How to get URL link on X (Twitter) App

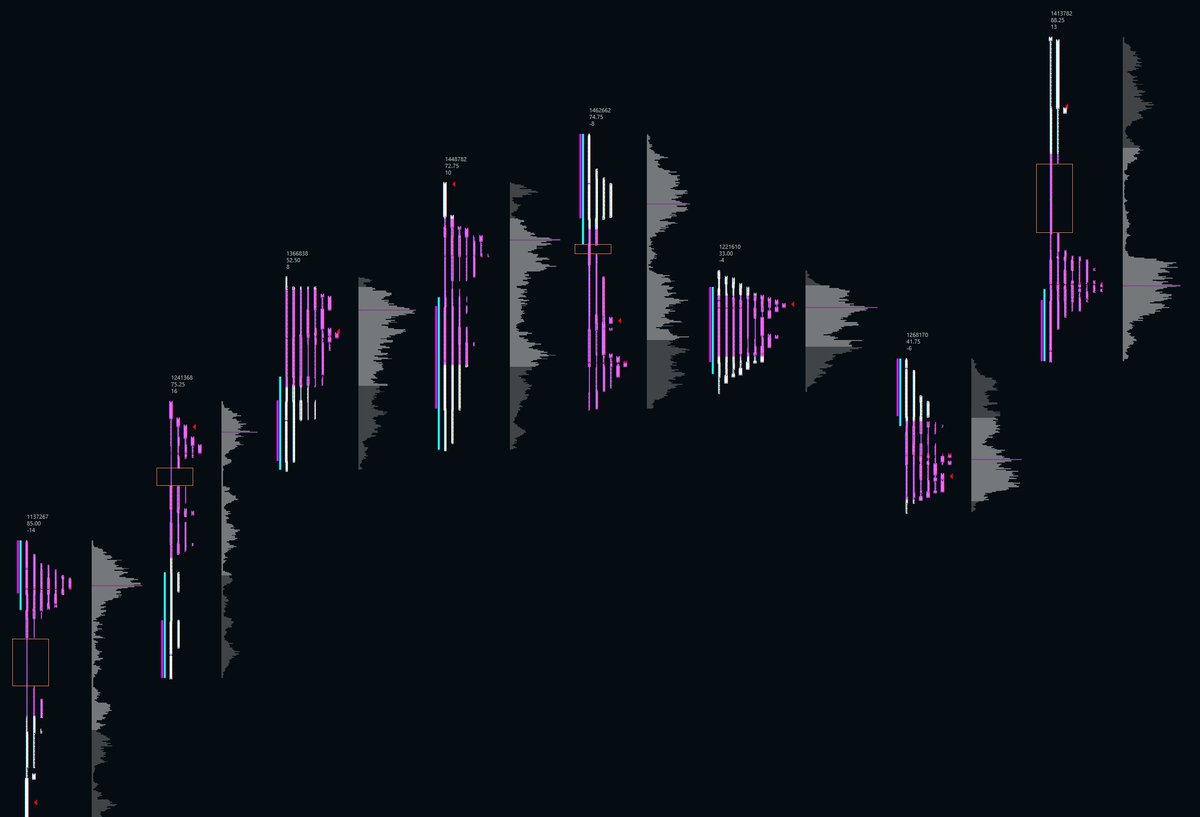

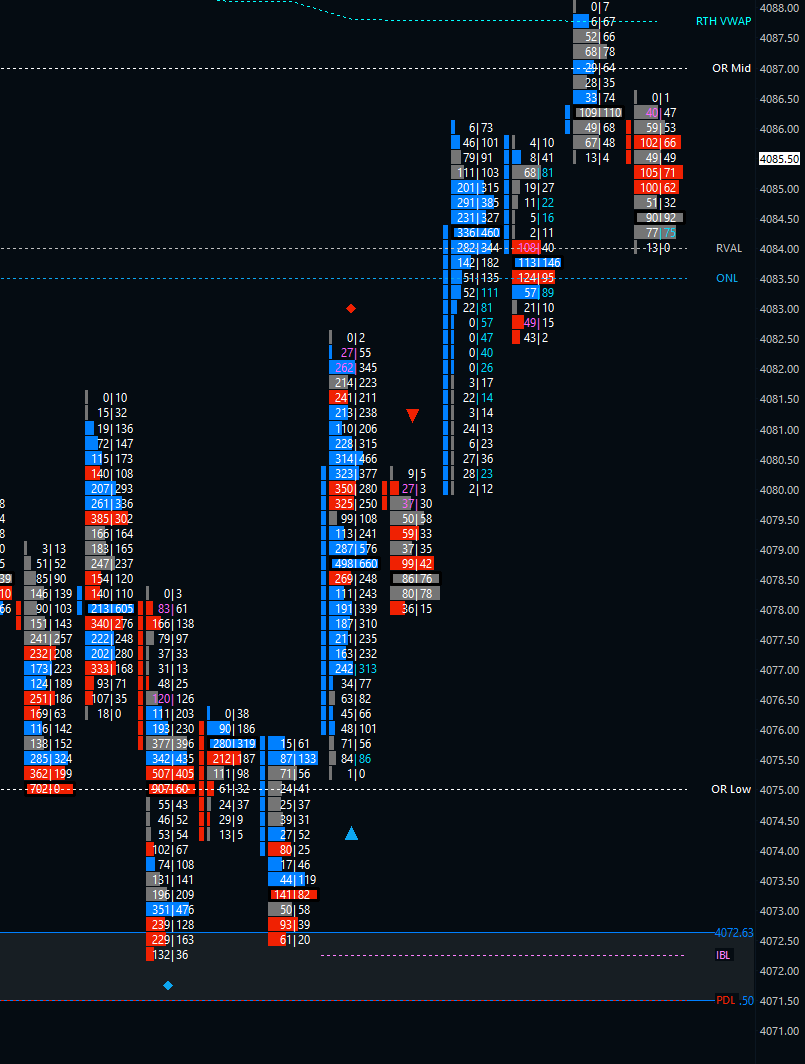

In its constant search for fair value, the market looks for selling exhaustion at the lows (the demand exceeds the supply and sellers are getting filled at higher prices so there’s no more interest to sell at lower prices)...

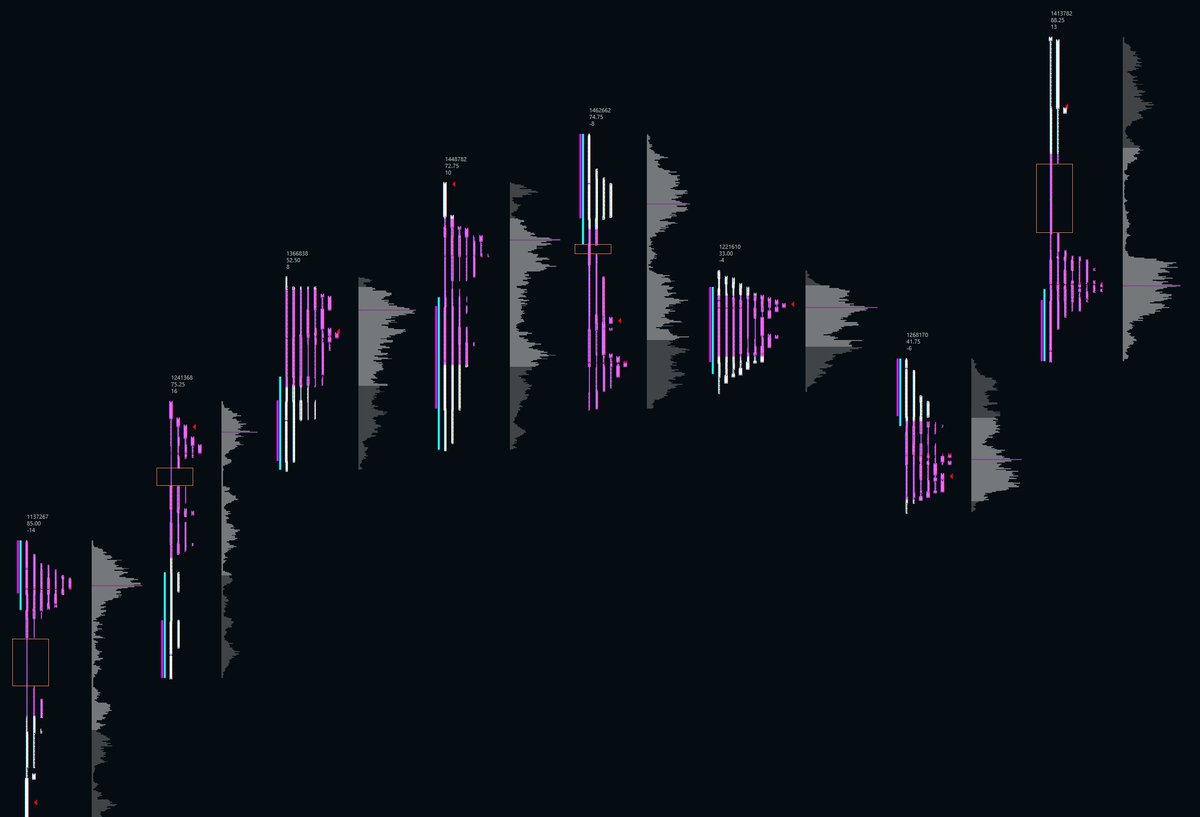

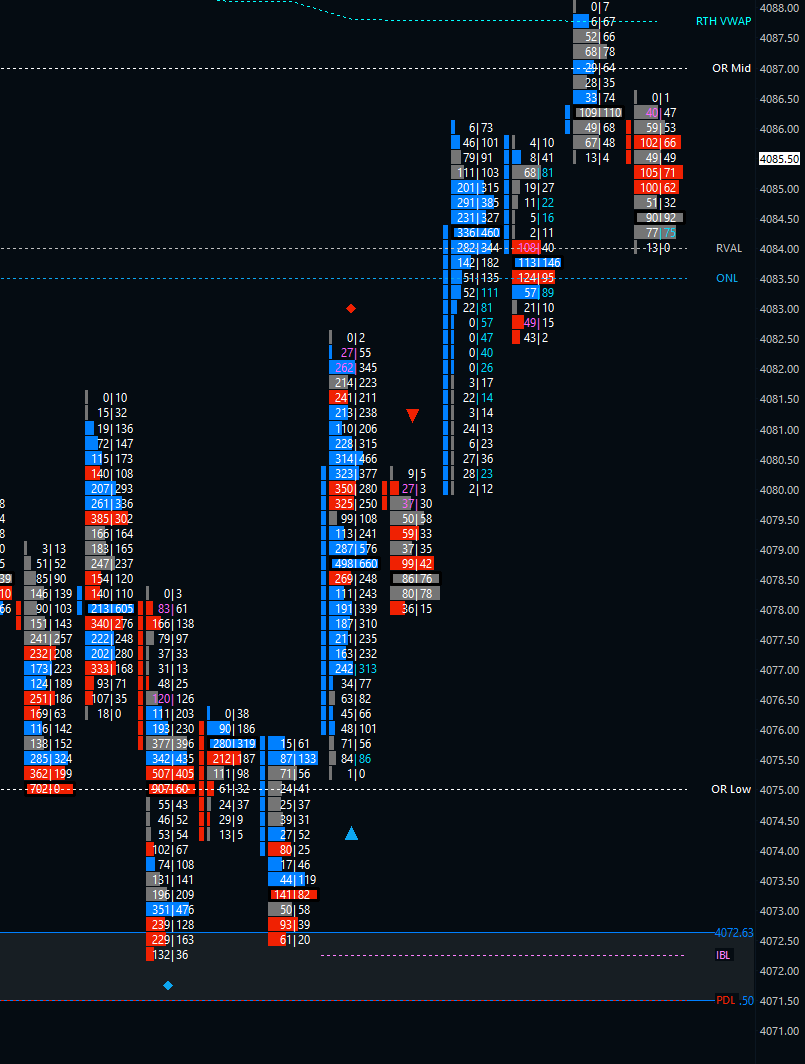

In its constant search for fair value, the market looks for selling exhaustion at the lows (the demand exceeds the supply and sellers are getting filled at higher prices so there’s no more interest to sell at lower prices)...

2/

2/

https://twitter.com/TheFakeAlec/status/1470149260867817477?s=202/