Is #OPSummer happening right now, or are we entering it? Can @optimismFND TVL flip @arbitrum?

Here is what's happening in @optimismFND and why you should start farming there if you haven’t already.

1/x 🧵

Here is what's happening in @optimismFND and why you should start farming there if you haven’t already.

1/x 🧵

First why we are having this convo right now?

1. $OP has been outperforming $ETH the last 2 weeks by over 100%.

2. @optimismFND TVL almost doubled in July and up over 40% last week, the biggest increase in TVL among all major chains.

1. $OP has been outperforming $ETH the last 2 weeks by over 100%.

2. @optimismFND TVL almost doubled in July and up over 40% last week, the biggest increase in TVL among all major chains.

.@Dynamo_Patrick identified @optimismFND's growth couple days ago:

https://twitter.com/Dynamo_Patrick/status/1551530873849249793?s=20&t=h_myD6LlrLGbTR77HCRvfQ

So why people rushing into @optimismFND right now?

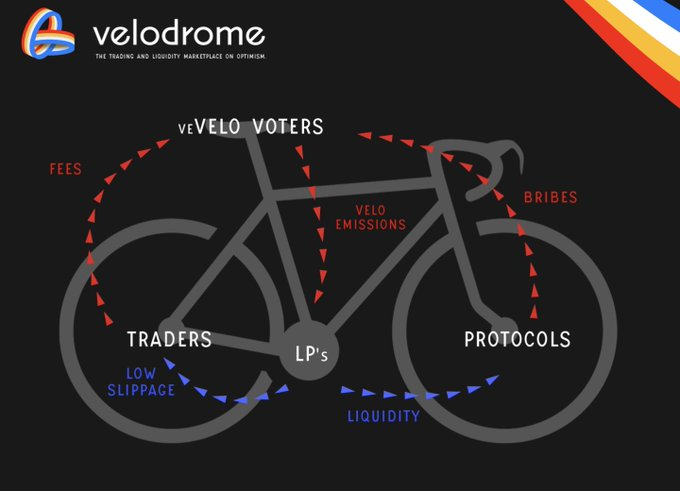

When we talking about OP TVL growth, we have to talk about what @VelodromeFi has done for the OP eco. Velo TVL increased over 600% this month, now it's the no.1 DEX on OP with $100M TVL, second largest behind @synthetix_io.

When we talking about OP TVL growth, we have to talk about what @VelodromeFi has done for the OP eco. Velo TVL increased over 600% this month, now it's the no.1 DEX on OP with $100M TVL, second largest behind @synthetix_io.

I bought some $VELO on the 14th, and wrote a nice long thread on @VelodromeFi but got rugged by twitter 🙃

If you want to learn more about the project, @TheDeFinvestor has a thread explaining the Solidly fork.

If you want to learn more about the project, @TheDeFinvestor has a thread explaining the Solidly fork.

https://twitter.com/TheDeFinvestor/status/1550533653658120193?s=20&t=YnPuvXdF1oevKeae_1U67Q

I turned bullish on $VELO when they announced the 3M $OP grant from @optimismFND, and @VelodromeFi is using 750k $OP to incentivize $VELO locking.

https://twitter.com/VelodromeFi/status/1545434763951017986?s=20&t=YnPuvXdF1oevKeae_1U67Q

The $OP grant Velodrome received is part of the Governance Fund program started in May and aiming to distribute "5.4% of the total token supply to projects on Optimism over the next six months via governance."

https://twitter.com/Cryptoyieldinfo/status/1519112005403090946?s=20&t=YnPuvXdF1oevKeae_1U67Q

In today's $OP price, @optimismFND is distributing over $360M to projects building on #Optimism in the next few months, and this is why I think #OPSummer is coming.

So far a number of projects have been approved for the grant, let's take a closer look on a few of them.

So far a number of projects have been approved for the grant, let's take a closer look on a few of them.

1. @synthetix_io

Approved for 9M $OP (~$14M USD)

3M $OP for sUSD liquidity and bridging incentives

4M $OP to incentivize an SNX/sUSD pool on Optimism

@synthetix_io constantly in the top 5 in terms of fee generating, V3 is also around the corner 👇

Approved for 9M $OP (~$14M USD)

3M $OP for sUSD liquidity and bridging incentives

4M $OP to incentivize an SNX/sUSD pool on Optimism

@synthetix_io constantly in the top 5 in terms of fee generating, V3 is also around the corner 👇

https://twitter.com/synthetix_io/status/1549061444389330945?s=20&t=YnPuvXdF1oevKeae_1U67Q

Safe to say holding $SNX will be very yield friendly for the next couple months.

Stake $SNX for ~60% APR and borrow $sUSD against it, then LP it on @CurveFinance(most likely where the 3M $OP incentives will go) or @VelodromeFi for some juicy yield.

Stake $SNX for ~60% APR and borrow $sUSD against it, then LP it on @CurveFinance(most likely where the 3M $OP incentives will go) or @VelodromeFi for some juicy yield.

2. @thalesmarket

Approved for 900K $OP (~$1.4M USD)

495K $OP to Thales users

315K $OP to $THALES/$ETH LP

Reward already started, check out the details here:

@Thales_Intern:

Approved for 900K $OP (~$1.4M USD)

495K $OP to Thales users

315K $OP to $THALES/$ETH LP

Reward already started, check out the details here:

https://twitter.com/thalesmarket/status/1547984955027755008?s=20&t=YnPuvXdF1oevKeae_1U67Q

@Thales_Intern:

https://twitter.com/Thales_Intern/status/1552748703919792131?s=20&t=YnPuvXdF1oevKeae_1U67Q

.@thalesmarket is an AMM-based positional markets, part of the @synthetix_io ecosystem.

Team has been building, recently launched @OvertimeMarkets, a sports market AMM:

And here is a tutorial by @tomuky:

Team has been building, recently launched @OvertimeMarkets, a sports market AMM:

https://twitter.com/Jayref5/status/1547855632719482880?s=20&t=YnPuvXdF1oevKeae_1U67Q

And here is a tutorial by @tomuky:

https://twitter.com/tomuky/status/1550221815728971776?s=20&t=YnPuvXdF1oevKeae_1U67Q

Current MCap for $THALES is $9.3M

$THALES/$USDC on @VelodromeFi: 300% APR

$THALES/$WETH on @thalesmarket: 243% APR

$THALES staking on @thalesmarket: 36% APR

$THALES/$USDC on @VelodromeFi: 300% APR

$THALES/$WETH on @thalesmarket: 243% APR

$THALES staking on @thalesmarket: 36% APR

3. @lyrafinance

Approved for 3M $OP (~$4.5M USD)

1.7M $OP to LPs of option market pools and $LYRA/$WETH

500k $OP to traders

A DeFi Options protocol, also part of the @synthetix_io eco. Here is a great thread on @lyrafinance by @mastermojo83:

Approved for 3M $OP (~$4.5M USD)

1.7M $OP to LPs of option market pools and $LYRA/$WETH

500k $OP to traders

A DeFi Options protocol, also part of the @synthetix_io eco. Here is a great thread on @lyrafinance by @mastermojo83:

https://twitter.com/mastermojo83/status/1552306789043036161?s=20&t=YnPuvXdF1oevKeae_1U67Q

4 weeks ago @lyrafinance launched a delta hedging sETH MMV, it has generated $18 million in volume from 2,000 trades and 400 traders.

The MMV now has $3.5M TVL and 31% APY(small sample size). Soon this vault will receive $OP incentives, gud stablecoin yield about to get better.

The MMV now has $3.5M TVL and 31% APY(small sample size). Soon this vault will receive $OP incentives, gud stablecoin yield about to get better.

Current MCap of $LYRA is $20M (vs. $DPX at $52M)

$LYRA/$USDC on @VelodromeFi: 339% APR

$LYRA is just a governance token atm, but a proposal has been put up for new tokenomics - xLYRA:

leaps.lyra.finance/leaps/leap-20

Thanks for pointing me the direction @dogoshii

$LYRA/$USDC on @VelodromeFi: 339% APR

$LYRA is just a governance token atm, but a proposal has been put up for new tokenomics - xLYRA:

leaps.lyra.finance/leaps/leap-20

Thanks for pointing me the direction @dogoshii

4. @BalancerLabs & @beethoven_x

Approved for 500K $OP (~$750K USD)

$OP will be used for bribes

$FRAX/$USDC/$MAI pool: 21% APR paid in $QI, $BEETS and $BAL

Approved for 500K $OP (~$750K USD)

$OP will be used for bribes

$FRAX/$USDC/$MAI pool: 21% APR paid in $QI, $BEETS and $BAL

5. @HundredFinance

Approved for 300K $OP (~$450K USD)

300K $OP for redistribution to Hundred Finance’s OP users in 12 tranches over the course of one year.

@HundredFinance is a multichain money market, people can stake stablecoins to earn $HND emissions, soon $OP rewards too.

Approved for 300K $OP (~$450K USD)

300K $OP for redistribution to Hundred Finance’s OP users in 12 tranches over the course of one year.

@HundredFinance is a multichain money market, people can stake stablecoins to earn $HND emissions, soon $OP rewards too.

6. @beefyfinance

Voting for 650K $OP (~$975K USD)

227.5K $OP to $BIFI/$OP LP

325K $OP to boost the farms of native Optimism protocols

@beefyfinance is the most trusted multichain yield optimizer.

Voting for 650K $OP (~$975K USD)

227.5K $OP to $BIFI/$OP LP

325K $OP to boost the farms of native Optimism protocols

@beefyfinance is the most trusted multichain yield optimizer.

7. @QiDaoProtocol

Voting for 750K $OP (~$1.1M USD)

150K $OP to $MAI borrowers

450K $OP to $MAI LP spread between @VelodromeFi and @CurveFinance over a year

@QiDaoProtocol is a stablecoin protocol similar to MakerDAO, allows users to borrow its stablecoin $MAI with no interest.

Voting for 750K $OP (~$1.1M USD)

150K $OP to $MAI borrowers

450K $OP to $MAI LP spread between @VelodromeFi and @CurveFinance over a year

@QiDaoProtocol is a stablecoin protocol similar to MakerDAO, allows users to borrow its stablecoin $MAI with no interest.

The $WBTC vault on @QiDaoProtocol is one of the best kept secret in #DeFi. You can deposit your $WBTC and borrow $MAI against it and earn ~100% APR paid in $QI. You will get paid more to borrow once QiDAO starts distributing the $OP rewards.

$MAI/$FRAX/$USDC pool: 21% APR paid in $QI, $BEETS and $BAL

$MAI/$USDC on @VelodromeFi: 20% APR

Incentivized pool on @CurveFinance soon

$OP vault just went live on @QiDaoProtocol:

$MAI/$USDC on @VelodromeFi: 20% APR

Incentivized pool on @CurveFinance soon

$OP vault just went live on @QiDaoProtocol:

https://twitter.com/QiDaoProtocol/status/1552845396740898816?s=20&t=YnPuvXdF1oevKeae_1U67Q

If you are not familiar with @QiDaoProtocol, check out this thread by @rektdiomedes:

https://twitter.com/rektdiomedes/status/1510089299970052098?s=20&t=YnPuvXdF1oevKeae_1U67Q

Last $OP Grant proposal I want to touch on is by @CurveFinance, applying for 1M $OP (~$1.5M USD). 100% of the $OP tokens will go to LP.

You can find the proposal here: gov.optimism.io/t/draft-gf-pha…

More $sUSD yield if this gets passed, 🧵 by @BarryFried1:

You can find the proposal here: gov.optimism.io/t/draft-gf-pha…

More $sUSD yield if this gets passed, 🧵 by @BarryFried1:

https://twitter.com/BarryFried1/status/1551395319597899776?s=20&t=h_myD6LlrLGbTR77HCRvfQ

That's it for today, happy farming on @optimismFND, give this a retweet if you find it helpful and follow me for more yields.

@rektdiomedes

@TheDeFinvestor

@Dynamo_Patrick

@Riley_gmi

@bizyugo

@0x_d24

@resdegen

@marvin89x

@BillyBobBaghold

@SmallCapScience

@westonnelson

Thank u!

@rektdiomedes

@TheDeFinvestor

@Dynamo_Patrick

@Riley_gmi

@bizyugo

@0x_d24

@resdegen

@marvin89x

@BillyBobBaghold

@SmallCapScience

@westonnelson

Thank u!

• • •

Missing some Tweet in this thread? You can try to

force a refresh