#Capitulation is not well understood. It means massive selling, where the bulk of likely sellers give up, en masse.

It does not usually mean "the bottom".

It does not require a $VIX jump or spiking put/call ratio.

Mid-June has many examples. Here are some...

(Thread 👇)

It does not usually mean "the bottom".

It does not require a $VIX jump or spiking put/call ratio.

Mid-June has many examples. Here are some...

(Thread 👇)

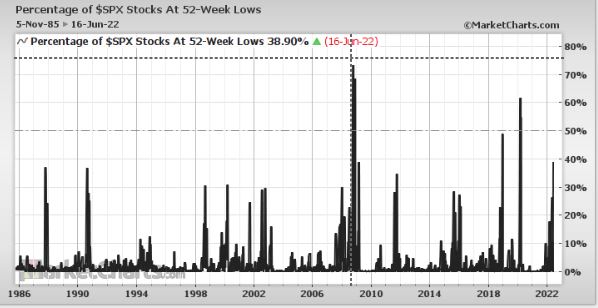

Capitulation example #1:

Spike in 52-wk lows

$SPX new lows hit 42% on June 16, closed at 39%. Only 16 lower readings since 1985.

Spike in 52-wk lows

$SPX new lows hit 42% on June 16, closed at 39%. Only 16 lower readings since 1985.

Capitulation example #3:

49% of $SPX stocks had declined 5+ consecutive days as of June 14. Only a couple other higher readings back to 1985.

49% of $SPX stocks had declined 5+ consecutive days as of June 14. Only a couple other higher readings back to 1985.

Capitulation example #7:

You can see capitulation visually via candlestick charting. Multiple massive bearish candles with gaps in between means no support. The waterfall decline is unrelenting selling. $SPX $SPY lost 12% in a week.

You can see capitulation visually via candlestick charting. Multiple massive bearish candles with gaps in between means no support. The waterfall decline is unrelenting selling. $SPX $SPY lost 12% in a week.

This is not an exhaustive list. There are many similar examples across indices. Feel free to share yours...

• • •

Missing some Tweet in this thread? You can try to

force a refresh