90% shitposting / 10% research

Nothing I say is advice for anything

I am a muffin after all!

How to get URL link on X (Twitter) App

So what was happening 2008ff?

So what was happening 2008ff?

https://twitter.com/seowie/status/1605872153324187648?s=20&t=e4-e4RAyYa5VRwNFOv9pnQAlso there is this seasonality chart for Bear markets since 1965 which does not favor any kind of January effect

Temperature in CW49 was 2,7°C below previous years avg and further forecast is also too cold to meet targets

Temperature in CW49 was 2,7°C below previous years avg and further forecast is also too cold to meet targets

https://twitter.com/Josh_Young_1/status/1599771554946039809?s=20&t=OVZh2Ji6WEXaZvsMfKcceQ

Claim 1

Claim 1

2) The Peel Hunt note

2) The Peel Hunt note

@NinoPlava @oilmutt Here he tried to present a simple pipeline plumbing challenge as a job stopper

@NinoPlava @oilmutt Here he tried to present a simple pipeline plumbing challenge as a job stopperhttps://twitter.com/MuffinmanMagic/status/1575699242496454656?s=20&t=F4q-7xHlE6_izI1kl1yc8g

https://twitter.com/Z22Holding/status/1571467483508518912

The whole EU produces less then 60m tons of thermal coal (hard coal) per year and consumes about 150m t of it

The whole EU produces less then 60m tons of thermal coal (hard coal) per year and consumes about 150m t of it

Adjusting sp target (37$) for increased free cashflow:

Adjusting sp target (37$) for increased free cashflow:

Rev growth over the last three half yrs for the segments and in total

Rev growth over the last three half yrs for the segments and in total

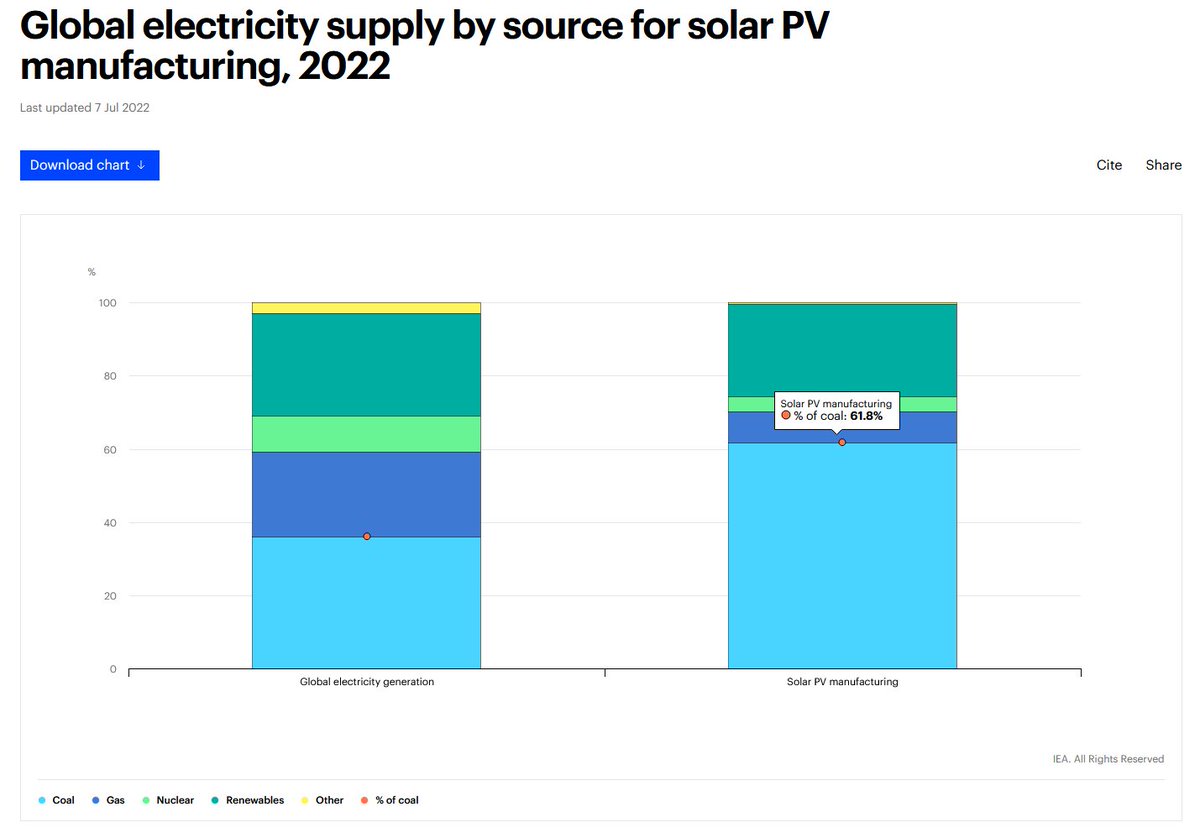

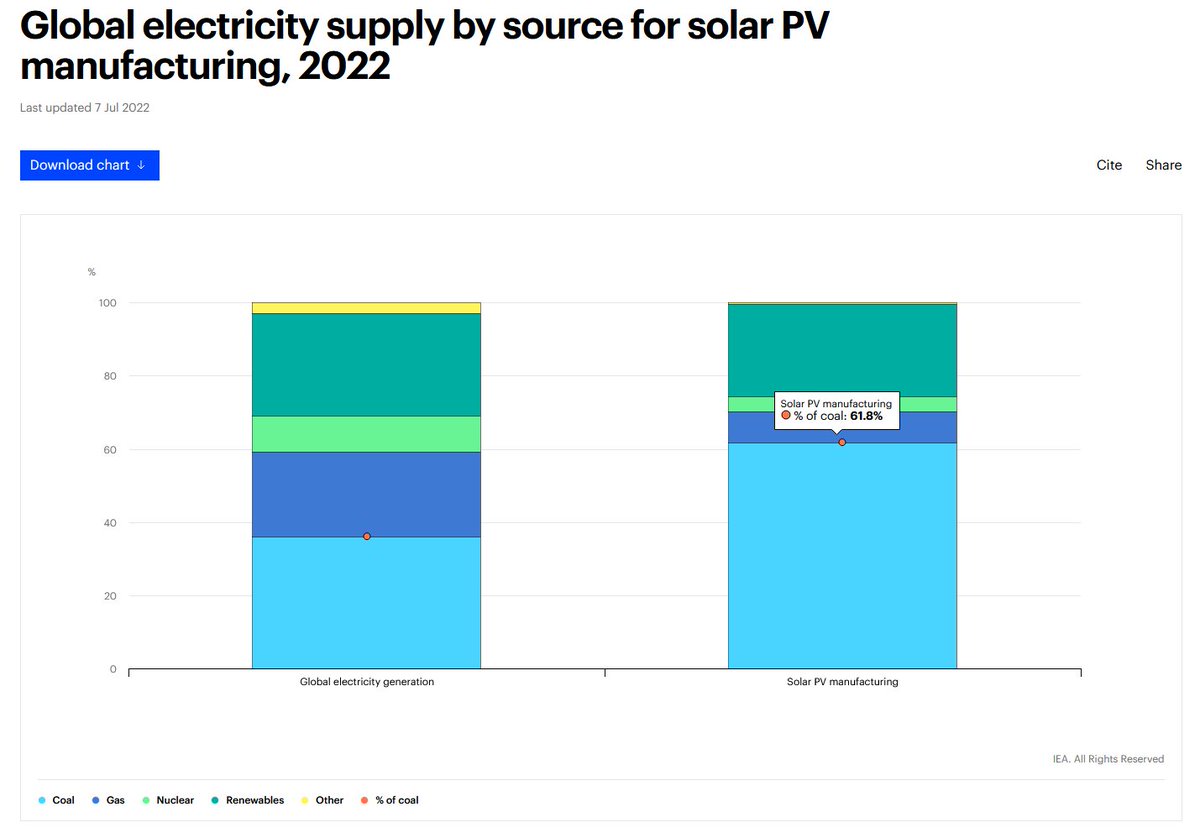

So at first lets see how much energy is needed to manufacture 1kWp worth of PV panels

So at first lets see how much energy is needed to manufacture 1kWp worth of PV panels

https://twitter.com/MuffinmanMagic/status/1549864007582060545?s=20&t=vq-HA9Wc9i9mOPHYQJy_bg

This graph shows how the Revenues, EBITDA, cost/t and tons sold have evolved over the last quarters

This graph shows how the Revenues, EBITDA, cost/t and tons sold have evolved over the last quarters

21,8% of US electricity is generated from coal

21,8% of US electricity is generated from coal

The company has now added ~300ft to the already known 450ft of oil bearing rock.

The company has now added ~300ft to the already known 450ft of oil bearing rock.

https://twitter.com/penny_student/status/1551089616169717762Lets see whats going on in the world right now

The mines in the Illinois basin produced 67% of the 17,1Mt of the other US segment in 2021

The mines in the Illinois basin produced 67% of the 17,1Mt of the other US segment in 2021