[#ELROND PROJECT ANALYSIS/#FITY]

Today, a Thread on @fity_fitness to explain you the project, tokenomics and money management of their partner Popugames (money raised by Fity and send to them) where one of member of the project is CEO.

Today, a Thread on @fity_fitness to explain you the project, tokenomics and money management of their partner Popugames (money raised by Fity and send to them) where one of member of the project is CEO.

Warning : I am going to relate the facts, only the facts, with proof and with the maximum of neutrality that I can show. It will be up to you to draw conclusions in order to avoid any risk of defamation.

I will try not to mention any names but it will be not easy given the focus of my analysis. I will also present the team vision in order to confront it with my own. So you can make your own opinion.

@Fity project may of course use their right of reply to provide explanations

@Fity project may of course use their right of reply to provide explanations

1/ Project fundamentals

2/ Presale

3/ Tokenomics and NFT

4/ Tracking of funds raised and Fity tokens (the biggest part)

-Lost of a part of funds from first NFT sales

-Using funds to buy Cantina Launchpad

-Member who bought their own token in presale

2/ Presale

3/ Tokenomics and NFT

4/ Tracking of funds raised and Fity tokens (the biggest part)

-Lost of a part of funds from first NFT sales

-Using funds to buy Cantina Launchpad

-Member who bought their own token in presale

First, quick briefing on the project :

Fity want to build a move and good habits to earn.

We can read on the website that they plan to base their reward system on the physical activity of users who hold their NFTs.

Their mission :

Fity want to build a move and good habits to earn.

We can read on the website that they plan to base their reward system on the physical activity of users who hold their NFTs.

Their mission :

These Avatar NFTs can be purchased by investors prior to listing on Dex only with Fity tokens and will offer a real utility in the Fity ecosysteme

The usefulness of these NFTs according to the current information are :

- Earning rewards for activity

- Eligibility for Airdrop

- Access to Fitnesss and nutrition Lifetime Acess

- Earning rewards for activity

- Eligibility for Airdrop

- Access to Fitnesss and nutrition Lifetime Acess

I personally got more information from a private conversation with Fity, I asked for their agreement to publish their full vision of their utilities and their business plan on them, unfortunately I didn't get an answer, so we will have to wait for more information from them.

The suplly will be 10k NFT, so a sold out will correspond to 10m tokens (out of 11m sell to investor) recovered by the team

Fity already sold investors' NFT which allowed you to buy 1 pack of 1000 reserved tokens by NFT for first 3 round ad then 1 pack of 500 reserved tokens

Fity already sold investors' NFT which allowed you to buy 1 pack of 1000 reserved tokens by NFT for first 3 round ad then 1 pack of 500 reserved tokens

All investors can buy 10 packs of 500 tokens maximum by wallet at each round but for an higher price than NFT investors

We can notice on roadmap (1)/(2) : a play to earn, a DAO, staking, and well-verse but no further explanation on what it will look like

I had a deep private discussion with the CEO who explained to me all the fundamentals of the project but I could not detail them here for obvious confidentiality reasons.

But I can tell you, imho, that the business plan seems solid and I really have nothing to underline on this.

But I can tell you, imho, that the business plan seems solid and I really have nothing to underline on this.

All this information he given me is not available in the Lite Paper and they started the presale without giving all this information to the investors.

I let you make your own opinion about it :

dapp.fity.fitness/pdf/litepaper.…

I let you make your own opinion about it :

dapp.fity.fitness/pdf/litepaper.…

They have also a very nice website and a nice mobile app, which shows that they have a good web and mobile dev. This allows us to see what the final product will look like, that's seems goods.

Personally, I would have preferred a complete whitepaper rather than an early presentation of the product, but that's their choice. For me, as investor, a complete view of the technical and blockchain solutions, the economy and its robustness, are more important imho.

Secondly, the presale :

The presale is made according to the scheme below, we can see two curves, one for investors with an investor NFT who have reserved tokens and better price, and one for all investors who will have to buy the token in first come first served mode.

The presale is made according to the scheme below, we can see two curves, one for investors with an investor NFT who have reserved tokens and better price, and one for all investors who will have to buy the token in first come first served mode.

The presale is realized in 10 rounds with 52% of all token supply for sale (without vesting) the price increasing with each new round, for the first 3 rounds

83% of the available tokens per round will be reserved for the NFT investor, for the next 2: 41% and for the last 5: 50%

83% of the available tokens per round will be reserved for the NFT investor, for the next 2: 41% and for the last 5: 50%

NFT investors in the first round will be able to buy their tokens at $0.005 for a listing on Dex planned at $0.25, thus resulting in a x50 ROI. In comparison, the last investor without NFT will buy the token at 0,075$ resulting of a x3,3 ROI

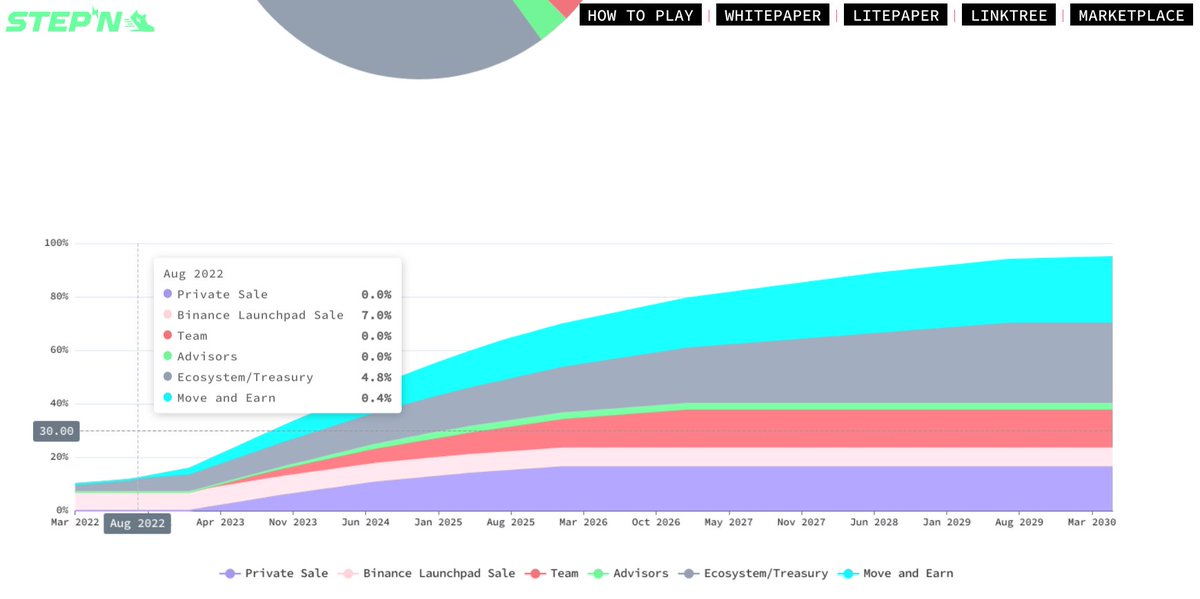

For comparison, #STEPN who popularized #MoveToEarn, offered 16.3% of its supply in private sale at $0.005, locked during 10 month and then vested during 3 years with between 1% and 4% of their tokens unlocked per month and a ROI on listing at x2.--

--For the public sale, it happened via Binance Launchpad with 7% available to buy at $0.01, without any vesting, and with no ROI on listing

To give you a synthetical view of the different ROIs on #Fity and their distribution within the presale supply :

docs.google.com/spreadsheets/d…

To give you a synthetical view of the different ROIs on #Fity and their distribution within the presale supply :

docs.google.com/spreadsheets/d…

- First round investor will turn 6500$ to 300 000$ at the listing on Dex.

- All investor will turn $357k to $2.75m which will be sellable upon listing of the token (there is no vesting) for an average ROI of all token of x7.7

- All investor will turn $357k to $2.75m which will be sellable upon listing of the token (there is no vesting) for an average ROI of all token of x7.7

With $71,5k, the Liquidity Pool is low compared to the net value of tokens that can be sold at listing (ratio LP/valuation of tokens of 1/38), in comparison a project like #ITHEUM have a ratio of 1/2,4 (25m $ITH in liquidity pool for 60m $ITH sellable)

The use of the funds raised is as follows, 60% in development, 20% in the liquidity pool, 20% in marketting on a total of $357K raised.

Thirdly, Tokenomics and NFT :

The tokenomics are as follows, 52% of the supply is given to investors without any vesting, 10% in metabounding, 9% in LP, 8% for Team/Adv, 8% for Marketting, 4% for Airdrop and 9% in stacking.

The tokenomics are as follows, 52% of the supply is given to investors without any vesting, 10% in metabounding, 9% in LP, 8% for Team/Adv, 8% for Marketting, 4% for Airdrop and 9% in stacking.

No information on the vesting of the tokens which are not issued from the presale is communicated, the team explained me that their tokens will be locked for 1 year then released periodically but this is not present on tokenomics with the usual release curve like Stepn's one

One of my questions after seeing the tokenomics was where is the Rewards part for the #MovetoEarn system ? The team gave me more information on this, (below)

Back to the comparison with #STEPN, the supply dedicated to #MovetoEarn is 30%.

Back to the comparison with #STEPN, the supply dedicated to #MovetoEarn is 30%.

I was also surprised by the % of supply given to presale investors, but the team give me an answer (below) and a % already dedicaced to metabounding which depends on Elrond's Team

What would happen to this supply if Elrond refused to integrate #Fity into his Metabounding ?

What would happen to this supply if Elrond refused to integrate #Fity into his Metabounding ?

As explained above, a 10k NFT sale is planned to raise 10m tokens from investors. I hypothesize that the funds will come from to fuel the #MovetoEarn

Vision of the Team : this sale of NFT is supposed to reduce the supply of token sellable in order to modify the above findings

Vision of the Team : this sale of NFT is supposed to reduce the supply of token sellable in order to modify the above findings

Indeed, if they recover 91% of the tokens held by investors in exchange for an NFT, they will no longer be saleable,

if all NFTs are sold, only 4.7% of tokens supply will remain in the hands of investors

This would drastically change the tokenomics presented above

if all NFTs are sold, only 4.7% of tokens supply will remain in the hands of investors

This would drastically change the tokenomics presented above

With a price of $250 (1000 Fity tokens), the 10k NFT collection will be valued at $2.5m.

Again for comparison, the initial offer of #STEPN was 100k NFT, at about $270 (1.3 SOL flirting with $207, at that time, in full bullrun) at the release for a valuation of $27m.--

Again for comparison, the initial offer of #STEPN was 100k NFT, at about $270 (1.3 SOL flirting with $207, at that time, in full bullrun) at the release for a valuation of $27m.--

--The offer however was not limited in order to not cap the number of users.

We have no information from #Fity about the possibility of increasing the supply of NFT or releasing a new collection in the future

We have no information from #Fity about the possibility of increasing the supply of NFT or releasing a new collection in the future

Let's take a look at what we know at the moment about the proposed fundraising strategy up to the listing of the token:

• A NFTs sale to investors allowing them to buy more tokens that will be reserved for them

• A NFTs sale to investors allowing them to buy more tokens that will be reserved for them

• A presale with 10 rounds and a price multiplied by 15 between the lowest and highest price ($0.075/$0.005)

• A sale of 10k NFTs to investors only that can be only purchased with the tokens bought during the pre-sale

• A sale of 10k NFTs to investors only that can be only purchased with the tokens bought during the pre-sale

• A sold out this would lead the project to recover 91% of the liquidity of their token initially sold in presale

• These NFTs can not be sold through a liquidity pool as for the tokens, the very principle of NFT being that they are not fungible, some will have a higher demand than others (so objectively less liquid than a token even in case of high demand on all collection)

• The utility value of this NFTs will be fully unlocked when the project will be launch and which will offer a return on investment in the medium/long term thanks to activity rewards and maybe other mechanisms not yet disclosed or a in short term by sales them

• Finally, the token will be listed on Maiar at $0.25, wih a price 50 times higher than the first round for NFT investors and 3.3 times higher than the one offered to non-NFT investors in the last round

Finally, used of funds :

But first, a short presentation of their partner Popugames. This company as for CEO and General Administrator 2 members of the Fity team. I looked up what games they had produced, i found a game named dragon coins on android It seems to be an app where-

But first, a short presentation of their partner Popugames. This company as for CEO and General Administrator 2 members of the Fity team. I looked up what games they had produced, i found a game named dragon coins on android It seems to be an app where-

-- you can watch ads to earn virtual coins which has a real money value, you can buy with money more coin and with them items in the game to get a bonus on coin reward. I don't think it can be called a GameFi as it is not related to crypto

I also found a mobile play to earn in development (I really like the art direction) on Elrond but there is very little info, and an app to simulate your farm on Maiar that looks pretty useful

Now, how 40% of a part of the money collected via the investor NFT sale was lost in only a few hours.

Let's dive into on-chain investigations

Let's dive into on-chain investigations

First of all, how i find Popugames wallet ?

I had a chat with the project manager on their telegrams, after questioning the choice of tokenomics by the team to create a healty growth the project manager answered me this :

I had a chat with the project manager on their telegrams, after questioning the choice of tokenomics by the team to create a healty growth the project manager answered me this :

I managed to find the wallet of the winner of the battle of the returns (1), the herotag of the wallet is @popugames (2)

By searching on the explorer, I found the wallet that received the funds from the NFT sale for early investor (1), we can see that it received a Fity NFT from a smart contract and then 220 EGLD (2)

110 EGLD will be sent to the popugames wallet, and his owner seemed to decide to make trading and farming with this liquidity

I detailed all this in a google form with a link to all the transactions :

docs.google.com/spreadsheets/d…

I detailed all this in a google form with a link to all the transactions :

docs.google.com/spreadsheets/d…

In short, it used 90 EGLD to fomo on the exploding ZPAY. After 1 close positive trade, it managed to buy the top and sell the low 2 times in a row resulting in a 40% loss of the initial sum, 55 EGLD remainin.

To give you an idea, in 15min TF here is a summary of his trades :

To give you an idea, in 15min TF here is a summary of his trades :

The remaining 20 EGLD will be used to buy #ITHEUM in price discovery, 20 $EGLD will be added to put this in LP. Everything will be withdrawn on May 11th when the all market crashes with a loss of ~8,5 EGLD

Only 66 EGLDs left out of the initial 110 received in this wallet.

Only 66 EGLDs left out of the initial 110 received in this wallet.

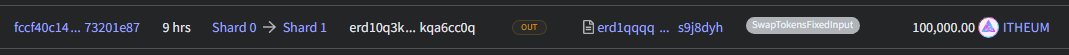

Yesterday, Popugames using funds that they directly received from presale wallet treasury to buy Cantina Lottery Ticket :

After the last round of presale, the treasury wallet send 102,4 EGLD to the @popugames wallet of the 256 egld raised

After the last round of presale, the treasury wallet send 102,4 EGLD to the @popugames wallet of the 256 egld raised

This is exactly 40% of the amount raised in this round.

If you remember the graph of the use of the funds raised, 60% dev, 20% LP, 20% marketing some might think it's money for LP and marketing but there's nothing to tell us that it's not just 40% of the money for development--

If you remember the graph of the use of the funds raised, 60% dev, 20% LP, 20% marketing some might think it's money for LP and marketing but there's nothing to tell us that it's not just 40% of the money for development--

-- so there are no assumptions or conclusions to be drawn

Back to the point, when the funds were received, the Popugames wallet did not have the funds to buy their Cantina tickets

How do we prove it? Well, let's go back in time and reverse the last transaction.

How do we prove it? Well, let's go back in time and reverse the last transaction.

The last 10 transactions are summarized below, a small explanation to know in which way read the excel : (1) funds before the (2) transaction = (3) funds after transaction.

so 17,95 + 102,4 = 120,35 EGLD

docs.google.com/spreadsheets/d…

so 17,95 + 102,4 = 120,35 EGLD

docs.google.com/spreadsheets/d…

For the wallets that received the 2950 USDC from part of the sale of the 80 EGLD out of the 102 EGLD received from the presale treasury wallets, it is exactly the same. I don't detail it, but if necessary I can prove it in the same way.

Not to mention the 167 EGLDs already sent for round 1 and the NFT sale, which are missing from the wallet. I have my own idea of where they went, but giving you the full UTXO detail of the wallet from these payments would be a daunting task without automated tools.

In total, of the 63 EGLD sent or spent by Popugames of the 102 EGLD received from the wallet treasury, about 60 will have been used to buy lottery tickets or NFTs from Cantina Launchpad

We can therefore hypothesize that the funds sent to Popugames (headed by the project manager of fity and whose company seems to be developing the promised play to earn) is a payment for their services,--

--but at the moment they are mostly used to invest or trade to make more money, rather than to pay the development costs of the game (whether this is why they received the funds ofc).

Last point of this trade, Popugames and wallets in the names of team's members bought fity presale tokens :

Back to the Popugames wallet, we can see that it has 9500 Fity tokens, how did they get there ?

We can find the reception of 5000 tokens on page 3, received from the smart contract dedicated to round 2

For the others, page 7 and 8, from the SC of the first round

We can find the reception of 5000 tokens on page 3, received from the smart contract dedicated to round 2

For the others, page 7 and 8, from the SC of the first round

Now let's analyze the time of reception of the tokens :

We can see that 4 packs of 500 tokens have been received between 17h25 (1) and 17h28 (2)

However the presale opened at 18h

We can see that 4 packs of 500 tokens have been received between 17h25 (1) and 17h28 (2)

However the presale opened at 18h

So they were bought before, we can make the hypothesis that it is a test of smart contract to check that everything worked. In that case, i don't understand why buy 4 packs of tokens, one would be enough, but maybe it's specific to the SC and I'm not a developer to understand it

Well, if they are tokens sent in excess in order to test the SC, it was necessary to recover them.

As a reminder, this is round 2 for investors without NFT, so 200k tokens must be available.

We can see two incoming transactions with tokens, 1k and 199k, no excess

As a reminder, this is round 2 for investors without NFT, so 200k tokens must be available.

We can see two incoming transactions with tokens, 1k and 199k, no excess

This wallet has bought tokens that were supposed to be sold before everyone, 1% less for the investors of this round.

The 6 others packs were bought during the presales between 18h00'54" and 18h01, another 1,5% in less.

The 6 others packs were bought during the presales between 18h00'54" and 18h01, another 1,5% in less.

For the 9 other packs bought in round 1 on page 7/8, they were all bought during the presale between 15:01 and 15:04, did they test the SC this time ?

well no, 200k token were received by the SC then the presale started directly at 15h.

well no, 200k token were received by the SC then the presale started directly at 15h.

For tokens purchased before the presale, although these may have been purchased in order to test the smarts contracts of presale, but they have still not been returned to the main wallet of the project holding all the unreleased tokens

So it is necessary to track them until the listing and check if they are sent back to the right wallet, or used for other purposes.

The project having submitted to the investors precise tokenomics and the tokens allocated to the team being locked during one year then released--

The project having submitted to the investors precise tokenomics and the tokens allocated to the team being locked during one year then released--

--periodically, not to respect it could reach the trust carried by the investors to the members of the team.

Now other wallets that are linked to the names of the team members:

This is more touchy because I don't want to show their identity, so I will try to prove the facts by revealing as little as possible about them.

This is more touchy because I don't want to show their identity, so I will try to prove the facts by revealing as little as possible about them.

I would like to point out that all the following is based entirely and only on public information and without OSINT or other methods of this type, only the blockchain, Elrond API and the information published on the Fity website

All the information to prove my statements will be either present on this thread and/or in a document detailing the origin of the tokens buyed in a more synthetic way posted below

First wallet who own 4500 Fity (1) :

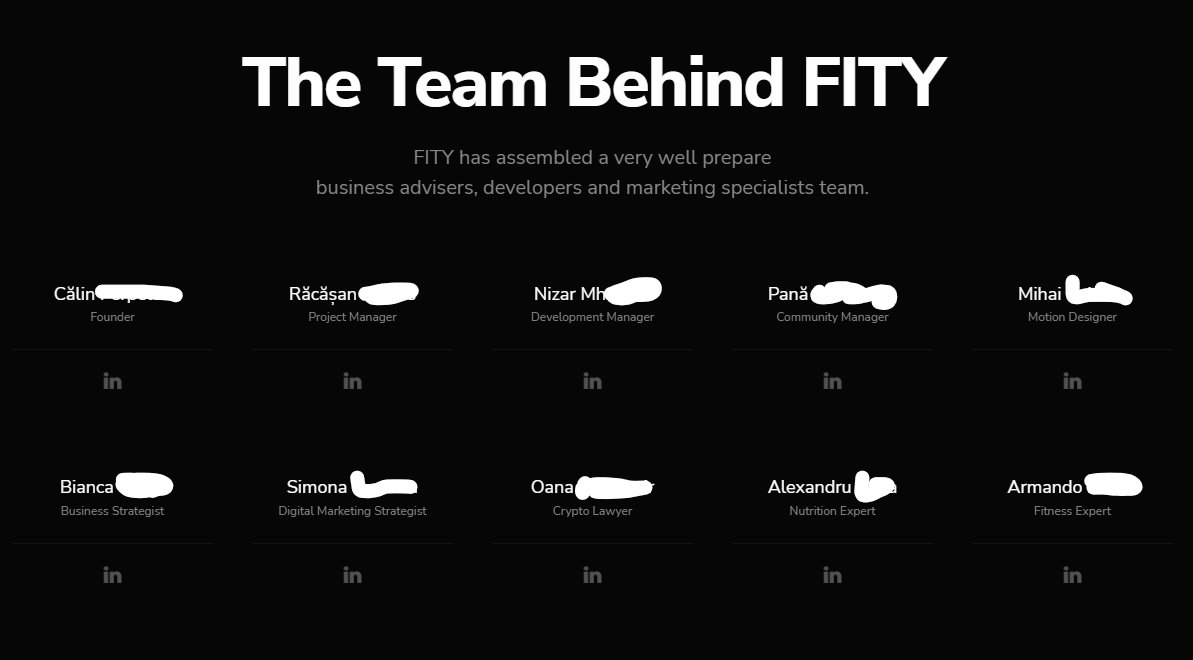

The herotag of this wallet is nizarmh.elrond (2), I hypothesize it is related to one person of the team in this list of members (3).

All these tokens were purchased with funds received from Popugames

The herotag of this wallet is nizarmh.elrond (2), I hypothesize it is related to one person of the team in this list of members (3).

All these tokens were purchased with funds received from Popugames

Second wallet who own 8500 Fity (1)

The herotag of this wallet is racasan.elrond (2). I hypothesize it is related to one person of the team in this list of members (3).

3k token were purchased during presale 1 with NFT investors and funds received from Popugames

The herotag of this wallet is racasan.elrond (2). I hypothesize it is related to one person of the team in this list of members (3).

3k token were purchased during presale 1 with NFT investors and funds received from Popugames

Third wallet who own 1500 tokens (1) :

The herotag of this wallet is axel4ro97.elrond (1). I hypothesize that it is related to this person of the team who have almost the same username on Telegram (2).

The herotag of this wallet is axel4ro97.elrond (1). I hypothesize that it is related to this person of the team who have almost the same username on Telegram (2).

A purchase of 500 tokens was made off-presale but was returned directly to the wallet treasury, this really looks like a SC test

Another portfolio is linked to this member, I will detail this in the excel below when i will finish this thread, so it comes. All transactions and herotag are sourced, there is other information that I have not explained so feel free to have a look

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

I wouldn't make any negative assumptions about what these tokens are intended for. There may be many explanations that would justify this : they will be returned later once the presale is finished, intended for future giveaways--

--or I missed an on-chain element hidden by the complexity of the analysis that would justify all this.

I'm just pointing out the facts : about 1% of the tokens intended to be distributed to investors have been bought by wallets linked by herotag to the names or usernames of some team members and they still hold them.

So I leave the floor to Fity or Popugames if they want to bring justifications that would explain everything that has been presented here. Let's make this analysis a debate and not an attack, which by the way it is not because I have only noted facts based on public information.

All this thread is only committed to me and me alone, if I made mistakes on the on-chain part or the analysis of the project, if some things are not precise, etc etc, don't hesitate to correct me or to ask me questions.

I do not impute in any way Fity in the management of the funds of Popugames, it is not the same company even if they are partners and that two of the members direct this company.

It's not their wallet I'm talking about, but the one of Popugames which received funds from the presale's treasury, if this is a payment for their services, I have no right to judge subjectively what they have the right to do or not with. I have related only the facts

As for the wallets linked to the members of the project, well I ask them the question, free to answer on the reasons of their detention on theses wallets or not.

Now let's get out of the analysis and talk crypto in general :

A project decides itself of its tokenomics, the price of the presale, the ROI to the listing, the vesting of the tokens etc. Any project or their members who buy their own token, comes back to have chosen what ROI--

A project decides itself of its tokenomics, the price of the presale, the ROI to the listing, the vesting of the tokens etc. Any project or their members who buy their own token, comes back to have chosen what ROI--

-- they could make on it and can unbalanced the tokenomics presented. So certainly, this can show some confidence in their own projects and their ability to carry it out. But a project member does not start with the same information as an investor, so there is an imbalance.

I am not qualified to speak about the legality and about regulation of such a practice and honestly, I don't care. But morally it is something that can be debated.

It's the same when it comes to cash management, the whole crypto sphere got offended--

It's the same when it comes to cash management, the whole crypto sphere got offended--

--When it learned that many projects were far too exposed to UST and criticized their money and risk management. Nothing illegal, especially in a legal limbo like crypto. But morally, there is debate.

An investment is first of all a story of trust between the investor and the company, the project or others. I think that the crypto ecosystem is too easily put in degen mode, if it remained only investors,--

--it would be one thing, but if the projects in which we invested in degen mode also plays the burnt heads, we repeat the same mistake as the financial institutions that we criticize all day long for their unlimited money board printing

Thanks who made it this far, this is the end of the thread, and damn it's long, I'm going to quote RT a reader thread because it's not possible.

Sorry for the broken promises of publication, this whole investigation has been full of twists and turns, I've only slept 7 hours in the last 4 days to get this done (as fast as I could and hopefully not to the detriment of quality) so I'll say goodnight !

• • •

Missing some Tweet in this thread? You can try to

force a refresh