"DJ Billionaire Investor Nicolas Berggruen to Buy Hearst Estate in Beverly Hills" Sept. 2021

sharecast.com/news/market_re…

"The pending sale of Beverly House caps years of legal wrangling over the future of the property, which was featured in the horse-head scene in "The Godfather"

sharecast.com/news/market_re…

"The pending sale of Beverly House caps years of legal wrangling over the future of the property, which was featured in the horse-head scene in "The Godfather"

"The winning offer is up from the $47 million stalking-horse bid by Mr. Berggruen's investment vehicle, Berggruen Holdings Ltd., that set the floor price for the property at auction, according to court papers. "

https://twitter.com/ppeketsi/status/1547521754599415811

"Leonard Ross, who had lived on the property since the 1970s, put a holding company he controls that owns the property into chapter 11 in November 2019 to avoid a foreclosure auction. "

dailymail.co.uk/news/article-7…

dailymail.co.uk/news/article-7…

"The property has also variously — and increasingly — been a credit line for Ross, who bought the estate at 1011 N. Beverly Drive in 1976 for less than $2 million, according to sources and court documents."

Isn't that the Bel Air area? #Tunnels 🙄

archive.ph/OrRfn

Isn't that the Bel Air area? #Tunnels 🙄

archive.ph/OrRfn

Just 10 minutes from the Bel Air Country Club

https://twitter.com/artisbrutal2021/status/1487115244665200652

Soho House West Hollywood? Owned by Ron Burkle..

archive.ph/Tuls0

"He was holding court, surrounded by admiring attendees of Michael Milken’s annual Global Conference."

archive.ph/Tuls0

"He was holding court, surrounded by admiring attendees of Michael Milken’s annual Global Conference."

https://twitter.com/artisbrutal2021/status/1549779316757696514

"Ross is a figure of intrigue for a dozen lawyers and real estate agents..

“I get the sense,” one broker said, “that he has never thought of himself as under the gun.”"

“I get the sense,” one broker said, “that he has never thought of himself as under the gun.”"

"Agents took exception to Ross’ “Art Deco lounge,” which is modeled after Hugh Hefner’s shuttered Los Angeles nightclub, Touch. One agent unfavorably compared it to an “80s cocaine den.”"

Hugh Hefner🙄

Hugh Hefner🙄

https://twitter.com/artisbrutal2021/status/1487114057236815879

"According to a 1993 Los Angeles Times profile, Ross went to UCLA Law School where he graduated first in his class and was roommates with famed OJ Simpson attorney Robert Shapiro "

Small world

Small world

https://twitter.com/artisbrutal2021/status/1493308506648326146

"Ross then went into private practice with Barry Marlin.

Marlin subsequently partook in what one FBI affidavit termed the “biggest Ponzi scheme in the nation’s history,” defrauding more than 1,000 investors, according to a 1979 account in the New York Times...

Marlin subsequently partook in what one FBI affidavit termed the “biggest Ponzi scheme in the nation’s history,” defrauding more than 1,000 investors, according to a 1979 account in the New York Times...

Marlin went to federal prison in 1978, and while Ross never faced criminal prosecution, he was subject to civil lawsuits claiming investor fraud.

Those lawsuits, according to the L.A. Times profile and those familiar with Ross’ career, were actually a windfall for the attorney"

Those lawsuits, according to the L.A. Times profile and those familiar with Ross’ career, were actually a windfall for the attorney"

Beverly House most famous owner was publishing giant William Randolph Hearst.

The media mogul was given the property as a gift by actress Marion Davies in 1946

en.wikipedia.org/wiki/Marion_Da…

> Hearst Castle

The media mogul was given the property as a gift by actress Marion Davies in 1946

en.wikipedia.org/wiki/Marion_Da…

> Hearst Castle

https://twitter.com/artisbrutal2021/status/1524961759441801216

2017: "Stars Show Up for an Exclusive Soho House Science Talk

Gwyneth Paltrow and James Van Der Beek were among the guests at the Berggruen Institute discussion on the impact of technology on society."

hollywoodreporter.com/lifestyle/life…

🤔

Gwyneth Paltrow and James Van Der Beek were among the guests at the Berggruen Institute discussion on the impact of technology on society."

hollywoodreporter.com/lifestyle/life…

🤔

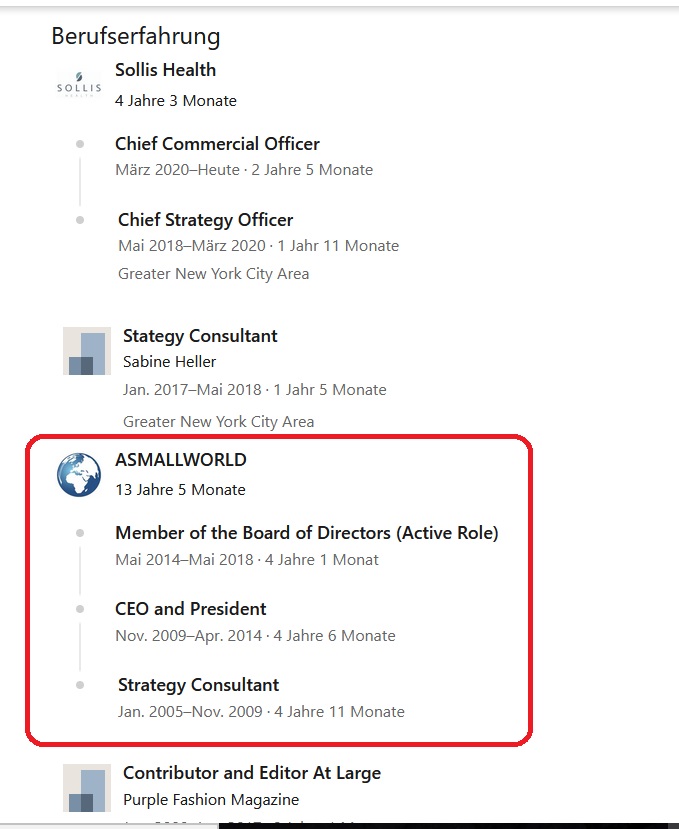

"Stars and scientists gathered at the West Hollywood Soho House ..where they listened to a conversation between Arati Prabhakar, former head of DARPA and a Berggruen Institute Fellow at Center for Advanced Study in the Behavioral Sciences at Stanford University, and John Markoff,

a columnist at the The New York Times and also a Berggruen Institute Fellow at CASBS."

John Markoff? Known for series of articles about the 1990s pursuit and capture of hacker Kevin Mitnick...

en.wikipedia.org/wiki/John_Mark…

John Markoff? Known for series of articles about the 1990s pursuit and capture of hacker Kevin Mitnick...

en.wikipedia.org/wiki/John_Mark…

https://twitter.com/artisbrutal2021/status/1522645207011012610

John Markoff > The Edge .. John Brockman, Jeffrey Epstein crowd

Here at THE EDGE SCIENCE DINNER 2003

edge.org/igd/1111

A list of the AI tech criminals in attendance.. too many to mention edge.org/event/the-edge…

Here at THE EDGE SCIENCE DINNER 2003

edge.org/igd/1111

A list of the AI tech criminals in attendance.. too many to mention edge.org/event/the-edge…

Markoff at THE EDGE "BILLIONAIRES' DINNER" 2002

edge.org/igd/1147

edge.org/igd/1147

https://twitter.com/pc_432/status/1202025390585200640

So.. I'm wondering what the well connected German Nicolas Berggruen wants with that Beverly House in the Bel Air location 🙄

https://twitter.com/artisbrutal2021/status/1549842718146404353

And now I'll do the thread on what actually lead me here #Sunak

• • •

Missing some Tweet in this thread? You can try to

force a refresh