REPORT: Nearly HALF of the funding for the two GOP congressional super PACs so far this election cycle has come from just 27 billionaires.

The GOP's tax cuts for the rich and corporations are paying off for them. 🧵

MORE: bit.ly/BillionairesBu… #TaxBillionaires

The GOP's tax cuts for the rich and corporations are paying off for them. 🧵

MORE: bit.ly/BillionairesBu… #TaxBillionaires

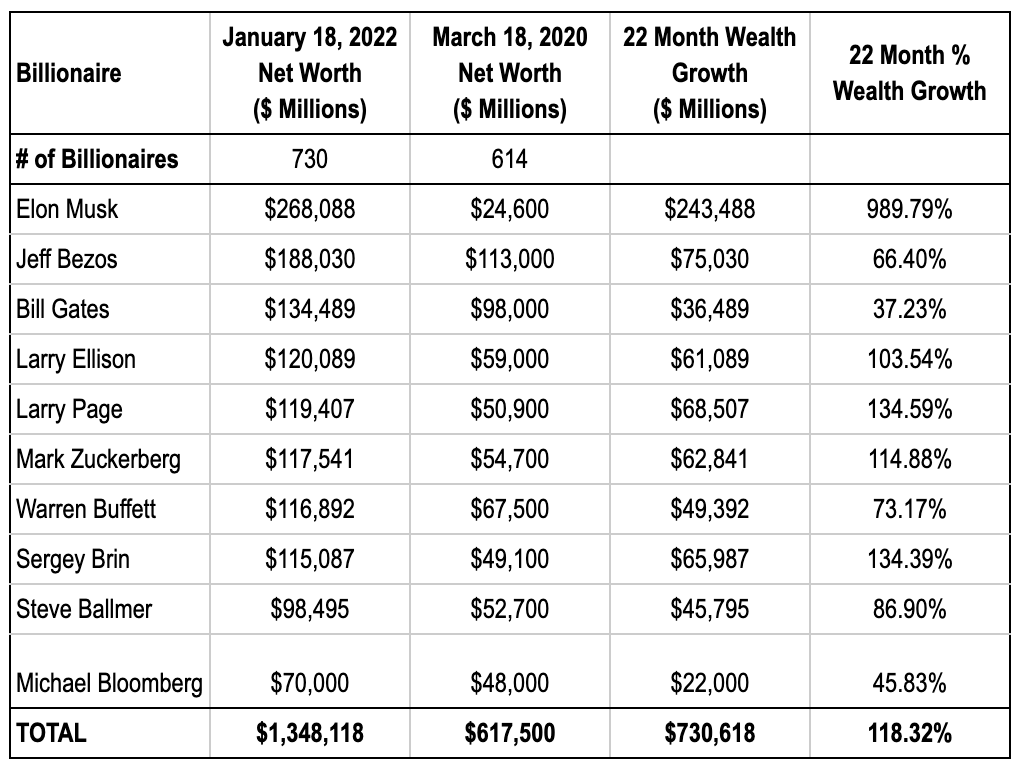

The wealth of these billionaire GOP donors grew by $82 BILLION in the first two years of the pandemic. Their donations this cycle? Less than 0.1% of that gain.

They're counting on that "small" investment in anti-tax Republicans to save them billions in taxes. #TaxBillionaires

They're counting on that "small" investment in anti-tax Republicans to save them billions in taxes. #TaxBillionaires

86% of that GOP billionaire money came from those who got rich on Wall Street.

Finance and investment billionaires particularly benefit from some of the most egregious special breaks in the tax code—tax breaks Republicans have been staunch defenders of. #TaxBillionaires

Finance and investment billionaires particularly benefit from some of the most egregious special breaks in the tax code—tax breaks Republicans have been staunch defenders of. #TaxBillionaires

The numbers don't include the vast amounts billionaires are pumping into dark money groups that AREN'T required to disclose their donors because of Citizens United.

Billionaire influence in elections has grown exponentially since Citizens United was decided in 2010.

Billionaire influence in elections has grown exponentially since Citizens United was decided in 2010.

Billionaires pumped $1.2 billion into the 2020 elections, almost 40x more than they did in 2010. In the 2020 election cycle, billionaires contributed nearly $1 out of every $10. #TaxBillionaires

As a result, many billionaires are throwing millions behind dark money groups like Club for Growth, who funnel money toward anti-tax candidates.

Club for Growth is notorious for having bankrolled insurrectionist members of Congress like Josh Hawley and Lauren Boebert.

Club for Growth is notorious for having bankrolled insurrectionist members of Congress like Josh Hawley and Lauren Boebert.

Club for Growth has received almost $32 million from shadowy billionaire Jeff Yass over the years. Yass has so far this cycle poured $28.5 million into right-wing candidates/groups.

This is the same Yass who avoided $1 billion in taxes in recent years.

This is the same Yass who avoided $1 billion in taxes in recent years.

https://twitter.com/4TaxFairness/status/1539241739264958467

Peter Thiel, the billionaire who spent $15 million on JD Vance's primary campaign in OH, and $13.5 million backing Blake Masters so far in AZ, has given Club for Growth $3 million in recent years.

Thiel has said he believes that freedom is no longer "compatible with democracy."

Thiel has said he believes that freedom is no longer "compatible with democracy."

We all have front-row seats to billionaires’ attempts to gain more wealth, influence and power in America, whether by buying media sites, busting unions, jacking up prices, buying elections, or dodging taxes.

Their election spending is no different—it's about power + influence.

Their election spending is no different—it's about power + influence.

And while each of us has one vote, billionaires can spend millions installing politicians who will rig the rules in their favor.

This is one of THE BEST reasons we have to #TaxBillionaires. We cannot allow them to continue purchasing outsize influence over our democracy.

This is one of THE BEST reasons we have to #TaxBillionaires. We cannot allow them to continue purchasing outsize influence over our democracy.

You can read the full report here: bit.ly/BillionairesBu…

And you can join the fight for a Billionaires Income Tax by using the hashtag #TaxBillionaires and visiting billionairestax.org

And you can join the fight for a Billionaires Income Tax by using the hashtag #TaxBillionaires and visiting billionairestax.org

The two Democratic congressional super PACs received about 17% of their contributions so far this cycle from billionaires—1/3 from Wall Street and 1/4 from crypto billionaires seeking lightened regulation. #TaxBillionaires

• • •

Missing some Tweet in this thread? You can try to

force a refresh