Why does market net flow work so well? 🧵

Flow trades force market makers to take the opposite side of the trade, and hedge with the underlying. When we buy lots of calls, MMs have to sell calls, and buy shares to hedge.

That buying pressure can help an upward momentum. Cont.

Flow trades force market makers to take the opposite side of the trade, and hedge with the underlying. When we buy lots of calls, MMs have to sell calls, and buy shares to hedge.

That buying pressure can help an upward momentum. Cont.

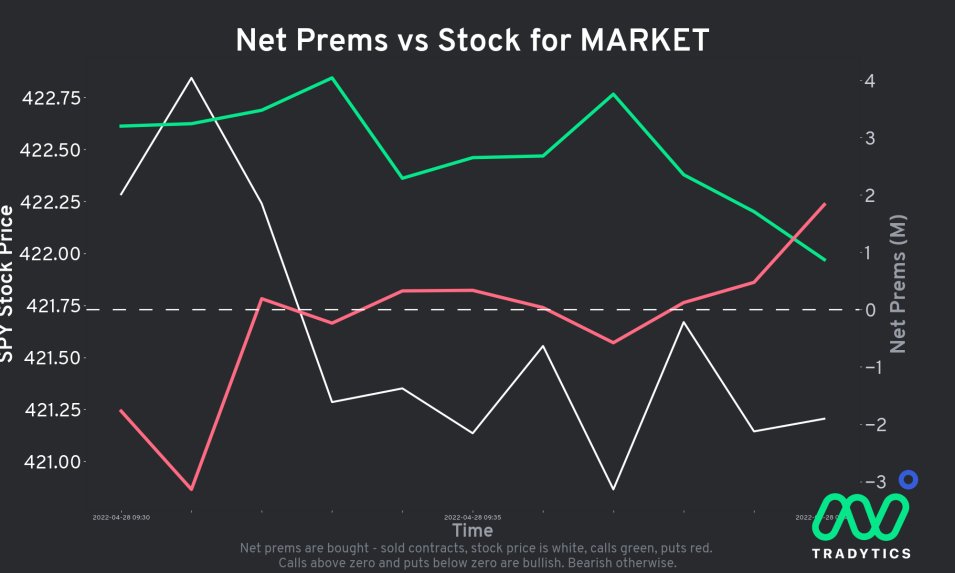

Since market net flow takes into account every single flow transaction, and also tries to identify the direction, it is basically letting us know what market makers will have to do!

That's one aspect of why it works, it provides us some help from MMs in short term.

That's one aspect of why it works, it provides us some help from MMs in short term.

The second reason why it works so well is that we have a filtering mechanism to filter out spreads, multi-legged trades, etc.

Therefore, the flow we consider is also mostly supposed to be directional flow i.e it shows traders sentiment.

Therefore, the flow we consider is also mostly supposed to be directional flow i.e it shows traders sentiment.

So we've got two things going in our favor.

1. MMs forced to hedge by going in the direction of what the market net flow is showing i.e more call buying by retail means more share buying by MMs.

2. Investor sentiment directly being surfaced in the chart by filtering bad flow.

1. MMs forced to hedge by going in the direction of what the market net flow is showing i.e more call buying by retail means more share buying by MMs.

2. Investor sentiment directly being surfaced in the chart by filtering bad flow.

That's a simple explanation as to why it is simple yet so effective, it just forces different parts of the market to go in the favor of what the chart is showing.

And that's very powerful. As long as we're identifying direction of the flow well, we're good. But that's also hard.

And that's very powerful. As long as we're identifying direction of the flow well, we're good. But that's also hard.

Hope this clarifies a couple of things. I'll talk more about the logic behind why it works and why it might not work on some days some other time.

Please share this thread so that others can understand the tool as well. It's not just some random stuff, there's logic to it.

Please share this thread so that others can understand the tool as well. It's not just some random stuff, there's logic to it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh