$UMAMI's $USDC vault finally launched yesterday & was at capacity in 30 MINUTES

I analyzed the impact to protocol revenues / $UMAMI stakers and the results were bullish to say the least 🚀

(NFA)

🧵👇

1/

I analyzed the impact to protocol revenues / $UMAMI stakers and the results were bullish to say the least 🚀

(NFA)

🧵👇

1/

Some background, $UMAMI launched on Arbitrum as an $OHM fork (RIP)

Like many other rebasing tokenomic models, the price 📉

New leadership was brought into the project in early 2021 & they pivoted to a new delta neutral yield farming strategy for their treasury

2/

Like many other rebasing tokenomic models, the price 📉

New leadership was brought into the project in early 2021 & they pivoted to a new delta neutral yield farming strategy for their treasury

2/

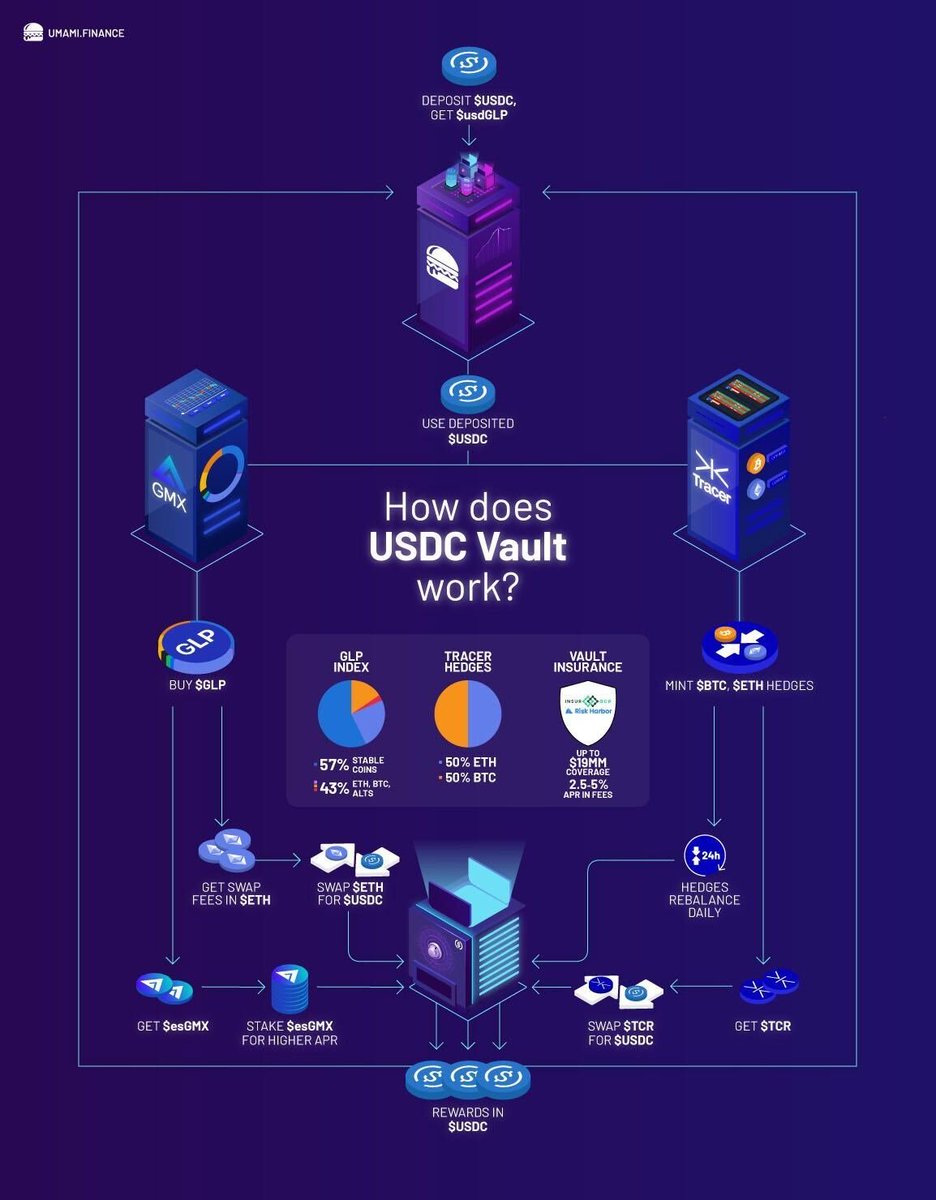

The team began laying the foundation for institutional caliber #realyield strategies

✔️ Updated tokenomics / rebasing eliminated

✔️ Audits / testing

✔️ New UI

✔️ Fiat on/off ramps

✔️ Robust roadmap

3/

✔️ Updated tokenomics / rebasing eliminated

✔️ Audits / testing

✔️ New UI

✔️ Fiat on/off ramps

✔️ Robust roadmap

3/

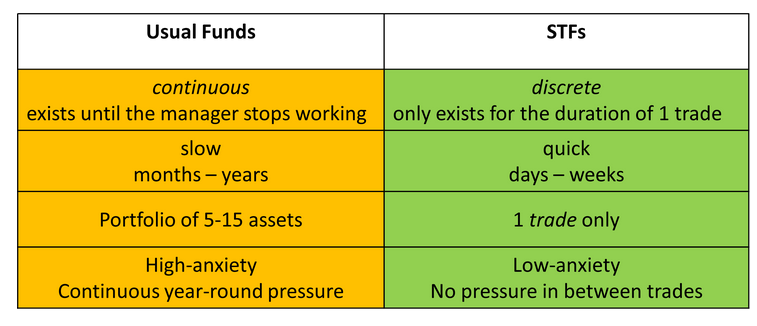

While the team was building, they deployed POL into delta neutral farming strategy that is similar to the $USDC vault

There are monthly treasury reports - results were impressive during turbulent times

June 22 - Treasury APY of 22% vs a 50% decline in $ETH

4/

There are monthly treasury reports - results were impressive during turbulent times

June 22 - Treasury APY of 22% vs a 50% decline in $ETH

4/

Fast Fwd to today

✔️ $USDC vault has launched for whitelist members only

✔️ Vault demand is high, it will significantly scale over coming months

✔️ Audit by zokyo complete

✔️ Insurance to be added as an option for vault depositors shortly

👇

5/

✔️ $USDC vault has launched for whitelist members only

✔️ Vault demand is high, it will significantly scale over coming months

✔️ Audit by zokyo complete

✔️ Insurance to be added as an option for vault depositors shortly

👇

5/

Earlier this month, $UMAMI completed legal incorporation as 2 separate entities: Umami Labs & Umami DAO

This is a critical step for institutions that are in ongoing discussions w/ $UMAMI regarding capital commitments

6/

This is a critical step for institutions that are in ongoing discussions w/ $UMAMI regarding capital commitments

https://twitter.com/UmamiFinance/status/1550486602413137921?s=20&t=VDRIOymakLf59D9fntryQQ

6/

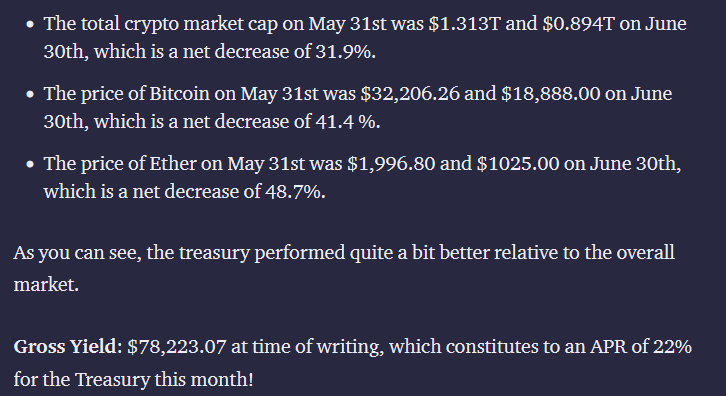

Quick tldr on the vault

Depositors provide liquidity for $GLP (GMX's liquidity tkn) while hedging exposure to volatile tokens that comprise $GLP via $TCR's 3S BTC / ETH perps

$TCR short perps will continually be rebalanced to maintain delta neut position using prop models

7/

Depositors provide liquidity for $GLP (GMX's liquidity tkn) while hedging exposure to volatile tokens that comprise $GLP via $TCR's 3S BTC / ETH perps

$TCR short perps will continually be rebalanced to maintain delta neut position using prop models

7/

And here's a marketing video that runs through the mechanics

Defi protocols, take note. Top notch quality

8/

Defi protocols, take note. Top notch quality

8/

https://twitter.com/UmamiFinance/status/1551557727398539265

$UMAMI is also bldg $ETH & $BTC maxy vaults that will provide deep liquidity to $TCR perps which will enable significant scaling of the $USDC vaults

Team expects ~$100M in TVL once the trio of vaults is up and running w/o diluting APY

8/

Team expects ~$100M in TVL once the trio of vaults is up and running w/o diluting APY

8/

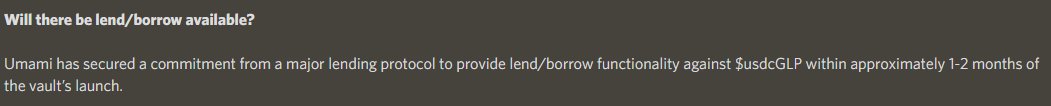

Once the trio of vaults are live, TVL should scale incredibly quickly

Using the ERC-4626 standard, $glpUSDC can be used as collateral for lenders & institutional demand is already high

9/

Using the ERC-4626 standard, $glpUSDC can be used as collateral for lenders & institutional demand is already high

9/

While this is just the beginning of a lot more building and TVL to come, I wanted to frame what types of revenues/yields are implied by ~$100M TVL

disclaimer: this doesnt account for any future products / TVL

Let's dig-in

👇

10/

disclaimer: this doesnt account for any future products / TVL

Let's dig-in

👇

10/

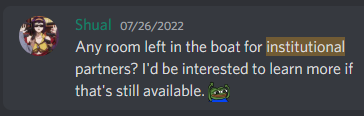

Need to first understand the tokenomics

✔️ Max Token Supply: 1M

✔️ Circ Supply: $640k

$127k tokens perma locked in deprecated contracts so the Max Supply that matters with regards to the FDV you should care about is 873k

< $25M FDV Adj for locked tkns

No emissions, anon

11/

✔️ Max Token Supply: 1M

✔️ Circ Supply: $640k

$127k tokens perma locked in deprecated contracts so the Max Supply that matters with regards to the FDV you should care about is 873k

< $25M FDV Adj for locked tkns

No emissions, anon

11/

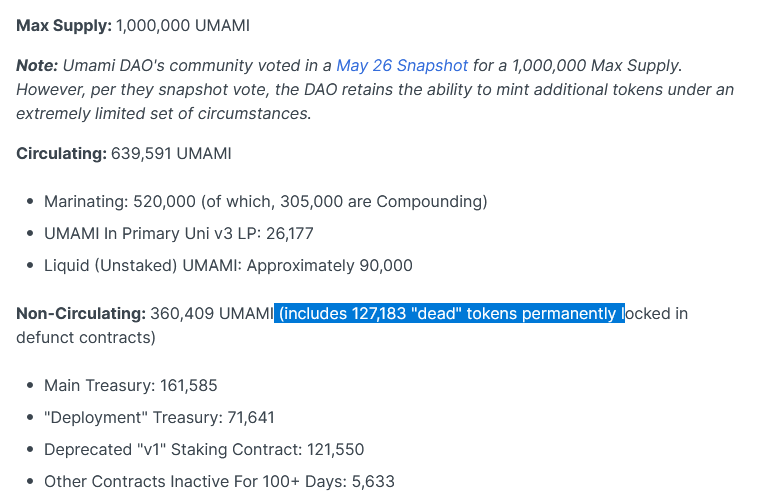

And the revenue model -- 50% of all yield is paid to $UMAMI stakers in $ETH and 50% goes to treasury

This is #Realyield, again no emissions

~500k of the 630k circulating tokens are staked and share in revenues

12/

This is #Realyield, again no emissions

~500k of the 630k circulating tokens are staked and share in revenues

12/

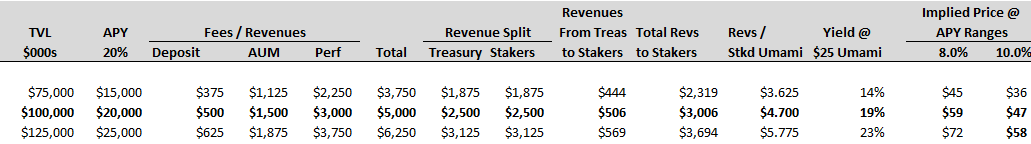

So the $USDC vault economics:

0.5% 1x deposit fee

1.5% annual fee on AUM

15% performance fee is if APY is 25%, fees are 15% * 25%

I will look at what is implied by $100M in TVL for the vault

13/

0.5% 1x deposit fee

1.5% annual fee on AUM

15% performance fee is if APY is 25%, fees are 15% * 25%

I will look at what is implied by $100M in TVL for the vault

13/

For $100M TVL assuming an APY of 20% (conservative):

Deposit fee: $500k

AUM fee: $1.5M

Perf fee: $3M ($100 * 20% * 15%)

Total Protocol revenue of $5M but that is split 50/50 w/ stakers & treasury

Remember treasury earns yield too...

14/

Deposit fee: $500k

AUM fee: $1.5M

Perf fee: $3M ($100 * 20% * 15%)

Total Protocol revenue of $5M but that is split 50/50 w/ stakers & treasury

Remember treasury earns yield too...

14/

Treasury is ~$4.5M today & per the assumptions ↑ it will earn another $2.5M in revenues. Assuming ~$140k in monthly OpEx treasury profits are ~$5.3M

Remember this is farmed, if this earns a 20% APY, that is ~$1M in revenue for the protocol, of which 50% goes to stakers

15/

Remember this is farmed, if this earns a 20% APY, that is ~$1M in revenue for the protocol, of which 50% goes to stakers

15/

Total Revenue to stakers is now $3M

Lets be conservative and assume 100% of circ tokens are staked, that's $4.70 in Yield paid out to each staked Umami or an APY of 20%

But let's be honest, there will be a bunch of people buying a token w/ an effective 20% $ETH yield ...

16/

Lets be conservative and assume 100% of circ tokens are staked, that's $4.70 in Yield paid out to each staked Umami or an APY of 20%

But let's be honest, there will be a bunch of people buying a token w/ an effective 20% $ETH yield ...

16/

... especially once you factor in that the team is building much more

W/ yields like that, people will buy the token and it will rise in price until the market lands on a "normalized yield"

Let's say people buy until yield is ~8-12%

17/

W/ yields like that, people will buy the token and it will rise in price until the market lands on a "normalized yield"

Let's say people buy until yield is ~8-12%

17/

Based on the #RealYield of $4.70 per token, price would need to rise to $47-59 for staked $UMAMI to yield 8-10% based on revenues in the vault and from yield on treasury

This only implied an FDV of $40-50M 👀

(remember this assumes 100% of circ $UMAMI staked, conservatv)

18/

This only implied an FDV of $40-50M 👀

(remember this assumes 100% of circ $UMAMI staked, conservatv)

18/

This is in no way meant to be a price target analysis or my view on the token's intrinsic valuation. It's a simple analysis assuming run rate impacts, it's a basic framework

19/

19/

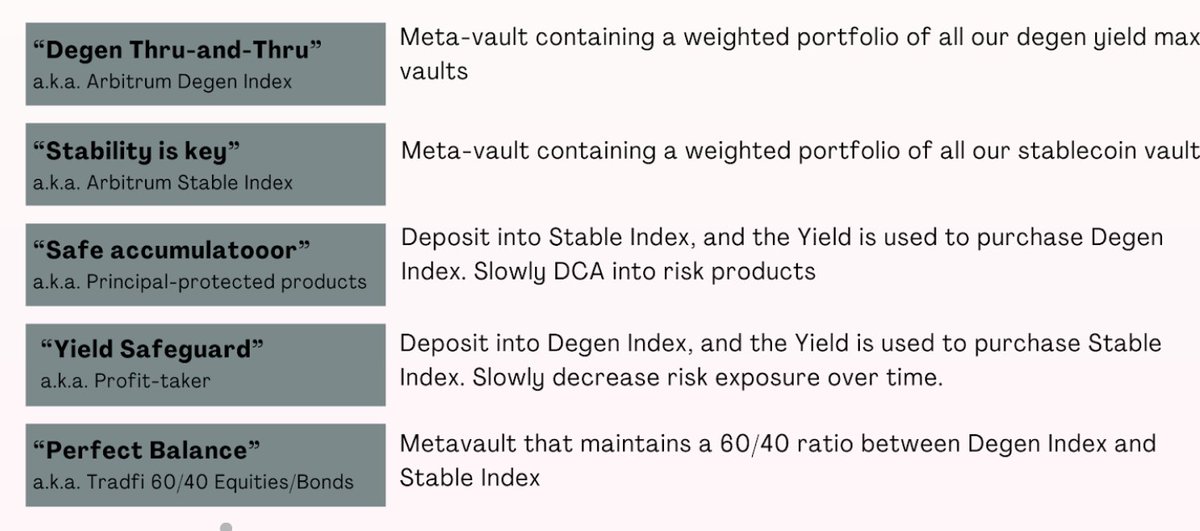

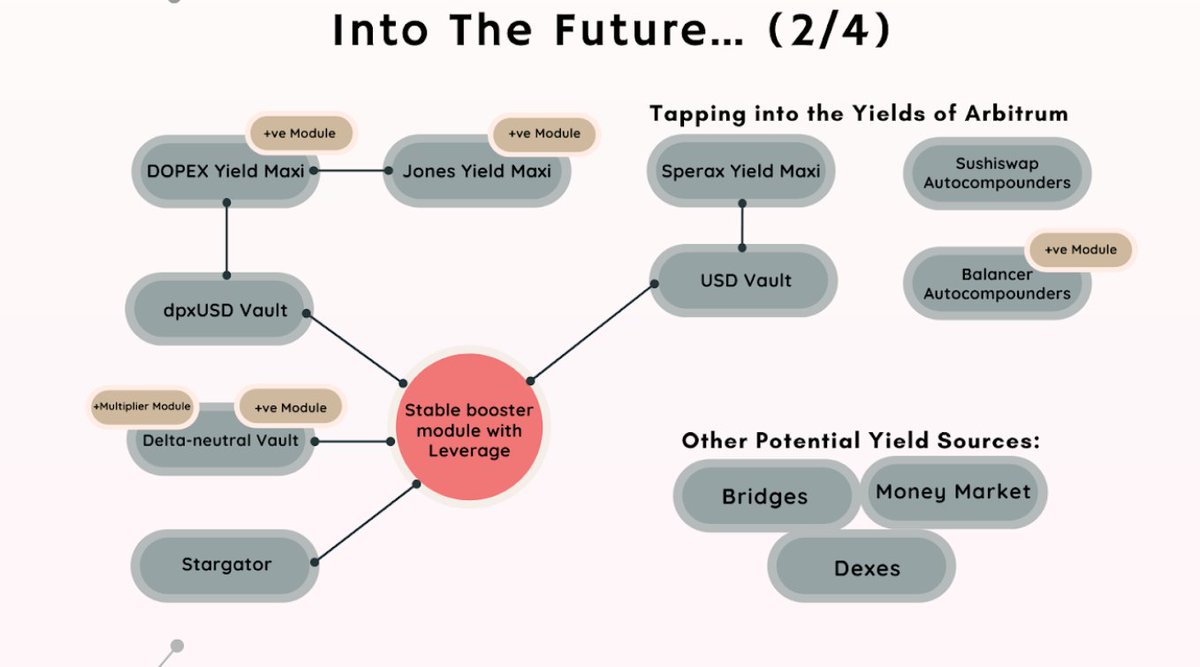

The analysis also doesn't capture the big 🧠 stuff the $UMAMI team is building

I will leave that for another post but heres a peak - non forkable, highly composable metavaults w/ customizable yield strats bldg across the Arbi defi ecosystem ie (30% degen, 70% delta neut)

20/

I will leave that for another post but heres a peak - non forkable, highly composable metavaults w/ customizable yield strats bldg across the Arbi defi ecosystem ie (30% degen, 70% delta neut)

20/

It definitely isnt crazy seeing a path w/ TVL that is multiples higher than the $100M modeled above OR expecting $UMAMI to establish itself as the foundation for yield strategies for Arbitrum

21/

21/

Disclaimer - I own $Umami. This is NFA, nor is this a "valuation analysis". It's one analysis w/ many assumptions that could prove to be untrue. DYOR

22/

22/

ccing for visibility

@IntrinsicDeFi @crypto_condom @BarryFried1 @Riley_gmi @SmallCapScience @808_Investor @CryptoHayes @SalomonCrypto @0xWenMoon @mynt_josh @dcfgod @BarryFried1

@MrGrumpyNFT

@alpha_pls @CurveCap @JackNiewold @JAI_BHAVNANI

@Darrenlautf

@IntrinsicDeFi @crypto_condom @BarryFried1 @Riley_gmi @SmallCapScience @808_Investor @CryptoHayes @SalomonCrypto @0xWenMoon @mynt_josh @dcfgod @BarryFried1

@MrGrumpyNFT

@alpha_pls @CurveCap @JackNiewold @JAI_BHAVNANI

@Darrenlautf

• • •

Missing some Tweet in this thread? You can try to

force a refresh