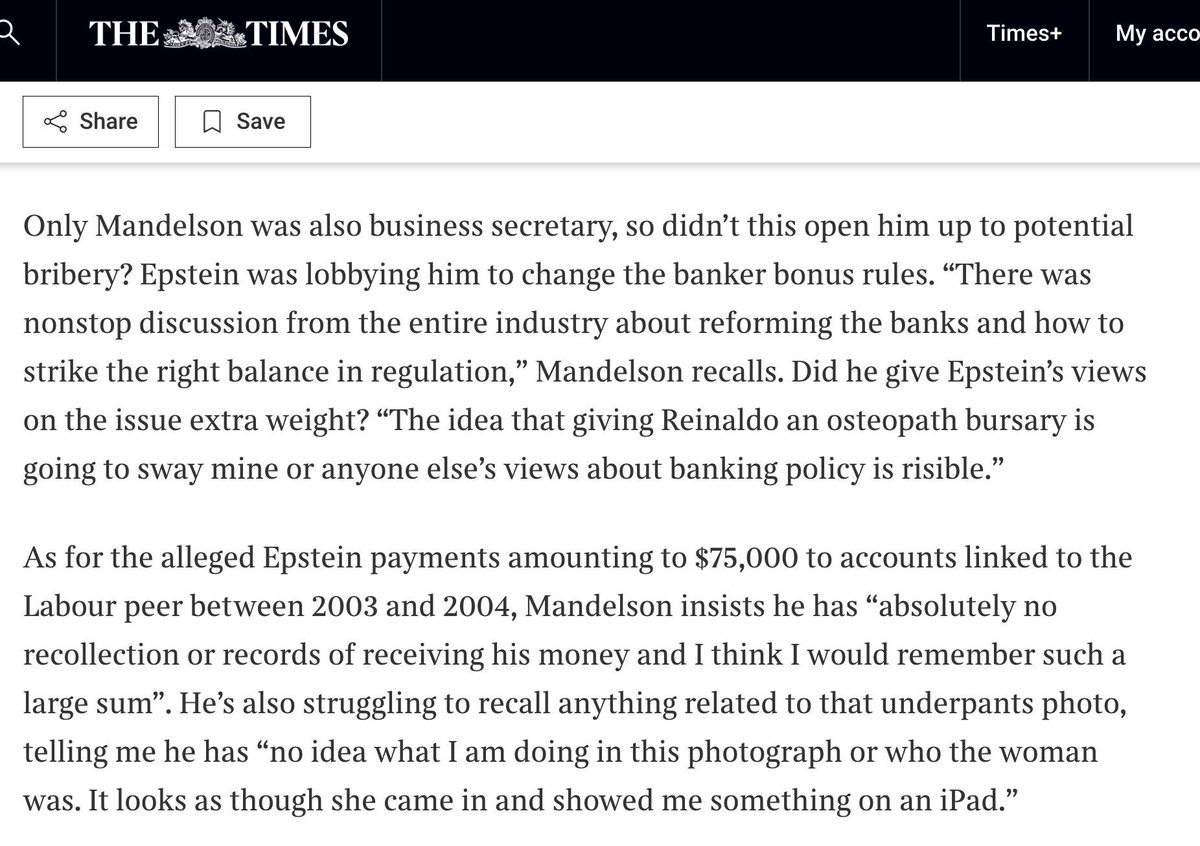

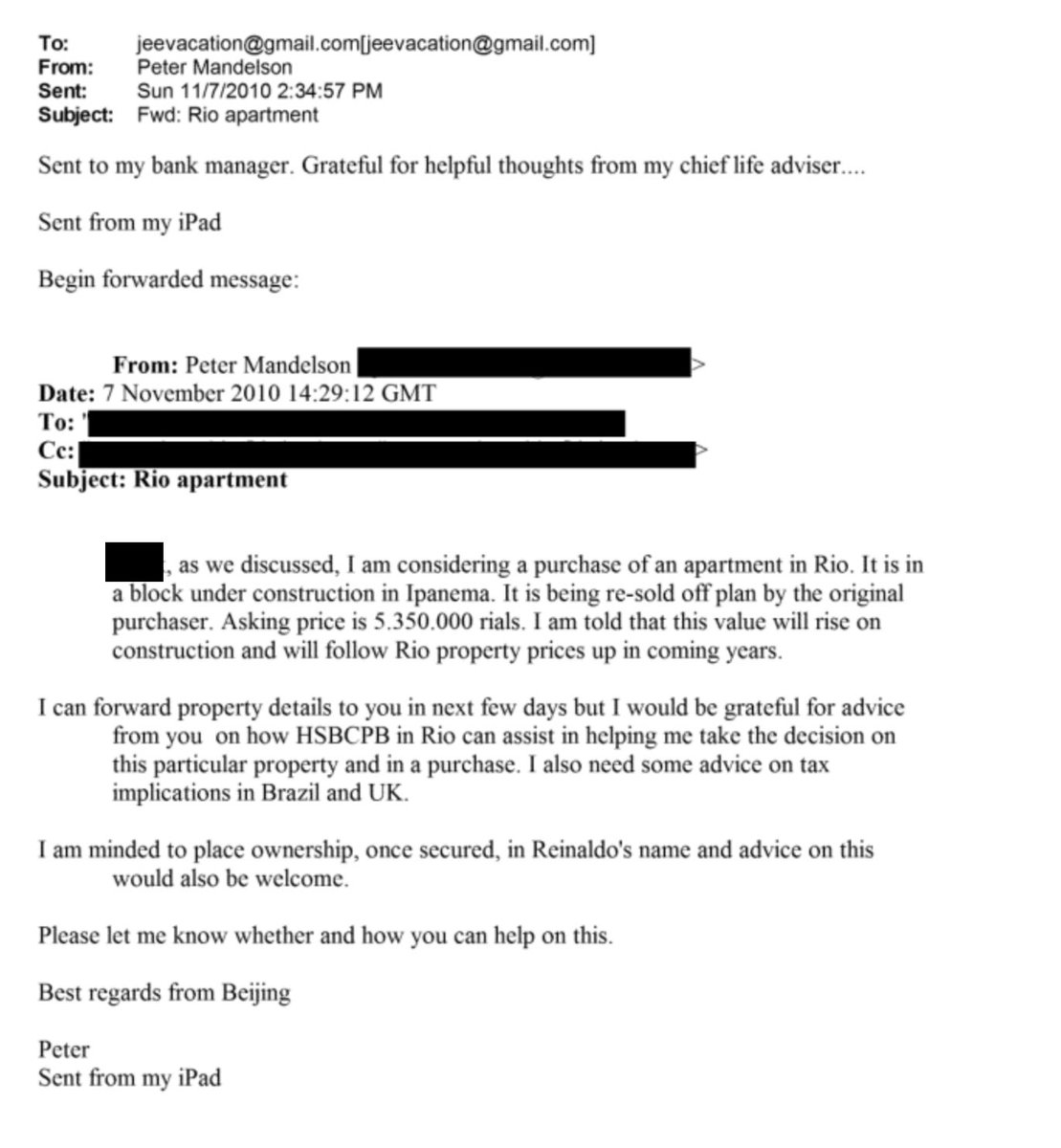

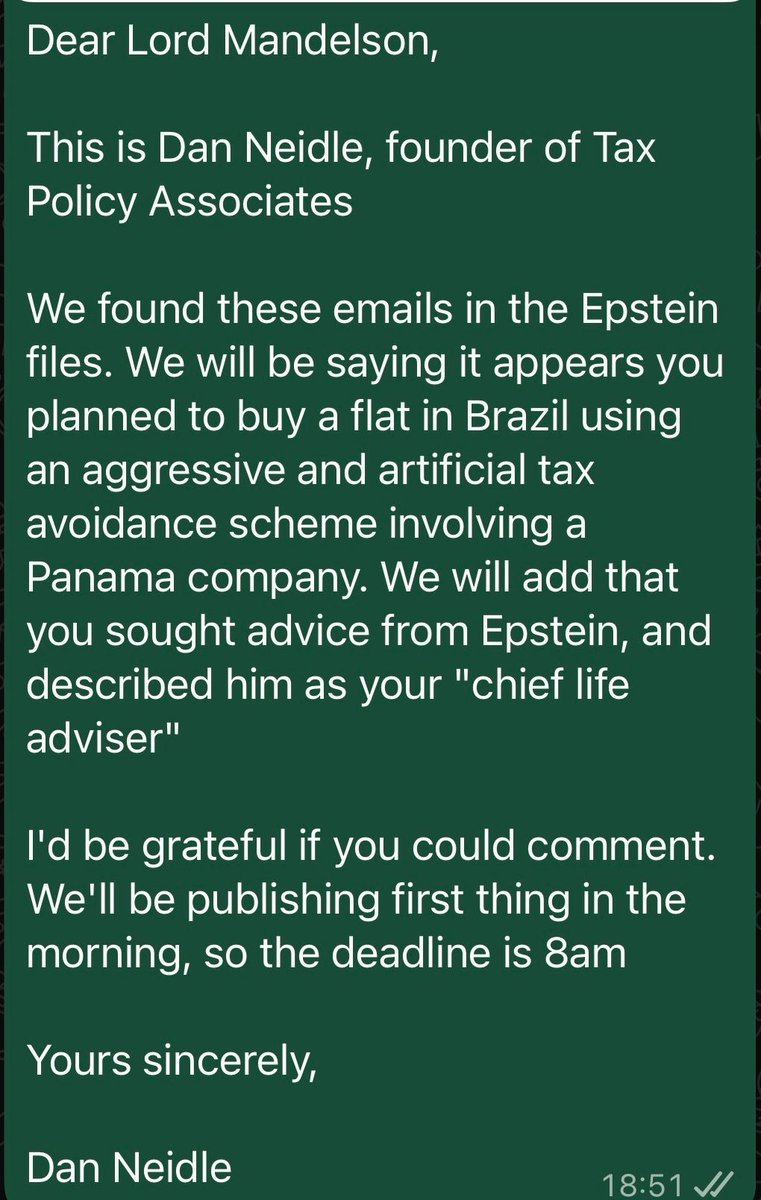

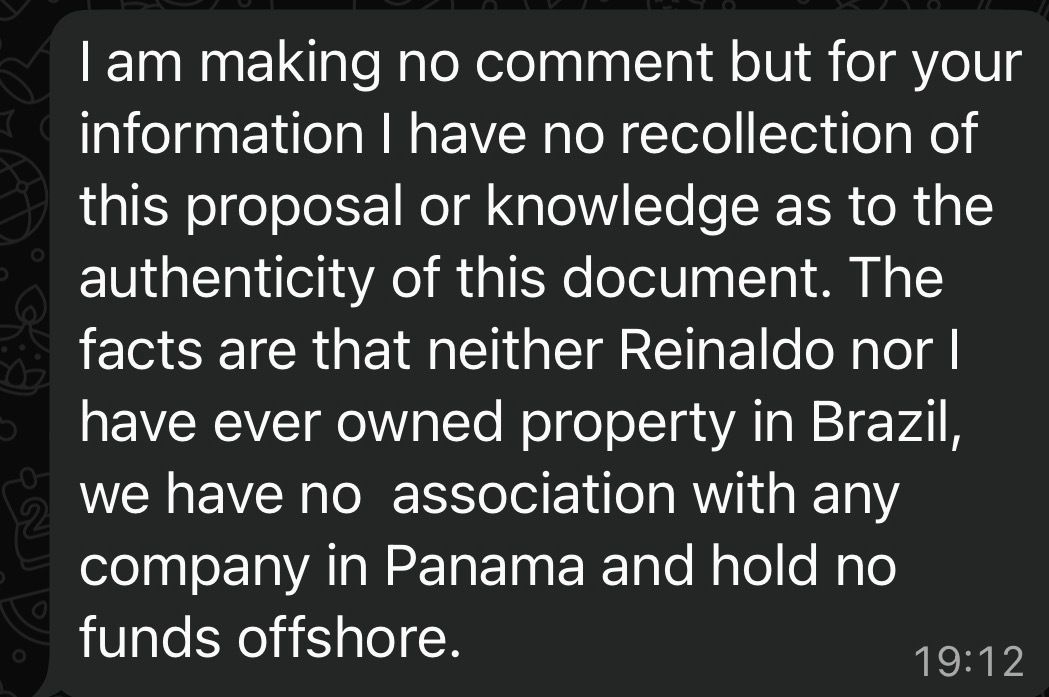

Mr Mandelson says he has no recollection of the proposal, or knowledge as to the authenticity of the documents.

Mr Mandelson says he has no recollection of the proposal, or knowledge as to the authenticity of the documents.

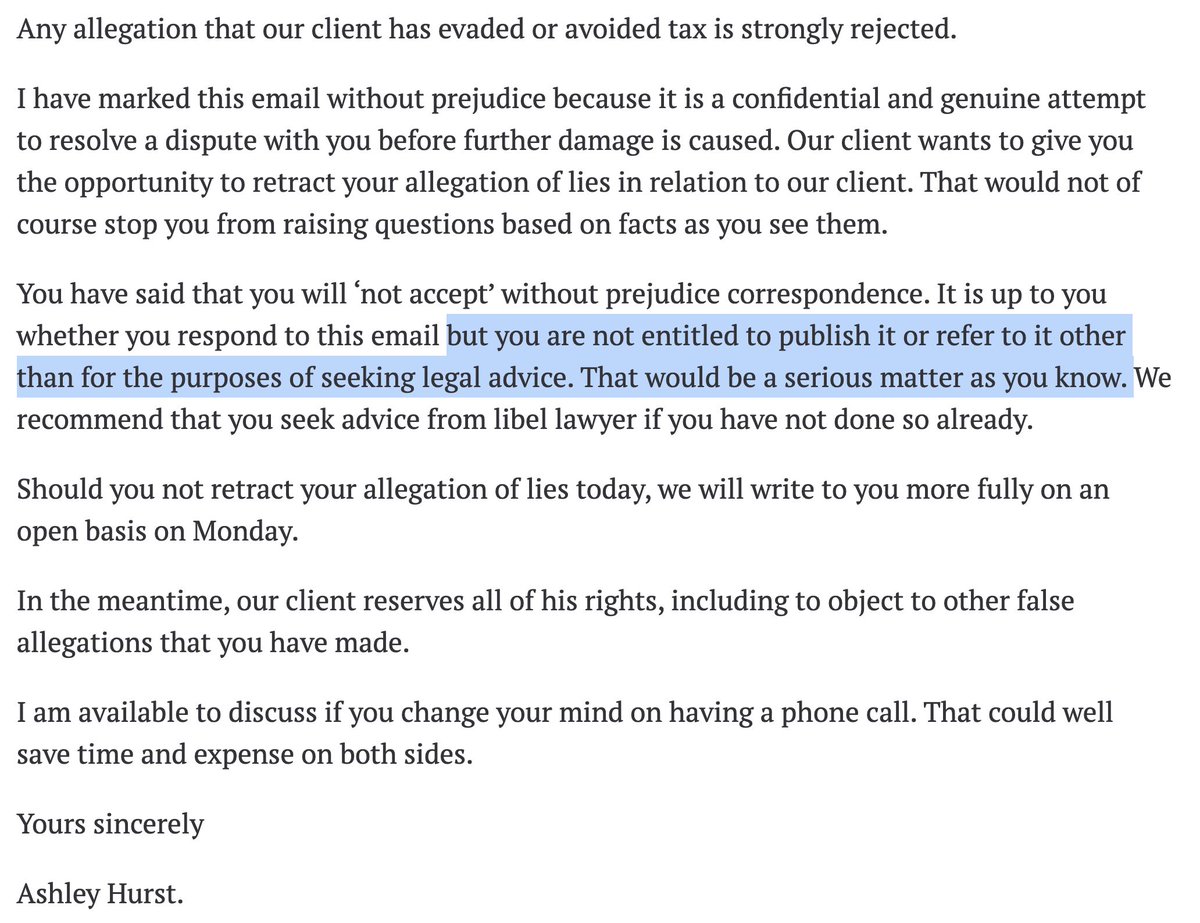

The SDT found the lawyer, Ashley Hurst, guilty of professional misconduct because he sent me a libel threat which he claimed I couldn't publish or even refer to.

The SDT found the lawyer, Ashley Hurst, guilty of professional misconduct because he sent me a libel threat which he claimed I couldn't publish or even refer to.

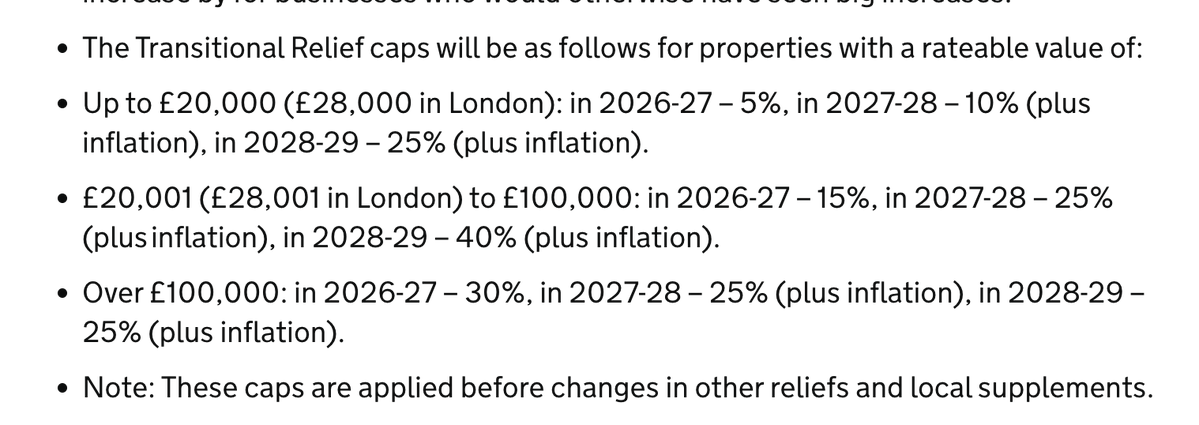

https://twitter.com/dustonlandlady/status/1993922942795960405The history here is a mess. Business rates are based on the market rent for a property. But this is usually way out of date.

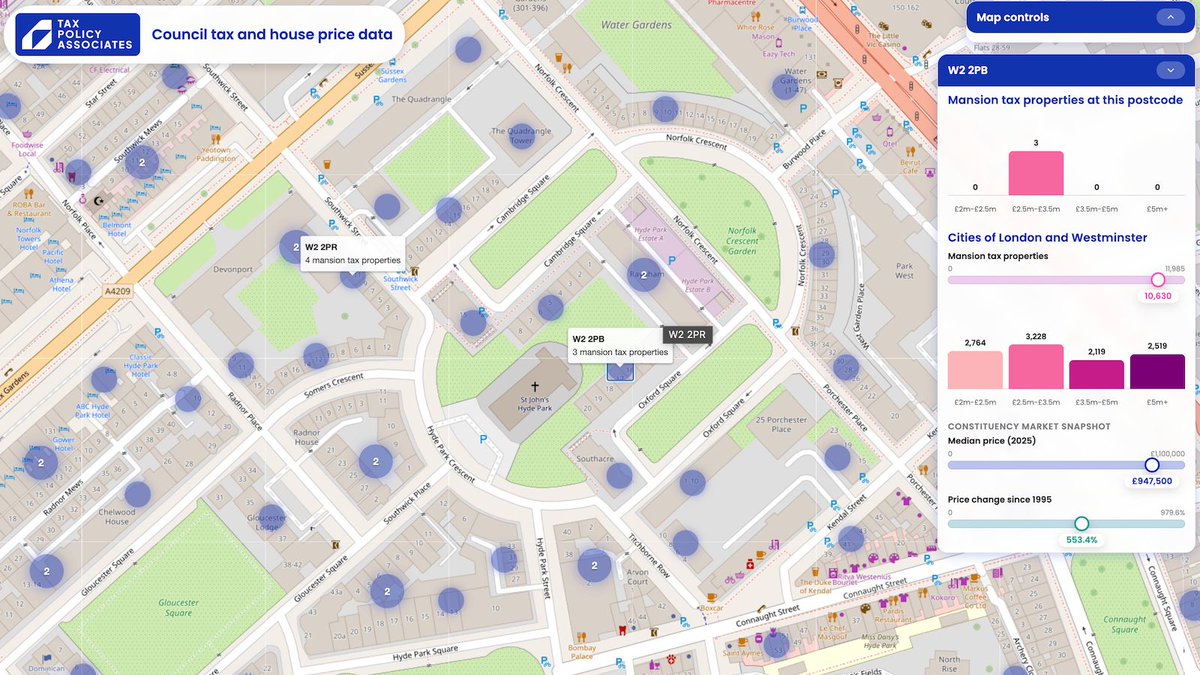

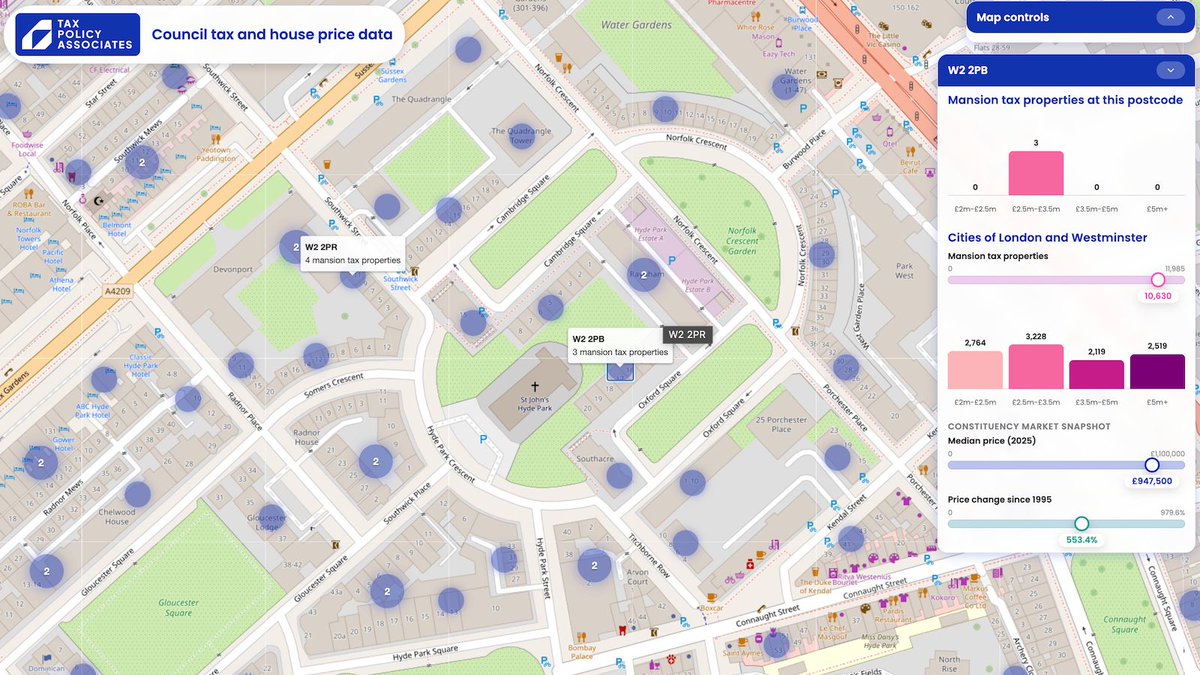

The map:

The map:

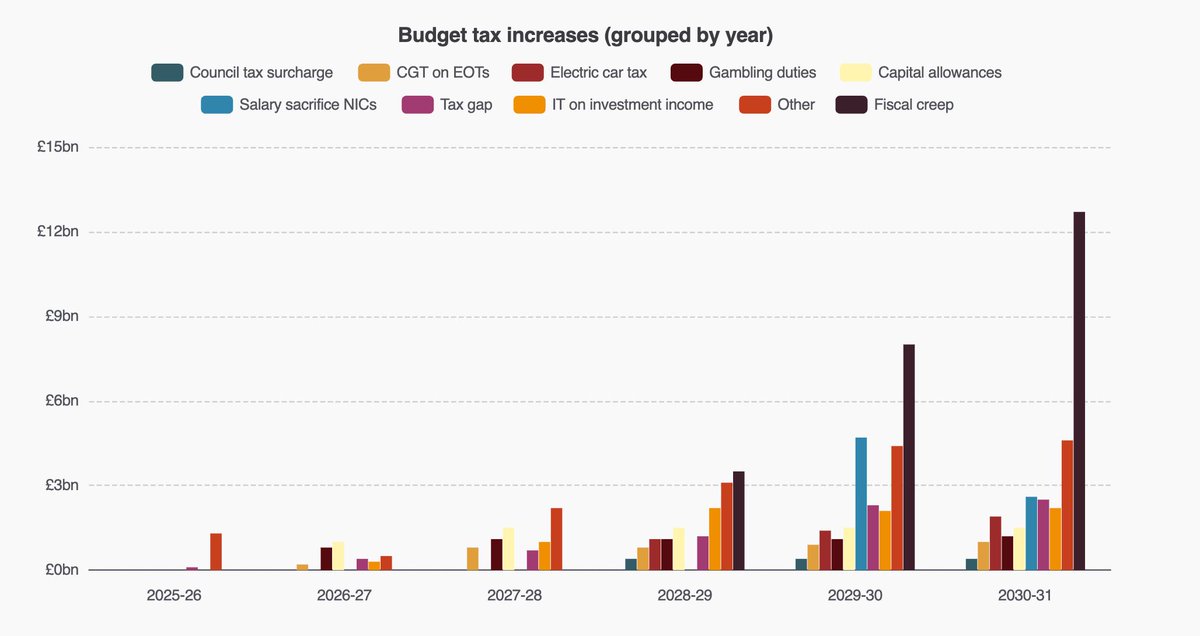

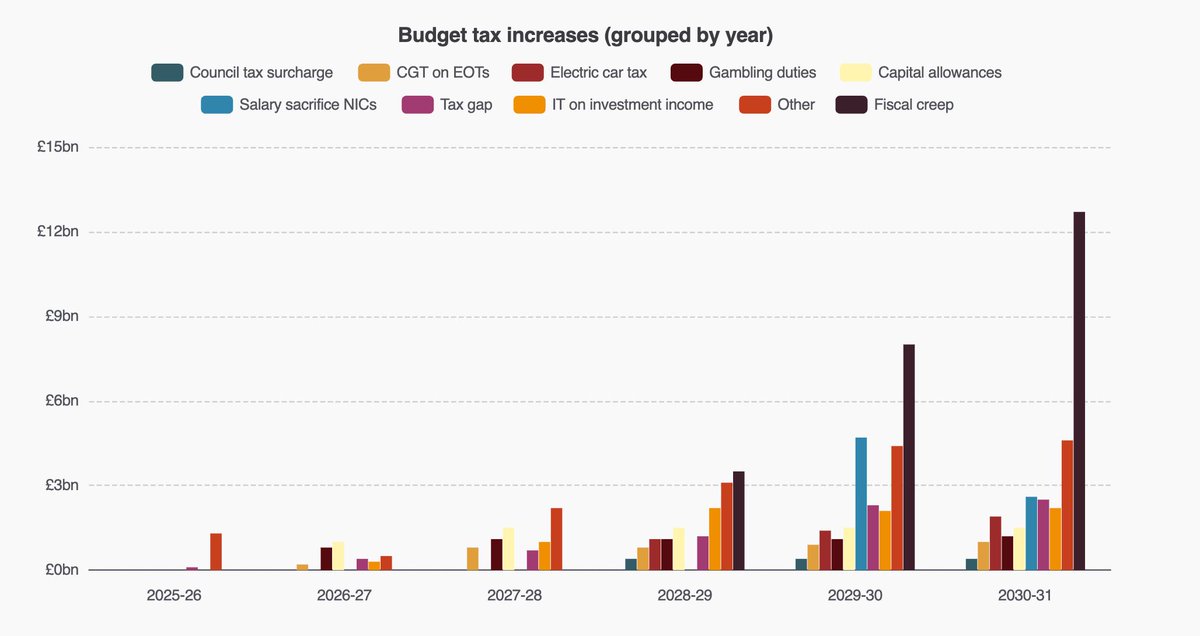

One answer is that this is a bit of an illusion. The chart shows the very large threshold freeze effect from this Budget, but no the almost-as-large threshold freezes from previous Budgets.

One answer is that this is a bit of an illusion. The chart shows the very large threshold freeze effect from this Budget, but no the almost-as-large threshold freezes from previous Budgets.

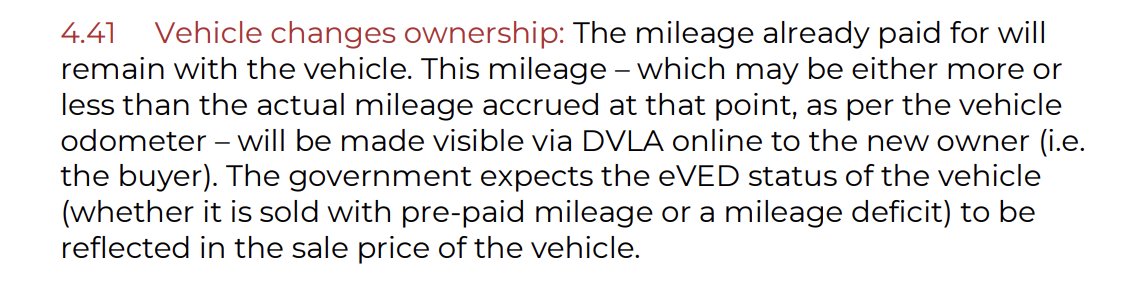

Time-travel aside, the second hand car market will become *slightly* more complicated, as you'll need to take into account whether the car you're buying has a "surplus" or "deficit" of EV duty.

Time-travel aside, the second hand car market will become *slightly* more complicated, as you'll need to take into account whether the car you're buying has a "surplus" or "deficit" of EV duty.

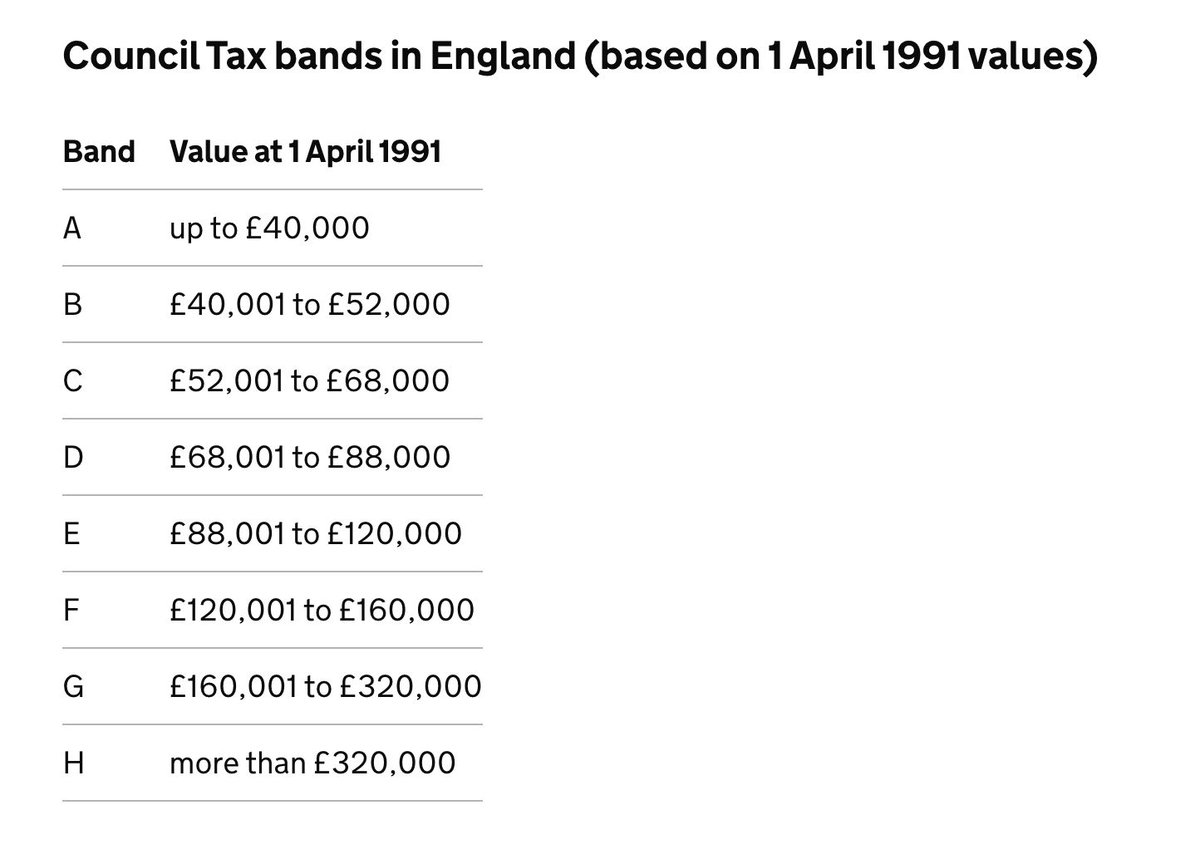

Here are the English council tax bands.

Here are the English council tax bands.

This goes way beyond a lawyer acting unethically. If Milne knows the statements he's making are false (and it seems likely he does) then it's fraud.

This goes way beyond a lawyer acting unethically. If Milne knows the statements he's making are false (and it seems likely he does) then it's fraud.