/1 Are you looking for a DEX that allows you to earn >20% APR for providing stablecoins without impermanent loss risk?

You should take a look at @lyrafinance

, the best DEX for options on #Optimism🤩

A 🧵 on Lyra and the strategy I use to get traders' fees👇

You should take a look at @lyrafinance

, the best DEX for options on #Optimism🤩

A 🧵 on Lyra and the strategy I use to get traders' fees👇

/2 Overview

Lyra is an options AMM that allows traders to buy and sell crypto options against a pool of liquidity.

The protocol uses Synthetix in 3 ways:

-options are quoted, paid for, and settled with sUSD.

-collateralizes the calls/puts with sETH/sUSD

-for delta hedging

Lyra is an options AMM that allows traders to buy and sell crypto options against a pool of liquidity.

The protocol uses Synthetix in 3 ways:

-options are quoted, paid for, and settled with sUSD.

-collateralizes the calls/puts with sETH/sUSD

-for delta hedging

/3 In order to establish the price of each option, Lyra takes into account 5 inputs:

• Asset price

• Strike price

• Risk-free interest rate

• Time to expiry

• Implied volatility

Lyra makes two-sided (buy and sell) options markets using the liquidity from ETH Vault.

• Asset price

• Strike price

• Risk-free interest rate

• Time to expiry

• Implied volatility

Lyra makes two-sided (buy and sell) options markets using the liquidity from ETH Vault.

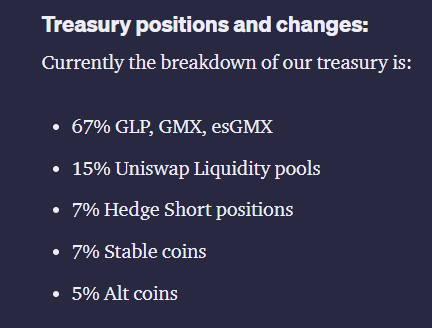

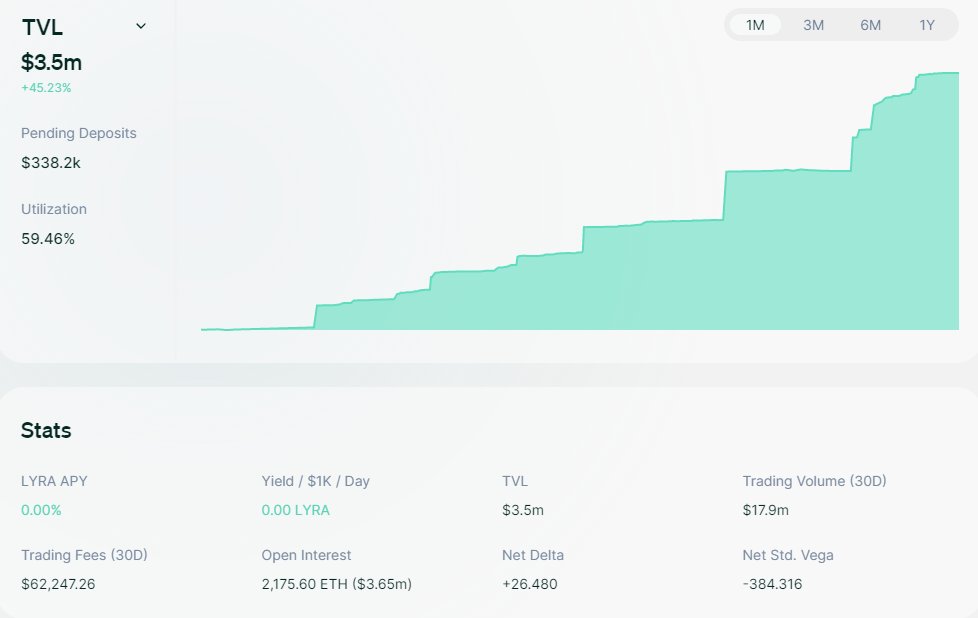

/4 ETH Market Vault

Those who provide sUSD liquidity will earn all the fees collected by the protocol from options traders.

62k fees were generated in the last month.

If 62k fees will also be generated in the next months, it will result in 744k fees generated each year.

Those who provide sUSD liquidity will earn all the fees collected by the protocol from options traders.

62k fees were generated in the last month.

If 62k fees will also be generated in the next months, it will result in 744k fees generated each year.

/5 ETH Market Vault has $3.5M TVL, so the liquidity providers are earning more than 20% APR sustainable rewards atm!

More than that, the protocol aims to keep the vault delta-neutral, so you shouldn't worry about the traders' PNL fluctuations.

More than that, the protocol aims to keep the vault delta-neutral, so you shouldn't worry about the traders' PNL fluctuations.

/6 Vault Risks

-smart contract risk

-losses due to failed liquidations

-withdrawal delay(LPs may be unable to withdraw liquidity when most deposited funds are used)

-the delta hedging may not work well in case of a big market crash

There's 7 days cooldown for withdrawing funds.

-smart contract risk

-losses due to failed liquidations

-withdrawal delay(LPs may be unable to withdraw liquidity when most deposited funds are used)

-the delta hedging may not work well in case of a big market crash

There's 7 days cooldown for withdrawing funds.

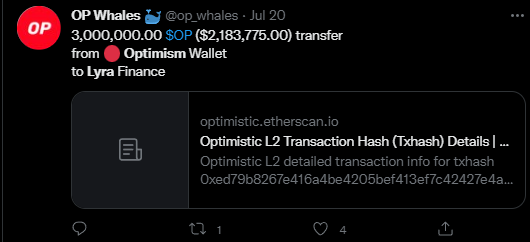

/7 $OP Grant

Lyra DAO received a 3,000,000 $OP tokens grant for deploying Lyra on Optimism.

The DAO will decide if a part of these tokens will be distributed to the vault LPs in the upcoming days.

So on top of 21% APR rewards LPs may also receive additional $OP rewards soon🤯

Lyra DAO received a 3,000,000 $OP tokens grant for deploying Lyra on Optimism.

The DAO will decide if a part of these tokens will be distributed to the vault LPs in the upcoming days.

So on top of 21% APR rewards LPs may also receive additional $OP rewards soon🤯

/8 Providing liquidity on Lyra is similar to providing liquidity on GMX.

But the vault on Lyra is delta neutral, so you don't have to worry about the traders' PNL fluctuations!

That's all!

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

But the vault on Lyra is delta neutral, so you don't have to worry about the traders' PNL fluctuations!

That's all!

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

@dogoshii

@mastermojo83

@itseneff

@0xmjs

@rektdiomedes

@EthBoi_

@fitzeth

@GatheringGwei

@dogoshii

@safetyth1rd

@Crypto_McKenna

@CryptoDefiLord

@westonnelson

@mastermojo83

@itseneff

@0xmjs

@rektdiomedes

@EthBoi_

@fitzeth

@GatheringGwei

@dogoshii

@safetyth1rd

@Crypto_McKenna

@CryptoDefiLord

@westonnelson

• • •

Missing some Tweet in this thread? You can try to

force a refresh