2/

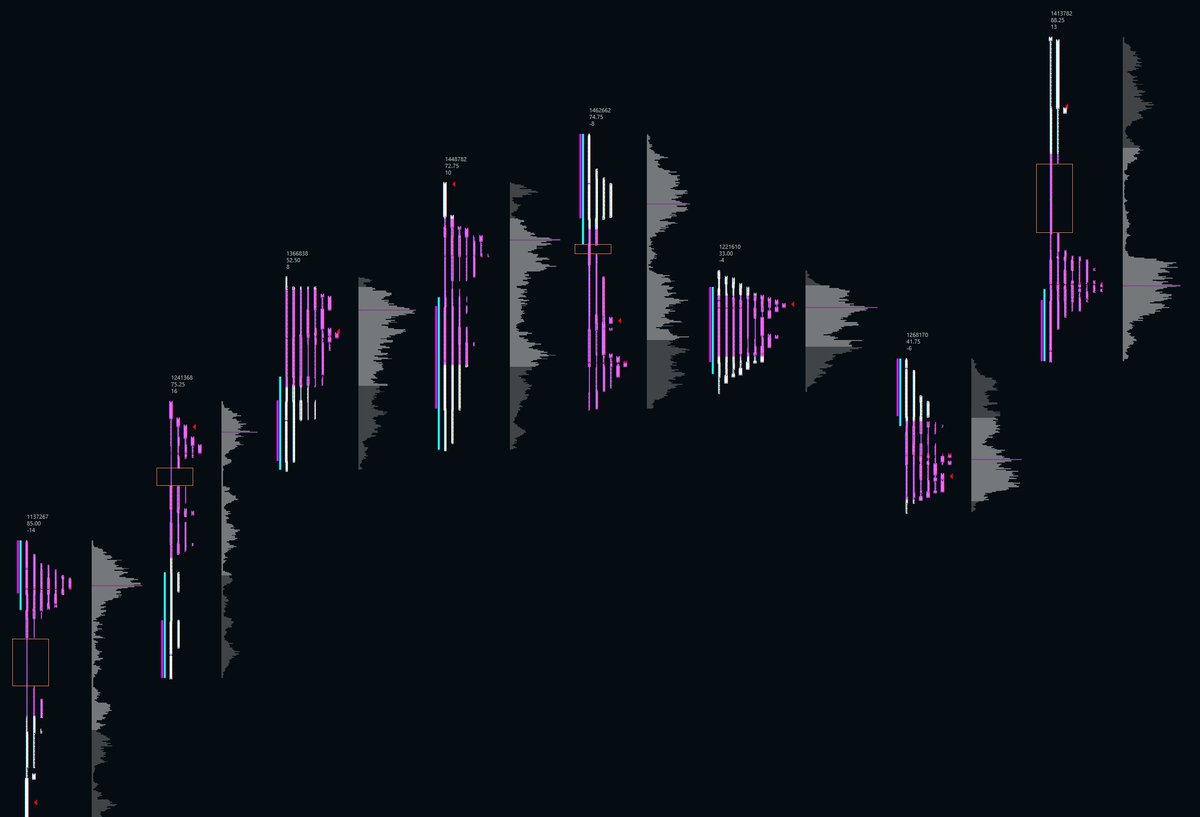

For those unfamiliar with them, single prints look like this (orange box) on a TPO profile. They represent areas in which there has been no proper 2-way trade. That makes them areas of interest and, on the other hand, they can help us gauge the strength of buyers and sellers.

For those unfamiliar with them, single prints look like this (orange box) on a TPO profile. They represent areas in which there has been no proper 2-way trade. That makes them areas of interest and, on the other hand, they can help us gauge the strength of buyers and sellers.

3/

Single prints, gaps, low volume nodes. They all share a similar principle, with different degrees of relevance. But what they signal is that the market sped through that area. Another way of seeing it is thinking of them as emotional buying or selling.

Single prints, gaps, low volume nodes. They all share a similar principle, with different degrees of relevance. But what they signal is that the market sped through that area. Another way of seeing it is thinking of them as emotional buying or selling.

4/

Imagine that a new iPhone comes out and it’s got everything that one could wish for in a phone and more. Everybody wants to get their hands on one and they’re afraid the inventory is going to be gone before they can buy one, so they start outbidding each other...

Imagine that a new iPhone comes out and it’s got everything that one could wish for in a phone and more. Everybody wants to get their hands on one and they’re afraid the inventory is going to be gone before they can buy one, so they start outbidding each other...

5/

... desperate to get a new iPhone. Once the frenzy fades, people might start to think if the iPhones are really that valuable or if they just got ahead of themselves in the heat of the moment.

... desperate to get a new iPhone. Once the frenzy fades, people might start to think if the iPhones are really that valuable or if they just got ahead of themselves in the heat of the moment.

6/

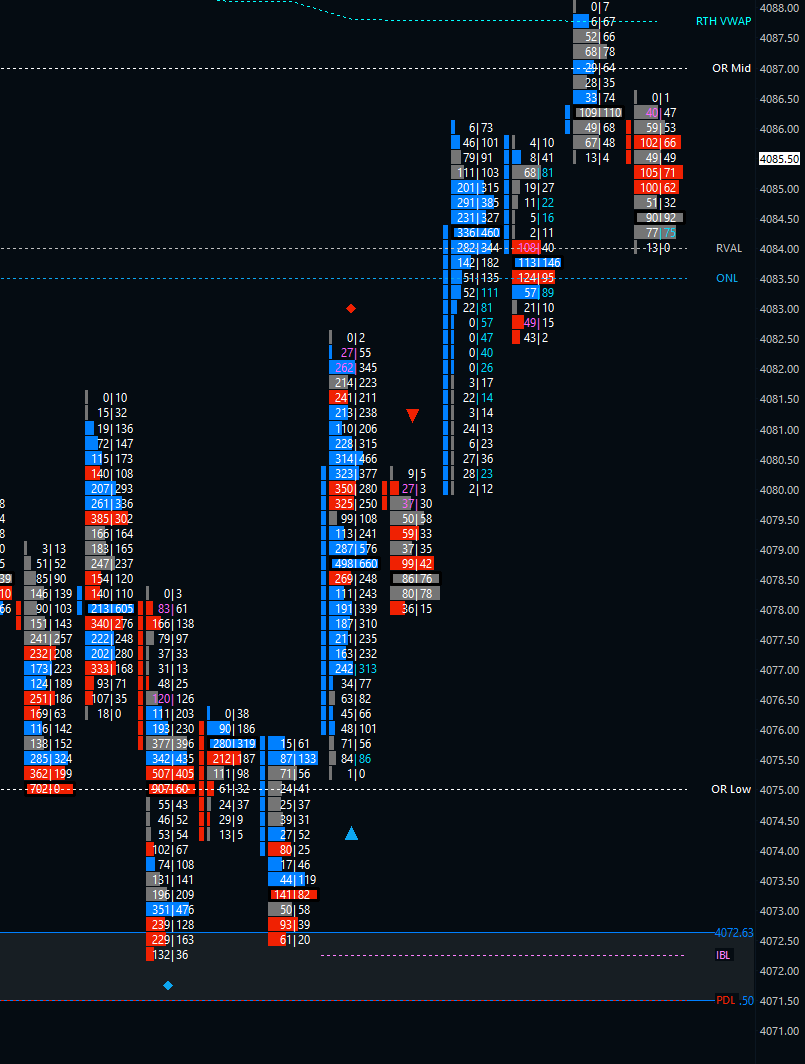

If we have single prints below us, for example, it signals that buyers wanted to buy immediately, irregardless of higher and higher prices. While sellers, seeing that they kept getting filled at higher and higher prices, kept putting their offers higher and higher.

If we have single prints below us, for example, it signals that buyers wanted to buy immediately, irregardless of higher and higher prices. While sellers, seeing that they kept getting filled at higher and higher prices, kept putting their offers higher and higher.

7/

By the way, “buyers” in this example can mean buyers initiating or shorts trying to cover. It doesn’t matter. At this point they’re both buyers. Remember, the moment you buy, you become a seller. And the moment you sell short, you become a buyer.

By the way, “buyers” in this example can mean buyers initiating or shorts trying to cover. It doesn’t matter. At this point they’re both buyers. Remember, the moment you buy, you become a seller. And the moment you sell short, you become a buyer.

8/

So, back to the single prints. We’ve got single prints below us in our example. As long as buyers manage to “defend” that area, I consider them stronger. Why? Because participants are still convinced that, at least for now, value is to be found above that area.

So, back to the single prints. We’ve got single prints below us in our example. As long as buyers manage to “defend” that area, I consider them stronger. Why? Because participants are still convinced that, at least for now, value is to be found above that area.

9/

No need to go back and really find out if value is to be found there or if the market got ahead of itself.

No need to go back and really find out if value is to be found there or if the market got ahead of itself.

10/

Why are single prints areas of interest? Because, once the aforementioned conviction recedes, there’s an interest in going back and retesting those areas.

Why are single prints areas of interest? Because, once the aforementioned conviction recedes, there’s an interest in going back and retesting those areas.

11/

Find out what market participants are now willing to do there. If the single prints are filled, it could signal that sellers (in our example) might have become stronger now.

Find out what market participants are now willing to do there. If the single prints are filled, it could signal that sellers (in our example) might have become stronger now.

12/

As @Michigandolf likes to say: “LVNs are areas where the market has to make a decision”. The same applies for single prints and gaps. If they remain unfilled, the market still thinks that fair value is “on this side”. If they get filled, we might flip over to the other side.

As @Michigandolf likes to say: “LVNs are areas where the market has to make a decision”. The same applies for single prints and gaps. If they remain unfilled, the market still thinks that fair value is “on this side”. If they get filled, we might flip over to the other side.

13/

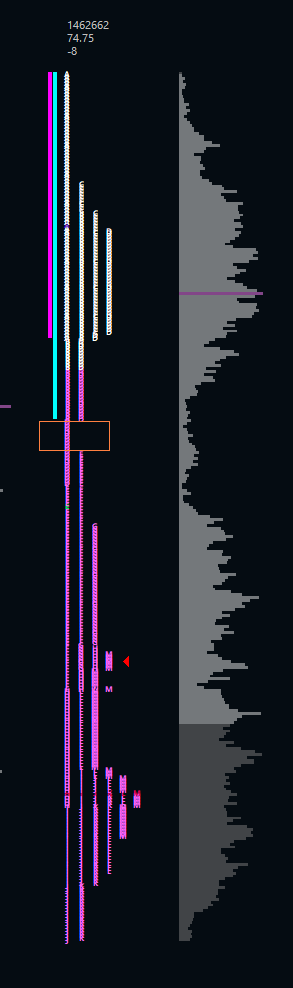

BTW, a simple “trick” to identify single prints if your platform doesn’t have TPO profiles:

Take a 30min chart and look for areas, within the same session, in which there’s no overlapping of candles (including the wicks).

BTW, a simple “trick” to identify single prints if your platform doesn’t have TPO profiles:

Take a 30min chart and look for areas, within the same session, in which there’s no overlapping of candles (including the wicks).

• • •

Missing some Tweet in this thread? You can try to

force a refresh