How to get URL link on X (Twitter) App

https://twitter.com/PaxosGlobal/status/1625241102268657675The sec's disclosure and surveillance scheme for securities is pretty good. This doesn't mean all frauds get caught or blocked of course.

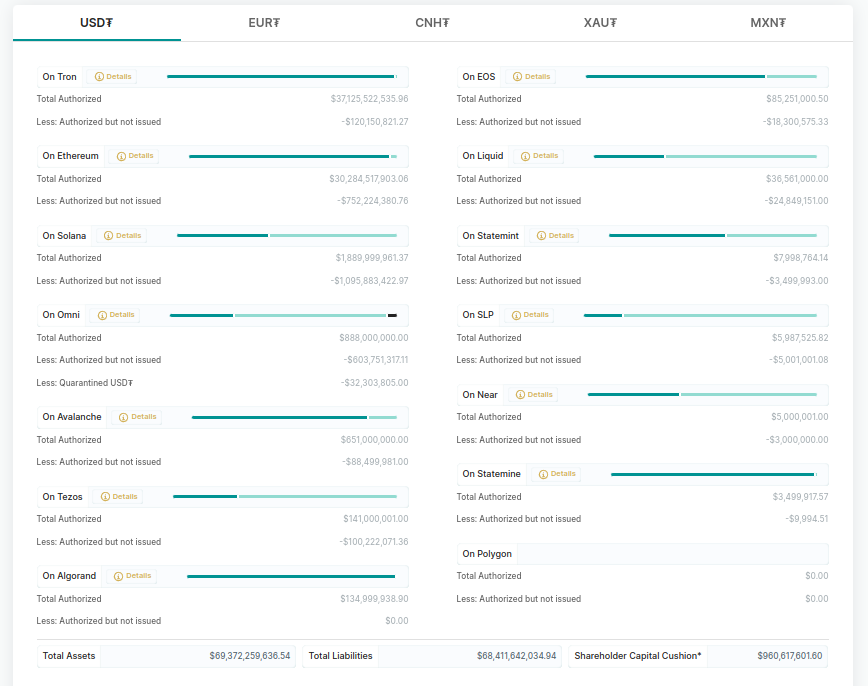

https://twitter.com/emilyjnicolle/status/1625207064149561346start with tether. they list all the chains they are issued on and call out one bridge that is outside their control.

https://twitter.com/DataFinnovation/status/1607675813721444353to me the statement clarifies that the pegged busd was at least part of the issue.

https://twitter.com/q2k_coke/status/1605682936522711043first: binance has fixed the tusd-on-bnb-geth backing.

https://twitter.com/Dogetoshi/status/1622088935336824833we've known since 2019 that the ideal form of trustless bridge is impossible.

https://twitter.com/utxo__/status/1622073477007302657si noninterest deposit balances were flat until the end of 2022

https://twitter.com/ByKyleCampbell/status/1621568815044624385Silvergate was funded by

https://twitter.com/DataFinnovation/status/1604423045564682241

https://twitter.com/cryptohippo65/status/1603574228216946690apols its a bit technical. its not ok to say "the binance chains dont look like real blockchains and fail basic token history audits" without proper evidence

https://twitter.com/SiegeRhino2/status/1593124406121082880second: receiving funds from random shell co is at least an admin problem for you if that shellco is later found to have done things wrong.

https://twitter.com/Bitfinexed/status/1402955175615213569

https://twitter.com/DataFinnovation/status/1555774613225107457

https://twitter.com/blockhead_co/status/1591285794177966080Here are early filings for the company