Exposé on the Dark Side of Market Structure

3 wks ago the SEC proposed a groundbreaking reform that could cut trading costs by >50%.

HUGE SHIT.

How did investors react?

Crickets🦗

Turns out <1% understood what's happening: how "market structure" works today.

Story time

👇

🧵

3 wks ago the SEC proposed a groundbreaking reform that could cut trading costs by >50%.

HUGE SHIT.

How did investors react?

Crickets🦗

Turns out <1% understood what's happening: how "market structure" works today.

Story time

👇

🧵

1/ Current state of confusion

"Market structure" (i.e. where & how ur order gets executed via financial plumbing) is the hottest most misunderstood topic of 2022.

Can brokers trade against me?

Can MMs frontrun me?

Is PFOF evil?

Is NBBO legit?

How the fuck does Citadel make $$$?

"Market structure" (i.e. where & how ur order gets executed via financial plumbing) is the hottest most misunderstood topic of 2022.

Can brokers trade against me?

Can MMs frontrun me?

Is PFOF evil?

Is NBBO legit?

How the fuck does Citadel make $$$?

Short answer to each question above is:

1) No

2) No

3) No

4) No

5) Because they understand & strategically exploit the loopholes in our current market plumbing. 🫰🫰

What are these loopholes and how much do they impact the execution quality of YOUR TRADES?

Keep reading.

1) No

2) No

3) No

4) No

5) Because they understand & strategically exploit the loopholes in our current market plumbing. 🫰🫰

What are these loopholes and how much do they impact the execution quality of YOUR TRADES?

Keep reading.

2/ Life Cycle of an Equity Order

To understand everything, let's start by tracing where a retail equity order goes after u click "Buy."

I'll only cover equities.

@HideNotSlide did this for OPTIONS:

To understand everything, let's start by tracing where a retail equity order goes after u click "Buy."

I'll only cover equities.

@HideNotSlide did this for OPTIONS:

https://twitter.com/hidenotslide/status/1448334977486180354

First in line to receive ur order is ur broker (RH, Schwab, etc.)

Broker then chooses the next step in the chain.

Can route to:

A) exchange

B) ATS (alternative trading system)

or

C) MM (market maker)

Broker's profit at each:

A) 5¢

B) 10¢

C) 50¢ 🔔🔔🔔

The (C)hoice is obvious.

Broker then chooses the next step in the chain.

Can route to:

A) exchange

B) ATS (alternative trading system)

or

C) MM (market maker)

Broker's profit at each:

A) 5¢

B) 10¢

C) 50¢ 🔔🔔🔔

The (C)hoice is obvious.

Why do MMs pay brokers 10x more than going straight to exchanges? And more importantly, WHO is subsidizing the diff?

(A) On lit exchanges, everyone competes & the order goes to best bidder. It's a fight between dozens of MMs, and the retail investor gets heavily price-improved.

(A) On lit exchanges, everyone competes & the order goes to best bidder. It's a fight between dozens of MMs, and the retail investor gets heavily price-improved.

(B) On an ATS, only MMs who are members of the ATS get to see the order & compete.

This means:

- Less fierce competition ➡️ smaller & price improvement

- Quotes are "hidden" from the market, ie. don't contribute to NBBO (national best bid & offer)

Hence the name "dark pool."

This means:

- Less fierce competition ➡️ smaller & price improvement

- Quotes are "hidden" from the market, ie. don't contribute to NBBO (national best bid & offer)

Hence the name "dark pool."

(C) When the order goes straight to a single MM, there's literally ZERO competition. MMs are 0% incentivized to give retail a better price, except by $0.0001 to inflate "EQ stats." (more on this later)

This shit doesn't happen in options.

100% of option orders print on exchange.

This shit doesn't happen in options.

100% of option orders print on exchange.

3/ SEC's June 22 Proposal

What was all that about?

TLDR: to put 100% of equity trades on lit exchanges

Why does this matter?

- 47% of all equity trades now occur off-exchange

- 90% of RETAIL equity trades now go straight to single MMs, short-circuiting fair competition

#ripoff

What was all that about?

TLDR: to put 100% of equity trades on lit exchanges

Why does this matter?

- 47% of all equity trades now occur off-exchange

- 90% of RETAIL equity trades now go straight to single MMs, short-circuiting fair competition

#ripoff

4/ Make EQUITIES MARKET STRUCTURE the same as current OPTIONS MARKET STRUCTURE

To read @GaryGensler's original proposal, see:

sec.gov/news/speech/ge…

I'll summarize his key points below,

focusing on the first 4 bullets

(since many have already debated PFOF ad nauseam)

To read @GaryGensler's original proposal, see:

sec.gov/news/speech/ge…

I'll summarize his key points below,

focusing on the first 4 bullets

(since many have already debated PFOF ad nauseam)

5/ How the Combo of Minimum Pricing Increment (MPI) + Off-Exchange Equities Screws U Over

Reason A:

On exchange, MPI of 1¢ means any price improvement is >= 1¢.

Off-exchange, no MPI exists so MMs who internalize can fill at sub-penny prices, ie. price-improve by < $0.0001.

Reason A:

On exchange, MPI of 1¢ means any price improvement is >= 1¢.

Off-exchange, no MPI exists so MMs who internalize can fill at sub-penny prices, ie. price-improve by < $0.0001.

Reason B:

Say Alice has a resting order at $99. Then Bob places a market order.

An MM steps front of Alice's displayed quotation to provide nominal price improvement (e.g. $0.0001) to Bob. Alice receives no fill.

Over time, our losses as Alice far outweighs our gains as Bob.

Say Alice has a resting order at $99. Then Bob places a market order.

An MM steps front of Alice's displayed quotation to provide nominal price improvement (e.g. $0.0001) to Bob. Alice receives no fill.

Over time, our losses as Alice far outweighs our gains as Bob.

6/ Why NBBO is a Lie

Imagine bid-ask at 3 exchanges:

48-51

49-52

47-50

Here, NBBO would be 47-50.

"Reg NMS" is supposed to protect the retail investor & ensure his order always executes within NBBO.

Sounds great, until u realize NBBO altogether excludes off-exchange quotes!!🤯

Imagine bid-ask at 3 exchanges:

48-51

49-52

47-50

Here, NBBO would be 47-50.

"Reg NMS" is supposed to protect the retail investor & ensure his order always executes within NBBO.

Sounds great, until u realize NBBO altogether excludes off-exchange quotes!!🤯

When quotes from dark venues (which are often better) fail to update the displayed NBBO:

➡️ the market is not aware of the "true" spread

➡️ Reg NMS fails to protect retail execution at the best spread

➡️ Retail traders eat up a higher execution cost

➡️ the market is not aware of the "true" spread

➡️ Reg NMS fails to protect retail execution at the best spread

➡️ Retail traders eat up a higher execution cost

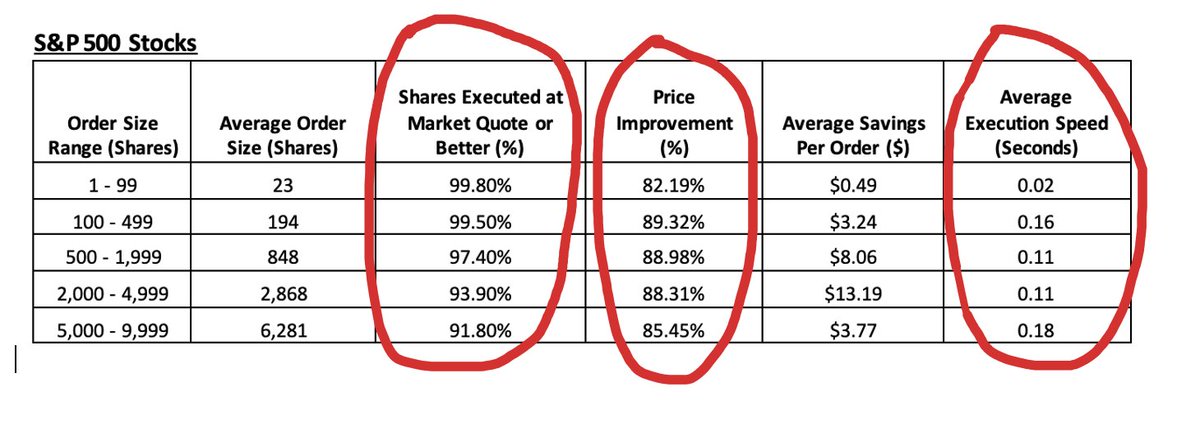

7/ Why "EQ" (Execution Quality) Stats Are Deceptive & Conveniently Omit "Missing-the-Execution" Cases

All brokers & MMs are required to publish quarterly execution stats in what's called "605 Reports." Columns are standardized.

Here's an example from Virtu.

All brokers & MMs are required to publish quarterly execution stats in what's called "605 Reports." Columns are standardized.

Here's an example from Virtu.

Imagine this scenario:

NBBO is 48-50.

Alice (at RH) places a resting buy at 49.

Bob (also RH) places a resting sell at 49.

Logically, Robinhood should match A&B.

But it'd earn $0.

Fuck that. Robinhood sends both to Citadel instead.

Citadel waits & executes neither immediately.

NBBO is 48-50.

Alice (at RH) places a resting buy at 49.

Bob (also RH) places a resting sell at 49.

Logically, Robinhood should match A&B.

But it'd earn $0.

Fuck that. Robinhood sends both to Citadel instead.

Citadel waits & executes neither immediately.

Afterall, both are non-marketable cuz neither printed to a lit exchange, so NBBO is still 48-50.

Now NBBO moves to 49-51. Citadel hits Bob @ 49.01, and leaves Alice hanging.

RH gets to add 100% to both columns: "Price Improvement" & "Shares Executed @ Market Quote or Better."

Now NBBO moves to 49-51. Citadel hits Bob @ 49.01, and leaves Alice hanging.

RH gets to add 100% to both columns: "Price Improvement" & "Shares Executed @ Market Quote or Better."

Alice literally missed her fill!

But since unfilled orders are N/A on price improv, neither CitSec nor RH took a hit.

And if market momentum continues, eventually Alice would cancel her order. "Avg Execution Time" is also untarnished.

CitSec + RH walk away w/ amazing EQ stats.

But since unfilled orders are N/A on price improv, neither CitSec nor RH took a hit.

And if market momentum continues, eventually Alice would cancel her order. "Avg Execution Time" is also untarnished.

CitSec + RH walk away w/ amazing EQ stats.

End/

To summarize, the SEC's latest proposal to migrate all retail equity orders to lit exchanges is 100% on point.

But because so few investors who stood to benefit understood enough about market structure, the world just shrugged & moved on.

To summarize, the SEC's latest proposal to migrate all retail equity orders to lit exchanges is 100% on point.

But because so few investors who stood to benefit understood enough about market structure, the world just shrugged & moved on.

If this lack of education continues, retail investors will continue to overpay to predatory market makers.

Original SEC proposal here:

sec.gov/news/speech/ge…

Spread the knowledge & retweet this thread to push securities regulation forward!

Original SEC proposal here:

sec.gov/news/speech/ge…

Spread the knowledge & retweet this thread to push securities regulation forward!

https://twitter.com/FabiusMercurius/status/1548370336944533510

• • •

Missing some Tweet in this thread? You can try to

force a refresh