Aptos is an exciting new blockchain developed by @AptosLabs, founded by former Meta (FaceBook) employees.

It's capable of powering 160,000 TPS, and has $350m of backing from FTX, Coinbase, a16z, Multicoin Capital and more.

🧵: A full breakdown of the new Layer 1: Aptos.👇

It's capable of powering 160,000 TPS, and has $350m of backing from FTX, Coinbase, a16z, Multicoin Capital and more.

🧵: A full breakdown of the new Layer 1: Aptos.👇

1/ In this thread, I'll cover:

• What is Aptos?

• The Tech

• Development

• Funding

• Ecosystem

• Where it fits in a competitive L1 landscape

• What is Aptos?

• The Tech

• Development

• Funding

• Ecosystem

• Where it fits in a competitive L1 landscape

2/ Aptos is a new L1, founded by former @Meta employees

@moshaikhs and @AveryChing.

They previously worked on the now-defunct Diem project by Meta Platforms.

@moshaikhs and @AveryChing.

They previously worked on the now-defunct Diem project by Meta Platforms.

3/ Diem (formerly known as Libra) was a permissioned blockchain-based stablecoin payment system.

The project was worked on by Meta for 2 years, before being abandoned in January 2022.

The project was worked on by Meta for 2 years, before being abandoned in January 2022.

4/ But, born from Diem was Move: A safe and reliable programming language which is now powering two new L1s: Sui (by @Mysten_Labs), and Aptos (by @AptosLabs).

5/ THE TECH

"Move" is aimed to solve the flaws of Solidity and EVM.

It is:

• Originally designed for Meta (FaceBook)

• Memory safe

• Quick for dev testing

• Expressive

• Home to both SUI and Aptos (up-and-coming L1s)

"Move" is aimed to solve the flaws of Solidity and EVM.

It is:

• Originally designed for Meta (FaceBook)

• Memory safe

• Quick for dev testing

• Expressive

• Home to both SUI and Aptos (up-and-coming L1s)

https://twitter.com/tracecrypto1/status/1544332560389607424?s=20&t=y6nibpOYWtYc4ArGxaRb3w

6/ TLDR: Don't fade Move (it's very impressive).

https://twitter.com/simplyianm/status/1546682656301219840?s=20&t=FA8q1ejVZ05zdrqawdwITw

7/ Aptos itself is defined as a high throughput and performance blockchain, which has a theoretical limit of TPS 160,000.

It's a POS blockchain, which harnesses the power of Move to implement the parallel execution of transactions via a BFT consensus.

medium.com/aptoslabs/the-…

It's a POS blockchain, which harnesses the power of Move to implement the parallel execution of transactions via a BFT consensus.

medium.com/aptoslabs/the-…

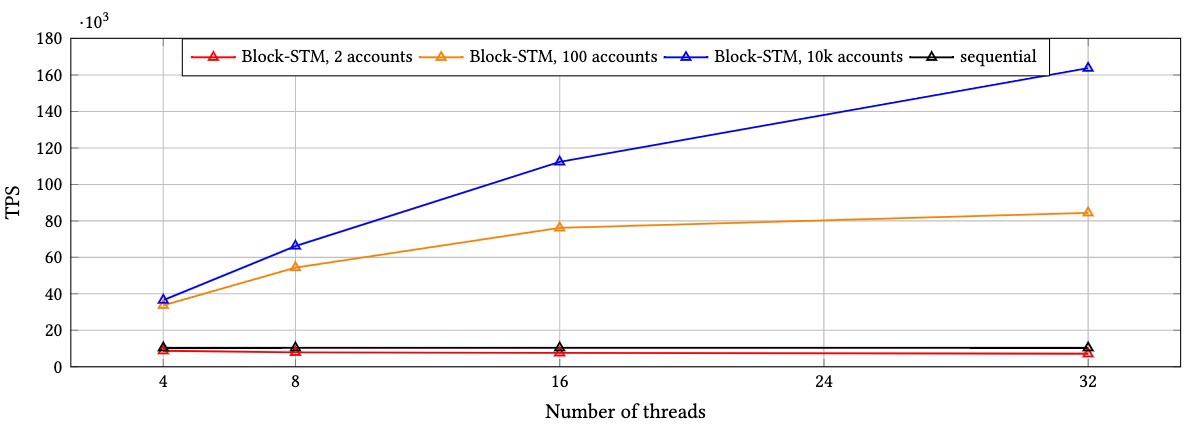

8/ @AptosLabs uses a Block-STM execution method, capable of powering 160,000 TPS.

"We designed and implemented a highly efficient, multi-threaded, in-memory parallel execution engine that can execute over 160k non-trivial Move transactions per second."

medium.com/aptoslabs/bloc…

"We designed and implemented a highly efficient, multi-threaded, in-memory parallel execution engine that can execute over 160k non-trivial Move transactions per second."

medium.com/aptoslabs/bloc…

9/ They achieve this by bypassing the sequential execution that many blockchains utilise (but isn't optimal for scaling), instead opting for "a parallel execution engine that extracts the maximum inherent speedup that is possible."

The chart below plots Block STM performance.

The chart below plots Block STM performance.

10/ Even @aeyakovenko (Solana co-founder) is a big fan of Parallelizable execution environments.

https://twitter.com/aeyakovenko/status/1546535426583719937?s=20&t=AG7E2rkrFLOHJIr8g7sx2w

11/ The tech is so exciting that one of his colleagues from @solana, @austinvirts decided to join @AptosLabs as Director of Ecosystem.

https://twitter.com/austinvirts/status/1549115616233041920?s=20&t=pS6kKBFlgsHoGVkwwRvtTQ

12/ Apparently, the network speed is so fast that the team minted millions of NFTs on testnet in under an hour 'for fun.'

This makes the chain perfectly suited to blockchain NFTs/gaming, a space which is expected to grow rapidly.

medium.com/aptoslabs/apto…

This makes the chain perfectly suited to blockchain NFTs/gaming, a space which is expected to grow rapidly.

medium.com/aptoslabs/apto…

13/ Aptos approaches tech developments with user experience in mind.

This stems from the belief that "the user experience needs significant improvement in safety and scalability in order to reach the masses."

If executed correctly, it could offer a major competitive advantage.

This stems from the belief that "the user experience needs significant improvement in safety and scalability in order to reach the masses."

If executed correctly, it could offer a major competitive advantage.

14/ DEVELOPMENT

Aptos has a Devnet which allows coders to contribute open-source code.

Impressively, there's already a huge list of developers, including:

Coinbase, Binance, Anchorage, Blockorus, Livepeer, Moonclave, Paxos, Paymagic, Rarible etc.

Aptos has a Devnet which allows coders to contribute open-source code.

Impressively, there's already a huge list of developers, including:

Coinbase, Binance, Anchorage, Blockorus, Livepeer, Moonclave, Paxos, Paymagic, Rarible etc.

15/ ~8000 developers are currently in the Aptos Discord server, which consists of 63,000 members.

Additionally, there are already ~4k node operators from 40 countries. This is despite Aptos not yet having a whitepaper.

Additionally, there are already ~4k node operators from 40 countries. This is despite Aptos not yet having a whitepaper.

16/ In order to incentivise development, Aptos announced a grant program.

DeFi, NFTs and Gaming are key focuses for the team, who are paying (a not yet disclosed amount) to developers who successfully apply for their grant program.

medium.com/aptoslabs/anno…

DeFi, NFTs and Gaming are key focuses for the team, who are paying (a not yet disclosed amount) to developers who successfully apply for their grant program.

medium.com/aptoslabs/anno…

17/ Development is an important consideration, as it affects the quality of applications on-chain (impacting user acquisition).

Invest early in the cycle and you stand to benefit the most, as per the flow of funds model:

Capital > Developers > Users > Transactions > TVL >Price.

Invest early in the cycle and you stand to benefit the most, as per the flow of funds model:

Capital > Developers > Users > Transactions > TVL >Price.

18/ FUNDING

Aptos is one of the most well-funded projects in crypto.

They announced a $200m funding round in March, led by @a16z.

The raise also includes investments from:

• Multicoin Capital

• Coinbase Ventures

• 3AC (this aged well)

• Tiger Global

• FTX Ventures

Aptos is one of the most well-funded projects in crypto.

They announced a $200m funding round in March, led by @a16z.

The raise also includes investments from:

• Multicoin Capital

• Coinbase Ventures

• 3AC (this aged well)

• Tiger Global

• FTX Ventures

19/ Fast forward to yesterday, and Aptos announced their Series A funding round, raising an additional $150m.

https://twitter.com/AptosLabs/status/1551559864744386560?s=20&t=ubeGdsRLTJQda4rzRWnkww

20/ This round includes some HUGE backers:

• FTX Ventures (led the round)

• Jump Crypto

• Andreessen Horowitz (a16z)

• Multicoin Capital

• Circle Ventures

• FTX Ventures (led the round)

• Jump Crypto

• Andreessen Horowitz (a16z)

• Multicoin Capital

• Circle Ventures

21/ For comparison, $SOL raised $25m before launch, compared to Aptos at $350m.

https://twitter.com/coinmamba/status/1551624745774465024?s=20&t=iqIEntvARyQah8h3OFljZA

22/ Sui by @Mysten_Labs, which is also built on the Move programming language and shares many of the same investors, is an official parter of Aptos.

Both have been heavily bet on by VCs, commanding valuations of $2b+.

They are being touted as 'The Heirs of Diem.'

Both have been heavily bet on by VCs, commanding valuations of $2b+.

They are being touted as 'The Heirs of Diem.'

23/ A partnership between the two likely indicates interoperability, made seamless by Move. The success of one inherently benefits the success of the other (hence why most VCs decided to bet on both).

Read more about Sui here:

Read more about Sui here:

https://twitter.com/milesdeutscher/status/1547048951504703488?s=20&t=h8d-iPBFezkvISyqoajMBw

24/ Importantly, although they both use Move and share similar backers: The technology does have some key differences:

This thread does a great job of comparing each aspect of the two:

This thread does a great job of comparing each aspect of the two:

https://twitter.com/cryptoalvatar/status/1551878534926401537?s=20&t=QTGYNvQjqDWdDmz9XGY1_Q

25/ ECOSYSTEM

There are 5 major ecosystem sectors that the Aptos team is working on:

• A decentralised stablecoin

• AMM/DEX

• Custom wallet

• Money Market

• Oracle

Full credit to @JAI_BHAVNANI:

There are 5 major ecosystem sectors that the Aptos team is working on:

• A decentralised stablecoin

• AMM/DEX

• Custom wallet

• Money Market

• Oracle

Full credit to @JAI_BHAVNANI:

https://twitter.com/JAI_BHAVNANI/status/1551961478932172800?s=20&t=n2XXxRdYZJG-BUspBz_6Ug

26/ Let's break down these 5 key projects from each category: 👇

STABLECOIN: Thala Labs

@ThalaLabs is building a 'hyper efficient' stablecoin on Move.

The protocol documents are expected 'soon'.

STABLECOIN: Thala Labs

@ThalaLabs is building a 'hyper efficient' stablecoin on Move.

The protocol documents are expected 'soon'.

https://twitter.com/ThalaLabs/status/1552052231624466432?s=20&t=IsP0HFACGtnfbXd8Xls4ag

27/ DEX: Pontum Network

@PontemNetwork is the first DEX on Aptos. Offering volatile (Uniswap), and stable (Curve) asset swaps.

It's also backed by:

• @MechanismCap

• @AlamedaResearch

• @Delphi_Digital

• @KeneticCapital

• @animocabrands

docs.pontem.network/00.-about-pont…

@PontemNetwork is the first DEX on Aptos. Offering volatile (Uniswap), and stable (Curve) asset swaps.

It's also backed by:

• @MechanismCap

• @AlamedaResearch

• @Delphi_Digital

• @KeneticCapital

• @animocabrands

docs.pontem.network/00.-about-pont…

28/ WALLET: Martian Wallet

@martian_wallet is a digital wallet, available as a chrome extension (similar to MetaMask).

It looks set to become Aptos' biggest wallet, and already has 15,000+ downloads. Here's a video of it in action:

@martian_wallet is a digital wallet, available as a chrome extension (similar to MetaMask).

It looks set to become Aptos' biggest wallet, and already has 15,000+ downloads. Here's a video of it in action:

https://twitter.com/i/status/1551250361771610116

29/ MONEY MARKET: Vial

@vialprotocol is a borrowing/lending platform, similar to @AaveAave. A much needed piece of infrastructure in an advanced DeFi ecosystem.

@vialprotocol is a borrowing/lending platform, similar to @AaveAave. A much needed piece of infrastructure in an advanced DeFi ecosystem.

30/ ORACLE: Switchboard

@switchboardxyz is an oracle on the Solana mainnet, which is expanding to Aptos.

We will also probably see a @chainlink integration in the future too.

@switchboardxyz is an oracle on the Solana mainnet, which is expanding to Aptos.

We will also probably see a @chainlink integration in the future too.

31/ But, the ecosystem is even more expansive than these 5 projects, with over 100 known projects currently in development.

https://twitter.com/MrAme34090868/status/1551320554841448448?s=20&t=8yvQAo2yKgFV4wZ-FJk5yw

32/ So, with big backers, deep pockets, an experienced team and active ecosystem development - how does Aptos fit into the current layer 1 landscape?

Firstly, let's consider the vested interests at play (VC backing).

Firstly, let's consider the vested interests at play (VC backing).

33/ It's clear by now that @SBF_FTX is making big bets on both Sui and Aptos, leading funding rounds for both.

Clearly Sam is a fan of Move and the technology powering these chains.

It's never wise to zig when Sam zags.

But what does that mean for @SBF_FTX's other ventures?

Clearly Sam is a fan of Move and the technology powering these chains.

It's never wise to zig when Sam zags.

But what does that mean for @SBF_FTX's other ventures?

34/ .@pythianism raised a valid point: That the launch of this chain could detract from the value capture of SBF's other tokens.

https://twitter.com/pythianism/status/1551574958450655232?s=20&t=T4XhhD08Nbgcuci1ZB1upw

35/ We know that SBF has a vested interest in multiple tokens, thus capturing the upside of his trajectory may become more difficult than anticipated.

Does $SOL take a tangible hit with the focus shifting to Aptos? It's certainly an ever-increasing competitive landscape.

Does $SOL take a tangible hit with the focus shifting to Aptos? It's certainly an ever-increasing competitive landscape.

36/ But in such a competitive landscape, where does Aptos fit in?

Firstly, the flexibility, security and interoperability provided by Move is a huge advantage.

If they can deliver on the tech, users and developers should love Aptos, considering their heavy focus on UI.

Firstly, the flexibility, security and interoperability provided by Move is a huge advantage.

If they can deliver on the tech, users and developers should love Aptos, considering their heavy focus on UI.

37/ More L1s means more competition.

Competition leads to increased innovation, yielding better results for the consumer in the long run.

Although it makes portfolio allocation slightly more difficult, a competitive environment is exactly what web 3.0 needs to progress.

Competition leads to increased innovation, yielding better results for the consumer in the long run.

Although it makes portfolio allocation slightly more difficult, a competitive environment is exactly what web 3.0 needs to progress.

38/ Remember, you can't buy Aptos yet, as their token hasn't officially launched.

But, I'll be keeping you updated when this changes, and on how the ecosystem is progressing.

So make sure you have post notifications turned on so you don't miss a beat.

But, I'll be keeping you updated when this changes, and on how the ecosystem is progressing.

So make sure you have post notifications turned on so you don't miss a beat.

39/ If you enjoyed this thread, follow me

@milesdeutscher for more.

Also, a Like/Retweet on the first tweet below would be much appreciated. 💙

@milesdeutscher for more.

Also, a Like/Retweet on the first tweet below would be much appreciated. 💙

https://twitter.com/milesdeutscher/status/1552281885438488577

• • •

Missing some Tweet in this thread? You can try to

force a refresh