Just over a year ago, I valued Zomato, the Indian food-delivery company, at ₹41/share, ahead of its IPO, and argued that it was joint bet on Indian growth, Indian eating habits and Zomato's business model. In hindsight, I was both wrong and right. bit.ly/3PDU39y

At the offering, the market had a very different view on the company, as the stock soared 51% from its offering price of ₹74, and Zomato continued to trade at stratospheric levels all through 2021, held up by easy access to risk capital and momentum. bit.ly/3PDU39y

In 2022, the mood shifted, Zomato rediscovered the laws of gravity, and the stock price dropped. Zomato's acquisition of Blinkit for $568 million ( ₹4500 crores) and the lock-in expiration exacerbated selling, pushing the price down to ₹41. bit.ly/3PDU39y

Much as I would like to claim vindication for my value, I attribute the convergence to chance, since (1) I valued Paytm, currently trading at ₹713 at ₹2000, (2) You cannot compare a price in July 2022 to a valuation in July 2021. Much has changed! bit.ly/3PDU39y

The company has had four earnings reports, with some good news (sustained growth, a larger cash buffer), some bad (lower take rate, worsening margins) and some questionable (acquisition-driven growth, side investments). bit.ly/3PDU39y

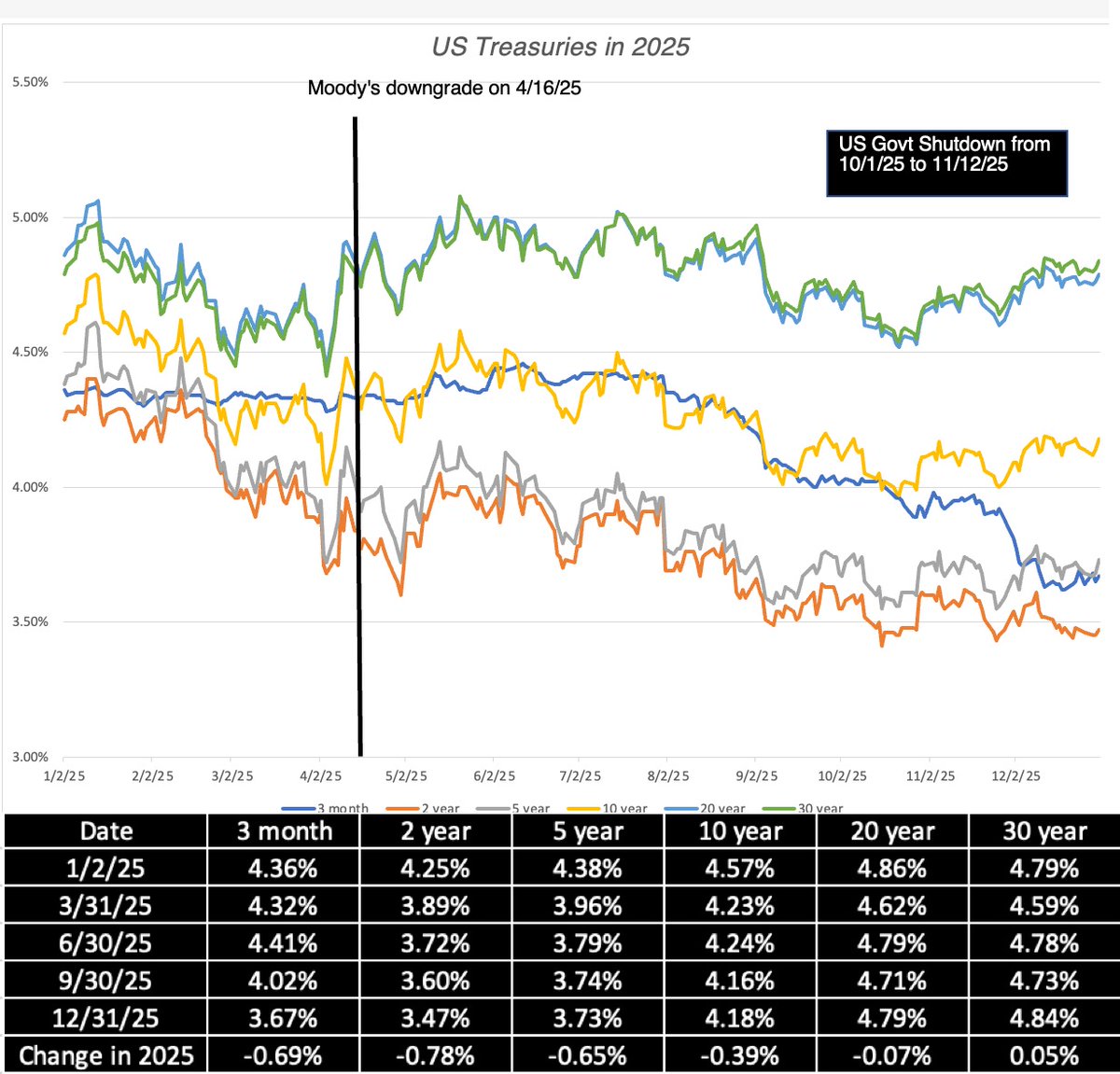

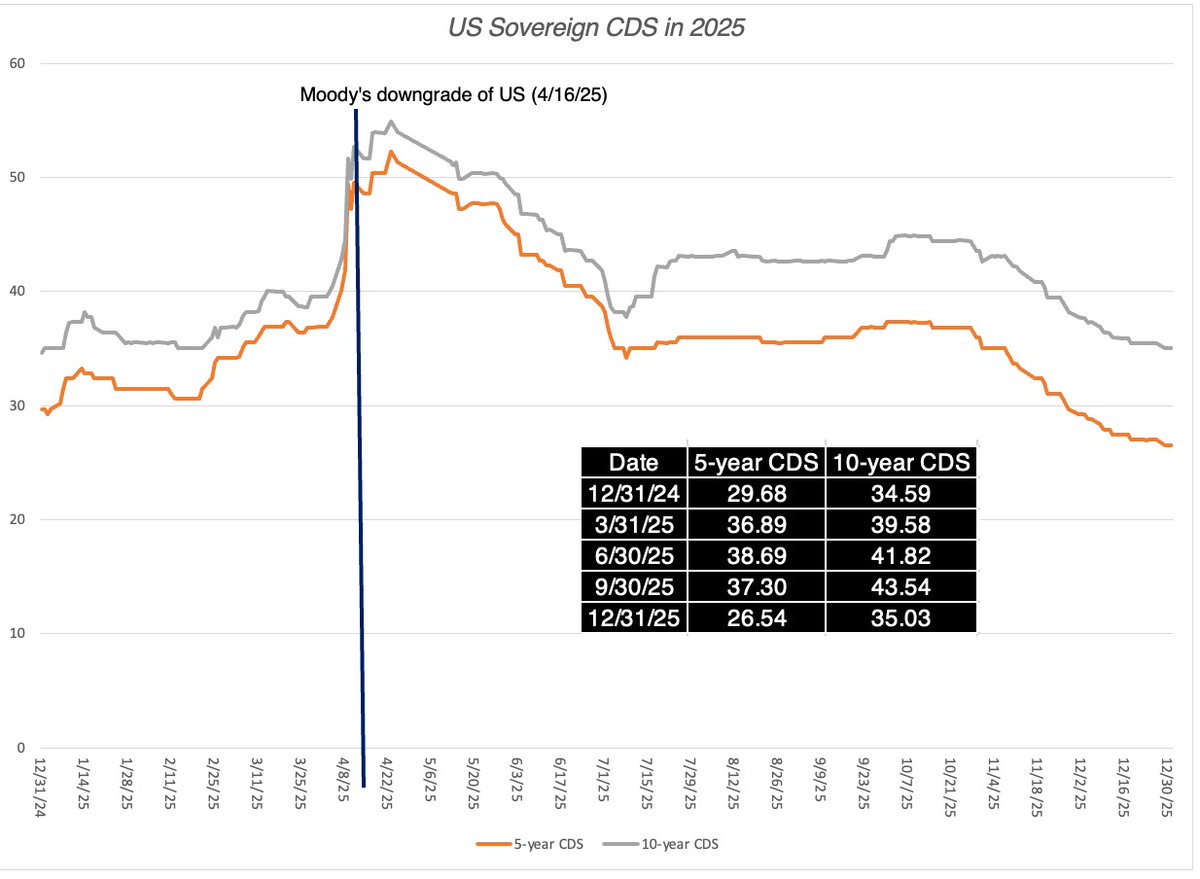

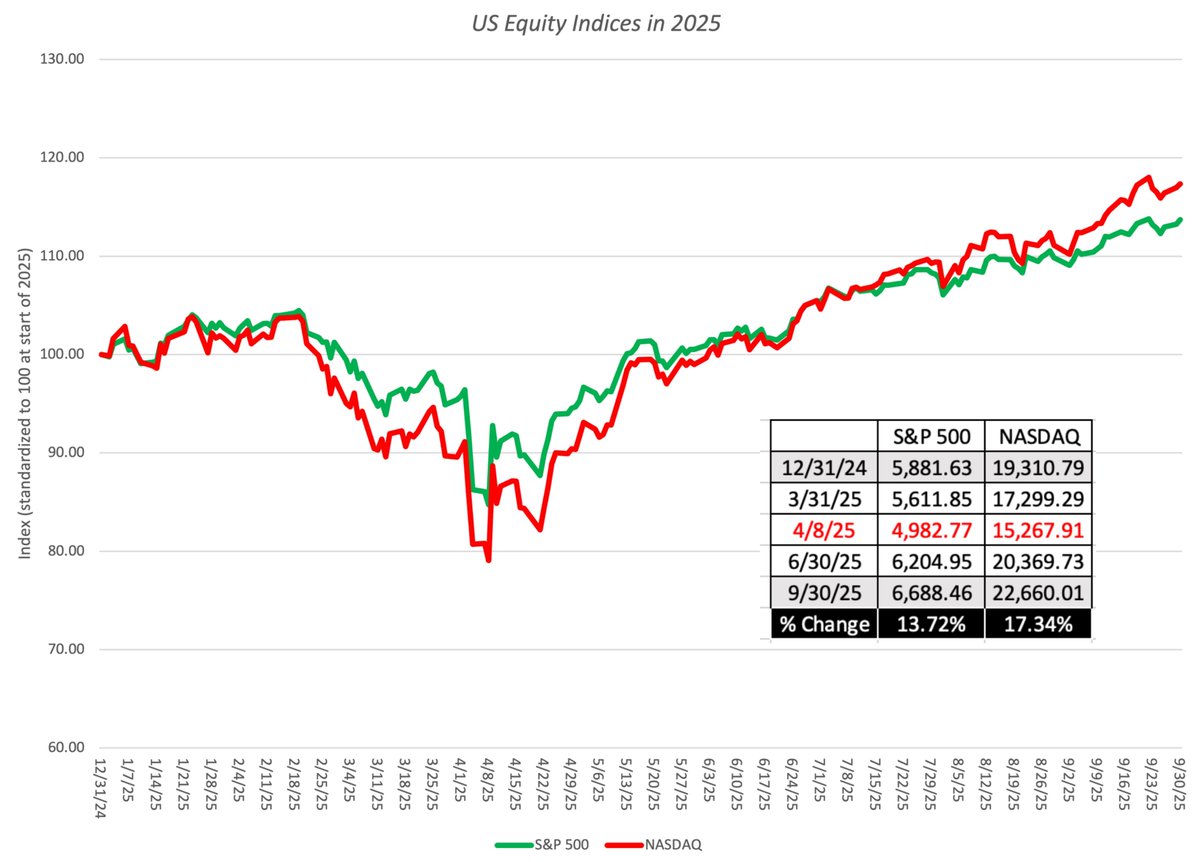

In macro changes, inflation has changed and unsettled markets around the world (pushing up risk free rates) and risk capital has gone to the side lines, pushing up equity risk premiums, increasing the costs of capital for all companies. bit.ly/3PDU39y

Updating my valuation to reflect both company and macro news, I adjust my story to reflect a bigger potential market (with grocery deliveries), albeit with lower revenue share and margins and a higher cost of capital to value Zomato at ₹35/share. bit.ly/3PDU39y

This is my valuation, not the valuation, of Zomato, and needless to say, I will be wrong on every single assumption. Rather than hide from uncertainty, I choose to face up to it. Here are my simulation results for Zomato. bit.ly/3PDU39y

If you are an investor, a week or two more like the last two will make Zomato a buy. If you are a trader, you are better off looking at price charts, consulting an astrologer or visiting your favored place of worship to get a sense of momentum shifts. bit.ly/3PDU39y

If you did buy Zomato at its 2021 prices, and feeling regret, please don't attribute to conspiracies (with bankers, founders and analysts as villains) what can be better explained by greed & myopia. You live by momentum, you die by it! bit.ly/3PDU39y

• • •

Missing some Tweet in this thread? You can try to

force a refresh