Lido DAO just rejected a $14m deal with @dragonfly_cap.

But, the deal was almost forced through by a mysterious whale who threatened to override the voting, despite public outcry.

🧵: With serious runway concerns brewing, what's in store for the future of $LDO and $ETH? 👇

But, the deal was almost forced through by a mysterious whale who threatened to override the voting, despite public outcry.

🧵: With serious runway concerns brewing, what's in store for the future of $LDO and $ETH? 👇

1/ In this thread I'll cover:

• What happened to Lido

• How a whale manipulated a key proposal

• The effect on $ETH itself

• Why DAOs are fundamentally flawed

• What happened to Lido

• How a whale manipulated a key proposal

• The effect on $ETH itself

• Why DAOs are fundamentally flawed

2/ Lido Finance is a liquid staking platform, offering liquidity for staked assets.

Liquid staking enables you to stake your assets and retain liquidity, without having to lock up your tokens.

This essentially allows you to use your staked assets to generate excess yield.

Liquid staking enables you to stake your assets and retain liquidity, without having to lock up your tokens.

This essentially allows you to use your staked assets to generate excess yield.

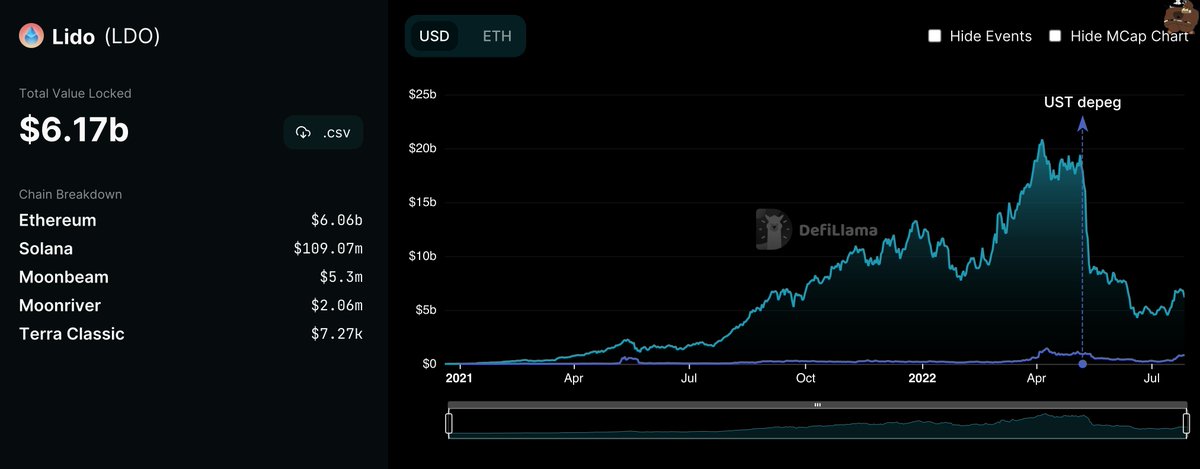

3/ There are a few liquid staking protocols, but @LidoFinance is by far the biggest with over $6.17b worth of assets deposited.

Of this $6.17b, 97% are $ETH deposits, making the platform extremely Ethereum dominant.

Of this $6.17b, 97% are $ETH deposits, making the platform extremely Ethereum dominant.

4/ Lido is set up as a Decentralised Autonomous Organisation (DAO), meaning governance power is distributed amongst the holders of the $LDO token.

Token holders can "participate in particular governance votes to further improve aspects of Lido".

More tokens = more power.

Token holders can "participate in particular governance votes to further improve aspects of Lido".

More tokens = more power.

5/ For example, Lido's treasury distributes funds to help develop and upgrade the Lido protocol to benefit both users and stakeholders.

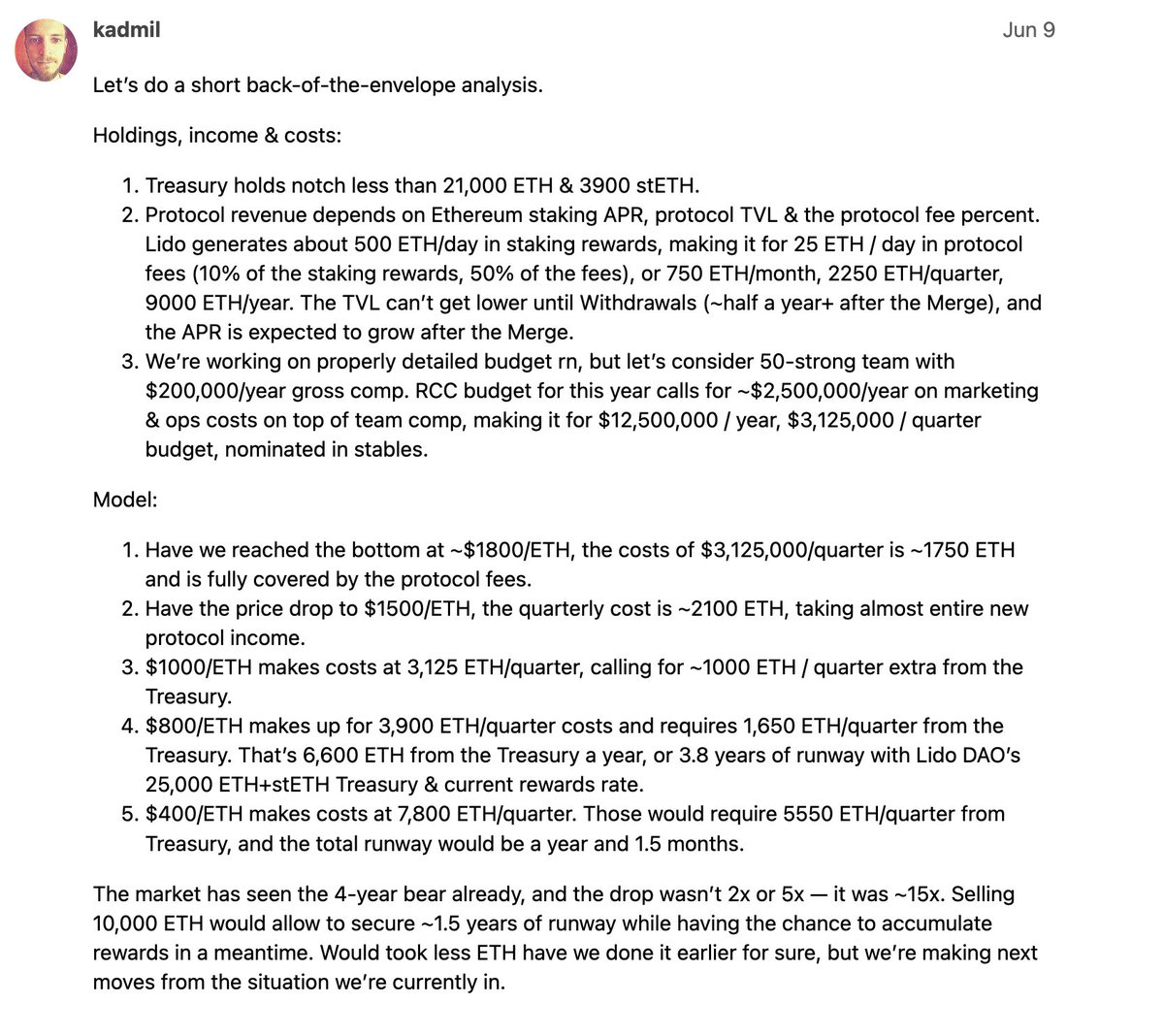

6/ However, the treasury's funds are denominated in $LDO, $ETH, and $stETH, meaning the protocol's runway is heavily reliant on asset price performance.

7/ There has been speculation that based on current spending rates, the protocol could be facing bankruptcy sometime in the future IF there's a substantial drop in the treasury's asset value (which is conceivable given current market conditions).

8/ After facing criticism on the forum, co-founder @cobie stated that “not selling $ETH to USD was an avoidable mistake. Lido should’ve sold ETH to USD gradually when ETH was higher”.

research.lido.fi/t/treasury-div…

research.lido.fi/t/treasury-div…

9/ The concerns regarding runway were acknowledged by the team, who introduced a new proposal as part of the 'Treasury Diversification Plan' on July 18th.

The proposal aims to 'secure ~2 years of operating runway for Lido DAO, in stable coins.'

research.lido.fi/t/treasury-div…

The proposal aims to 'secure ~2 years of operating runway for Lido DAO, in stable coins.'

research.lido.fi/t/treasury-div…

10/ A summary of the proposal:

• 20M LDO (2% of supply) to be sold by the DAO treasury at a purchase price equal to $29,043,051.43 in $DAI stable coin.

• DragonFly Capital to acquire 1%, or 10M LDO.

• Other partners to acquire the remaining 1%, or 10M LDO tokens.

• 20M LDO (2% of supply) to be sold by the DAO treasury at a purchase price equal to $29,043,051.43 in $DAI stable coin.

• DragonFly Capital to acquire 1%, or 10M LDO.

• Other partners to acquire the remaining 1%, or 10M LDO tokens.

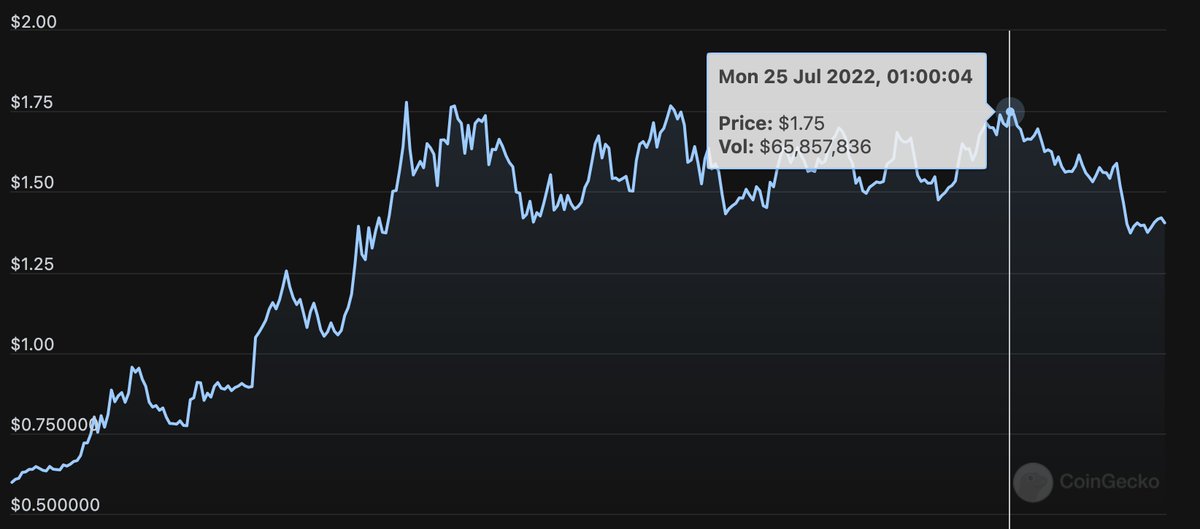

11/ Of the 20M $LDO set to be sold: 1% of LDO supply (10M) was to be sold to DragonFly Capital in exchange for 14,521,530 $DAI ($1.45 per LDO).

12/ At the time, this was roughly a 1.5x premium vs current market price.

However, due to a price surge related to the $ETH Merge narrative, the price of $LDO shot up to over $1.70.

However, due to a price surge related to the $ETH Merge narrative, the price of $LDO shot up to over $1.70.

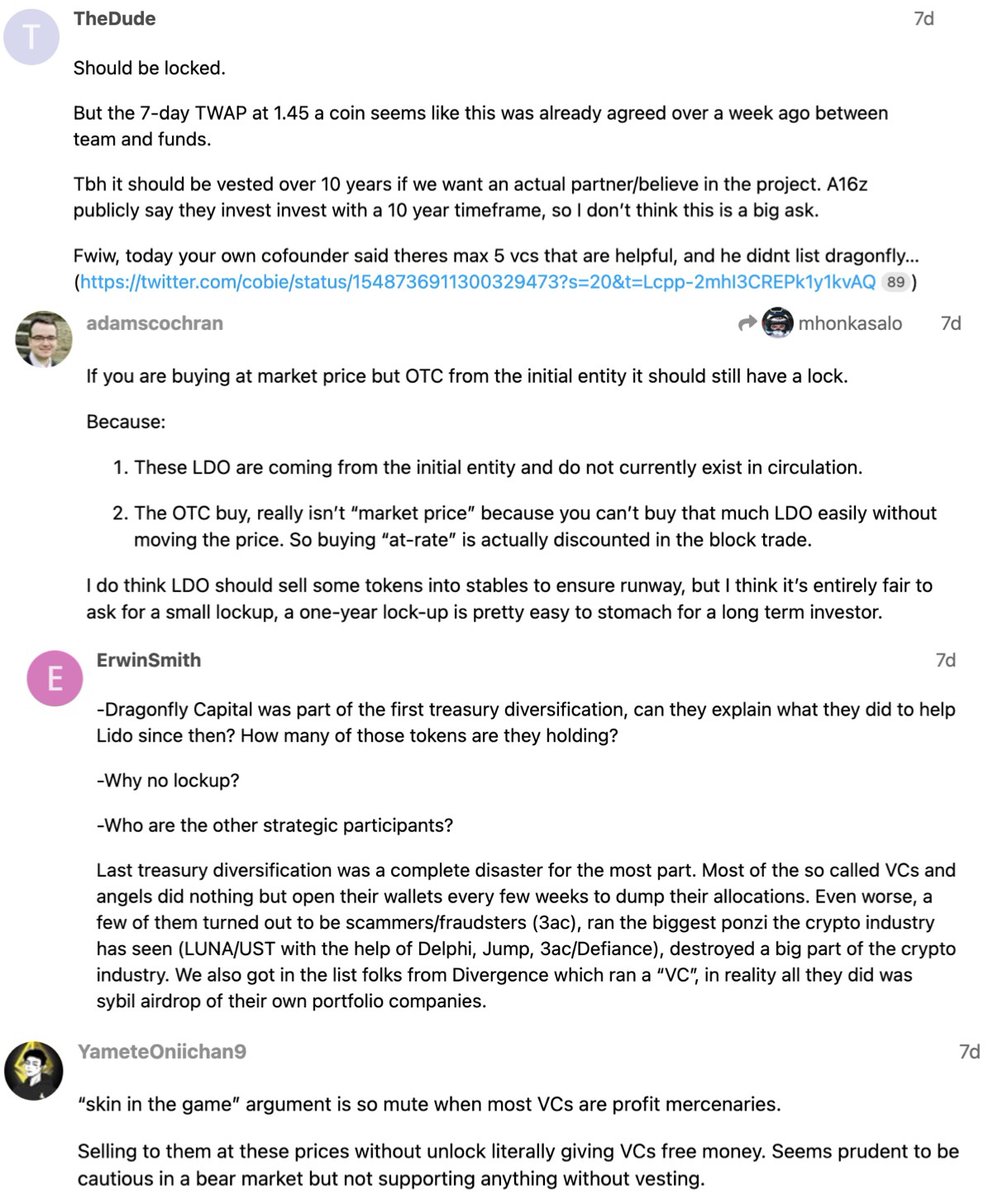

13/ Concerns started brewing amongst holders that if Dragonfly purchased these tokens (now at below market value), they would simply dump their tokens on the open market.

The proposal had no lockup clause, meaning Dragonfly would be free to sell tokens at their discretion.

The proposal had no lockup clause, meaning Dragonfly would be free to sell tokens at their discretion.

14/ Even @cobie agreed that "it doesn’t make much sense to me for there to be no lockup on tokens.”

A. Ramachandran (Dragonfly Partner), rebutted by saying that "it’s difficult for us to invest in illiquid token deals, hence the no-lockup structure of this deal.”

A. Ramachandran (Dragonfly Partner), rebutted by saying that "it’s difficult for us to invest in illiquid token deals, hence the no-lockup structure of this deal.”

15/ Nonetheless, On July 21, @LidoFinance commenced voting on the proposal, focusing on the 1% allocation for @dragonfly_cap.

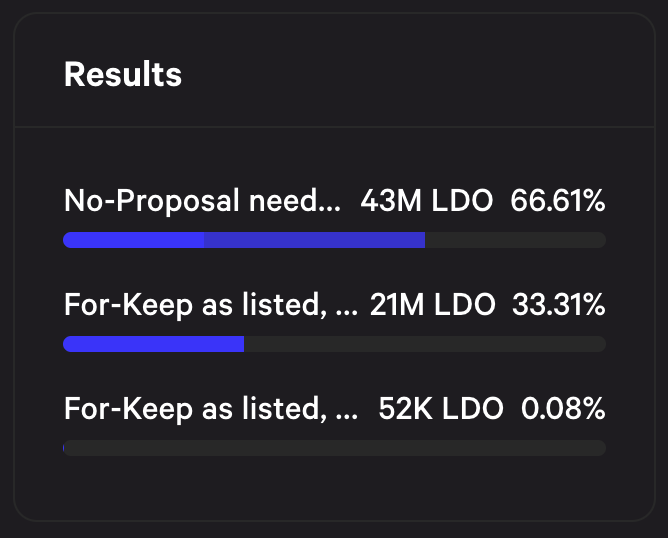

There were 3 options for voters:

• No-Proposal needs work

• For-Keep as listed, 1 yr lock up

• For-Keep as listed, no lock up

snapshot.org/#/lido-snapsho…

There were 3 options for voters:

• No-Proposal needs work

• For-Keep as listed, 1 yr lock up

• For-Keep as listed, no lock up

snapshot.org/#/lido-snapsho…

16/ Despite the "no" vote dominating in the proposal's early stages, an anonymous whale stepped in with a HUGE 15M $LDO vote, opting to continue the deal with NO lock up.

17/ The community was outraged that despite an (almost) unanimous consensus on the forums, one singular whale could simply swoop in and sway the voting.

https://twitter.com/HsakaTrades/status/1550347588066492418?s=20&t=90TWH9y2CVmYpbqjnbrZig

18/ Shockingly, @ASvanevik (@nansen_ai CEO) revealed that the whale was actually funded by none other than @SBF_FTX's @AlamedaResearch!

https://twitter.com/ASvanevik/status/1550366913251115008?s=20&t=FXxbhXgJ30GFHv22kTQybQ

19/ In another turn of events, the whale changed their vote from "For-Keep as listed, no lock up" to "For-Keep as listed, 1 yr lock up".

Still voting for the proposal to succeed, but instead with a 1 year lockup applied to Dragonfly's $LDO tokens.

Still voting for the proposal to succeed, but instead with a 1 year lockup applied to Dragonfly's $LDO tokens.

https://twitter.com/HsakaTrades/status/1550715471036616705?s=20&t=90TWH9y2CVmYpbqjnbrZig

20/ But, the vote was soon trumped, as another whale came to the rescue, voting 17M $LDO to cancel the proposal.

The proposal ended with 66.61% of the votes opting for "no".

The proposal ended with 66.61% of the votes opting for "no".

21/ Lido is now proposing to revisit discussions on the forum in order to issue a revised proposal via a "fresh vote."

https://twitter.com/LidoFinance/status/1551854477912702977?s=20&t=90TWH9y2CVmYpbqjnbrZig

22/ The situation draws many clear comparisons to the recent @solendprotocol saga, which highlighted some key issues regarding the degradation of the essence of decentralisation.

https://twitter.com/milesdeutscher/status/1538918950909919232?s=20&t=sksL7pC3j6dPk-wDQ8Z8eg

23/ Although the DAO model has the intention of decentralisation, the reality is that voting is still heavily manipulatable by whales.

999/1000 users could vote on an outcome, but if one singular entity holds more tokens (i.e voting power), the entire outcome is overridden.

999/1000 users could vote on an outcome, but if one singular entity holds more tokens (i.e voting power), the entire outcome is overridden.

24/ But, ideology aside, what does this situation mean for @LidoFinance specifically?

Remember, Lido is by far the biggest player in the liquid staking space, and with the $ETH merge touted for a September completion, it's set to be one of the biggest beneficiaries.

Remember, Lido is by far the biggest player in the liquid staking space, and with the $ETH merge touted for a September completion, it's set to be one of the biggest beneficiaries.

25/ With more $ETH upgrades on the way, and Lido seemingly set to capture this growth, it makes sense that the team has a long-term time horizon.

Thus, runway becomes crucial - and they need to find a solution in the meantime to sustain the protocol.

Thus, runway becomes crucial - and they need to find a solution in the meantime to sustain the protocol.

https://twitter.com/milesdeutscher/status/1550315295402668032?s=20&t=YK6YsqQUx5gCBYiz5h4bdg

26/ Since expenses are denominated in dollars, and the treasury's assets are still currently in $LDO, $ETH, and $stETH, then any substantial drop in the $ETH price would spell disaster for Lido's runway.

Meaning, the team has to make a choice whether to act now or later.

Meaning, the team has to make a choice whether to act now or later.

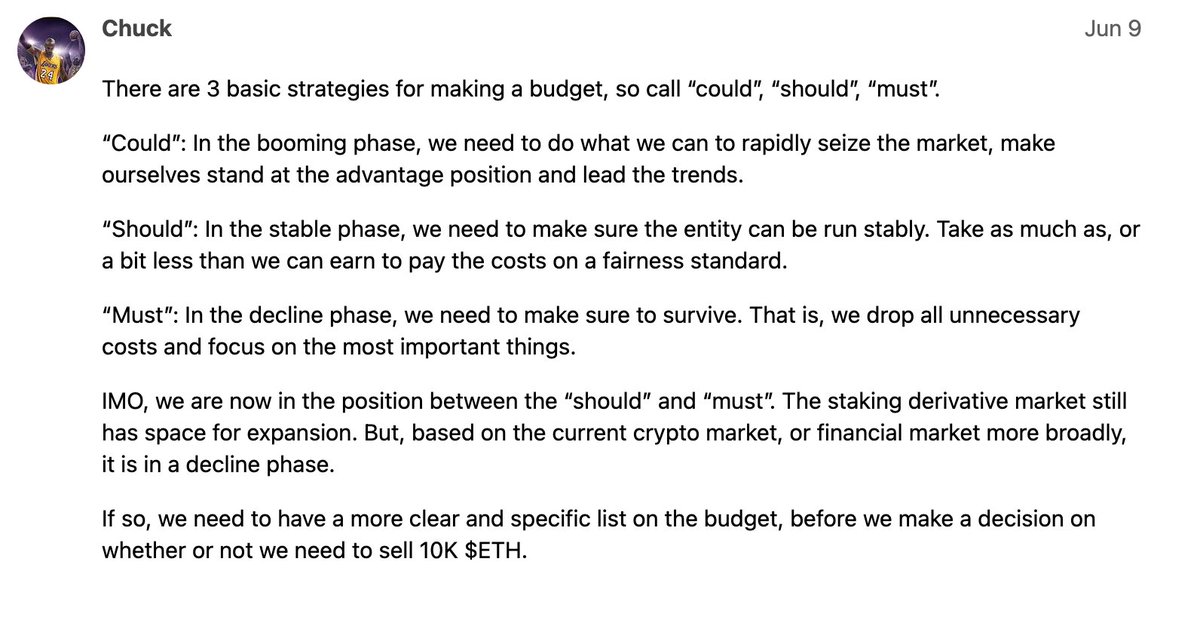

27/ Chuck (from the Lido forum) nails the plan down to 3 strategies for determining a budget: Could, Should and Must.

In terms of the effect on Ethereum itself, it seems as if Lido-specific issues won't have a significant impact on $ETH.

In terms of the effect on Ethereum itself, it seems as if Lido-specific issues won't have a significant impact on $ETH.

28/ The latest proposal was clearly an indication that the team wants to increase their dollar holdings, as they are serious about ensuring runway is secured.

I have faith that the Lido team will arrive at a decision which pleases all stakeholders.

I have faith that the Lido team will arrive at a decision which pleases all stakeholders.

30/ I'll add updates to this thread as the situation progresses, so make sure you have post notifications turned on if you don't already.

31/ If you enjoyed this thread, follow me @milesdeutscher for more.

Also, a Like/Retweet on the first tweet below would be much appreciated. 💙

Also, a Like/Retweet on the first tweet below would be much appreciated. 💙

https://twitter.com/milesdeutscher/status/1551957574320214023

• • •

Missing some Tweet in this thread? You can try to

force a refresh