Amazing similarities between 3AC sales of GBTC and DCG purchases:

- 3AC accumulated position while, simultaneously, pledging the shares to Genesis

- DCG started buying

- DCG’s buys match 3AC’s unpledged amount that somehow was sold

WTF

- 3AC accumulated position while, simultaneously, pledging the shares to Genesis

- DCG started buying

- DCG’s buys match 3AC’s unpledged amount that somehow was sold

WTF

3AC had ~39mm GBTC as of 31Dec2020. ~24mm were pledged and now gone.

Where did the 15mm go?

Why does it seem to match DCG’s purchase program?

Where did the 15mm go?

Why does it seem to match DCG’s purchase program?

Some speculation and math based on public filings.

“I believe in coincidences. Coincidences happen every day. But I don't trust coincidences.”

- Garak

“I believe in coincidences. Coincidences happen every day. But I don't trust coincidences.”

- Garak

Start with the well-known 3AC position. ~39mm shares.

At one time this was worth >2 billion dollars

sec.gov/Archives/edgar…

At one time this was worth >2 billion dollars

sec.gov/Archives/edgar…

We know from 3AC filings that ~24mm were pledged to Genesis & EquitiesFirst. That collateral was liquidated. They no longer hold any. where did the 15mm go?

We also know GBTC flipped from a premium to a discount during this period.

So there was a lot of selling relative to BTC

We also know GBTC flipped from a premium to a discount during this period.

So there was a lot of selling relative to BTC

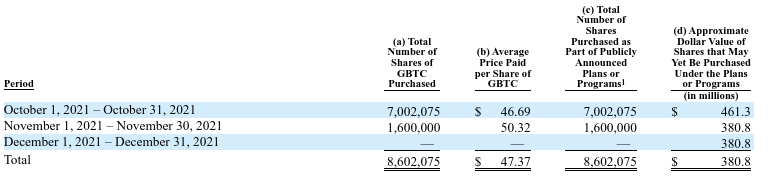

Eagle-eyed readers will see they bought 15mm through Jan 2022, and 18mm through March 2022.

The q1 filing is the latest available. They still had capacity to buy in q2.

15mm you say? Really?

Now let’s look at the pledge dates:

The q1 filing is the latest available. They still had capacity to buy in q2.

15mm you say? Really?

Now let’s look at the pledge dates:

On 1Jan2021 they had about 35mm unencumbered GBTC shares. Over the next year(ish) that number went to 0 while:

- they pledged 20mm

- DCG bought 15-18mm

net flat you say?

From recent Grayscale 10-Qs they own a lot. Accumulation in line with the disclosures.

- they pledged 20mm

- DCG bought 15-18mm

net flat you say?

From recent Grayscale 10-Qs they own a lot. Accumulation in line with the disclosures.

Did DCG just buy 3AC’s position? Did they coordinate off-market?

Why the one large pledge around the bitcoin high in Nov 2021? Consolidating a string of trades that financed the build-up?

It gets weirder. This old QCP blog post contains a gem:

qcpcapital.medium.com/market-update-…

Why the one large pledge around the bitcoin high in Nov 2021? Consolidating a string of trades that financed the build-up?

It gets weirder. This old QCP blog post contains a gem:

qcpcapital.medium.com/market-update-…

Look at the change in 3AC’s GBTC position during 3Q2020

They bought 18mm GBTC and then pledged most of that back to an affiliate of the issuer for cash.

The first 13G was filed mid 2020 so the position can’t be too much older.

WTF?

(the red box is from the blog post)

They bought 18mm GBTC and then pledged most of that back to an affiliate of the issuer for cash.

The first 13G was filed mid 2020 so the position can’t be too much older.

WTF?

(the red box is from the blog post)

How old?

269mm shares as of 31Dec2019 at a price ~$9 so the 5% reporting threshold is only $125mm. they didnt file.

For end-2020 number is 639mm*32*5%=$1B

Action was 2020 as position more than 10x. When price only 3x.

Didn’t file for 2021 so had less than 692*5%=34.6mm shares

269mm shares as of 31Dec2019 at a price ~$9 so the 5% reporting threshold is only $125mm. they didnt file.

For end-2020 number is 639mm*32*5%=$1B

Action was 2020 as position more than 10x. When price only 3x.

Didn’t file for 2021 so had less than 692*5%=34.6mm shares

GBTC was trading at a premium then. Meaning they probably:

- buy BTC

- put BTC into GBTC

- get 1 fresh GBTC

- pledge GBTC for cash at/above par

You can loop that with minimal initial capital. The constraint is Genesis’ access to funding and willingness to fund.

- buy BTC

- put BTC into GBTC

- get 1 fresh GBTC

- pledge GBTC for cash at/above par

You can loop that with minimal initial capital. The constraint is Genesis’ access to funding and willingness to fund.

maybe 3AC’s position came from nowhere

looped small initial capital through that

turbo-leveraged long financed by DCG.

3AC was talking a lot about this. ~time of this tweet they pledged about 700mm worth of GBTC

the shilling looks kicked off ~5Jan21

looped small initial capital through that

turbo-leveraged long financed by DCG.

3AC was talking a lot about this. ~time of this tweet they pledged about 700mm worth of GBTC

the shilling looks kicked off ~5Jan21

https://twitter.com/zhusu/status/1456054085472325633

And BTW DCG changed their accounting treatment for these assets during 2021.

Compare 2020 and 2021 accounting policies:

Compare 2020 and 2021 accounting policies:

Although their accounting policies are odd overall. Taken from a different Grayscale trust’s docs: they didn’t think the Bitcoin and Ethereum markets were active and significantly-observable as of mid 2021. So who knows what they are doing

BTW note the subtle Solana shade too

BTW note the subtle Solana shade too

Those are the US-entity docs. We also know Genesis novated their 3AC deals offshore in mid 2020. Why was that? This passage from the 3AC “big doc” has a bit of an odor to it now.

Anyway, whatever ridiculous accounting treatment was used:

when GBTC hit 50 this position was worth nearly 2 billion dollars against likely-not-big equity.

3AC maybe sold, DCG definitely bought.

3AC were Hwang-style billionaries w/ DCG playing the CS role

when GBTC hit 50 this position was worth nearly 2 billion dollars against likely-not-big equity.

3AC maybe sold, DCG definitely bought.

3AC were Hwang-style billionaries w/ DCG playing the CS role

Except GBTC is now trading roughly where it was in 2020. Net of management fees that position should be down huge because of the leverage.

After the Terra weekend GBTC hit the same level it was at in 2020.

10x long, 2% mgmt fee, 2yr = down 40% before other losses

After the Terra weekend GBTC hit the same level it was at in 2020.

10x long, 2% mgmt fee, 2yr = down 40% before other losses

3AC was probably already turbo-insolvent if properly magin-called

There is an argument they were also an affiliate of DCG

@fintechfrank this is why they pitched the trade

theblock.co/post/152735/th…

There is an argument they were also an affiliate of DCG

@fintechfrank this is why they pitched the trade

theblock.co/post/152735/th…

liquidators have 3AC trade records and emails. Should be straightforward for them to check if there is was anything untoward going on

These are securities. One of the involved parties owns both the issuer of those securities & registered broker-dealer loaning money against them

These are securities. One of the involved parties owns both the issuer of those securities & registered broker-dealer loaning money against them

They did the trades through TradeStation, a regulated US broker. That’d be easy to check too. Any collusion is, um, bad.

This stinks. It smells a bit like an Nigerian barge. If you dont get the joke read the link

I never expected to tag @bethanymac12

forbes.com/2004/09/20/cx_…

This stinks. It smells a bit like an Nigerian barge. If you dont get the joke read the link

I never expected to tag @bethanymac12

forbes.com/2004/09/20/cx_…

Again verifying this theory is near-trivial because:

- 3AC’s liquidators have their docs

- Genesis is a registered broker-dealer

- Grayscale issues registered securities

- 3AC traded through an arms-length US broker

Surely the regulators can provide some clarity on this one.

- 3AC’s liquidators have their docs

- Genesis is a registered broker-dealer

- Grayscale issues registered securities

- 3AC traded through an arms-length US broker

Surely the regulators can provide some clarity on this one.

Oh, and TradeStation’s Japanese parent company owns a crypto exchange, VC firm, and all manner of stuff. On a cursory look there are no links.

If someone wants to waste their time there is a journey waiting to be taken.

If someone wants to waste their time there is a journey waiting to be taken.

Am also reminded grayscale, then called secondmarket, got in trouble for "activities that could

influence artificially the market for the offered security" in 2016. this settlement is related to why the current setup is so odd.

"legal analysis" from the SEC feels relevant here

influence artificially the market for the offered security" in 2016. this settlement is related to why the current setup is so odd.

"legal analysis" from the SEC feels relevant here

• • •

Missing some Tweet in this thread? You can try to

force a refresh