Some thoughts & facts on the german coal revolution

Germany is heavily dependend on russian energy imports

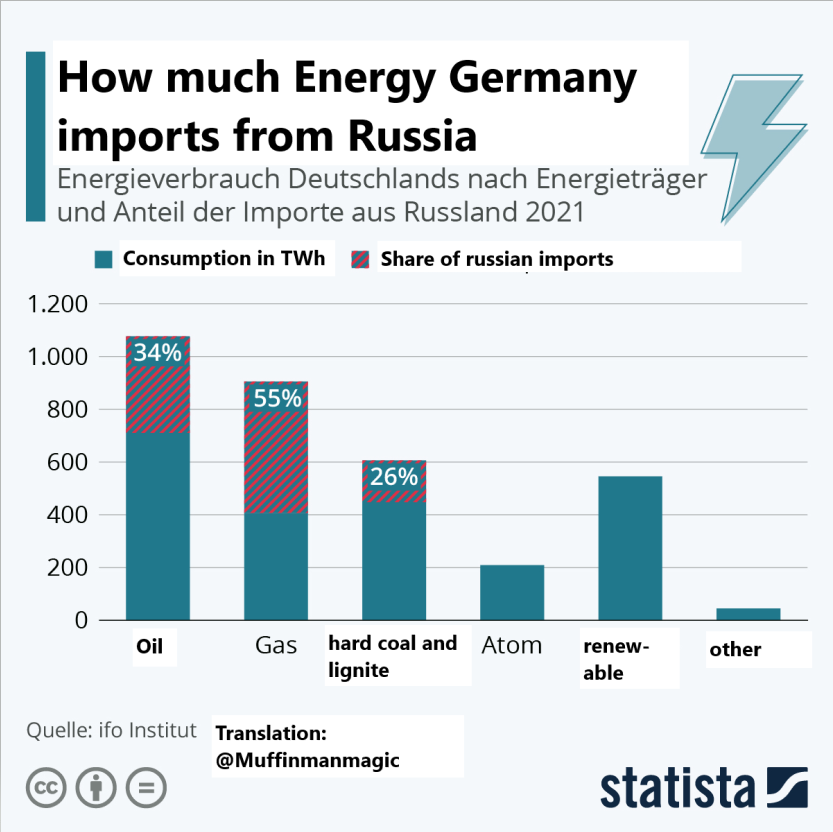

This graphic shows just how bad it is

The hard coal imports from Russia were 1,3 Mt in Q1'22

Coal imports to fully stop from 1st August

A 🧵(1/6)

rferl.org/a/germany-to-s…

Germany is heavily dependend on russian energy imports

This graphic shows just how bad it is

The hard coal imports from Russia were 1,3 Mt in Q1'22

Coal imports to fully stop from 1st August

A 🧵(1/6)

rferl.org/a/germany-to-s…

So from August there will be demand for non russian coal of 1,3 Mt on the already stressed international coal markets (5,2 Mt/year)

In 2021 global trade volume was 277 Mt for thermal coal so the german demand will add ~2% to global trade volume

(2/6)

reuters.com/business/energ…

In 2021 global trade volume was 277 Mt for thermal coal so the german demand will add ~2% to global trade volume

(2/6)

reuters.com/business/energ…

But wait, there is more!

Germany imports 55% of its gas from Russia

12% of all gas is used to generate electricity

But the gas is needed to keep the industry running and to keep the houses from freezing

So gas consumption needs to be cut in electricity generation

(3/6)

Germany imports 55% of its gas from Russia

12% of all gas is used to generate electricity

But the gas is needed to keep the industry running and to keep the houses from freezing

So gas consumption needs to be cut in electricity generation

(3/6)

The plan to reactivate old hard coal and lignite power plants has been approved by the german parliament, i posted about it here

To replace the 90TWh electricity from gas alot coal would be needed

Actually its 99 billion pounds per year

How much ?

(4/6)

To replace the 90TWh electricity from gas alot coal would be needed

Actually its 99 billion pounds per year

How much ?

(4/6)

https://twitter.com/MuffinmanMagic/status/1545128627385368577?s=20&t=bre7Ib8BHhp6guXtx9IQYg

Well, that would be 49,5 Mt of coal per year

BUT: There are not enough coal power plants to produce that much

There is 4.3 GW idle coal power (=30% of current active power)

Hard coal supplies 55 TWh/year so we can add 16,5 TWh which can replace 18% of the gas demand

(5/6)

BUT: There are not enough coal power plants to produce that much

There is 4.3 GW idle coal power (=30% of current active power)

Hard coal supplies 55 TWh/year so we can add 16,5 TWh which can replace 18% of the gas demand

(5/6)

That corresponds to 9,1 Mt of hard coal/year (3,3% of global trade)

If russia keeps the gas supply restrained as much as they did BEFORE this weeks outage of NS1 we will see this demand and germany will add 5% to global hard coal trade demand

Got coal ?

END

#CoalTwitter

If russia keeps the gas supply restrained as much as they did BEFORE this weeks outage of NS1 we will see this demand and germany will add 5% to global hard coal trade demand

Got coal ?

END

#CoalTwitter

@mfwarder

Maybe you have some ideas / info to share with us how the 5% (of global trade volume) additional hard coal demand caused by the german coal revolution could influence pricing of hard coal ?

Details see thread above

Would be highly appreciated!

Maybe you have some ideas / info to share with us how the 5% (of global trade volume) additional hard coal demand caused by the german coal revolution could influence pricing of hard coal ?

Details see thread above

Would be highly appreciated!

• • •

Missing some Tweet in this thread? You can try to

force a refresh