$GLP will transform the Defi ecosystem. Here's a 🧵 on why.

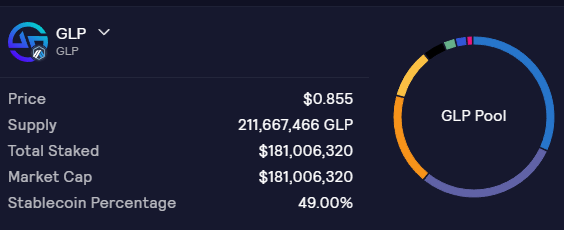

First, some context on what $GLP is. GLP is a token asserting partial ownership of $GMX's liquidity pool. You can mint GLP by depositing funds into the GMX liquidity pool and redeem GLP for a share of funds in the liquidity pool.

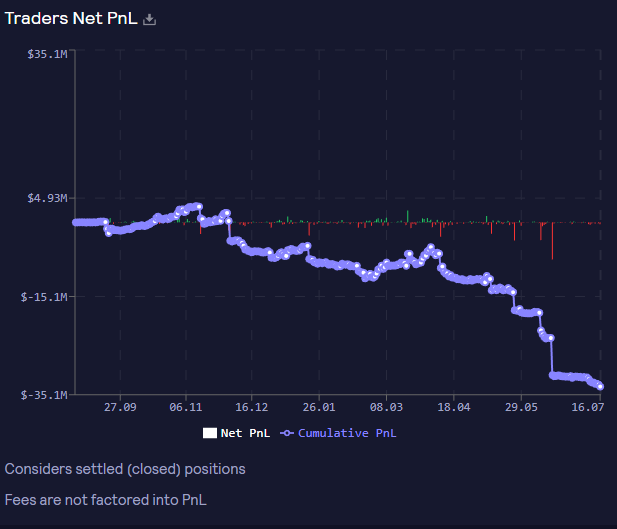

GMX deploys the capital in its liquidity pool, and uses it to provide margin for leverage traders. Liquidity providers (GLP owners) profit when traders are unprofitable, and lose when traders are profitable.

One of the things so attractive about $GLP is how it provides #RealYield to its users. Instead of just printing new tokens, all yield paid out to GLP owners comes from trading fees and trader losses on GMX.

The main upside of this is that most traders are astoundingly unprofitable, and their losses are able to produce great yields for their counterparties. This is shown pretty well by this chart of trader P&L over time.

The best part? The GMX liquidity pool, while comprised of a few different assets, is composed of roughly 50% stablecoins -- meaning the yield LPs are earning is earned largely from stables in an automatically hedged portfolio.

Some protocols like @UmamiFinance are taking this one step further, creating delta neutral positions on top of GLP -- in turn generating up to 20% yield on USDC!

@UmamiFinance It's important to note a few things about this yield -- first, it will likely decrease in the future as more depositors take positions with Umami.

@UmamiFinance Second, no, it is not like Anchor and UST. This is real yield, earned from a business with real cash flows. Anchor was a Ponzi -- this is an investment.

@UmamiFinance GLP's deep pools of liquidity also present the opportunity to address the liquidity issue facing many new protocols -- especially in bear markets, even great protocols often don't have enough TVL to produce a long-term sustainable ...

@UmamiFinance ... project (eg. insufficient deposits into Dopex SSOV vaults).

@UmamiFinance As it grows, GLP can fix this by renting liquidity to other protocols, potentially for an even higher yield than what it earns now as a perp exchange.

@UmamiFinance What are some risks inherent in holding GLP?

@UmamiFinance 1) Market exposure. By holding GLP you are indirectly exposed to the basket of assets held in GMX's liquidity pool, so market downturns can hurt GLP's price.

@UmamiFinance 2) Smart contract risks. If the protocol is exploited, it would make sense that GLP would be the first thing hackers would go after. It's worth noting that GMX has been audited and that users can purchase smart contract insurance.

@UmamiFinance 3) Trader profits. While this is statistically highly unlikely, in the event of traders becoming hugely profitable, GLP's price would suffer as the value of the assets in the pool decreases in order to compensate traders.

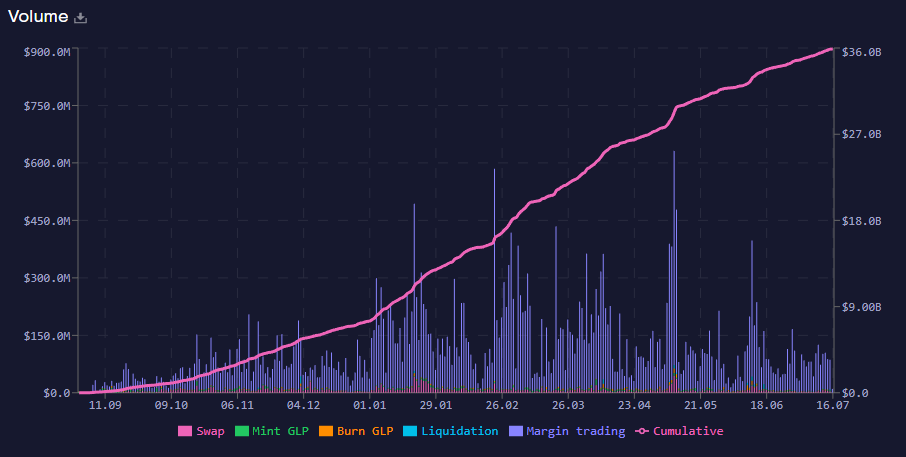

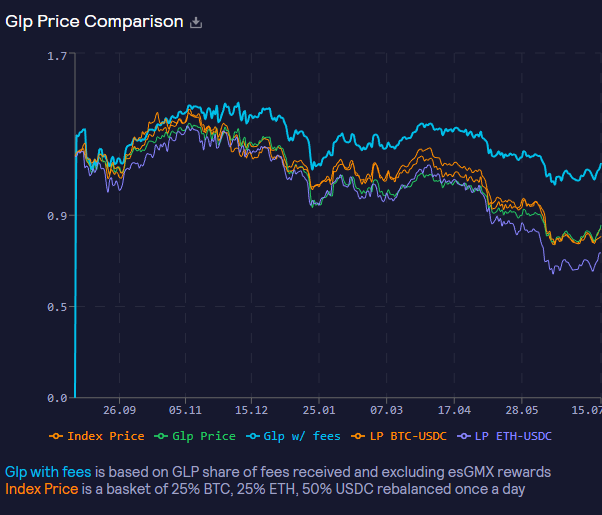

@UmamiFinance Here are some interesting charts about $GLP and $GMX, courtesy of stats.gmx.io:

@UmamiFinance GMX's volume over time:

@UmamiFinance $GLP outperforming other LP pairs. Notice the fees (yield users earn) is what drives $GLP's success.

@UmamiFinance Net P&L of traders on GMX over time:

@UmamiFinance @GMX_IO

@GBlueberryClub

@cryp_growth

@marvin89x

@defipleb

@tanoeth

I'm sure I missed many more great creators haha.

@GBlueberryClub

@cryp_growth

@marvin89x

@defipleb

@tanoeth

I'm sure I missed many more great creators haha.

• • •

Missing some Tweet in this thread? You can try to

force a refresh