We’re fighting to build an economy that works for all of us by making the wealthy and corporations pay their fair share in taxes.

4 subscribers

How to get URL link on X (Twitter) App

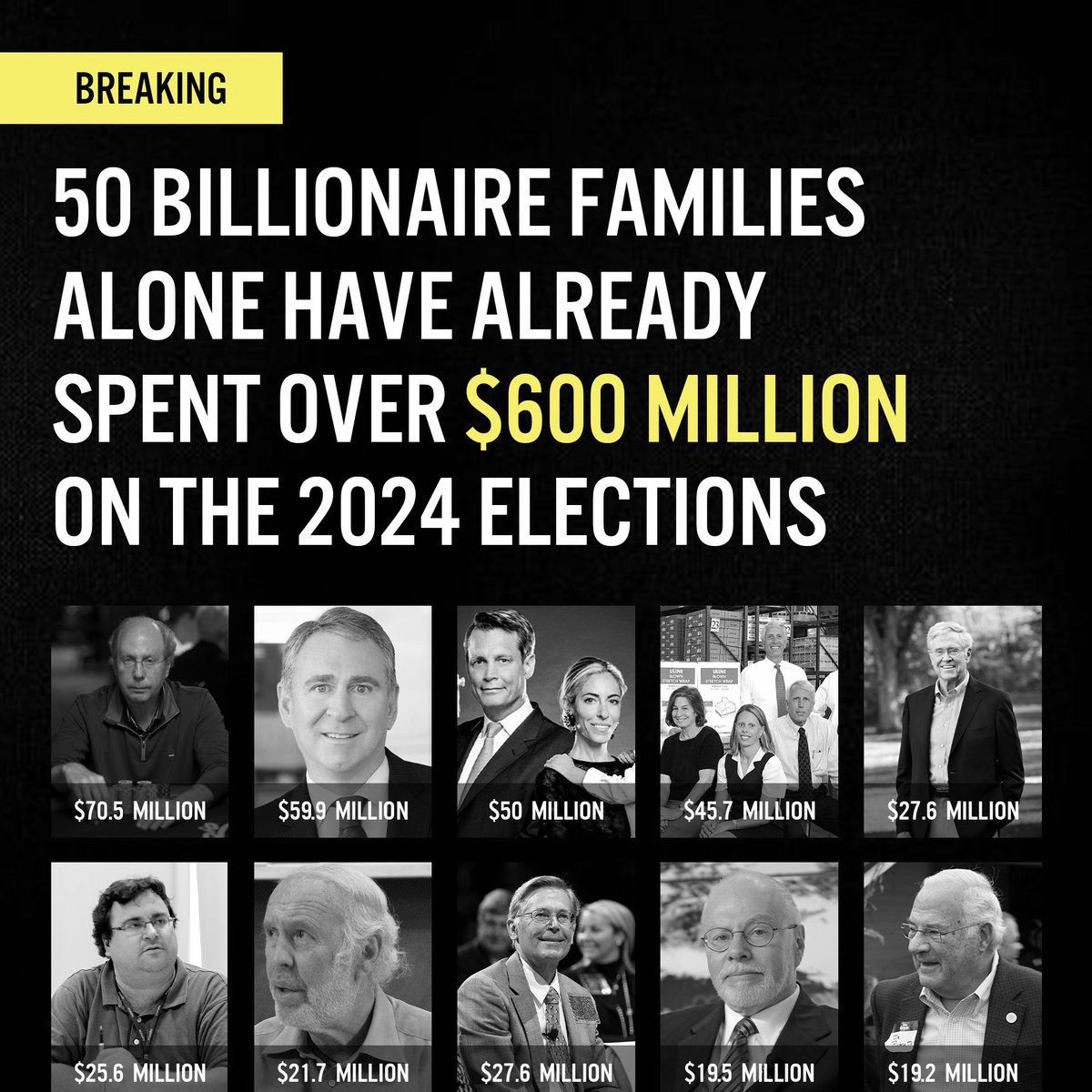

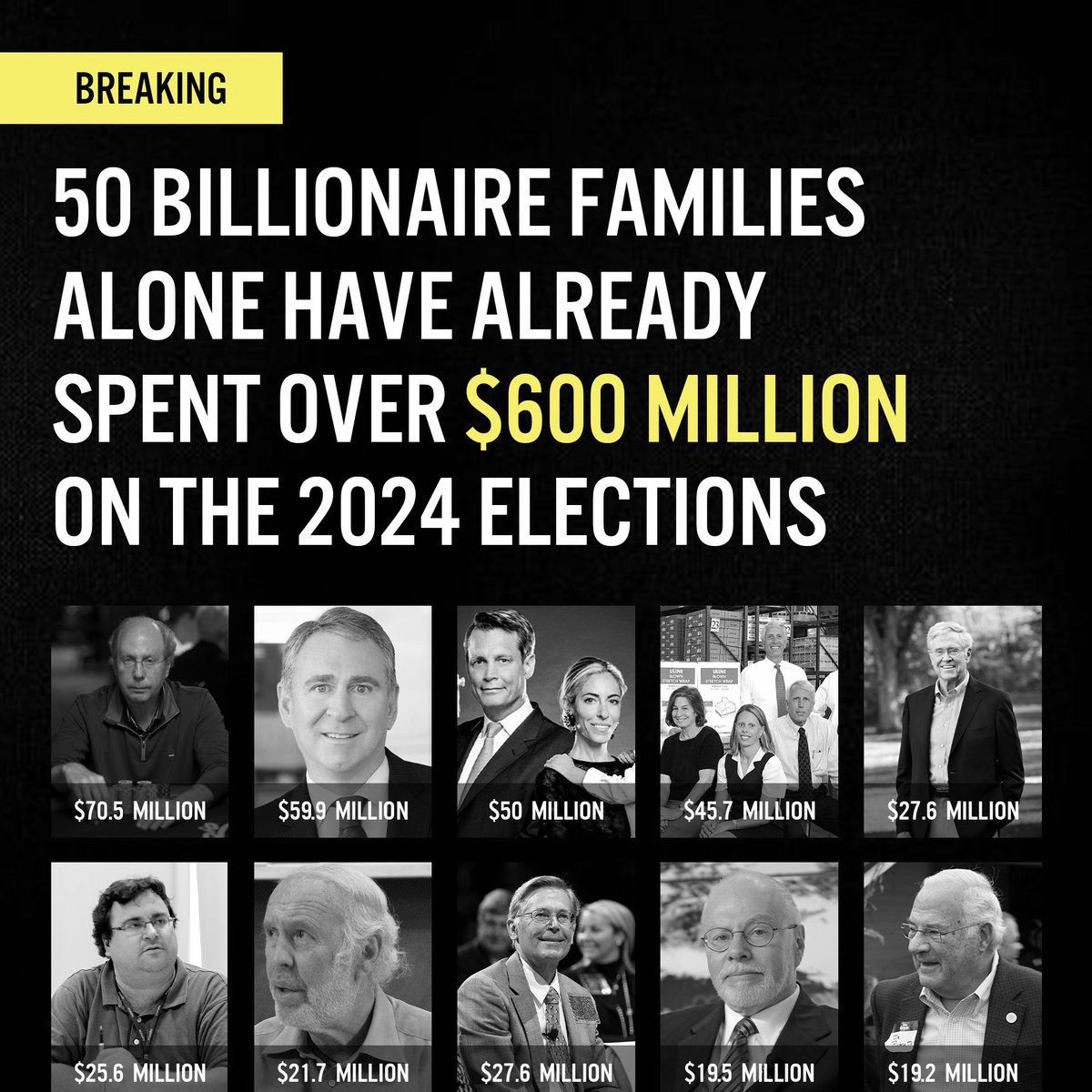

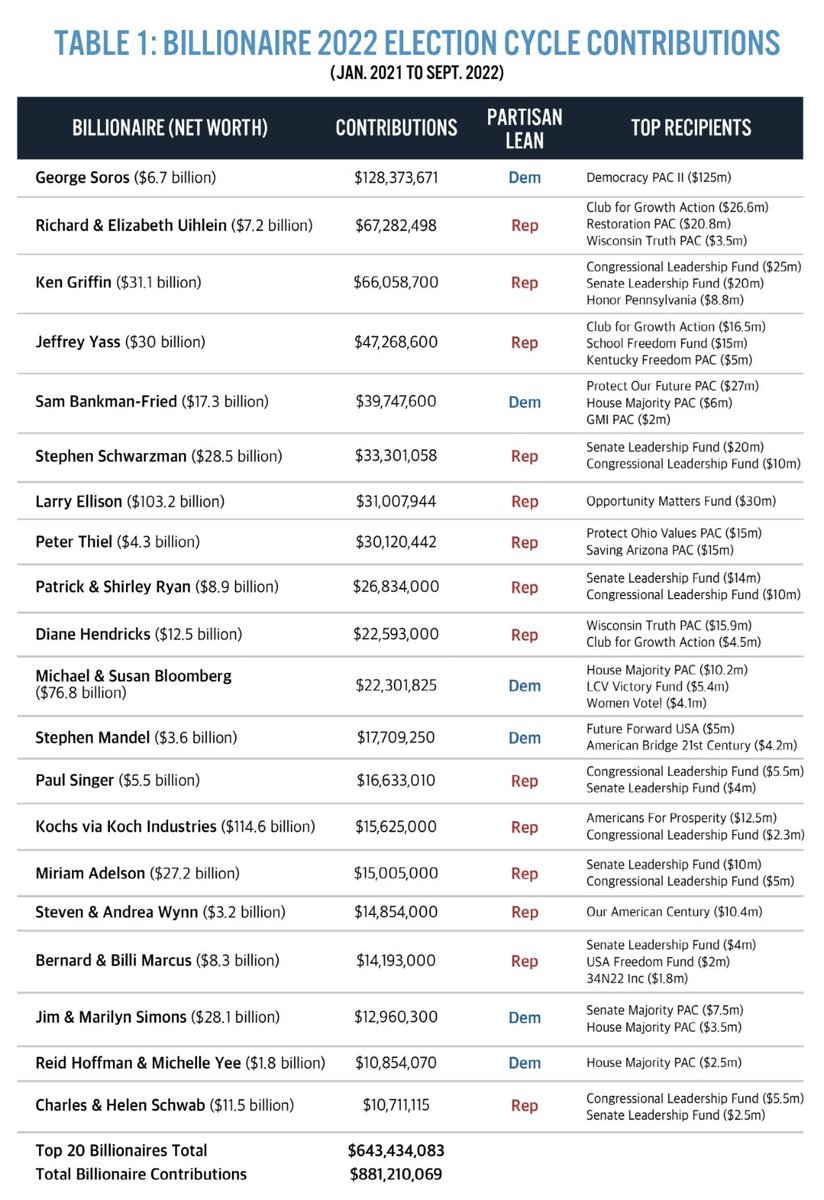

The vast majority of the money—$416 million—is going to Republicans or conservative groups hellbent on renewing the Trump tax cuts for the wealthy and slashing vital services for working people.

The vast majority of the money—$416 million—is going to Republicans or conservative groups hellbent on renewing the Trump tax cuts for the wealthy and slashing vital services for working people.

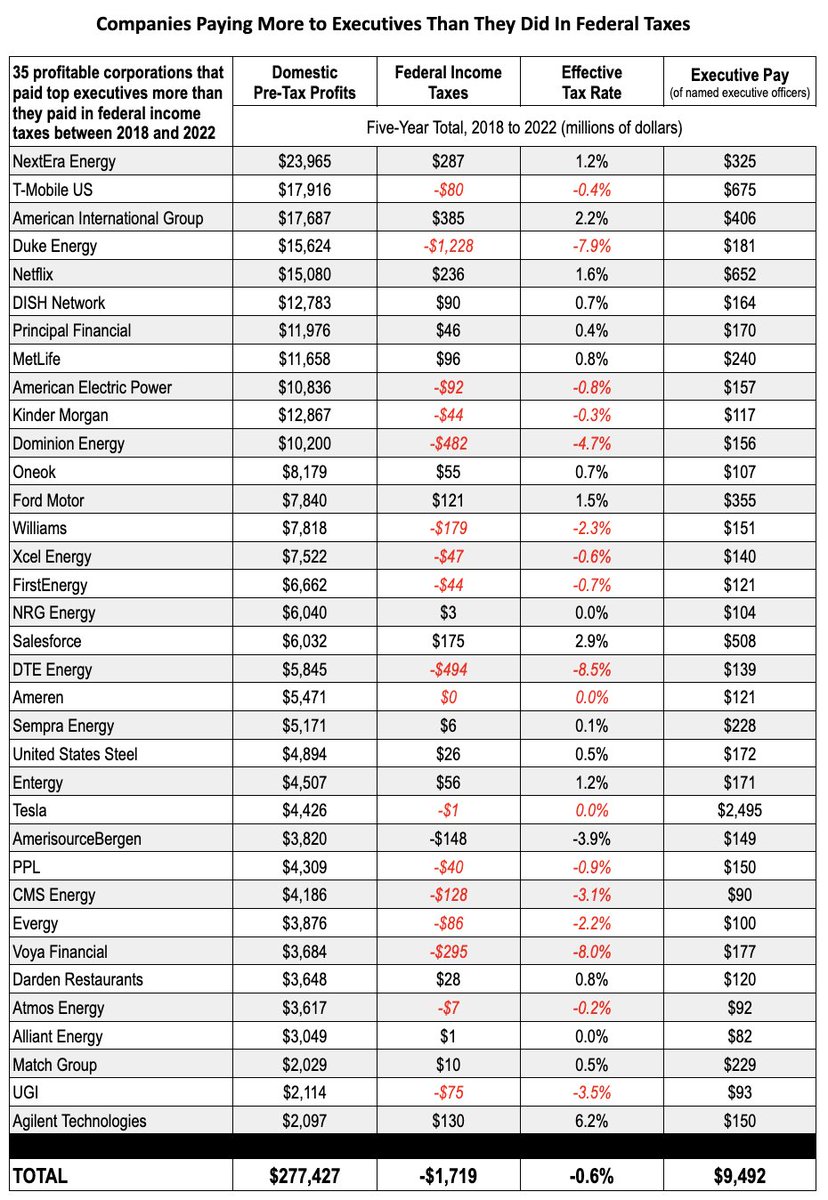

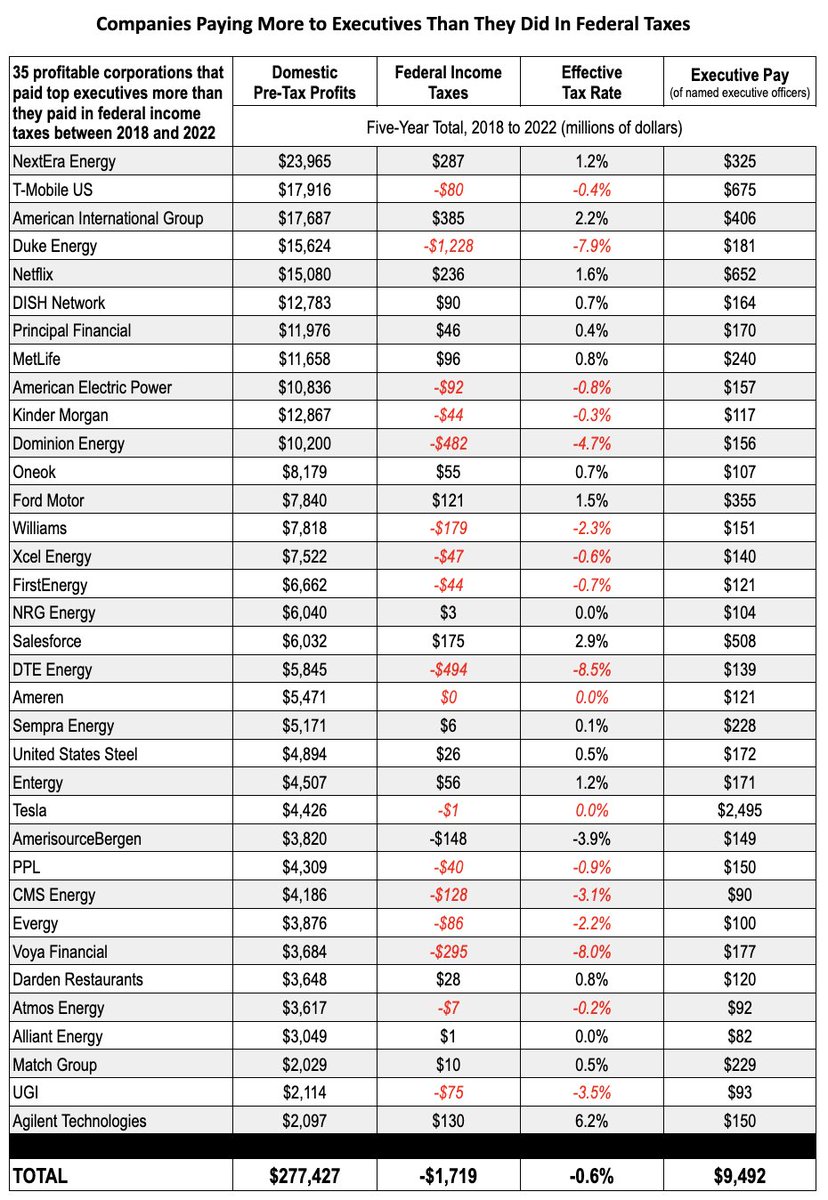

29 other high-profile, profitable corporations also paid their execs more than they paid in federal income taxes in at least two of those five years, including:

29 other high-profile, profitable corporations also paid their execs more than they paid in federal income taxes in at least two of those five years, including:

Billionaires and centimillionaires now hold 700% of the amount of unrealized gains they held in 1989.

Billionaires and centimillionaires now hold 700% of the amount of unrealized gains they held in 1989.

A number of billionaires—including Elon Musk, Jeff Bezos, and Michael Bloomberg—have gamed the system to pay $0 in federal income taxes in recent years, even as their wealth was skyrocketing.

A number of billionaires—including Elon Musk, Jeff Bezos, and Michael Bloomberg—have gamed the system to pay $0 in federal income taxes in recent years, even as their wealth was skyrocketing.

These GOP tax cuts would disproportionately benefit the wealthy.

These GOP tax cuts would disproportionately benefit the wealthy.

The failure of America’s tax code to fairly tax billionaires leaves them with the excess cash—and the entitlement—to spend huge amounts on candidates and causes.

The failure of America’s tax code to fairly tax billionaires leaves them with the excess cash—and the entitlement—to spend huge amounts on candidates and causes.

A bombshell @propublica report revealed that for decades GOP mega-donor Harlan Crow has hosted Thomas on luxury vacations worth hundreds of thousands of dollars—that Thomas never disclosed.

A bombshell @propublica report revealed that for decades GOP mega-donor Harlan Crow has hosted Thomas on luxury vacations worth hundreds of thousands of dollars—that Thomas never disclosed.

In 2017, the Trump-GOP tax scam created huge incentives for corporations to export jobs and profits offshore.

In 2017, the Trump-GOP tax scam created huge incentives for corporations to export jobs and profits offshore.

One of the most dangerous parts of this bill is it replaces the income tax with a sales tax.

One of the most dangerous parts of this bill is it replaces the income tax with a sales tax.

The letter states that at a time when corporations are making record-high profits, paying record-low taxes as a share of the economy, and price-gouging consumers, they should be paying more of their fair share, not less.

The letter states that at a time when corporations are making record-high profits, paying record-low taxes as a share of the economy, and price-gouging consumers, they should be paying more of their fair share, not less.

DonorsTrust has been called the "dark money ATM" of the right, thanks to the millions it funnels to conservative causes on behalf of anonymous millionaire and billionaire donors.

DonorsTrust has been called the "dark money ATM" of the right, thanks to the millions it funnels to conservative causes on behalf of anonymous millionaire and billionaire donors.

But wait, there's more.

But wait, there's more.

Club for Growth isn't quiet about its priorities.

Club for Growth isn't quiet about its priorities.